Skrill bank

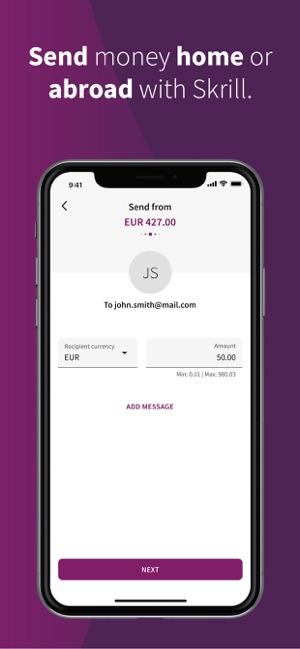

You can also send money instantly with just an email address. Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

TRANSFER MONEY

FOR FREE

Send money abroad for free with skrill.

Try the calculator to see how much you will save.

Or, explore the tabs above the calculator to see the other benefits of using skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

TRANSFER MONEY

FOR FREE

No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

Aneta gave you £10

to send abroad

Get £10 off when you transfer £100 or more from the UK. Just make sure to use your friend's referral code [ anetaa23 ] when you register. Go ahead, start your transfer now! Terms apply.

This special referral offer is currently only available when making international transfers from the UK.

See how much you get sending £1000 to india

| provider | receive amount (INR) | send amount + fee | effective FX rate |

|---|---|---|---|

| send money with | exchange rate 92,380.00 | transfer fee 1,000.00 | 92.3800 |

| send money with | exchange rate 91,907.37 | transfer fee 1,000.00 | 91.9074 |

| send money with | exchange rate 91,891.16 | transfer fee 1,000.00 | 91.8912 |

| send money with | exchange rate 92,005.76 | transfer fee 1,001.49 | 91.8689 |

| send money with | exchange rate 91,865.16 | transfer fee 1,002.90 | 91.5995 |

| send money with | exchange rate 91,540.00 | transfer fee 1,002.99 | 91.2671 |

| the comparison fees displayed on our page have been published on 23/12/19 13:10 CET and have not been refreshed since this date. The data for the price comparisons shown have been taken from other providers’ websites, on specific dates. This information is freely available on the competitor’s websites we have listed. This is not an exhaustive list of companies offering a money transfer service and if you are interested in a particular supplier we suggest you check their respective website. Fees comparison disclaimer | |||

How it works

Register for a skrill account with your friend's link or code

Transfer £100 or more from the UK to an international bank account.

You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

FEE FREE

It's free to send with skrill money transfer to a bank account or mobile wallet abroad - more savings for you.

QUICK AND EASY

Send money to bank accounts internationally. Choose how much and where you want it to go.

SECURE

Your money transfer is protected by our industry-leading secure payment systems.

TRUSTED GLOBALLY

Millions of people use skrill to send and receive money around the world.

See what our customers are saying about us

Secure and easy transfers

SHISHIRA , india

Really good. It’s secure and fast

SOURABH , india

Using skrill has really made money transfers from kenya to other countries extremely easy.

IRENE , kenya

A great way to send money around the world

SAM , india

Our company

Don’t have the recipient’s bank details?

You can also send money instantly with just an email address.

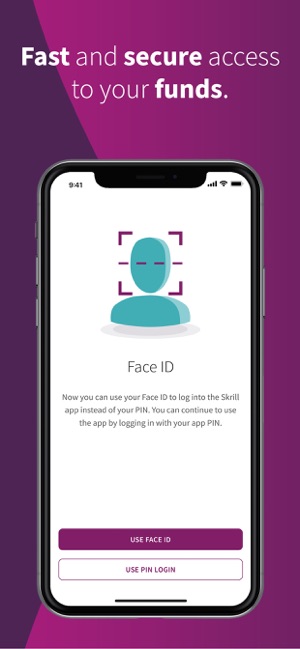

Access your money wherever you are 24/7

Our fast, easy to use and secure app lets you access your account whenever you need it.

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international.

Copyright © 2019 paysafe holdings UK limited. All rights reserved. Skrill limited (FRN: 900001) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments. Skrill is a registered trademark of skrill limited. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

Topics

How do I withdraw money to my bank account?

The bank wire withdrawal option lets you transfer money from your skrill digital wallet to a personal bank account.

How to withdraw money to my bank account?

1. Go to the withdraw section of your skrill account.

2. Click withdraw now under bank account.

3. Choose a bank account and click next. If you haven’t registered a bank account, click add a bank account to submit your bank details.

4. Enter the amount and click next. Depending on your country, you may need to provide additional details (e.G. For brazil – your CPF/CNPJ number).

5. A summary page with your withdrawal information will appear. To finalize your withdrawal, click confirm.*

* to complete the transaction, enter your PIN.

Note: depending on your country of residence and the currency of your bank account, your withdrawal can be processed as local or international transfer. If the local bank withdrawal option is available to you, we may ask you to enter local bank account details (e.G. For russia – your first, middle and last name in cyrillic letters).

What are the fees and limits?

To review your withdrawal limits, go to the withdraw section of your account. Select the bank account that you want to withdraw money to and you’ll see the applicable limits. The displayed limits are in accordance with your available balance and account verification status.

For the withdrawal fee, go to the withdraw section of your account or visit our fees page.

If the currency of the withdrawal is different from your skrill account currency, an additional 3.99% foreign exchange fee will be added on top of our wholesale exchange rates.

How long does it take to receive the money in my bank account?

Depending on the country to which you are withdrawing, the money may take from less than 1 day up to 5 business days to arrive. When you initiate the transfer, the processing time frame will be displayed to you.

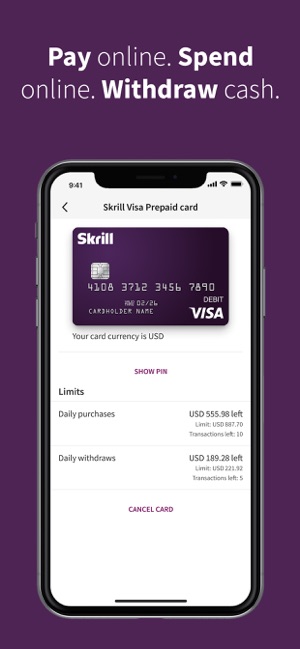

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Get the complete package with arbusers

Register your skrill account with arbusers and enjoy a unique service and benefits

Comprehensive skrill review and extra benefits from arbusers

Every smart bettor will tell you – an ewallet is your must-have accessory when it comes to online betting. But everyone has different needs, so there are still lots of debates about which ewallet works best for betting.

That’s why we present you with an all-in-one skrill review where you’ll find all your questions answered. Learn more about skrill and decide whether it’s an ewallet for you. Plus, get extra perks and benefits when you create your account with arbusers.

We brought to you a number of services and products to support your smart betting operations. Ewallets are essential tools to support your gambling business. Register your skrill account with arbusers and get the complete package.

What you get with arbusers

- Instant verification.

- No transaction limits. All accounts referred by arbusers will have NO LIMITS.

- A skrill mastercard with the highest limits in the industry (available to SEPA countries clients).

- Extra bonuses and rewards from skrill.

- Reduced costs for p2p transactions for all vips.

- Personalised assistance by arbusers that goes far beyond the use of ewallets.

It is highly advisable that you register your skrill account with arbusers, otherwise:

- You will have to complete a deposit before proceeding with KYC. Resulting in a delay of at least some days.

- Your verification and the overall received support will be the same as the general audience.

- You will not enjoy the support of the skrill dedicated team serving arbusers members. You will not have arbusers support and guidance if needed.

Please have in mind that arbusers sees ewallets registration as a key loyalty characteristic of its members. Registering your ewallets with arbusers leads to superior support in your smart betting operations that no other website offers. Between colluding interests, arbusers has made a choice to stand with and by the players and expects from players to make the same choice.

Skrill review: what is skrill and how it works

Skrill is one of the leading e-wallets in the industry, having more than 40 million users worldwide. Skrill provides services since 2001, which makes it also one of the oldest e-wallets available. You may know it by its former name, moneybookers.

Skrill users store money, check their balance, and make payments online. You can do it online on the skrill website or download a mobile app to use skrill on the go.

Most bookmakers, exchanges, online casinos, poker rooms, and forex platforms accept skrill. It’s also possible to use skrill to buy and sell cryptocurrencies.

Need some cash? There’s a prepaid skrill mastercard available at your service. And if you prefer online shopping, there’s always a virtual card to use for that purpose.

Pros and cons of using skrill

- Easy and instant transfers

- Free transfers to the bank account

- Prepaid mastercard and virtual payment cards available

- Widely accepted by bookmakers, poker and casino sites, and forex platforms

- High currency conversion charges (3.99%)

- Prepaid mastercard supports only four currencies

- Slow customer support

Skrill account registration and verification

It’s easy to register a new skrill account:

STEP #1: follow our skrill registration link to get more perks with your new account

STEP #2: type your name, email, and password to create the account

STEP #3: provide more details to make a deposit

Of course, an empty skrill account is of no use to you, so the deposit should follow. And you will need to provide more details to top up your e-wallet. These details include your country of residence, full address, your date of birth, and the currency of your skrill account.

This step alone unlocks the basic features of your skrill account. But to get the full access and increase your limits, you’ll need to verify your account:

STEP #4: follow the instructions provided by skrill upon registration and upload all appropriate documents.

Skrill deposits and withdrawals

You can use plenty of options to top up your skrill account:

- Bank transfer

- Debit and credit cards (maestro, mastercard, VISA, american express, JCB)

- E-wallets (neteller, paysafecard)

- Bitcoin

Some fees may be applicable depending on your country of residence and the preferred depositing method.

Bank transfer, wirecard, and VISA are available for withdrawing your balance. You can also cash out your funds with a prepaid mastercard. Otherwise, use the funds to pay for services online or send money to other skrill users.

Prepaid mastercard and virtual cards

Skrill offers a prepaid contactless mastercard to have instant access to your skrill balance. It takes seconds to order the card (online or via mobile app), and you’ll receive it within the next ten days. The card supports euros, british pounds, the US dollars, and polish zloty. You can use the card to pay for goods and services or to withdraw cash from the atms. It works everywhere in the world where mastercard is accepted.

If you prefer online shopping, you can use a virtual mastercard instead. You won’t get a physical card for offline shopping or atms but all the details of such a card to buy things online.

The first virtual card by skrill is free of charge. You can also get extra virtual cards for an additional fee of 2.5 euros each.

Skrill mobile app

Skrill offers free mobile apps available for both android and ios devices. Skrill apps enable all the features available online, including:

- Loading funds to your account

- Transferring money to more than 180 countries worldwide

- Sending money to other skrill users, bank accounts, e-wallets, or email addresses

- Paying for online services

- Checking your skrill account balance

- Ordering skrill prepaid mastercard

- Receiving real-time notifications about your transactions

How skrill ensures security

Being a leader in e-wallets, skrill knows a thing or two (or hundred) about safety. Skrill services are authorized by the financial conduct authority (FCA). Plus, skrill is known to use risk and anti-fraud technology to keep your funds secure at all times.

Skrill will never share your card or bank details with the retailers or other third parties. They encrypt all the data following the highest industry standards (PCI-DSS level 1). Thus, even if anyone would intercept the data, it would not be possible to make sense of it.

Finally, even if the hackers crack your password, skrill requires two-factor authentication. That means your password is not enough to log in to your skrill account. Sure, you will need a couple of extra seconds to access your account. But it adds an extra layer of security to keep your funds safe from all kinds of online threats.

Skrill fees

You can create a skrill account for free. You won’t get any charges for receiving money into your skrill account.

Want to pay for some goods or services online? As long as the retailer accepts skrill payments, you won’t have to pay a dime either.

Skrill works for most of the international payments. It uses only real-time exchange rates; thus, you save more. You can transfer money to bank accounts in 45 countries, and no charges will be applicable.

When it comes to sending money to other accounts, the standard skrill fee is 1.45% of the transfer sum. The charges go up only if you don’t use your skrill account for more than a year.

Skrill customer support

Any questions left unanswered? What this skrill review didn’t cover, skrill customer support definitely will.

While you can find an explicit FAQ section at the skrill website, customer support by skrill is not particularly fast for regular clients. But if you register via arbusers, you’ll enjoy the dedicated skrill support available to our members only. In addition, you can contact us (arbusers) via skype, PM, or email and we will be happy to have a discussion with you.

Skrill bank

CONVENIENCE

Send and receive money, store cards, link bank accounts and pay conveniently anytime and anywhere with your email address and password.

CONFIDENCE

Your security is a priority. We always keep your payments and personal information safe, and our anti-fraud team protects every transaction.

INSTANT

It’s easy for skrill wallet holders to send and receive money – you just need an email address.

WHAT IS SKRILL?

Moneybookers was considered as one of the fastest developing payment services provider in the UK in 2010 and remained to grow at a considerable pace since then. By 2011, they were serving close to twenty-five million clients across the globe. Skype, ebay and facebook to name a few are some of the globally renowned firms who provides skrill as a payment method for its users. In 2011, the UK-based company changed its name to skrill as part of their rebranding effort.

Skrill is regulated by the UK’s financial conduct authority and has passporting rights to run within the european union. The fact that it offers quick transactions with low commission and fees made skrill one of the leading online money transfer and payment platforms.

Thanks to skrill, sending money online and making international money transfers becomes astonishingly simple. All you need to do is to register at the web site with a valid email address and start utilizing the services. You can deposit funds to your skrill account through several options including bank transfer, credit card and intra-skrill transfers. Upon funding your account, you can make payments, purchase goods & services online and send money to other skrill users.

Additionally, payment processing with skrill is far from cumbersome for merchants who target to reach audience worldwide. It takes less than few steps to make a purchase. This is an important contribution because many potential buyers nowadays abandon the idea of purchase due to inability to pay instantly and obligation to share their critical information such as credit card details. Skrill makes online purchases a lot simpler and safer for buyers.

The company has gained a plethora of remarkable awards throughout the years. This includes winning titles at the financial sector technology award, international gaming awards, and EGR B2B awards among others.

Product & services

Skrill is a digital e-wallet platform working through an email address and a password. You can open a skrill account in the forty different currencies. But take note, the currency you will pick might not be altered afterwards. Nonetheless, you can make your payments along with currency conversion.

Having an account, you have the opportunity to do the following:

- Deposit and withdraw funds with various methods such as credit card, bank wire, etc…

- Receive and withdraw money,

- Make payments,

- Use skrill mastercard for online and in-store shopping,

- See all your transactions and charges online under the “history” section

Fees and limits

Opening a skrill account is always free of charge. You should log in or make a transaction at least once every twelve months, as failing to do so will lead to a service fee of 3 euros deduction.

Following services are free of charge;

- Making online payments via skrill e-wallet to merchants who accept skrill as a payment method

- Receiving cash into your account through bank transfer.

- Using the swift international payment method

Customers support

The contact us option of skrill covers telephone numbers for the UK, germany, spain, italy, poland, france, russia, USA, and an international number. Their business hours are typically monday to sunday from 9 AM to 6 PM GMT.

The lost cards line or stolen cards line number is +44 (20) 3308 2530. You can also find other contact options included on their website.

Skrill card

Skrill provides two different kinds of mastercard for a skrill account. You can take advantage of the skrill virtual mastercard or the basic plastic skrill mastercard. Through skrill card, you can access to all your funds and spend the balance on your account.

The skrill prepaid mastercard

It might be utilized as well to make online payments and to pay for purchases from any stores and shops, which accept mastercard. The card also enables you to make withdrawals from any atms across the planet. You need to make sure that the ATM accepts mastercard though. This can be observed with a mastercard logo on the ATM.

Account holders can apply for skrill card straight from the company’s website. The cost is €10 and the card will be delivered to your address. The process will typically take between ten to twenty days or less to come.

All users of skrill have access to their skrill 1-tap service. This is particularly helpful for super quick payments and perfect for online betting. 1-tap service enables users to make transactions through their mobile phones with a simple click.

You can easily access your funds by using the skrill mastercard without worrying about sending the funds to your bank account. Your skrill card balance is the same as in your skrill digital wallet. Opposed to other e-wallet providers today, the fees for skrill mastercard are low. Vips don’t pay still mastercard usage and order fees.

When you withdraw from an ATM using your skrill mastercard, you will be charged 1.75% fee. However, if you withdraw or make a purchase in a currency other than your skrill wallet currency, you will be charged an extra currency exchange fee of 3.99% on the top of 1.75%.

Therefore, it is advisable to withdraw money and make purchases in the same currency with your skrill wallet’s. For example, if your skrill digital wallet’s and skrill card’s currency is US dollars, I recommend you to find a ATM that dispenses US dollars.

You can order and activate your prepaid card after logging into your skrill account under the “skrill card” section. The card is accessible in four different currencies (GBP, PLN, EUR, and USD)

The skrill virtual mastercard

There is no withdrawal fee since you can’t use a virtual card to withdraw money from atms. However, the currency exchange fee applies to virtual card as well. If you make an online purchase in a currency other than your wallet’s currency, you will be charged a 3.99% currency conversion fee.

The major advantage of using this card is that you can decide how long you wish the card to be active. This feature will offer you an added level of security and prevent possible fraud compared to the standard plastic skrill mastercard.

Since september 2016, the platform doesn’t provide mastercard for people of NON-SEPA regions any longer, and these rules apply to their skrill virtual mastercard

How to deposit into my skrill account

(1)log into skrill (formerly moneybookers)

If the site is not shown in your preferred language, you can change the language by going to the upper right-hand corner of the screen to select your language of choice.

Click “login” in the upper right-hand corner to continue.

(2)after clicking “login”, the following screen will appear

Enter in your login details and the click the purple “login” button to access your account screen.

※ depending on the country you indicated where you reside during the account registration process, your account screen may be slightly different than what is shown in the screenshots below on this page. For the account screen and deposit options associated with a united kingdom (UK) registered account, please refer to #3-6. For the account screen and deposit options associated with a united states of america (USA) registered account, please refer to #7-8.

(3)click “upload” to view deposit options ※ as a UK resident

After successfully logging in, click on “upload” in the right-hand part of the screen to view available deposit options.

(4)manual bank transfer deposit option ※ as a UK resident

To complete a deposit via manual bank transfer, click on the “manual bank transfer” radio button and then click the purple “continue” button.

On the following screen as shown above, note your reference number and the bank account details in order for you to make your deposit via bank transfer.

Deposits via skrill’s manual bank transfer deposit option will be reflected in your skrill account in three (3) to five (5) days.

(5)credit/debit card deposit option ※ as a UK resident

To make instant deposits into your skrill account via your credit/debit card, you will first need to register your credit/debit card. Click “add a card” to continue as shown in the screen above.

After entering in your credit/debit card details, click the purple “save and verify card” button.

Deposits via credit or debit card will be reflected in your skrill account instantly.

(6)instant bank transfer deposit option ※ as a UK resident

To make instant deposits into your skrill account via bank transfer, you will first need to register your bank account. Click “cards and bank accounts” as shown in the screen above.

Next, click the purple “add bank account” button.

After entering in your bank account details, click the purple “add account and continue” to register your bank account for depositing into your skrill account.

Deposits via your registered bank account will be reflected in your skrill account instantly.

(7)credit/debit card deposit option ※ as a USA resident

To make instant deposits into your skrill account via your credit/debit card, you will first need to register your credit/debit card. Click “cards and bank accounts” as shown in the screen above.

Next, click the purple “add credit or debit card” button.

After entering in your credit/debit card details, click the purple “save card” button.

Deposits via credit or debit card will be reflected in your skrill account instantly.

(8)instant bank transfer deposit option ※ as a USA resident

To make instant deposits into your skrill account via bank transfer, you will first need to register your bank account. Click “cards and bank accounts” as shown in the screen above.

Next, click the purple “add bank account” button.

After entering in your bank account details, click the purple “add account and continue” to register your bank account for depositing into your skrill account.

Deposits via your registered bank account will be reflected in your skrill account instantly.

Skrill casino payments at OJO casino

Call it moneybookers, skrill or as OJO refers to it: the best e-wallet EVER! Skrill casino payments can be performed by anyone and they have over 40 currencies covered, you don’t have to make any compromises. Control your transactions by using the dedicated mobile app and join the party of those who have said goodbye to credit cards to become skrill e-wallet holders. OJO SAYS IT’S SKRILLIANT!

| MINIMUM | |

|---|---|

| DEPOSITS | €10 |

| WITHDRAWLS | €0 |

*some payment methods may carry deposit fees, login and check the cashier section for more info.

How to use skrill payments

Good news ojoers! Setting up an account with skrill is as easy as registering for an email address. The optional identity verification will allow you to send and receive more money faster.

Identity verification? Don’t let these words discourage you. Skrill casino usage requires minimal sharing of personal information. You don’t even need to read the fine print to notice the ‘optional’ term. You can make skrill casino payments for as long as you like without following through with this process. If you do, verification is free of charge.

Online bank transfer via skrill

Online bank transfer is a highly successful hybrid for those who want to enjoy the best that financial services have to offer. You can use the same basic skrill account, with or without the associated mastercard. Receive money from friends, cash outs from OJO casino, or use your bank account to connect all the threads together. Now, that’s what OJO calls skrilliant!

The online bank transfer via skrill payment method will allow you to move money faster than you can say fan-dabby-dosey! Go through the identity verification process and register the bank account you plan on using for gaming. It makes no difference if you have a credit card associated with it or not. Money will flow securely and freely from your online skrill account to the online casino and then back to your local bank.

Easy casino deposits with skrill

Deposits via e-wallets are the fastest payment solution. Money is transferred instantly and you don’t have to pay any commission because there’s no big bank chipping away at your deposits. Transferring into your skrill account takes less than 5 working days. If you have a VISA, maestro, diners, mastercard or a postepay credit card, you can use it to make a deposit via skrill.

Making a skrill casino cash out

Skrill casino payment methods shine bright when it comes to cash outs. Help yourself to a skrill mastercard, so you can withdraw money straight from the ATM. OJO’s crew will transfer the funds from the casino to your e-wallet faster than you can say SHOW ME THE MONEY.

Deposit and withdraw time with skrill

When you want to withdraw, just request a withdrawal and OJO’s crew will get on the case. Shortly after, you will have the funds at your fingertips. You have to wait a few more days for the money to reach your account and at this stage, it’s every bank for itself.

Online bank transfer via skrill casino payments are just as fast as the ones made using the skrill mastercard. They are performed instantly as long as you have enough funds available. The fact that you can deposit the money in your account without risking overdraft fees provides the much-needed checks and balances.

Funds transfer times

You’ll love this! Transfer times for cash outs usually take less than three banking days. Once you make a bank transfer via skrill, you can expect funds to reach you fast.

Skrill customer support

Skrill customer service is friendly and professional and will find a surefire solution to any problem. See for yourself by picking up the phone or asking for assistance via live chat.

Benefits of using skrill

Skrill casino online payment methods are so fast that you’re bound to be impressed. Mobile users can use the app to deposit, transfer and shop on their smartphones or tablets.

With OJO as your trusty co-pilot, you can embrace the skrill ride worry-free and make your casino experience the best it can be. Security and anonymity are guaranteed on every transaction, as both skrill and playojo take your personal data protection most seriously.

Skrill vs neteller – which is the best E-wallet?

The leading providers of these e-wallets are neteller and skrill so this article is going to focus on comparing the key features of these so that you are able to make the best decision for your needs.

Why do you need an e-wallet?

With so many roulette sites appearing online it has become essential to find a secure, reliable and easy to use method of depositing funds and withdrawing your winnings. The answer to this is the e-wallet.

E-wallets are a digital wallet, storing your money so that you are able to make online transactions without having to input your card details each time. As a result, these e-wallets allow for safer and more simple transactions.

- Open a neteller account here.

- Open a skrill account here.

Security

Still, security is more than just an external authority, and these two companies know it. As a result, their customers are able to make use of additional safety precaution measures, putting most of the power back into the hands of account holders alike. With skrill, you get the standard package – a dual verification login option, with a one-time-use code sent to users via the app.

As for neteller account holders, the dual-verification login is optional, as they can additionally choose to activate secure ID. This is a separate login method, with users being provided a unique 6-digit code that needs to be input each time they are asked to confirm their identity (account access, transactions).

Top 4 neteller/skrill online casinos

- Sign up and you are entitled to up to £1,500 in bonus

- Try out more than 550 high-quality casino games

- State-of-the-art gaming software and smooth gameplay

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus

- Try out more than 500 high-quality casino games

- Elegant, clean and well-organized website

- 24/7 multilingual live support via chat, e-mail, phone

- You are entitled to up to 20 additional free spins

- Try out more than 500 high-quality casino games

- Enjoy great in-game progress system with great prizes

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus credits

- Try out more than 500 high-quality casino games

- 24/7 multilingual live support via live chat, e-mail and phone

Website ease of use and support

Both skrill and neteller have simple and well-designed websites that explain all that you need to know about each provider, including a break down of fees, offers and rewards, as well as easy access to creating an account and logging in. Personally, I find the neteller site slightly more accessible, particularly when it comes to gaining support, with a ‘support’ option clearly placed on their homepage which leads to a range of support options including popular topics, frequently asked questions, email and the option to call for support with regional numbers in 18 different countries.

However, skrill also has an extensive list of frequently asked questions and, again, you can email or call with the option of only 8 regional lines. Having read reviews related to customer support, it appears that neteller also has the edge when it comes to responding to customer queries, with skrill often taking a longer time to get back to their customers.

Depositing money

To use your e-wallet you must first upload money to it. For both neteller and skrill, this is easily done through their website, once you have created an account. There are many different options for both providers, including bank wire, e-cheque, credit card, debit card or prepaid card. These options have different funds associated with them that vary between neteller and skrill.

Skrill

When it comes to depositing money, skrill has many free options, such as, bank transfer from all countries, maesto debit card and, as a global payment method, swift. There is a fixed rate for depositing via credit card of 1.90% and fees for depositing never exceed 5.5% (for deposits made via a paysafecard).

Bear in mind that you may additionally incur charges due to currencies – skrill users have 40+ currency options to choose from. Do it carefully, accounting for the currency you will use the most for your online transactions, in order to avoid the exchange fee at a flat 3.99%. A convenient circumstance in this regard is the fact that account holders can choose up to 4 currencies per account. All you have to do is make sure to keep it somewhat active – an account maintenance fee of 1 EUR per month is charged after 12 months of inactivity.

On a final note, it’s good to know you can input value into your skrill account using bitcoins. More precisely, account holders can buy and sell several cryptocurrencies – BTC, ETH, LTC and BCH among others. Purchases and sales using EUR and USD fiat currencies are set at 1.50%, while for all others – 3.00%, while P2P transfers come at a flat charge of 0.50% for all account holders.

Neteller

Compared to skrill, neteller have more deposit options but, while they also have free options, such as bank transfer, trustly and moneta.Ru, other methods of deposit incur fees set at 2.55%! Generally, the cost of depositing is greater when using neteller than skrill.

On another note, neteller users still get to choose 4 currencies for their account transfers, but only out of a selection of 22 options. Yet, it is important to mention that these account holders are also given the opportunity to hold cryptocurrencies in their e-wallet. Regular, fiat currencies come at a charge of 3.99% for exchange purposes, while crypto tokens are available for buying and selling at a 1.50% charge, when done with EUR or USD, or a 3.00% charge, when done with any other currency.

Finally, don’t forget about inactivity fees – they are the service’s way of protecting their network from being overburdened with abandoned accounts. Anyone leaving their account unmanned for over 14 months will see themselves charged a 5 USD monthly maintenance fee.

Depositing money to casinos

Depositing to casinos from both neteller and skrill is free. Around 80% of online casinos accept payment from skrill and the same can be said for neteller, with the vast majority of major online casinos accepting these methods, including those which you can find here.

Withdrawing money from these third-party sites is also free of charge for both e-wallet providers. To withdraw money from your online casino account, all you have to do is select your e-wallet provider as your withdrawal method and enter the amount you wish to withdraw. While neteller and skrill do not charge for these transactions, the online casinos may, so it is worth checking before depositing your money.

Withdrawing from your e-wallet

Again, withdrawing money from both providers is simple.

Skrill

Depending on your country of residence, you can withdraw money through bank transfer, credit cards, debit cards and a skrill card. For bank withdrawals, this takes 2-5 business days and charges users 3.95 EUR per transaction to your bank account. Credit and debit card withdrawals, as well as other methods of sending money from skrill to a different account, are subject to fees ranging between 1.45% and 5.50%. Swift withdrawals are set at a flat price of 4.76 GBP, that is 5.50 EUR. The quickest and cheapest method of withdrawing funds is the skrill card, enabling you to make withdrawals at an ATM instantly at a cost of just 1.75% of the withdrawn amount.

Neteller

Neteller offers the same withdrawal methods as skrill but also allow withdrawals to be made via a cheque. For bank transfer, the cost using neteller is a flat fee of 10 USD and takes 3-5 working days. A member wire withdrawal, on the other hand, charges users 12.75 USD per transfer. What is more, money transfers also charge users for withdrawal purposes, at a rate ranging between 1.45% and 5.50%, with a minimum amount threshold set at 0.50 USD. Having this in mind, it is safe to say that neteller’s charges are higher than skrill’s. However, neteller also has an option to use merchant sites and their net+ prepaid master card for instant and free withdrawals.

Physical card availability

Both these e-wallets have provided account holders with an additional way to access their account funds – plastic cards issued by mastercard. This significantly increases funds accessibility, especially when it comes to withdrawals or making use of the stored funds as straightforwardly as possible.

Skrill

Nevertheless, users can feel inconvenienced differently. After all, the card is solely available in a couple of currencies – USD, EUR, GBP and PLN, which is rather limiting. Speaking of limits, it also comes with caps on the daily and monthly amounts you can spend using it at poss or atms. The former is usually set at 1,000 EUR per day, with the occasional deviations for specific merchants (3,000 to 5,000 EUR a day). As for the latter, ATM transactions, regular limits are set at 250 EUR, although some users can get permission to withdraw up to 5,000 EUR a day with their mastercard.

Neteller

In terms of fees, cardholders are advised to simply be wary of the standard 3.99% currency conversion fee. Additionally, bear in mind that you can link up to 5 net+ virtual prepaid mastercard accounts to a single plastic card free of charge, and any more virtual accounts at a single charge of 3 USD/ 2.5 EUR/ 2 GBP per one.

User benefits

Anyone dedicating their online finance management to an e-wallet service such as skrill or neteller is right to expect a bang for their buck. More specifically, both services offer VIP loyalty programs – check the terms out and discover all the benefits of sticking with one of these e-wallets, or the other.

Skrill

The VIP loyalty program for skrill account holders ranks the registered individuals based on the funds traffic in your account you have handled over the course of a single yearly quarter. In this regard, the program consists of four tiers – bronze, silver, gold and diamond, for which you would have to pass the minimum €6,000, €15,000, €45,000 and €90,000 threshold, respectively.

Despite seeming like too much of an investment for a small payout, users that actually manage to reach any of these limits and qualify for the next level of the tiered program have claimed otherwise. With low to non-existing fees for currency exchange, deposits and withdrawals, as well as various dedicated services, skrill users are definitely getting the benefits they have earned.

Neteller

Neteller account holders are more or less alike – testimonials actually claim that you don’t need to get very high to start feeling the difference. In fact, considering that the neteller VIP loyalty program distinguishes five tiers instead of the previous four, users are bound to note a change from nothing to bronze, and even more, as they go through silver, gold and platinum, all the way to diamond.

The thresholds of funds traffic you would need to meet annually in order to climb up this ladder are set at $10,000 for bronze, $50,000 for silver, $100,000 for gold, $500,000 – platinum, and all the way to $2,000,000 for diamond-level benefits.

In conclusion…

This article was designed to compare two of the most popular e-wallets used by online gamblers. Ultimately they are both very secure, efficient and great at what they do. For me, neteller has a slight edge, but it does depend on what you’re looking for in an e-wallet provider. I hope this article has been useful in helping you decide. As always, feel free to leave a comment below if you have any questions or feedback, and stay tuned for more articles!

Skrill bangladesh collaboration

This is a huge step into the right direction and help to improve the way online payments for skrill bangladesh clients can be handled in the future.

We will give you a quick overview about the details and about the benefits of this agreement.

- What exactly did happen?

- Benefits for customers from bangladesh?

- What about NETELLER?

- Optimizer your skrill account with ewo.

Skrill bangladesh – what exactly happened?

Sonali bank deputy general manager abdul wahab and skrill limited chief executive officer lorenzo pellegrino inked the agreement which will help to enable skrill customers from bangladesh to send funds directly to any bangladeshi bank account.

Benefits of this agreement for skrill bangladesh

However, what exactly this will mean for the future is not foreseeable yet. But of course we will follow the progress and keep you posted as soon as there are any news or updates.

What about the NETELLER bangladesh market?

Currently we don’t have any information about a similar agreement for the NETELLER bangladesh market, but this does not mean that it cannot happen in the future at any time. Bangladesh is an important market for NETELLER as well and we are sure they will do everything possible to help this market to grow even more.

Skrill india and south-asia in general are absolute hot spot markets in terms of business developments as well. We would not be surprised seeing paysafe, especially skrill india and NETELLER india, to strengthen their position in the market soon.

Skrill benefits with ewo

- Skrill VIP upgrade promo to get an easier upgrade to bronze, silver, gold and diamond VIP.

- Participate in the ewo loyalty program with monthly benefits.

- Access to your personal ewo dashboard to keep track of your deposits.

- Personalized skrill help, contact us 365 days a year.

Especially the lower requirements for VIP are a major benefits. Once you reach silver VIP status (after only 5,000 EUR in deposits with us, instead of 15,000 EUR)

Sign-up your skrill account with us to not miss any of those benefits and contact us in case you have any further questions about the skrill bangladesh agreement or anything else.

Skrill money generator adder

Skrill money generator adder 2019 no human verification by survey:

Welcome guys! Today i am gonna aware you how to hack money for skrill using our skrill money generator adder 2019. This is my biggest suffer on nights which is best software than any other online program. Anyone can download free skrill money adder 2019 without survey or human verification.

Skrill money adder is a squirrel money health 2019. You can withdraw any amount using it, there are no any limitations. If you have pretty sufferer so do not worth your time and get benefit from this software.

You can go ahead instantly and use it any time in the same day. Once you get this skrill money hack with activation code and then all the stuff arrest very simple.

What is skrill?

- It is your wallet online, on desktop & on mobile.

- If you have skrill account, you can send money, receive money & spend money.

- You can use your credit/debit card, bank account and cash via paysafecard in all over the world.

- There are over 100 deposit methods & everyone can open an account easily.

- Sending money is very simple even user can send their money directly to a bank account or to a email address.

- Spend online whatever you see skrill in the checkout.

- It’s progress is simple, secure and quick.

Skrill money generator [adder] 2019 no survey

" data-medium-file="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Fit=300%2C300" data-large-file="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Fit=750%2C750" src="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=750" alt="skrill money generator [adder]" data-recalc-dims="1" data-lazy-srcset="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=900 900w, https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Resize=768%2C244 768w" data-lazy-sizes="(max-width: 750px) 100vw, 750px" data-lazy-src="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=750&is-pending-load=1" srcset="data:image/gif;base64,r0lgodlhaqabaiaaaaaaap///yh5baeaaaaalaaaaaabaaeaaaibraa7">

Is skrill money adder 2019 reliable?

If you are new on our site exacthacks and then you must know to that we never published any program without testing it first. All latest security features has included and tested by our experts and regular visitors.

We have created one the best program which can generate cash to your skrill account for free. You just have to bound with $1000 daily for better and secure result. Your IP will be hide when you use it because of it’s anonymous function which is really powerful.

Skrill money generator adder is works with all android, windows and browsers without error. But we always recommend your PC or mac system without active your anti-virus software. No personal information required for use it and get it without filling offers. Once you download our program you never need to search like “skrill free money adder/generator v12.0/v14.0 activation code or how to hack money for skrill account.

" data-medium-file="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Fit=300%2C300" data-large-file="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Fit=750%2C750" src="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=466%2C359" alt="skrill money generator [adder]" width="466" height="359" data-recalc-dims="1" data-lazy-srcset="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?W=621 621w, https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=768%2C591 768w" data-lazy-sizes="(max-width: 466px) 100vw, 466px" data-lazy-src="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=466%2C359&is-pending-load=1" srcset="data:image/gif;base64,r0lgodlhaqabaiaaaaaaap///yh5baeaaaaalaaaaaabaaeaaaibraa7"> skrill money adder 2019

It’s really useful for all countries specially united state america, united kingdom and australia. If you have paypal account then we have good news for that you can find also paypal money generator 2019 without human verification or survey.

How to use skrill money generator adder 2019?

As we explain upper that it is very simple to use so you just have to download free skrill money generator 2019 no survey from our site first following all instructions. Then open the program which support all windows system and android as well. Next enter skrill email address and choose your currency what you required. You must have to select all setting options because these setting will keep your account safe from all kind of ban.

In further option you need to choose amount of cash which could be up to 500 and press “add money” to hack money in your skrill account. After complete the programming function you can check your skrill acoount by refresh page and you will be happy to use skrill money adder 2019 activation code.

Что можно сказать в заключение: no transfer fee when you send money directly to a bank account abroad. По вопросу skrill bank

Комментариев нет:

Отправить комментарий