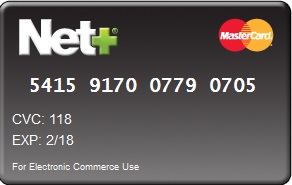

Neteller card

How can I apply for the net+ prepaid mastercard®? The net+ prepaid mastercard® is a plastic card containing the latest chip and PIN technology. So you can use it like a credit or debit card. It allows you to access the funds in your NETELLER account by withdrawing from an ATM or making purchases in person at locations that accept mastercard. After we receive your application, the net+ prepaid mastercard® is usually mailed out to you within 2-10 business days. When you get it you need to activate it and then you'll have instant access to the funds in your NETELLER account.

What is the net+ prepaid mastercard® and how can I get one?

What is the net+ plastic prepaid mastercard®?

Net+ cards are prepaid cards that operate on the mastercard® platform. They provide you with instant access to the funds in your NETELLER account. The net+ prepaid mastercard® enables you to make purchases online and in person. You can also make ATM withdrawals anywhere mastercard is accepted.

How does the net+ prepaid mastercard® work?

The net+ prepaid mastercard® is a plastic card containing the latest chip and PIN technology. So you can use it like a credit or debit card. It allows you to access the funds in your NETELLER account by withdrawing from an ATM or making purchases in person at locations that accept mastercard. After we receive your application, the net+ prepaid mastercard® is usually mailed out to you within 2-10 business days. When you get it you need to activate it and then you'll have instant access to the funds in your NETELLER account.

How can I apply for the net+ prepaid mastercard®?

First ensure your NETELLER account has been verified. Then, when signed in, select the "net+ cards" link found on the left-side of your screen to request your card.

1. Click on the green button get net+ prepaid mastercard®.

2. Confirm your mailing address. If you do not need to update it, click on the green get the net+ card button.

3. Choose your currency. We recommend that you choose the currency that matches the currency of your NETELLER account, to avoid the currency exchange fee.

4. Select a four-digit PIN. Do not choose an easy to guess PIN code, such as your birthday, or a PIN code with repeating digits (e.G. 0000).

5. When you have selected your currency and PIN, click the green confirm button.

The net+ prepaid mastercard® will be mailed out to you and usually arrives within 2-10 business days.

*A shipping/handling fee of 10.00 EUR will be applied. Please check if you have enough funds in your NETELLER account to cover this fee.

How do I load funds to the net+ prepaid mastercard®?

The net+ prepaid mastercard® and net+ virtual prepaid mastercard® are directly connected to your NETELLER account, therefore no loading is required. Funds for purchases made with your net+ prepaid mastercard® cards will automatically be debited from your NETELLER account.

*net+ prepaid mastercard® is only available to residents of authorized european economic area (EEA) countries.

NETELLER net+ mastercard

The NETELLER net+ prepaid mastercard is a plastic card that is sent to you that you can use for cash withdrawals at thousands of supported mastercard atms worldwide or pay in any shop that accepts mastercards. With the net+ prepaid mastercard the available balance of your card is the same as the balance of your NETELLER ewallet account and cannot be exceeded.

NETELLER card fees

There are no ongoing costs like monthly/yearly fees or inactivity fees with the NETELLER card. The card can be ordered for a one-time shipping and handling fee of 10.00€ in your NETELLER account after logging in.

For ATM withdrawals there is a 1.75% fee. Paying in shops (POS – point of sale) is free as long as the currencies match. When using a NETELLER card in a different currency than your NETELLER account or when performing a transaction in a different currency than your net+ card you are charged with a 3.99% FX currency exchange fee.

To avoid FX fees, choose the currency of the country that you want to use the card primarily. All fees are charged directly from your NETELLER account. The net+ prepaid mastercard is available in eight currencies: GBP, USD, EUR, CAD, SEK, DKK, AUD and JPY.

For more information on the NETELLER net+ prepaid mastercard, please check netellers website and check our page about the NETELLER fees.

NETELLER card limits

Members of ewallet-optimizer enjoy the highest ATM limits of 3,300 USD/day including the highest transfer limits (check 2nd table below).

For more information on limits for regular account holders, please check the following tables and also visit our NETELLER limits comparison.

NETELLER mastercard limits for non-VIP clients

NETELLER mastercard limits for VIP & gold VIP clients or higher

Order NETELLER mastercard

To order your NETELLER prepaid mastercard, please log into your account and select “net+ cards” -> “get a plastic card“.

NETELLER net+ virtual prepaid mastercard

The virtual prepaid mastercard is a non-phsyical prepaid mastercard. Therefore, you do not need to receive a physical card.

Instead, you can create virtual card details from within your NETELLER account and use them to shop online.

Please keep in mind also the privacy concerns that come with a virtual mastercard in general.

Fees

The first virtual prepaid mastercard created within your account is FREE.

You can then add up to 5 more net+ virtual prepaid NETELLER mastercards and even set limits how much you are allowed to spend (optional). After the first free virtual card, each next card created costs 2.50 EUR. When using different currencies, there is a FX fee of 3.99% of the amount spent.

Limits

You can spend up to 6,300 EUR per 24h with the net+ virtual prepaid mastercard. Please check the following tables for more information about the limits.

Net+ virtual prepaid mastercard® unverified limits

Net+ virtual prepaid mastercard® verified limits

Order NETELLER card

To order your NETELLER net+ virtual prepaid mastercard, please log into your account and select “net+ cards” -> “get a virtual card“.

NETELLER net+ mastercard and virtual card – availability

Since the end of september 2016 NETELLER does not offer mastercards for residents of NON-SEPA countries any longer. Besides the fact that those clients are not able to receive a new NETELLER mastercard, all other services will stay available.

The NETELLER card is available in the following countries:

NETELLER mastercard – comparison and summary

The net+ virtual prepaid mastercard can only be used to shop online. ATM cash withdrawals are not possible. When shopping online, a higher security level is achieved through the individual setting of spending limits and protection against unauthorized use. It also has higher spending limits than the physical card.

The net+ physical prepaid mastercard is necessary to get cash from atms and is s safe way to pay in online shops also. When dealing with unknown shops, a net+ virtual prepaid mastercard can be used for extra caution.

Please contact us if you have further questions about the NET+ mastercard.

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

About NETELLER

Founded in 1996, NETELLER quickly became the biggest ewallet on the market. They are owned and operated by the paysafe group (formerly known as optimal payments PLC) and are publicly traded on the london stock exchange since 2004.

With NETELLER, you can easily and securely move your funds online to and from a huge number of available merchants, send money to friends and also access your balance with the net+ prepaid NETELLER mastercard, paying everywhere where mastercard is accepted, or simply getting cash from the ATM.

As of 2015, optimal payments as the mother company of NETELLER bought skrill and are now working closely together. Those changes also made it possible to transfer funds from your NETELLER account to your skrill account and vice versa.

NETELLER & ewallet-optimizer

Ewallet-optimizer is our biggest and valued affiliate partner for NETELLER, offering customers the very best treatment, fastest support and additional benefits without any extra fees.

NETELLER’s partnership with ewallet-optimizer since 2014 has been an important factor in our growth and brand building all over the world.

We are very happy with the ongoing long-year partnership and look forward to continuing and growing our partnership even more in the future.

In may 2014 we started the partnership with NETELLER to be able to offer another great ewallet provider to our customers. NETELLER is available at almost all poker sites, forex providers, casino sites and sportsbooks. In combination with our ewo bonus program, NETELLER is the perfect choice for any customer who is looking for a safe, fast and easy solution to move their funds.

We will continue our great partnership with NETELLER and always strive to offer the best benefits for all clients who sign up through us.

Reviews from our loyal clients

Partner network

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

NET+ prepaid mastercard®

Net+ prepaid mastercard® gives you instant access to assets on your NETELLER account.

It allows all the activity in the account, and even online shopping and ATM withdrawals remain confidental.

HOW TO REQUEST A NET+ PREPAID MASTERCARD

First off, you need to create a new NETELLER account and verify it. With the vipdeposits neteller you can have increased daily limits on ATM withdrawals that equals $3300. Card issue costs 10 euro, but for VIP silver and above it is free.

Starting from september 29th, 2016 the net+ prepaid mastercard® is only available to residents of the european economic area (EEA) countries which includes austria, belgium, bulgaria, croatia, czech republic, cyprus, denmark, estonia, finland, france, germany, greece, hungary, iceland,ireland, italy, latvia, lithuania, liechtenstein, luxembourg, malta, netherlands, norway, poland, portugal, romania, spain, slovakia, slovenia, sweden, united kingdom.

MAIN BENEFITS FOR NET+ PLASTIC PREPAID mastercard® USERS

The net+ prepaid mastercard® gives you an opportunity to avoid any connections with your bank or transfers to bank accounts. The money you have in your NETELLER account is available worldwide and instantly.

Below are the fees and limits of the net+ prepaid mastercard® for vipdeposits users:

| the cost of the card issuance | $13 |

| fee for one-time ATM withdrawal | 1.75% or €4 ($6) for VIP gold and higher |

| number of ATM cash withdrawals per day | 10 |

| daily limit for ATM cash withdrawals | $3300 |

| number of payments at points of sales per day | 15 |

| daily limit for payments at points of sales | $7000 |

| conversion fee | 1,29% – 3,99% |

| available currencies for NETELLER account and net+ prepaid mastercard® | GBP, USD, EUR, CAD, SEK, DKK, AUD, JPY |

The balance of your NETELLER account is equal to the balance of your net + prepaid mastercard® .

The balance of your net+ prepaid mastercard® is equal to the balance of your NETELLER account.

The card is valid for 3 years and does not require annual fees.

NETELLER sends its plastic cards by regular post. Delivery to most of the countries usually takes 1-2 weeks, but can be slower depending on the location of your post office.

To activate the card you need to log in to your NETELLER account and enter the last three digits of the card number.

Take your time to learn more about the advantages you get with our vipdeposits NETELLER program , fill in the application form below and enjoy all the benefits that NETELLER and vipdeposits offer you!

JOIN NETELLER + VIPDEPOSITS LOYALTY PROGRAM

If you already have a NETELLER account,

please proceed to step 2 and fill out the form.

Skrill vs neteller – which is the best E-wallet?

The leading providers of these e-wallets are neteller and skrill so this article is going to focus on comparing the key features of these so that you are able to make the best decision for your needs.

Why do you need an e-wallet?

With so many roulette sites appearing online it has become essential to find a secure, reliable and easy to use method of depositing funds and withdrawing your winnings. The answer to this is the e-wallet.

E-wallets are a digital wallet, storing your money so that you are able to make online transactions without having to input your card details each time. As a result, these e-wallets allow for safer and more simple transactions.

- Open a neteller account here.

- Open a skrill account here.

Security

Still, security is more than just an external authority, and these two companies know it. As a result, their customers are able to make use of additional safety precaution measures, putting most of the power back into the hands of account holders alike. With skrill, you get the standard package – a dual verification login option, with a one-time-use code sent to users via the app.

As for neteller account holders, the dual-verification login is optional, as they can additionally choose to activate secure ID. This is a separate login method, with users being provided a unique 6-digit code that needs to be input each time they are asked to confirm their identity (account access, transactions).

Top 4 neteller/skrill online casinos

- Sign up and you are entitled to up to £1,500 in bonus

- Try out more than 550 high-quality casino games

- State-of-the-art gaming software and smooth gameplay

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus

- Try out more than 500 high-quality casino games

- Elegant, clean and well-organized website

- 24/7 multilingual live support via chat, e-mail, phone

- You are entitled to up to 20 additional free spins

- Try out more than 500 high-quality casino games

- Enjoy great in-game progress system with great prizes

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus credits

- Try out more than 500 high-quality casino games

- 24/7 multilingual live support via live chat, e-mail and phone

Website ease of use and support

Both skrill and neteller have simple and well-designed websites that explain all that you need to know about each provider, including a break down of fees, offers and rewards, as well as easy access to creating an account and logging in. Personally, I find the neteller site slightly more accessible, particularly when it comes to gaining support, with a ‘support’ option clearly placed on their homepage which leads to a range of support options including popular topics, frequently asked questions, email and the option to call for support with regional numbers in 18 different countries.

However, skrill also has an extensive list of frequently asked questions and, again, you can email or call with the option of only 8 regional lines. Having read reviews related to customer support, it appears that neteller also has the edge when it comes to responding to customer queries, with skrill often taking a longer time to get back to their customers.

Depositing money

To use your e-wallet you must first upload money to it. For both neteller and skrill, this is easily done through their website, once you have created an account. There are many different options for both providers, including bank wire, e-cheque, credit card, debit card or prepaid card. These options have different funds associated with them that vary between neteller and skrill.

Skrill

When it comes to depositing money, skrill has many free options, such as, bank transfer from all countries, maesto debit card and, as a global payment method, swift. There is a fixed rate for depositing via credit card of 1.90% and fees for depositing never exceed 5.5% (for deposits made via a paysafecard).

Bear in mind that you may additionally incur charges due to currencies – skrill users have 40+ currency options to choose from. Do it carefully, accounting for the currency you will use the most for your online transactions, in order to avoid the exchange fee at a flat 3.99%. A convenient circumstance in this regard is the fact that account holders can choose up to 4 currencies per account. All you have to do is make sure to keep it somewhat active – an account maintenance fee of 1 EUR per month is charged after 12 months of inactivity.

On a final note, it’s good to know you can input value into your skrill account using bitcoins. More precisely, account holders can buy and sell several cryptocurrencies – BTC, ETH, LTC and BCH among others. Purchases and sales using EUR and USD fiat currencies are set at 1.50%, while for all others – 3.00%, while P2P transfers come at a flat charge of 0.50% for all account holders.

Neteller

Compared to skrill, neteller have more deposit options but, while they also have free options, such as bank transfer, trustly and moneta.Ru, other methods of deposit incur fees set at 2.55%! Generally, the cost of depositing is greater when using neteller than skrill.

On another note, neteller users still get to choose 4 currencies for their account transfers, but only out of a selection of 22 options. Yet, it is important to mention that these account holders are also given the opportunity to hold cryptocurrencies in their e-wallet. Regular, fiat currencies come at a charge of 3.99% for exchange purposes, while crypto tokens are available for buying and selling at a 1.50% charge, when done with EUR or USD, or a 3.00% charge, when done with any other currency.

Finally, don’t forget about inactivity fees – they are the service’s way of protecting their network from being overburdened with abandoned accounts. Anyone leaving their account unmanned for over 14 months will see themselves charged a 5 USD monthly maintenance fee.

Depositing money to casinos

Depositing to casinos from both neteller and skrill is free. Around 80% of online casinos accept payment from skrill and the same can be said for neteller, with the vast majority of major online casinos accepting these methods, including those which you can find here.

Withdrawing money from these third-party sites is also free of charge for both e-wallet providers. To withdraw money from your online casino account, all you have to do is select your e-wallet provider as your withdrawal method and enter the amount you wish to withdraw. While neteller and skrill do not charge for these transactions, the online casinos may, so it is worth checking before depositing your money.

Withdrawing from your e-wallet

Again, withdrawing money from both providers is simple.

Skrill

Depending on your country of residence, you can withdraw money through bank transfer, credit cards, debit cards and a skrill card. For bank withdrawals, this takes 2-5 business days and charges users 3.95 EUR per transaction to your bank account. Credit and debit card withdrawals, as well as other methods of sending money from skrill to a different account, are subject to fees ranging between 1.45% and 5.50%. Swift withdrawals are set at a flat price of 4.76 GBP, that is 5.50 EUR. The quickest and cheapest method of withdrawing funds is the skrill card, enabling you to make withdrawals at an ATM instantly at a cost of just 1.75% of the withdrawn amount.

Neteller

Neteller offers the same withdrawal methods as skrill but also allow withdrawals to be made via a cheque. For bank transfer, the cost using neteller is a flat fee of 10 USD and takes 3-5 working days. A member wire withdrawal, on the other hand, charges users 12.75 USD per transfer. What is more, money transfers also charge users for withdrawal purposes, at a rate ranging between 1.45% and 5.50%, with a minimum amount threshold set at 0.50 USD. Having this in mind, it is safe to say that neteller’s charges are higher than skrill’s. However, neteller also has an option to use merchant sites and their net+ prepaid master card for instant and free withdrawals.

Physical card availability

Both these e-wallets have provided account holders with an additional way to access their account funds – plastic cards issued by mastercard. This significantly increases funds accessibility, especially when it comes to withdrawals or making use of the stored funds as straightforwardly as possible.

Skrill

Nevertheless, users can feel inconvenienced differently. After all, the card is solely available in a couple of currencies – USD, EUR, GBP and PLN, which is rather limiting. Speaking of limits, it also comes with caps on the daily and monthly amounts you can spend using it at poss or atms. The former is usually set at 1,000 EUR per day, with the occasional deviations for specific merchants (3,000 to 5,000 EUR a day). As for the latter, ATM transactions, regular limits are set at 250 EUR, although some users can get permission to withdraw up to 5,000 EUR a day with their mastercard.

Neteller

In terms of fees, cardholders are advised to simply be wary of the standard 3.99% currency conversion fee. Additionally, bear in mind that you can link up to 5 net+ virtual prepaid mastercard accounts to a single plastic card free of charge, and any more virtual accounts at a single charge of 3 USD/ 2.5 EUR/ 2 GBP per one.

User benefits

Anyone dedicating their online finance management to an e-wallet service such as skrill or neteller is right to expect a bang for their buck. More specifically, both services offer VIP loyalty programs – check the terms out and discover all the benefits of sticking with one of these e-wallets, or the other.

Skrill

The VIP loyalty program for skrill account holders ranks the registered individuals based on the funds traffic in your account you have handled over the course of a single yearly quarter. In this regard, the program consists of four tiers – bronze, silver, gold and diamond, for which you would have to pass the minimum €6,000, €15,000, €45,000 and €90,000 threshold, respectively.

Despite seeming like too much of an investment for a small payout, users that actually manage to reach any of these limits and qualify for the next level of the tiered program have claimed otherwise. With low to non-existing fees for currency exchange, deposits and withdrawals, as well as various dedicated services, skrill users are definitely getting the benefits they have earned.

Neteller

Neteller account holders are more or less alike – testimonials actually claim that you don’t need to get very high to start feeling the difference. In fact, considering that the neteller VIP loyalty program distinguishes five tiers instead of the previous four, users are bound to note a change from nothing to bronze, and even more, as they go through silver, gold and platinum, all the way to diamond.

The thresholds of funds traffic you would need to meet annually in order to climb up this ladder are set at $10,000 for bronze, $50,000 for silver, $100,000 for gold, $500,000 – platinum, and all the way to $2,000,000 for diamond-level benefits.

In conclusion…

This article was designed to compare two of the most popular e-wallets used by online gamblers. Ultimately they are both very secure, efficient and great at what they do. For me, neteller has a slight edge, but it does depend on what you’re looking for in an e-wallet provider. I hope this article has been useful in helping you decide. As always, feel free to leave a comment below if you have any questions or feedback, and stay tuned for more articles!

Prepaid creditcard

Geen inkomenseis en BKR-toetsing: dus voor iedereen aan te vragen.

5 creditcards gevonden voor u

N26 mastercard

Viabuy prepaid mastercard

Bunq green card

N26 you

N26 metal

Prepaid creditcard kopen

Een prepaid creditcard is de goedkope variant (en in één geval zelfs compleet gratis) van een gewone creditcard, waarbij u alleen het geld kan besteden wat eerst door u zelf is gestort (het prepaid-idee).

Wilt u een prepaid creditcard kopen? Hierboven staat een overzicht van de meest gekozen prepaid kaarten.

Hoe werkt een prepaid card?

Een prepaid creditcard werkt anders dan een reguliere creditcard. Bij een prepaid creditcard is het namelijk de bedoeling dat de gebruiker eerst geld overmaakt naar de card, alvorens er mee kan worden betaald.

Ook de debit card lijkt veel op de prepaid card. Het verschil is dat u dan een bruikbare bankrekening heeft waar het geld van wordt afgeschreven.

Het is bij een prepaid creditcard niet mogelijk om aankopen te doen zonder een positief saldo op de creditcard. Een BKR-toetsing is dan ook niet noodzakelijk, omdat er geen tijdelijk krediet wordt verstrekt.

Voordelen

De prepaid creditcard kent een aantal belangrijke voordelen:

- Vrijwel hetzelfde betaalgemak als bij een reguliere creditcard.

- Alleen uitgaven doen voor zover het saldo toereikend is.

- De kosten zijn laag (of zelfs nihil)

- Eenvoudig aan te vragen (geen inkomenseis of BKR)

Nadelen

Er zijn ook wat (kleine) nadelen aan de prepaid card:

- Het huren van een auto of borg staan bij een hotelreservering zijn niet mogelijk (behalve bij de bunq travel card en green card).

- Betalen bij onbemande benzinepompen en tolwegen vaak niet mogelijk.

- Sommige aanbieders hanteren een toeslag voor het ‘opladen’ van de prepaid kaart.

Let altijd goed op de voorwaarden van de prepaid kaart. Uw kaartaanbieder kan u hierover informeren.

Kosten prepaid creditcard

Hoewel een prepaid creditcard relatief goedkoop is, is hij ook weer niet gratis. Uitzondering hierop is de N26 mastercard. Deze kaart is namelijk wel gratis aan te vragen en kent geen jaarlijkse kosten.

Bij de meeste prepaid cards moet de gebruiker:

- Een jaarlijkse bijdrage of aanschafkosten betalen aan de uitgever

- Een kleine toeslag betalen voor iedere keer dat u de kaart oplaadt

Het kan overigens voorkomen dat er een negatief saldo op de kaart ontstaat, bijvoorbeeld wanneer de jaarlijkse bijdrage wordt ingehouden en er niet voldoende saldo op de kaart staat. Indien de gebruiker dan niet tijdig betaald, kan er een boete in rekening worden gebracht.

Waarom een prepaid card?

Een prepaid creditcard kan een uitkomst zijn:

- Als u vanwege inkomenseisen of een BKR-toetsing niet in aanmerking komt voor een normale creditcard

- Als u alleen geld wilt uitgeven dat u daadwerkelijk heeft

- Als u wilt besparen op kosten, maar toch overal wilt kunnen betalen.

- Als u een auto wilt huren in het buitenland, maar niet in aanmerking komt voor een normale creditcard (dit geldt alleen voor de bunq travel card en green card)

Vergelijken van prepaid cards

Op creditcard.Nl kunt u eenvoudig verschillende prepaid creditcards vergelijken op basis van verschillende kenmerken, zoals:

- Bestedingslimiet

- Jaarlijkse bijdrage

- Overige kosten en voorwaarden

U kunt de prepaid creditcard altijd aanvragen in de beveiligde omgeving van de aanbieder.

NETELLER frequently asked questions

1. What is NETELLER?

NETELLER is an "online wallet" that allows you to deposit, withdraw and transfer funds online. NETELLER provides same-day payments and instant cash transfers to and from affiliated merchant sites and between NETELLER account holders.

2. What is NETELLER instacash?

NETELLER instacash allows you use the bank account you registered with NETELLER to transfer funds to your account.

The NETELLER instacash system will check the balance of your NETELLER account and will transfer your balance if sufficient funds are available. If your funds are insufficient, the transfer will be supplemented by the funds in your NETELLER registered bank account.

Note: the minimum amount you can transfer using instacash is $10. For example, if a player makes a deposit request of $100, but only has $93 in his NETELLER account, $90 will be taken from his NETELLER account and the balance of $10 will be taken from his NETELLER registered bank account.

NETELLER instacash is only available for canadian players.

3. Do I need to open an account with NETELLER?

Yes. Please go the NETELLER site where you can create an account - it's fast and easy.

4. I already have a NETELLER account. Can I use it?

Yes, if you already have a NETELLER account you can use it to fund your account.

Note:the email address you registered with NETELLER and the cashier must be the same or your request will be declined by NETELLER's security system.

5. How do I get a NETELLER account?

Please follow the steps below:

- Visit https://member.Neteller.Com/mflux/member/signup.

- Once you have completed the NETELLER sign-up form you will receive an email. This email contains instructions for 'step 2' (your NETELLER account activation).

- Please follow the instructions, you will be prompted to submit your NETELLER account ID and secure ID (found in the email), plus the password you originally entered on the NETELLER account sign-up page. Save this email for further reference.

Once you have completed these two steps, your NETELLER account (or 'online wallet') is active and ready to be funded.

6. How do I get a NETELLER instacash functionality?

If you already have a NETELLER account then you need to register your bank account with NETELLER. NETELLER will send a small deposit to the bank account that you registered. Verify this small deposit to enable the instacash function.

7. How do I fund my NETELLER account?

NETELLER offers many instant and local options for funding your NETELLER account, including free debit card deposits, local bank deposits, credit cards and international bank transfers. There are also many other local options depending on where you live. For further information on funding your account visit http://www.Neteller.Com/fees/.

Electronic funds transfer (EFT): EFT a transfer of funds directly from your bank account, processed through the automated clearing house (ACH) network to your NETELLER account.

Instacash deposits: instacash deposits work like EFT deposits but are virtually instantaneous! You must have a registered and verified a bank account with NETELLER in order to make instacash deposits

NETELLER system transfer:receive funds from a friend or relative also registered with NETELLER.

8. How long does it take to credit money to my NETELLER account?

Credit card deposit:instant credit (if the transfer is approved by your bank).

Electronic fund transfer (EFT):requires four to five business days for clearance through ACH. Once your bank has authorized the transaction, NETELLER will fund your account immediately.Instacash deposit:

Can be credited virtually instantaneously (seenetellersite for complete details)

Note: to transfer funds from NETELLER to your account, login to your account, go to the 'cashier' and select 'deposit'.

9. How do I fund my account using NETELLER?

To fund your account with NETELLER:

- Log in to your account.

- Go to the 'cashier' tab and select 'deposit'.

- You will now see the NETELLER logo. To select this deposit option simply click on the icon.

- Enter or select your deposit amount and bonus code (if applicable), then click on 'deposit'.

- Enter your NETELLER 'account ID' and 'secure ID' that were sent to you in the registration email you received from NETELLER. Click 'submit'.

Once you have received confirmation that your transfer was successful, your funds will be instantly available in your account.

10. How do I use my NETELLER instacash account to add funds to my account?

To fund your account with NETELLER instacash:

- Log in to your account.

- Go to the 'cashier' and click on 'deposit'.

- In the NETELLER payment option, click on "deposit now".

- Enter the amount you wish transfer and your bonus code (if you have one).

- Enter your NETELLER 'account ID' and 'secure ID' that were sent to you in the registration email you received from NETELLER.

- Enter the last 4 digits of the bank account that you registered with NETELLER. Click 'submit'.

Once you have received confirmation that your transfer was successful, your funds will be instantly available in your account

11. How long does it take for money to get credited to my account?

The money is credited to your account instantly, provided you have sufficient funds in your NETELLER account.

12. How much does NETELLER charge for this service?

Please refer to NETELLER for updates on their processing and service charges

http://www.Neteller.Com/fees/

13. Can I withdraw using NETELLER?

Yes, to withdraw using NETELLER, you need to have made a successful deposit with your NETELLER account. If you already have made a successful deposit with your NETELLER account, simply login to the cashier, click 'withdrawal' and then select NETELLER. Your cash will be sent electronically to your NETELLER account.

14. Can I withdraw through NETELLER if I deposited through other means?

Yes, to withdraw using NETELLER you need to have made a successful deposit with your NETELLER account within the last six months.If you have made a successful deposit within the last six months, visit the cashier, select the 'withdrawal' tab and then select the NETELLER logo.The amount of your withdrawal will be sent electronically to your NETELLER account after our internal procedure has been completed.

15. Can I withdraw the same day I deposit through NETELLER?

16. Can I withdraw more than my initial deposit using NETELLER?

Yes. However, please remember that all withdrawals are first approved by our internal review team. This process usually takes approximately up to three business days. Once we have processed your withdrawal, it will take 2 - 6 hours for the funds to appear in your bank account.

17. What is the average processing time for NETELLER withdrawals?

All withdrawals are first approved by our internal review team, which takes approximately up to three business days. Once we have processed your withdrawal, it will take 2 - 6 hours for the funds to appear in your bank account.

18. What is the minimum and maximum amount I can withdraw using NETELLER?

The minimum withdrawal amount that you can withdraw via NETELLER is 10.00 USD equivalent and the maximum withdrawal amount is 50000.00 USD equivalent.

19. Is there a reason why I cannot deposit with NETELLER in my account currency?

NETELLER transacts in AUD, CAD, DKK, EUR, GBP, HUF, MXN, NOK, PLN, SEK, USD only.

Buy-sell bitcoin for paypal online

In this article, we aim to talk about how to buy or sell bitcoin with paypal instantly and anonymously online. You will find useful and up to date information about some other e-currencies too. You can also exchange, sell and buy ripple, ethereum, monero, zcash, and other cryptocurrencies at our website in less than a few seconds.

So what is a cryptocurrency?

A cryptocurrency is a form of online currency which is acting peer-to-peer for online payments. There is no need for a central authority. Since its start in 2008, it has grown into a worldwide currency with high technology. Also, a huge community of users is investing and using this kind of currency. As a result, online users are increasing every day. In this guide, we hope to explain how to instantly buy or sell BTC, ripple, ethereum, monero, zcash, and other cryptocurrencies. We also aim to explain how to use it to make your financial life better.

How to sell bitcoin for paypal:

- Choose to sell bitcoins on the left column.

- Click on the payment method you wish to receive for exchange.

- Enter your account email or account number. For ex: your paypal email address.

- Click EXCHANGE.

- Send the BTC amount to the provided address.

- Wait a few minutes for the network to confirm your transfer to receive your money.

How to get bitcoins

The best way to learn how to buy or sell bitcoin instantly using paypal is to try it out yourself. We will tell you how to set up your wallet. Also, you can find useful information here on how to get going with this electronic currency. After reading the whole page, if your questions remain unanswered, please use the contact us form.

We will discuss this matter in more detail on this page in the mining section. But here is a quick answer: some users connect their computers to the p2p network mentioned above to verify transactions. So the network rewards these users instantly. It is a fair trade for the amount of computing power they present to the network.

What was the hard part of cryptocurrency creation?

Since everyone can copy anything digital again and again, the hard part of creating an e-currency is to be sure that nobody spends the same money again. This is important for making and performing a digital payment system. In the old ways, a trusted central authority like paypal is verifying all of the transactions. The main new thing which makes bitcoin unique is that it uses general agreements in a peer-to-peer network. The main purpose of these agreements is to verify transactions in a massive P2P network. This has made a system in which none of its payments are reversible and no one can freeze an account. Also, the transaction fees are much lower compared to other payment systems.

BTC walletssers are able to send and different types of it

A “wallet” is somehow equal to a bank account. It allows you to get, keep, and send them to others if you want. There are two major types of wallets, A software wallet, and a web wallet. You install and use the software wallet on your PC or mobile device. Security of your coins is in your own hands and you have complete control over it. Yet they might be difficult to install and maintain. On the other hand, a third party is hosting and running a web-based wallet. Web-based wallets are so much easier to use. We advise you to choose a reliable wallet provider with high levels of security for protecting your money.

The digital wallet is a place to store your digital money and it is where users should check when selling or buying bitcoins with paypal. The wallet exists on the cloud webspace or the user’s computer. The wallet functions in a similar way to a bank account. Like all banks, the wallet lets its users send or get, pay for services or goods, and save money for the future. Opposite to the bank accounts, BTC wallets are not insured by any third party such as the FDIC.

Wallet in a cloud: servers might get hacked. Companies might vanish with clients’ coins.

Wallet on a computer: you might delete your wallet by accident. Viruses might destroy data in your wallet.

Sending and receiving buy and sell bitcoin

Users can send and receive BTC to each other by using ios or andriod mobile apps or by using their computers. Sending paypal to ethereum is very similar to sending cash online. Sending is an easy process as it is more like sending an email to someone else. Copy and paste the receiver’s address, choose the amount, and click send. This seems easy to people who are providing their credit card info to purchase bitcoin with a credit card or to sell it and withdraw to a debit card. This sending method lets people be in complete control over the transaction process. Please keep in mind that all transactions are irreversible. You put the receiver’s address and there is no going back after you click send.

The recipient may need to wait for a few minutes to see the payment that you have made. This waiting time depends on many different things. It depends on the wallet type the two parties are using. Furthermore, it depends on the network of the two parties too. Sometimes the first transaction confirmation shows up in about ten minutes or so. Many web-based wallets require no less than six confirmations before they confirm a transaction. This can take up to sixty minutes or more.

For receiving, provide your receiving address to the other party. Then all you have to do is to wait for the other party to send the payment. The story is the same when you want to sell your bitcoins to anyone and exchange it for paypal. As mentioned above, for the blockchain network to confirm the transaction, you may need to wait about ten minutes. Also, it’s good to know that a 100% confirmed transaction is the one that has six confirmations or more.

Know more about blockchain and confirmations

The blockchain is a public library of every transaction in the network. A complex algorithm distributes the blockchain on every machine connected to the network. Therefore, the blockchain will remain as long as the bitcoin network survives. Since the blockchain exists on many different computers, it is impossible to edit it. By analyzing the blockchain, anyone can verify the balance of each wallet they wish.

The mining process creates a new block every ten minutes or so. The miner’s job is to confirm and validate all transactions. The previous blocks and the new block is in the blockchain forever. The mining process adds a new block to the blockchain every ten minutes. This newly added block records all of the new transactions in the network. Then the BTC network verifies the transactions and confirms the transfer.

For example, imagine that john is selling bitcoin online to jane, and john sends the amount instantly. Yet the transaction remains unconfirmed until the successful creation of the next block in the network. As soon as that block is there, john’s money is verified and it is included in that new block. Then john to jane’s transaction has only one confirmation. About every ten or twenty minutes after the first block, the miners create a new block different than the previous one. After the creation of each new block, the network reconfirms the transaction again. Yet there is no need for more than 5 reconfirmations. Some companies only require one confirmation, but many require more than one confirmation for transferring bitcoins for online sales. Since each confirmation lowers the chance of reserving a payment. Requiring six confirmations is common in this industry and it takes about sixty minutes.

Who is satoshi nakamoto

In early 2008, an anonymous internet who calls himself satoshi nakamoto published a paper. The paper title was “bitcoin: A peer-to-peer electronic cash system”. Furthermore, this outlined the main and basic concepts which have built it. In january 2009, miners created the first block. A few days later, developers released a client software that made bitcoin online available to the public for exchanging, buying, and selling.

Satoshi nakamoto remained active in the newly made community until june 2010. Then he gave the lead developer crown to gavin andresen and faded out from the community.

We all know a little about him. The name satoshi nakamoto was somehow a cover for an online individual. Some say it was presenting a group of people that worked in harmony. Many attempts to find out who satoshi nakamoto is have failed. The new yorker has investigated to learn more about satoshi nakamoto and found nothing. Also, fast company tried to reach satoshi nakamoto and ended up with no final result.

Who is in charge?

As mentioned earlier, no central person or central authority is in charge. Many developers give away their time and effort to develop open-source software. Also, all of the changes are subject to the approval of gavin andresen who is the lead developer. The miners may choose between sticking to the old software or installing the new version. So it is best for the miners to only accept changes that are proper for buying bitcoin in the long run. No third party can misuse the system because of these checks and balances.

History of price

In the early days of 2010, the first exchanges were taking place on the bitcointalk website. One user sold 10,000 bitcoins for a $26 pizza. The recognition of this electronic currency has increased over time. Also, the value of it increased as awareness increased.

In june of 2011, the value of a single unit of bitcoin at the online sale market rose to $31. The value dropped down to less than $2 by october 2011. It began to see a great rise in value online recognition for the rest of 2011 and 2012. In march and april of 2012, a single unit value started rising from $50. The rise did not stop until it reached $270 per bitcoin for buyers and sellers. Then, the value fell to less than $80. After the crash down, the value stood back to $160 in about one business day.

Is bitcoin good for investing

Many users have tried to instantly purchase bitcoin for investment purposes, and sell it later for a profit. They are treating it to goods for exchange. Similar to any other easy investments, this one has had mixed results too. Yet, at a glance, a single unit value of this electronic currency has raised to 500% comparing to what it was three years ago.

Silicon valley people have paid lots of attention to a few companies in the early days of last year. For example, Y combinator and the fundersclub and many others have raised more than a million dollars. A single company called coinbase has raised more than 7 million dollars too. Similar to mentioned companies, coinlab from seattle, WA has raised over $650k from investors. Lightspeed ventures are examples of many investors who have invested lots of money. Also, another group of focused investors brings small startups up to the main arena. They call themselves bitangels and have come together for creating a focused group of investors.

Mining

Mining is a series of calculation processes running on a computer. The purpose of these processes is to verify and confirm the transactions. The miners create a new data block of transactions in about every ten minutes. Then the network awards them for their help and donation to the network. This helps the network to verify transactions and to distribute funds between its users.

Mining used to be profitable by using your standard personal computer or laptop. Nowadays the cost of electricity needed to do the mining is a lot more than the amount of the coins you might mine. Mining now requires specialized hardware to be profitable, so it can compute more processes with less energy.

There is an all-time competition for bitcoin mining by using high-power computers to solve complex math puzzles. Currently, the winner will receive 25 XBT in every 10 minutes or so. Mining is the main method of adding and creating new coins.

Security tips to keep your electronic money safe

Any bitcoin amount you get is in danger of being lost or stolen. Weak security or computer failure may result in stolen or lost electronic currency. Therefore, it is a wise decision to have more than one backup in some secure places.

Many ways may result in the loss of bitcoins you have purchased. For example, if you lose your secret key combination, no one can open the safe forever, not even you. If someone finds out your secret key combination, you should consider your coins already lost. Therefore, it is a smart thing to have a backup of secret key combinations in different places to ensure that you will never lose it. Consider all the purchased bitcoins gone if any of the backups are in hands of someone else.

Imagine you have a big amount of money in a private safe. This safe is in a public area where everyone has easy access to it. Also, the safe secret key is a combination of letters and numbers, so long that it is impossible to guess. You can never remember the combination of the secret key to the safe, so you must write it down. In the network, the safe is the blockchain, and your coins are the big amount of money. Also, the safe combination is your private keys in this network.

What users can do with their purchase

Users can sell merchandise with BTC anonymously. Also, international transfers are easier, faster and cheaper than bank transfers. Since it is not tied to any country or any special regulation, users can trade bitcoin instantly. Many businesses and corporations like it because there are no credit card fees. Other users just sell paypal and receive bitcoins as an investing opportunity since they hope that its value goes up over time.

Buying and selling bitcoins from our website

Several online websites with different exchange rates allow users to trade, sell and buy bitcoins. We claim to be the fastest and the most anonymous of all with the best exchange rate.

No one knows what this e-currency will become in the future. Like any other thing in this world, it can change too. So long, the governments are not happy about taxation and their low control over this e-currency.

Each transaction is recorded in a public log, but the names of buyers and sellers of bitcoin are never revealed in the purchase. Only their wallet ids are available for the public to view. This method keeps all of the users’ transactions private and anonymous. It also lets them exchange without anything tracing back to them. That is the main reason it has become the currency of choice for anyone purchasing drugs or doing other illegal activities.

Other types of e-currency exchange service we offer

Along with the other services and products, at the aphachanger.Com website, we offer some special services which no other website offers. Tired of searching for a low rate paypal exchange service? Looking for a US-based exchanger but do not know whom to trust? Having a problem with transferring funds from paypal to skrill, perfect money or moneygram? The good news is we are here to answer all your needs.

Browse through the website, buy, sell, and learn about bitcoin. All transactions can be completed with any major credit/debit card. You may use moneygram, western union, and alipay. Most of the transactions generally take place in a single business day. We assure the safety and efficiency of every single exchange order. Your money is in good hands with us.

We will never be undersold. For that purpose, we always stock large e-currency reserves for each e-currency we work with. We can assure you prompt service, and always have the best exchange rate for large orders. So good that other exchange websites are unable to fulfill due to their limited resources. At alphachanger.Com, we are proud of our excellent customer service support. That is why the majority of our customers are coming from referrals from other customers. This gives us great pride. We have built our reputation in time through the quality of our service.

Give us a try today. We hope to be able to build a long-lasting business relationship with you. We aim to serve you with all your exchanging needs in the future. Thank you for your business and continued support!

Now that you know how to sell or buy bitcoin instantly and anonymously, it’s better to learn more about how to transfer money. You can learn a lot from the articles in other sections. If you feel confused about anything, feel free to contact us.

NET+ plastic prepaid mastercard®

С картой net+ plastic prepaid mastercard® вы получите мгновенный доступ к средствам своего электронного кошелька для совершения покупок в интернете, а также возможность снимать наличные в банкоматах.

Эта карта, которую можно заказать сразу после верификации, позволяет вам моментально и анонимно снимать наличные в любом банкомате мира, не привязываясь к банковским переводам, которые подотчетны регулирующим органам.

Как заказать карту NETELLER ?

Для начала — нужно зарегистрироваться в NETELLER по нашей ссылке и пройти верификацию.

Участники программы vipdeposits NETELLER имеют повышенные лимиты на снятие наличных — 3300$ в сутки. Заказ карты стоит 10€, для статуса VIP silver и выше — бесплатно.

Преимущества карты net+ plastic prepaid mastercard®:

Используя карту «NETELLER mastercard», вам не придется связываться с банком вашей страны или выводить деньги с помощью банковского перевода: ваши средства на счете NETELLER доступны вам моментально и по всему миру.

Тарифы карты net+ plastic prepaid mastercard® для участников программы vipdeposits NETELLER:

| стоимость выпуска карты net+ plastic prepaid mastercard® | 13$ |

| комиссия за единоразовое снятие наличных в банкомате | 1.75% или 6$ для VIP gold и выше |

| количество снятий наличных в банкомате в сутки | 10 |

| суточный лимит на снятие наличных в банкомате | 3300$ |

| количество оплат в точках продаж в сутки | 50 |

| суточный лимит на оплату покупок картой neteller в точках продаж | 7000$ |

| комиссия за конвертацию | 1,29% — 3,99% |

| доступная валюта для счета NETELLER и карты net+ mastercard® | GBP, USD, EUR, CAD, SEK, DKK, AUD, JPY |

Балансом карты net+ plastic prepaid mastercard® является баланс вашего счета NETELLER.

Карта net+ plastic prepaid mastercard® именная — на ней будет нанесено имя, указанное вами в счете NETELLER при регистрации.

Срок действия карты — 3 года.

Отсутствуют ежегодные взносы за пользование картой (для владельцев статуса silver и выше).

Карта net+ plastic prepaid mastercard® высылается обычным письмом и попадет в обычный почтовый ящик. Доставка карты net+ plastic prepaid mastercard® занимает 7-10 рабочих дней, но во многом этот срок зависит от работы почты страны, в которой вы проживаете.

Для активации карты net+ plastic prepaid mastercard® нужно войти в свой аккаунт NETELLER и ввести последние четыре цифры карты в разделе «карты».

Таким образом, карта net+ plastic prepaid mastercard® — это постоянный доступ к вашим средствам на счете NETELLER в любом банкомате и магазине мира!

Программа лояльности vipdeposits NETELLER, предлагает лучшие условия использования карты net+ plastic prepaid mastercard® присоединяйтесь, заполнив заявку ниже.

Присоединяйтесь к программе vipdeposits NETELLER

Если у вас уже есть счет NETELLER, переходите

сразу к шагу 2 и заполните заявку.

3 best website to create free virtual debit card (VCC) 2018

Let’s create a free virtual debit card now! VCC stands for virtual credit card(also known as a virtual debit card). A virtual debit card is much useful when you don’t want to use your original bank details on a website.Also, you can use it to buy from international websites. I will teach you how to create a free virtual debit card.

Unlike other websites, I didn’t just copy-paste content here! These virtual debit cards are tested by myself!

What is a virtual debit card/virtual credit card

Simply put VCC is a debit card without the physical plastic card, but you will get the card holders name, from and to date, card number, cvv number all in online. This can be used for online transactions only.

You can recharge the VCC(virtual debit card) using local bank account transfer, international bank account transfer and more even easier ways such as credit or debit card transfer. Advantages of a virtual debit card is that it can be used internationally without revealing any of your personal data or banking data. However the virtual debit card provider will have your billing address with them.

Virtual debit card comes from virtual card technology which is derived from card not present idea.

Now there are many virtual debit card providers are out there. Some of them allows us to create an account and issue a virtual debit card for free but for each transaction they will levy some charges like 1.9% to 4.5% from your account. This percentage varies according to providers and it will come to a lower percentile once the amount you transferred is higher than their limit.

Why you need free VCC (virtual debit card)?

Virtual debit card has many advantages.Here I discuss some major use of entropay

- Hassle free purchase frominternational online shopping website.Getting a credit card from bank isn’t easy.Even though you may fail in card decline problems.So virtual debit card is best solution for you.

- You can add money to betting website.Some countries decline transfer from bank to online betting website.So virtual debit card help here.

- Add money to popular website for business purpose. Some websites : flippa, paypal, google developer console, upwork, fiverr, etc

- Easy money transfer. Actually its help to transfer money.Create a virtual debit card and give card number and cvv your friend who need money across country.They can use simple like a visa card

How to create free VCC (virtual debit card)

Here i will explain best free virtual debit card providers, they are

1. Entropay free virtual debit card

Entropay offers free of charge for opening an account, creation of card and online transactions.

Entropay is my favourite vcc to make payment online.

With no credit checks, extra costs, or administrative delays, entropay offer a simple virtual prepaid card solution designed with corporate online transactions in mind. Entropay purchasing allows you to create, manage, edit or delete prepaid virtual cards through a simple, instant, online interface.

Entropay virtual debit card features

- Multiple currencies support: use entropay virtual cards to pay like a local in €EUR, £GBP and $USD.

- Accepted globally: use entropay cards to shop online anywhere visa is accepted in +120 countries.

- Fair fees: top up from as low as 1%. Plus, it’s always free to create a card and make an online purchase with a card

- Unlimited virtual cards: you can create unlimited virtual cards over the lifetime of your account.With an entropay account, you can have 10 active cards at any time. Deleting and creating new cards is a snap!

- Protect from frauds: use one entropay card per merchant. If a merchant is ever compromised, breaches are contained.Delete entropay cards instantly to protect yourself from fraud and fishy charges.

- Set limits:set individual card limits for ultimate control over your money. Adjustable card limits stop runaway subscription charges and help you budget better.

Creation of VCC in entropay

- Goto entropay.Com & sign up

- Complete the sign up form

- After clicking on submit, you will get a welcome email

- Click on the “cards” in the navigation menu

- Click on “create card”

- Type your “card nick name”

- Then click “create”

- Thats all, your first VCC has been created.

To top up the card click on “top up card” and choose any of the methods you wish to choose and fill up the details accordingly. Once the top up has been completed you will get the card number, cvv number in that card itself and you can use it for online payments.

To add more than one card you have to upgrade your account to standard or pro.

2. Neteller free virtual debit card

Neteller also offers free of charge account creation and card creation as well. One additional plus point is that it doesn’t charge any fess for local bank deposit and international bank transfer.Vcc also call virtual debit card!

Neteller virtual debit card features

pay with confidence:NETELLER makes paying online easy – even where debit and credit cards may not work.

Spend your money on thousands of international sites

Creation of virtual debit card in neteller

- Goto this signup link

- Fill in the required details

- Click open account

- You will get a confirmation mail, open the mail

- Click sign in link in the mail

- Provide the details and sign in

- Click on money in option

- Choose preferred method and add the minimum fund designated.

- After that select the net+ cards link found on the left side of your screen

- Select the net+ virtual prepaid mastercard® section

- Click on add a card

- Select the desired currency. Please choose the currency that you do most of your shopping with as there will be a currency exchange rate fee of 3.99% if there is currency conversion.

- Name your card (optional).

- Fill in a lifetime limit (optional).

- Once you generate the net+ prepaid mastercard®, you will notice the 16-digit card number appear, along with the security code (CVV) and the expiry date.

You can now use that net+ virtual generated card number at your favorite merchant.

Neteller net+ vcc available on limited countries only!

Note: even though the first net+ virtual prepaid mastercard® is free of charge, every next card will cost 3 USD (2.5 EUR/ 2 GBP). You can have up to 5 active net+ virtual prepaid mastercard® cards at a time.

3.Yandex money free virtual debit card

Yandex money is a russian based payment service comapany.There is no restriction for other countries to use there service and vcc for free.

When you enter there website.You would be like “what the hell is this,I don’t know this language”

“cool…….” just translate this website using google translator ��

Creation of yandex money virtual debit card

- Go to yanedex money & sign up

- Signup with your google account, social profile, or email.Also, provide phone number

- While registration you will get OTP to your mobile. So, enter OTP on the website and finish the registration.

- Then, select yandex.Money cards on left side of your homescreen.

- Select order a card or create a card (may be shown as ‘virtualmap‘ means virtual card.There may be translation error I think)

- Enter your name and create your card!

- You will receive a CVV number on your registered mobile number.

Conclusion

This is a tutorial on how to create a virtual debit card for free of cost. I have explained the best providers out there for virtual debit card and its step by step procedure for creating a new card as well. These tutorials made after check almost virtual debit card provider on the internet and provide you best one!

Hope you enjoyed it and if found useful share it with your friends as well.

Что можно сказать в заключение: what is the net+ prepaid mastercard® and how can I get one? What is the net+ plastic prepaid mastercard®? Net+ cards are prepaid cards that operate on the mastercard® platform. They provide по вопросу neteller card

Комментариев нет:

Отправить комментарий