Neteller account

If the site is not shown in your preferred language, you can change the language by going to the upper right-hand corner of the screen to select your language of choice. If you would like to fund your NETELLER account, click “put money into my account” to continue through the deposit process. As you can register this information later, you may instead click on “view my account” to gain access to your account screen.

How to open a NETELLER account

(1)click the logo or link below to access NETELLER

(2)click “join for free”

If the site is not shown in your preferred language, you can change the language by going to the upper right-hand corner of the screen to select your language of choice.

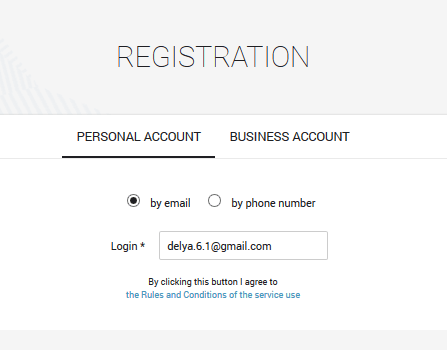

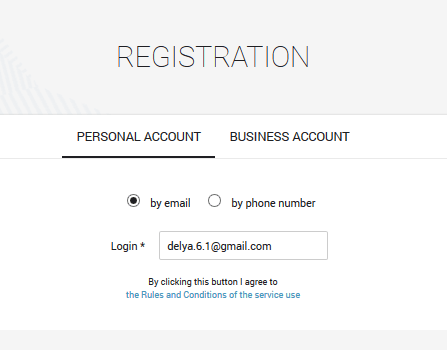

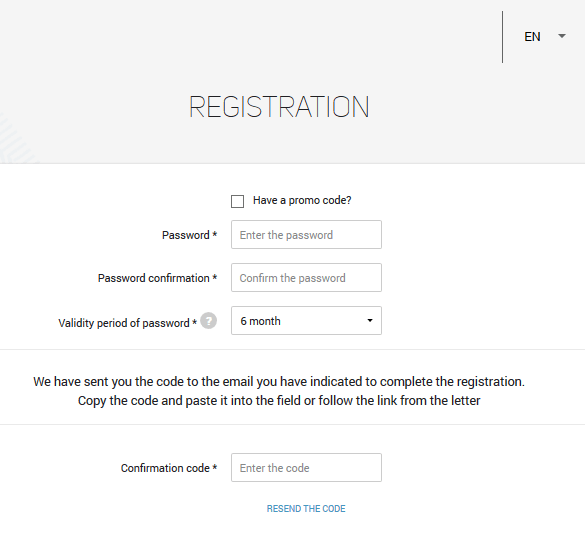

(3)after clicking “join for free”, the following screen will appear for you to enter your details

When choosing the currency of your account, we recommend that you select the same currency as your betting currency at the online bookmakers where you have registered to save on transaction fees when depositing and withdrawing.

Click “continue” to move on to the next screen.

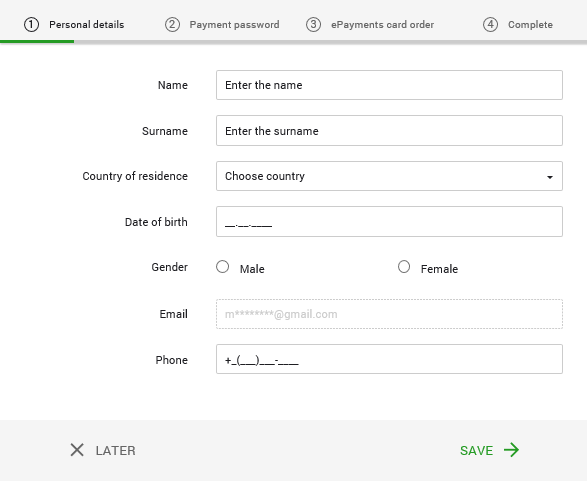

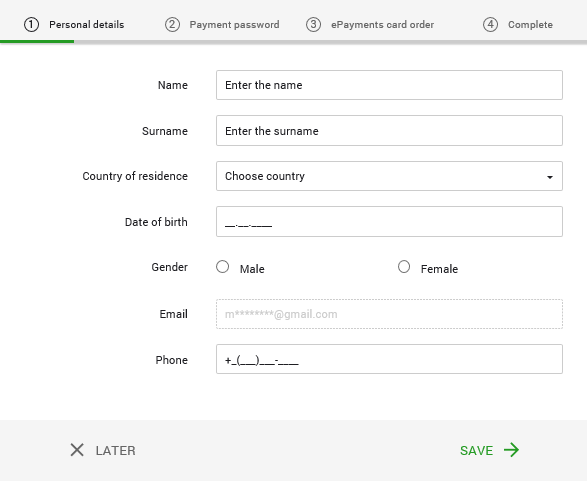

(4a)enter in your personal details

Click “continue” to move on to the next screen.

(4b)enter in your personal details ※ USA residents

If you reside in the united states of america, you will be sent a free net+ prepaid card upon funding your NETELLER account. In order to receive your card, please make sure that you have entered in your correct mailing address.

Click “continue” to move on to the next screen.

(5)confirm your security question answers

Click “continue” to move on to the next screen.

(6)registration complete

After completing your registration, you will be shown a screen similar to the one above with your account ID and secure ID. We recommend that you store these details in a safe place for future reference when wanting to log in and use your NETELLER account.

If you would like to fund your NETELLER account, click “put money into my account” to continue through the deposit process. As you can register this information later, you may instead click on “view my account” to gain access to your account screen.

※ USA residents

If NETELLER is unable to verify your identity based on the details that you entered in the previous screens, the above screen will be shown. Look over the details carefully to make any changes that need be before clicking the green “confirm” button.

Neteller

Neteller is the most popular gateway for investing or transferring money in the forex market. We who are trading forex in bangladesh are always facing various problems for investing or withdrawing money as there is no opportunity to make transactions directly from our local banks. That’s why traders are always worried about their investment. Many people ask us, “what option do you use to trade in a forex broker?” most of the time, traders in our country, use account transfer method from other traders account or use some unknown sources to deposit fund by using some third party organizations but none of these options are safe. Because, in most brokers, the way you deposit funds, you have to use the same method to withdraw funds from broker account.

Now suppose, if you use to deposit funds by transferring from another account, then please think of it, how can you withdraw your invested amount from broker account? Broker also will not allow you to withdraw that money. So, the question arise, how to solve this problem? Please read the entire article in detail. Hope you will get answers to all your questions.

– video tutorial –

Neteller is one of the most popular and reliable gateway to invest in the forex market. The reason behind its greater popularity. It is very easy to get this neteller in our country and you can easily transfer money to another neteller account or if you have a neteller master card you can easily withdraw money from any ATM. You can also withdraw neteller’s funds directly through your local bank if you wish.

How to open a neteller account?

It doesn’t cost any to open a neteller account. You can open an account for free. Many people use to buy and sell this neteller account in exchange of BDT. Our suggestion is to please never buy a neteller account that has been registered by anyone else. Remember, registering a neteller account is completely free and you do not need to spend a penny for this. If you have this article in mind, you can easily open a neteller account yourself.

Register free neteller account

We are working with neteller for last couple of years as regional support. If you face any problem regarding neteller, please feel free to contact us anytime.

After clicking on the registration button above, you will come to the following form which you will need to complete. Fill out the form correctly and click the “open account” button. Your neteller account will be open and you will receive a confirmation email with your email id. Now you can login and verify your neteller account.

How to verify neteller account?

We have encountered the most problems with verifying neteller’s account. But the funny thing is, it’s a very easy process. We get into this problem because of some of our own mistakes. Now we will discuss how to verify your neteller account.

Step 1, after opening the neteller account correctly, you must, first deposit any amount via uploading money tab or can transfer from other neteller account user. Then you will get the option to verify your account. Amount can be any, however, from neteller to neteller’s minimum $5 can be transferred. If you have skrill amount, you can deposit $ 0.01. If you do not have skrill dollars, we will give you $ 0.01 to verify the account.

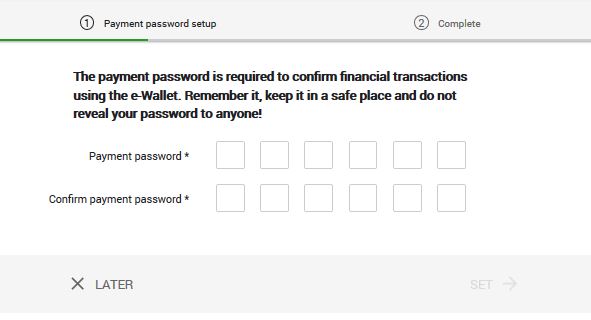

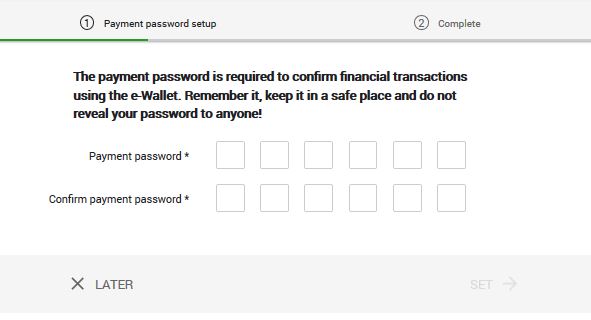

Step 2, after depositing the amount – you will need to set up 3 different security questions so that if your neteller account is blocked for any reason or you have any problem you can recover the account by answering these questions. For the sake of account security, you must answer these questions properly and refrain from sharing them with anyone else. Then, you need to set a 6 digit PIN code for your account. You will need this code when logging in and making a payment to another account. That is, you should use security code when transferring funds from your neteller account to someone else’s neteller account. For the sake of account security, refrain from sharing this security PIN with anyone. But if you ever forget this code, you can set it up to recover. So no worries for that.

Step 3, now you have to upload a copy of NID / passport / driving license to verify your name correctly. Here you will submit two color photographs of your NID / passport / driving license. In this case you need to use the webcam.

Last step, to verify your address, upload a copy of any utility bill / council papers / court bill / bank statement that is in your name. Now take your NID / passport / driving license in front of your face. (you must use webcam to upload this image directly)

NB: when you are trying to verify your neteller account, please be aware of the followings:

- The uploaded image must be colored. Neither whitening nor photocopying will be acceptable.

- The picture of the NID / passport / driving license is clear and your name and date of birth must be visible here.

- The image cannot be scanned and duplicated. Scanning documents cannot be acceptable for any verification. In this case, when submitting the document, you will take a picture directly from your smartphone/webcam and upload it.

- When taking a picture of a document, place it on a clear table, then take good focus on it and take the picture and please be sure that, all the 4 corners of your documents are clearly visible.

- Do not register or verify your neteller account through VPN. This may cause your account to be permanently blocked.

- Never open two or multiple neteller accounts under the same name, it will block your two accounts. Neteller organization does not offer the benefits of using more than one account and when you register the account, your internet IP is going to be stored on neteller’s server. So, if you try to register an account by using the same IP, you will be in danger.

- Don’t proceed to open an account with wrong information. If you do not have the required information, there is no need to register an account in your name. If you do so, you can put yourself in danger.

- Do not use your neteller account login information using multiple browsers or ips. This may cause your account to be compromised. One more thing is important, never login or browse to a neteller account by using a public internet connection (ex: market, park, hotel or cybercafe). This may result in your account being permanently blocked.

Please contact us if you have any problems. For more details on verification, please visit the neteller section of our forum. The link to the forum is given at the end of the article.

Neteller

Neteller is the most popular gateway for investing or transferring money in the forex market. We who are trading forex in bangladesh are always facing various problems for investing or withdrawing money as there is no opportunity to make transactions directly from our local banks. That’s why traders are always worried about their investment. Many people ask us, “what option do you use to trade in a forex broker?” most of the time, traders in our country, use account transfer method from other traders account or use some unknown sources to deposit fund by using some third party organizations but none of these options are safe. Because, in most brokers, the way you deposit funds, you have to use the same method to withdraw funds from broker account.

Now suppose, if you use to deposit funds by transferring from another account, then please think of it, how can you withdraw your invested amount from broker account? Broker also will not allow you to withdraw that money. So, the question arise, how to solve this problem? Please read the entire article in detail. Hope you will get answers to all your questions.

– video tutorial –

Neteller is one of the most popular and reliable gateway to invest in the forex market. The reason behind its greater popularity. It is very easy to get this neteller in our country and you can easily transfer money to another neteller account or if you have a neteller master card you can easily withdraw money from any ATM. You can also withdraw neteller’s funds directly through your local bank if you wish.

How to open a neteller account?

It doesn’t cost any to open a neteller account. You can open an account for free. Many people use to buy and sell this neteller account in exchange of BDT. Our suggestion is to please never buy a neteller account that has been registered by anyone else. Remember, registering a neteller account is completely free and you do not need to spend a penny for this. If you have this article in mind, you can easily open a neteller account yourself.

Register free neteller account

We are working with neteller for last couple of years as regional support. If you face any problem regarding neteller, please feel free to contact us anytime.

After clicking on the registration button above, you will come to the following form which you will need to complete. Fill out the form correctly and click the “open account” button. Your neteller account will be open and you will receive a confirmation email with your email id. Now you can login and verify your neteller account.

How to verify neteller account?

We have encountered the most problems with verifying neteller’s account. But the funny thing is, it’s a very easy process. We get into this problem because of some of our own mistakes. Now we will discuss how to verify your neteller account.

Step 1, after opening the neteller account correctly, you must, first deposit any amount via uploading money tab or can transfer from other neteller account user. Then you will get the option to verify your account. Amount can be any, however, from neteller to neteller’s minimum $5 can be transferred. If you have skrill amount, you can deposit $ 0.01. If you do not have skrill dollars, we will give you $ 0.01 to verify the account.

Step 2, after depositing the amount – you will need to set up 3 different security questions so that if your neteller account is blocked for any reason or you have any problem you can recover the account by answering these questions. For the sake of account security, you must answer these questions properly and refrain from sharing them with anyone else. Then, you need to set a 6 digit PIN code for your account. You will need this code when logging in and making a payment to another account. That is, you should use security code when transferring funds from your neteller account to someone else’s neteller account. For the sake of account security, refrain from sharing this security PIN with anyone. But if you ever forget this code, you can set it up to recover. So no worries for that.

Step 3, now you have to upload a copy of NID / passport / driving license to verify your name correctly. Here you will submit two color photographs of your NID / passport / driving license. In this case you need to use the webcam.

Last step, to verify your address, upload a copy of any utility bill / council papers / court bill / bank statement that is in your name. Now take your NID / passport / driving license in front of your face. (you must use webcam to upload this image directly)

NB: when you are trying to verify your neteller account, please be aware of the followings:

- The uploaded image must be colored. Neither whitening nor photocopying will be acceptable.

- The picture of the NID / passport / driving license is clear and your name and date of birth must be visible here.

- The image cannot be scanned and duplicated. Scanning documents cannot be acceptable for any verification. In this case, when submitting the document, you will take a picture directly from your smartphone/webcam and upload it.

- When taking a picture of a document, place it on a clear table, then take good focus on it and take the picture and please be sure that, all the 4 corners of your documents are clearly visible.

- Do not register or verify your neteller account through VPN. This may cause your account to be permanently blocked.

- Never open two or multiple neteller accounts under the same name, it will block your two accounts. Neteller organization does not offer the benefits of using more than one account and when you register the account, your internet IP is going to be stored on neteller’s server. So, if you try to register an account by using the same IP, you will be in danger.

- Don’t proceed to open an account with wrong information. If you do not have the required information, there is no need to register an account in your name. If you do so, you can put yourself in danger.

- Do not use your neteller account login information using multiple browsers or ips. This may cause your account to be compromised. One more thing is important, never login or browse to a neteller account by using a public internet connection (ex: market, park, hotel or cybercafe). This may result in your account being permanently blocked.

Please contact us if you have any problems. For more details on verification, please visit the neteller section of our forum. The link to the forum is given at the end of the article.

About NETELLER

Founded in 1996, NETELLER quickly became the biggest ewallet on the market. They are owned and operated by the paysafe group (formerly known as optimal payments PLC) and are publicly traded on the london stock exchange since 2004.

With NETELLER, you can easily and securely move your funds online to and from a huge number of available merchants, send money to friends and also access your balance with the net+ prepaid NETELLER mastercard, paying everywhere where mastercard is accepted, or simply getting cash from the ATM.

As of 2015, optimal payments as the mother company of NETELLER bought skrill and are now working closely together. Those changes also made it possible to transfer funds from your NETELLER account to your skrill account and vice versa.

NETELLER & ewallet-optimizer

Ewallet-optimizer is our biggest and valued affiliate partner for NETELLER, offering customers the very best treatment, fastest support and additional benefits without any extra fees.

NETELLER’s partnership with ewallet-optimizer since 2014 has been an important factor in our growth and brand building all over the world.

We are very happy with the ongoing long-year partnership and look forward to continuing and growing our partnership even more in the future.

In may 2014 we started the partnership with NETELLER to be able to offer another great ewallet provider to our customers. NETELLER is available at almost all poker sites, forex providers, casino sites and sportsbooks. In combination with our ewo bonus program, NETELLER is the perfect choice for any customer who is looking for a safe, fast and easy solution to move their funds.

We will continue our great partnership with NETELLER and always strive to offer the best benefits for all clients who sign up through us.

Reviews from our loyal clients

Partner network

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

How to deposit into my NETELLER account

(1)log into NETELLER

If the site is not shown in your preferred language, you can change the language by going to the upper right-hand corner of the screen to select your language of choice.

Click “sign in” in the upper right-hand corner to continue.

(2)after clicking “sign in”, the following screen will appear

Enter in your login details and the click the green “sign in” button to access your account screen.

※ depending on the country you indicated where you reside during the account registration process, your account screen may be slightly different than what is shown in the screenshots below on this page. For the account screen and deposit options associated with a united kingdom (UK) registered account, please refer to #3-6. For the account screen and deposit options associated with a united states of america (USA) registered account, please refer to #7-8.

(3)click “money in” to view deposit options ※ as a UK resident

After successfully logging in, click on “money in” in the upper left-hand corner of the screen to view available deposit options.

(4)fast bank transfer deposit option ※ as a UK resident

NETELLER’s fast bank transfer deposit option is a domestic deposit option allows you to make a deposit that normally will be reflected in your NETELLER account within two (2) hours.

Click the green “continue” button to move on to the next screen.

Click the green “continue” button to move on to the confirmation screen.

Note your payment reference number and the available banks to which you can make your deposit payment.

(5)domestic bank transfer deposit option ※ as a UK resident

Click “deposit now FREE” as indicated above to continue.

After entering in and confirming your deposit amount, the final confirmation screen will appear for you to check the details in order for you to make your deposit via domestic bank transfer.

Deposits via NETELLER’s domestic bank transfer deposit option normally will be reflected in your NETELLER account within one (1) business day, however it may take up to two (2) business days in some instances.

(6)international bank transfer deposit option

※ as a UK resident

Click “deposit now FREE” as indicated above to continue.

After entering in and confirming your deposit amount, the final confirmation screen will appear for you to check the details in order for you to make your deposit via international bank transfer.

Deposits via NETELLER’s international bank transfer deposit option normally will be reflected in your NETELLER account within three (3) business days, however it may take a little longer in some instances.

(7)click “money in” to view deposit options

※ as a USA resident

After successfully logging in, click on “money in” in the upper left-hand corner of the screen to view available deposit options.

(8)deposit options ※ as a USA resident

As a USA registered account holder, you are provided with only two deposit options via credit card as indicated in the screen above.

Neteller review

Neteller is our recommended choice of banking option when it comes to handling depositing and withdrawing funds from online bookmakers. When you want to fund your betting account from neteller, it usually takes less than a minute, and withdrawals are swift as well. And best of all - these are free!

However, funding your neteller account (from your own bank account) can have large fees attached to it, depending on which method you use, so make sure you are comfortable with that before you deposit money to your account.

After you have funds in place though, neteller is in the top spot when it comes to handling online betting banking.

About neteller

Neteller originates from canada, and was created there back in 1999. Since then it has moved and have also been acquired by the paysafe group plc.

Their core focus is being an online ewallet, processing payments online. Most of their work is done for the gambling industry, amounting to over 90% of their revenue and turnover.

Although they may look like a bank, they do not offer loans and other similar bank like services to it's customers. They online process payments.

Why use neteller?

Usually the simplest methods of depositing to your preferred betting site is by simply whipping out your credit card and punch in your numbers to deposit money, but depending on which website you use or where you are from this may not always be an option.

That is where getting an ewallet like neteller is a good alternative for depositing money. While banks in some countries are prohibited from processing transactions to online sportsbooks, all most of them allow deposits to neteller, which you then in turn can use to transfer to your betting website of choice.

Best betting sites that accept neteller

Most gambling sites offer neteller as a deposit option, so this list does not differ much from other ones. The only thing to note is that neteller has pulled out of the US after the UIGEA happened and will not allow customers from USA.

Neteller in india

If you are from india, you are allowed to create an account at neteller and use it to fund gambling site accounts. However, there are problems when you want to move funds out of india, which is what you are doing if you are depositing to neteller (neteller is based in the isle of man under british rule). Most credit cards and banks will block your transaction, making you unable to get funds into neteller.

This has to do with the reserve bank of india (RBI) enacting the liberalised remittance scheme. This limits the amount of funds that indians are allowed to move out of the country per year. There are different limits based on your plan of use for the money, so if you state it is for gambling, you will get rejected automatically.

What our visitors have noted to us and what we have experienced ourselves after years of trial and error is that the ICICI bank seems to be able to get this process through without any problems. Most other banks don't seem to allow these transactions out of the country and will try to block them. So if you want to deposit to neteller from india, we recommend using ICICI bank and their credit cards.

Alternatively you can try the federal bank in india, as they also seem to have some success rate when it comes to deposits to neteller.

How to create a neteller account

Although this is a simple process, it does takes some time to get everything setup. Note that once you have everything in place, moving money around is very swift, you just need to have some patience getting it ready.

4 steps to creating an account at neteller

- Visit neteller and click the button in the top right named "join for free".

- Fill out the signup form and click the "open account" button at the bottom.

- Write down your neteller secure ID that will appear on the next screen and confirm your account in the email you will receive.

- Login to your neteller account and click the big green button that reads "money in" to deposit funds. Remember to use ICICI bank or federal bank for a higher chance of success of deposit.

As simple as that! If you want a more detailed explanation on how to go through these steps, just read on:

Visit neteller

First you need to visit www.Neteller.Com to signup for an account. Click on the 'join for free' button, either in the top right or in the middle of the screen.

Fill out the signup form

Now you will be taken to the next screen where you will be met with a signup form. Simply fill in the required information. You need to provide some information confirming your identity, as well as some security info to make sure that your account is protected. This includes a random password that should be strong and also security questions to help verify your account should you be so unfortunate as to lose your account details.

Know that this is all a part of the great care neteller has for its customers. It might seem like a hassle when you are in the middle of it, but when they save your account from fraud, you will be thanking them.

Confirm your email and neteller secure ID

When you have clicked the 'open account' button and come to the next screen you will see some text that say an email has been sent to your email for confirmation (go to your email and click that confirmation link to confirm your account) and also your neteller secure ID will be displayed there. Be sure to write it down somewhere and keep it hidden.

That is all that is needed to create the account. You should get an email with your account details. To confirm your account you should call neteller or they will call you, so make sure you have access to the phone number that you used in the signup process. Also keep all the information you gave at hand as they will ask some questions regarding your account. For video explanation look further down.

Funding your neteller account

You can transfer funds to your neteller account using the most popular payment processors like VISA, mastercard, bank transfer and many others. However, there are fees attached to the funding methods, and these vary depending on which you choose. Here is a list of the most popular ones and the fees attached:

Funding options and associated fees:

- VISA - 1.90 - 4.95%

- Mastercard - 1.90 - 4.95%

- Bitcoin - 1.00%

- Bank transfer - FREE

- Paysafecard - 7.00%

As you can see, the options you should prefer are local bank deposits or international bank transfers. By using these options it might take awhile for your funds to show up in your account, but they are free to process at least. If you are anxious to get on with your betting, VISA and mastercard hold a 1.90% fee which is ok if you are depositing smaller amounts, but be sure to stay away from the most expensive methods out there like the paysafecard which hosts an almost a 10%(!) fee to deposits.

Also, as we have mentioned further up in the article, you should use either cards or deposits from the ICICI bank or federal bank if you are depositing from india. Those banks allow deposits to neteller and will yield higher chance of success.

Once you have funds in your account the transfer fees are 0% for depositing at online sportsbooks, so make sure to take advantage of all the free bets, bonuses and promotions that the online sportsbooks offers.

How to create an neteller account video:

A lot of people have sent us emails asking us how to create an account with neteller and other questions regarding the process. We decided to create a video to answer some of these questions and guide you through the process.

How to create an neteller account video in hindi:

How to deposit money to neteller account in hindi:

Our thoughts on neteller

This is our preferred method of online banking here at www.Onlinecricketbetting.Net. We have only good things to say about this company and their commitment to keeping your funds secure.

At first it might seem like a hassle to answer security questions if you get your password wrong once or if you login from abroad, but it makes me feel confident that my funds are secure at all times when it is held by neteller.

It is also a very swift and probable way of depositing funds for gambling online, so if you want to bet on cricket, you kinda have to deal with neteller. Guess it is a huge bonus that they are a solid operation then!

Free cricket betting tips

Sign up to our newsletter and receive daily FREE cricket betting tips and betting offers to your email!

How to transfer money from neteller to bank account

This is a comprehensive guide on how to transfer money from neteller to bank account. Bellow you will find a walk through on how to transfer money from neteller to bank account. If you are looking to signup to neteller go to this page. If you want to know more about the neteller VIP program you can find that here. And if there is anything in this article you want to know more about you can contact us here.

How to transfer money from neteller to bank account?

Follow this step by step guide bellow on how to transfer money from neteller to bank account.

- Log into your neteller account (if you don’t have one already click here for VIP silver)

- Go to the ‘money out’ section in your account

- Click on ‘bank withdrawal’ and then ‘add a bank account’.

- Enter your bank account details. If you are not sure about your banking details, contact your bank and they will be able to provide this information for you.

- Click ‘continue’, confirm your account details and click on ‘confirm’.

Once the bank details are confirmed, a micro deposit will be sent to your account from neteller. The micro deposit is normally, received within 2 to 5 business days. In order to see the micro deposit, you need to check your bank statement or online bank account. Once the micro deposit is received, please make a note of the amount of the transaction. You will then need to sign into your NETELLER account click on ‘money out’ and enter the micro deposit number in the relevant field.

If you are having any issues on how to transfer money from neteller to bank account, you can consult netellers support here.

Which countries can I make a bank transfer withdraw?

At this current time neteller provides a bank transfer option as a withdrawl method for SEPA countries and andora. You can find a list of these to the right

SEPA is a payment-integration project of the EU. Consisting of the 28 european union countries and 3 european economic area countries. For more information about SEPA click here.

Neteller account

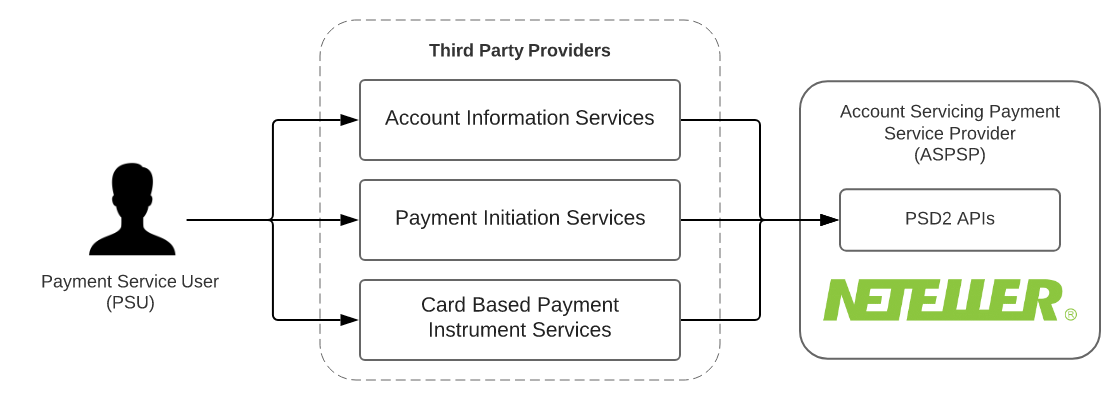

European payment services directive 2015/2366 (also known as PSD2) defines the following actors and roles:

Payment service user (PSU) - psus are the end-users of the services provided by tpps and aspsps. They are either physical persons or entities (organisations, companies, administrationsвђ¦). They do not interact directly with the PSD2 API.

Account servicing payment service provider (ASPSP) - these are payment service providers (psps) which are in charge of holding payment accounts for their customers (PSU).

Third party provider (TPP) - these actors can intermediate between psus and aspsps, acting on behalf of PSU. Depending on the services they provide tpps fall in one of the following categories;

- Account information services (AISP role) will allow the PSU to get information, through a single interface, about all of his/her accounts, whatever the ASPSP holding this account.

- Payment initiation services (PISP role) for requesting a payment request approval by the PSU and requesting the subsequent execution through a credit transfer.

- Card based payment instrument issuers (CBPII role) that will check the coverage of a given payment amount by the psuвђ™s account.

Neteller acts as account servicing payment service provider (ASPSP) in PSD2 terms.

Neteller payment service directive compliance

To comply with PSD2, neteller provides modified customer interface (mobile apis) to qualified third party payment service providers for the following purposes:

- Account and transaction information for account information service providers (aisps)

- Payment initiation for payment initiation service providers (pisps)

Card-based payment instrument issuers (cbpiis) use cases are not supported by neteller

The apis are modified existing customer interfaces fulfilling the following PSD2 requirements:

- API access is restricted only to qualified third party providers.

- TPP API access is restricted to their respective regulated roles

- Access to PSU account and data from TPP requires explicit user conscent, that can be revoked

- Transaction operations require strong customer authentication

Qualified third party providers

In the context of PSD2, being a qualified third party provider (TPP) means:

- Having obtained the authorization from a national competent authority (NCA) to operate as a payment services provider, with the roles it requires (AISP, CBPII, PISP). The list of national register entities can be found on the open banking europe website.

- Having obtained from a qualified trust service provider (QTSP), qualified website authentication certificates (QWAC) and qualified sealing certificates (qsealc), that have a PSD2 eidas certificate profile. Details on qualified trust service providers and the PSD2 eidas certificate profile can also be found on the open banking europe website.

Neteller supports only qualified website authentication certificates (QWAC) certificates for API access

In order for a third party to qualify for production API access, both steps must have been completed and they must have matching data (the NCA delivers a registration number that must written in the certificate data).

It is possible for a qualified third party to lose its qualification, either because the certificate becomes invalid, or because the NCA decides to revoke the tppвђ™s authorization.

Third party provider oauth client registration

In order to access neteller apis, the third party providers are required to register oauth 2 clients for their applications. Registration and management of oauth 2 clients is provided by PSD2 oauth2 and client management apis.

Client management API calls require mutual TLS authentication, with a qualified website authentication certificate (QWAC) issued to the TPP by a qualified trust service provider.

Client registration is performed through POST request on /psd2-oauth2/v1/registrations resource in client management API endpoint with JSON body containing the following properties:

- Client_name - A human-readable name for the client, that will be shown to the user during the consent process.

- Scope - REQUIRED A space-separated list of scopes, that the client has (or requests) access to. In a PSD2 context, the following values are available:

- Aisp - account information and recent transaction history apis

- Pisp - payment initiation service providers use cases apis

- Cbpii - card-based payment instruments issuers use cases apis

- Logo_url - OPTIONAL URI string that specifies a logo for the client, as a data scheme URI. If available, the data will be used to show the user a logo during the consent process.

- Token_endpoint_auth_method - token endpoint authentication method. Use urn:paysafe:oauth:token-endpoint-auth-method:eidas-qwac:psd here.

- Redirect_uris - REQUIRED A list of HTTPS urls that describes the redirection endpoints for the client.

- Grant_types - REQUIRED restricted to authorization_code and refresh_token . Other grant types are not supported in a PSD2 context.

- Response_typesREQUIRED - use code as a value here.

- Jwks - A JSON web key set object, that describes the public keys and certificates related to the given client. In the scope of PSD2, the JWK set must be the set of qualified sealing certificates (qsealc) that can be used by the client to sign requests.

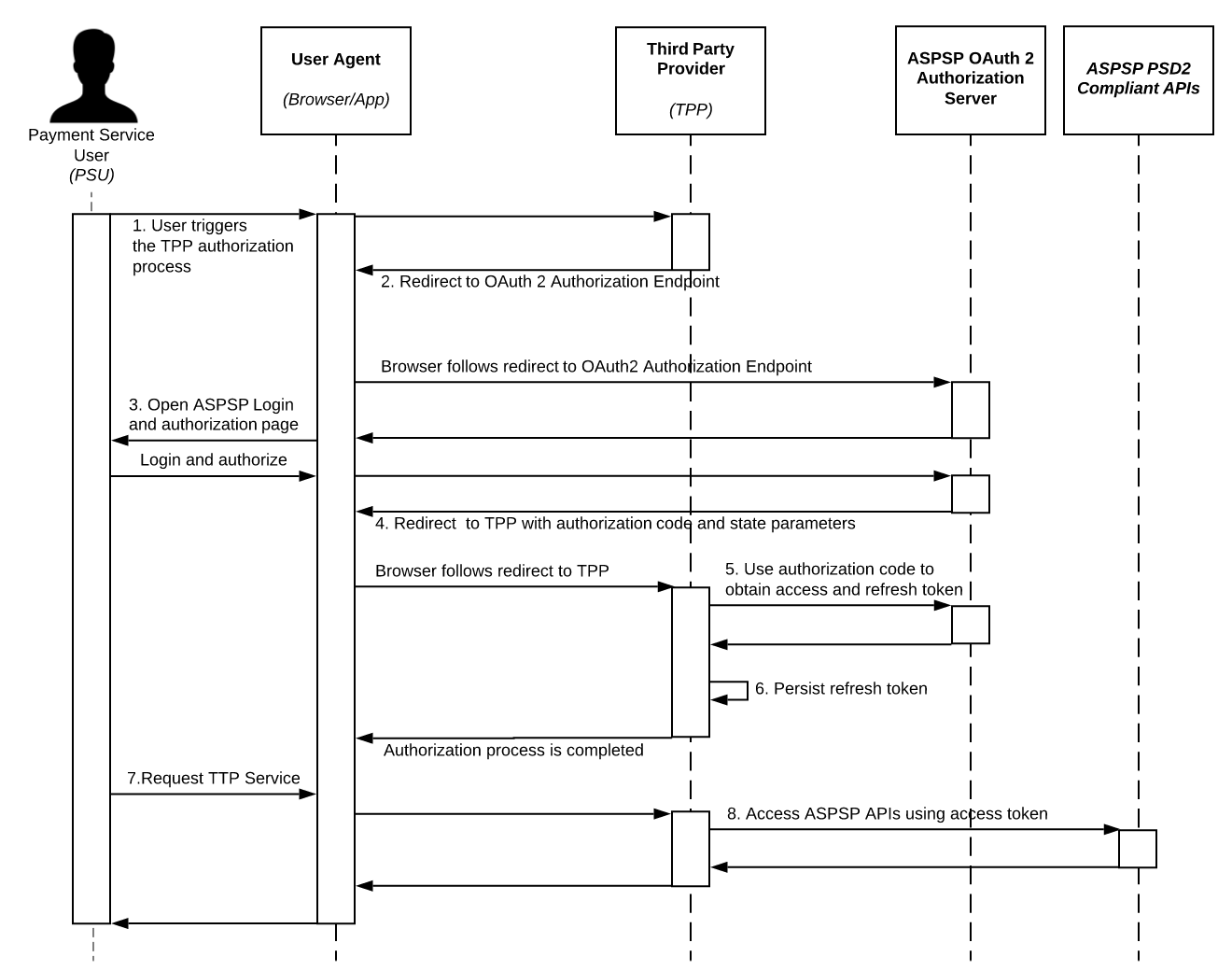

Authentication and authorization flow

Authentication and authorization are implemented as specified in oauth 2.0 authorization code grant flow RFC 6749.

The essential prerequisities for setting up the authorization flow for TPP applications are the following:

- Oauth 2 client must be registered for the TPP applicaion

- TPP application must integrate with the PSD2 oauth2 authorization server and token endpoints.

- Use of the oauth 2 PKCE extension is mandatory, with the SHA-256 method

The detailed authorization flow proceeds as described in the sequence diagram:

- From the third party provider (TPP) website/application, the payment service user (PSU) triggers the authorization process in order to allow access to his neteller account resources

- The TPP website/application redirects the browser to the ASPSP (neteller) oauth 2 authorization server, with the required oauth 2 client parameters

- Response_type - equals to code

- Client_id - the oauth client ID registered by TPP during onboarding

- Scope - the desired access scope. The scope must be one of client scopes defined during client registration.

- Redirect_url - the redirect url provided by TPP, to which to return the authorization code.

- State - the TPP session state parameter

- Code_challenge - SHA-256 code challenge parameter as defined in section 4.2 of oauth 2 PKCE extension

- The ASPSP (paysafe) oauth 2 authorization server provides the user login and conscent interface. At this point, the payment service user must authorize the third party provider.

- The browser gets redirected back to tppвђ™s redirect URL with the authorization code and state request parameters

- Third party provider (TTP) application uses the authorization code and PCKE secret (code_verifier) to obtain access and refresh token from oauth authorization server. The following parameters are passed to the oauth authorization server

- Client_id - the TPP oauth 2 client id

- Client_secret - the TPP oauth 2 client secret

- Grant_type - use authorization_code as value

- Code - the authorization code

- Redirect_uri - should match the oauth client redirect url

- Code_verifier - PCKE code verifier

- Refresh token can be persisted by TPP application and used for re-issuing access tokens as specified in section 6 of RFC6749. Access tokens obtained in this way only provide access to information for which an SCA is not necessary.

- Payment service user uses the related TPP functionality, that requires ASPSP

- TPP can access the corresponding ASPSP (neteller) apis on user behalf using the obtained access token.

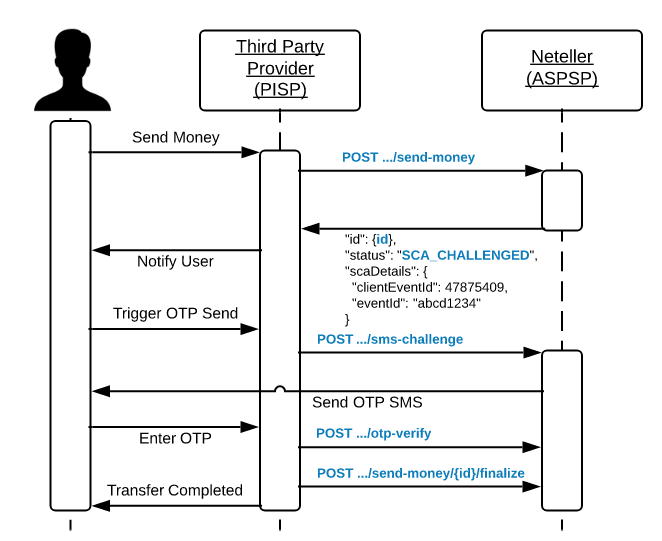

Strong customer authentication

Strong customer authentication (SCA) is a requirement for payment actions. Upon initiation of money transfer, the transfer will get SCA challenge in the response and can not be finalized until SCA challenge is resolved by the user.

One time password generation is triggered and send directly to the user according to his account configuration. The OTP is passed over from the user to the third party provider and used to confirm the OTP challenge. After that the transaction can be finalized.

User presence and offline account access

Tpps are required upon calling neteller apis for AISP and PISP use cases to attach PSU original IP address as HTTP header.

The following HTTP headers should be present and carry the PSU origin:

The absense of the PSU IP address is interpreted as TPP accessing user data without user presence and such calls are subject to the following restrictions

- AISP shall not access PSU account data in unattended mode more than 4 times in 24 hours unless it has collected the user consent for that.

Account information services apis

The apis allow accessing PSU account and transaction history information using the below listed apis.

The apis requires one of the following scopes:

- Aisp - allows accessing customer account information and recent transaction history

Payment initiation services apis

The apis allow performing transactions to other neteller accounts.

The apis requires pisp scope for access. During money transfer SCA challenge will be triggered.

Card based payment instrument use cases support

Neteller mobile apis does not provide dedicated api for funds confirmation.

API documentation and support

Server API endpoints can be found in their respective API reference documentation:

Why OVE?

Instant VIP status for neteller/ easier & faster skrill VIP when sign up via OVE

Monthly extra cashback from OVE

Dedicated support from our team

Free for everyone AND absolutely no fees

Our extra benefits

- Lower required to upgrade silver and gold VIP

- P2P fees limited to 10 USD

- 0.3% cashback on your transfers monthly

- Fully verified within 1 business day

- Verification without webcam

- Additional & faster support by us

INSTANT VIP with OVE

Our extra benefits

- Easier & faster VIP silver status upgrades.

- 0.2% cashback on your transfers

- Join to REF program & earning up to 20% revenue share on friends bonus

- Additional & faster support by us

Easier to get SILVER vip with OVE

Top 10 excellent member of month

REVIEW FROM OUR LOYAL CLIENT

Excellent. Your flatform very good. Im started earning $125 cash back of june

Great. Chưa bao giờ thấy xài skrill net lại có thêm nhiều lợi ích như vậy :))

Ad nên cập nhật thêm nhiều forex brokers hơn cho anh em có nhiều lựa chọn. Ad ơi

Site này ok đấy. Sẽ giới thiệu bạn bè vô ref hehe

Good good. Vừa ăn cashback net vừa có com forex

If have more vantage brokers. I will vote 5 stars. Hope will be comming soon

Thanks. Upgrade acc so fast

Cashback paid. Please add more forex

Thank you very much. I am very grateful

Optimalvip-ewallet.Com does not advertise any gambling and only contains information of neteller and skrill for our customers. If any content presented here is illegal in your country, please to leave the website. We do not hold any responsibility for your course of actions.

About optimalvip-ewallet

From 2017 onwards, with more than 2 years of work experience and customer support, making using ewallet in their online transactions with brokers easier. In particular, with our support team. We always guide customers how to register accounts and verify accounts easily and quickly as possible. We can take care of our customers problems whenever needed. We believe that we have a mission to connect, help and bring more benefits to more customers. We are committed to making every effort to build trust for the suppliers and partners we work with and the highest satisfaction from customers who have always trusted in us.

Quick account depositing at roboforex

Using skrill * and NETELLER *

Regulated

international companies

Skrill and NETELLER are electronic payment systems with international licenses and regulation from the FCA (financial conduct authority).

Bank transfer

and deposits from cards

Use any method to deposit funds to skrill or NETELLER electronic wallets – bank transfer, bank cards, or even other payment systems.

Instant funds

depositing

The funds deposited to your roboforex account via skrill and NETELLER systems are transferred instantly without any commissions.

Best conditions for roboforex clients

An offer from roboforex! The company undertakes to compensate your commission * , which is charged when you deposit funds to or withdraw them from your skrill or NETELLER wallet. Don’t forget to make screenshots of your balance operations, e-mail them to our live support to [email protected] , and your expenses will be compensated * !

Depositing/withdrawal conditions at roboforex can be found below:

Do you experience any difficulties with depositing funds?

Open skrill or NETELLER electronic wallet and deposit funds to your roboforex trading accounts instantly and without any commissions!

exception list (below the instruction) -->

exception list

exception list

only for SEPA countries

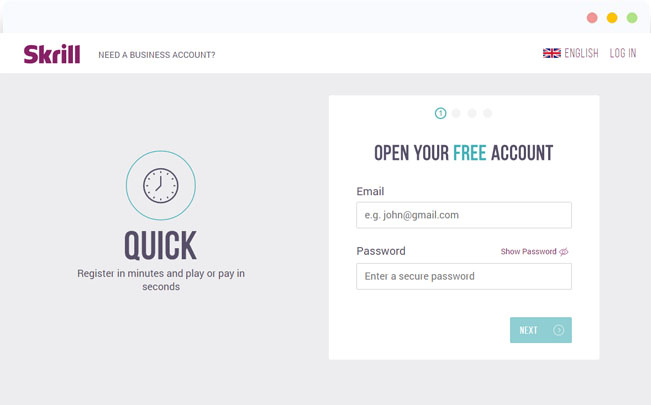

How to open a skrill account

- Start the registration procedure by entering your E-mail and creating a password at https://account.Skrill.Com/signup.

- Your account will be opened after you fill in all necessary fields of the registration form.

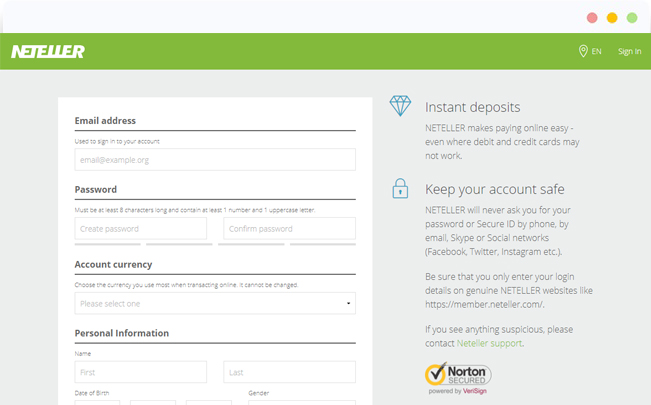

How to open a NETELLER account

- Start the registration procedure at https://member.Neteller.Com/signup.

- Fill in all necessary fields of the registration form and click "open account".

- In the window, you will see the NETELLER secure ID, a 6-digit security code sued for making payments. Copy it somewhere and keep secure.

How to open an epayments account

- Start the registration procedure at https://my.Epayments.Com/#/registration.

- Choose "personal account" and then enter your or phone number, depending on what is more convenient for you to use for logging in to the system in the future.

- Fill in the fields with personal information. Please note that your name and surname have to be specified exactly the same way they are printed in the document to confirm your identity.

- Create a payment password or copy it and keep secure, you will need it for making payments in the future.

- In the next window, you have an opportunity to order an epayments plastic card. In case you don’t need it, skip this step.

- After you complete all the steps described above, your epayments wallet will be opened.

* — commission compensation conditions:

- Your commission may be compensated only in the following circumstances:

- You deposit funds to your skrill or NETELLER (hereinafter called the payment system) wallet using bank transfer and then deposit them from the wallet in this payment system to your roboforex account.

- You withdraw funds from your roboforex account to the wallet in the payment system and then transfer them from the wallet in this payment system to your bank account.

- You deposit funds to your wallet in the payment system using a VISA/mastercard card and then transfer them from the wallet in this payment system to your roboforex account, but only if this card can’t be used for depositing funds straight to roboforex accounts (methods of depositing funds by means of VISA/mastercard cards are specified on “deposit funds” page of your members area).

- You withdraw funds from your roboforex account to the wallet in the payment system and then transfer them from the wallet in this payment system to a VISA/mastercard card, but only if this card can’t be used for withdrawing funds straight from roboforex members area (methods of withdrawing funds by means of VISA/mastercard cards are specified on “withdraw funds” page of your members area).

- The company compensates the payment system commission only for the amount of funds, which was actually transferred from the payment system to roboforex (in case of depositing) or from roboforex to the payment system (in case of withdrawal).

- To receive the compensation, a client has to provide screenshots or account statements, which show depositing/withdrawal operations through the payment system using bank transfer or VISA/mastercard cards.

- The company reserves the right to deny the commission compensation in case of excessive use of the offer.

Official sponsor of "starikovich-heskes" team at the dakar 2017

Experienced racers with more than 60,000 off road kilometers in europe, africa, and australia under their belt.

Official sponsor of muay thai fighter andrei kulebin

A many-time thai boxing world champion, an experienced trainer, and an honored master of sports.

Что можно сказать в заключение: looking to register and setup your account at NETELLER? View here for a step-by-step guide. Plus, learn how to deposit, transfer and withdraw your money. По вопросу neteller account

Комментариев нет:

Отправить комментарий