Skrill balance

Therefore, it is advisable to withdraw money and make purchases in the same currency with your skrill wallet’s. For example, if your skrill digital wallet’s and skrill card’s currency is US dollars, I recommend you to find a ATM that dispenses US dollars. Having an account, you have the opportunity to do the following:

Skrill balance

CONVENIENCE

Send and receive money, store cards, link bank accounts and pay conveniently anytime and anywhere with your email address and password.

CONFIDENCE

Your security is a priority. We always keep your payments and personal information safe, and our anti-fraud team protects every transaction.

INSTANT

It’s easy for skrill wallet holders to send and receive money – you just need an email address.

WHAT IS SKRILL?

Moneybookers was considered as one of the fastest developing payment services provider in the UK in 2010 and remained to grow at a considerable pace since then. By 2011, they were serving close to twenty-five million clients across the globe. Skype, ebay and facebook to name a few are some of the globally renowned firms who provides skrill as a payment method for its users. In 2011, the UK-based company changed its name to skrill as part of their rebranding effort.

Skrill is regulated by the UK’s financial conduct authority and has passporting rights to run within the european union. The fact that it offers quick transactions with low commission and fees made skrill one of the leading online money transfer and payment platforms.

Thanks to skrill, sending money online and making international money transfers becomes astonishingly simple. All you need to do is to register at the web site with a valid email address and start utilizing the services. You can deposit funds to your skrill account through several options including bank transfer, credit card and intra-skrill transfers. Upon funding your account, you can make payments, purchase goods & services online and send money to other skrill users.

Additionally, payment processing with skrill is far from cumbersome for merchants who target to reach audience worldwide. It takes less than few steps to make a purchase. This is an important contribution because many potential buyers nowadays abandon the idea of purchase due to inability to pay instantly and obligation to share their critical information such as credit card details. Skrill makes online purchases a lot simpler and safer for buyers.

The company has gained a plethora of remarkable awards throughout the years. This includes winning titles at the financial sector technology award, international gaming awards, and EGR B2B awards among others.

Product & services

Skrill is a digital e-wallet platform working through an email address and a password. You can open a skrill account in the forty different currencies. But take note, the currency you will pick might not be altered afterwards. Nonetheless, you can make your payments along with currency conversion.

Having an account, you have the opportunity to do the following:

- Deposit and withdraw funds with various methods such as credit card, bank wire, etc…

- Receive and withdraw money,

- Make payments,

- Use skrill mastercard for online and in-store shopping,

- See all your transactions and charges online under the “history” section

Fees and limits

Opening a skrill account is always free of charge. You should log in or make a transaction at least once every twelve months, as failing to do so will lead to a service fee of 3 euros deduction.

Following services are free of charge;

- Making online payments via skrill e-wallet to merchants who accept skrill as a payment method

- Receiving cash into your account through bank transfer.

- Using the swift international payment method

Customers support

The contact us option of skrill covers telephone numbers for the UK, germany, spain, italy, poland, france, russia, USA, and an international number. Their business hours are typically monday to sunday from 9 AM to 6 PM GMT.

The lost cards line or stolen cards line number is +44 (20) 3308 2530. You can also find other contact options included on their website.

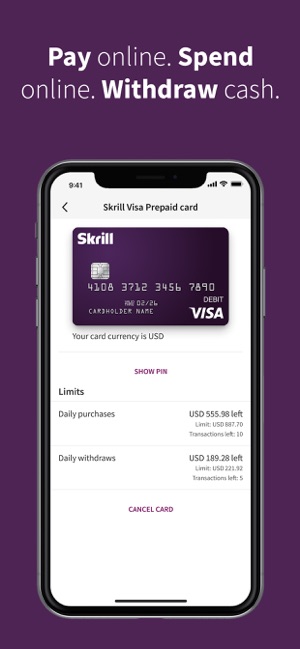

Skrill card

Skrill provides two different kinds of mastercard for a skrill account. You can take advantage of the skrill virtual mastercard or the basic plastic skrill mastercard. Through skrill card, you can access to all your funds and spend the balance on your account.

The skrill prepaid mastercard

It might be utilized as well to make online payments and to pay for purchases from any stores and shops, which accept mastercard. The card also enables you to make withdrawals from any atms across the planet. You need to make sure that the ATM accepts mastercard though. This can be observed with a mastercard logo on the ATM.

Account holders can apply for skrill card straight from the company’s website. The cost is €10 and the card will be delivered to your address. The process will typically take between ten to twenty days or less to come.

All users of skrill have access to their skrill 1-tap service. This is particularly helpful for super quick payments and perfect for online betting. 1-tap service enables users to make transactions through their mobile phones with a simple click.

You can easily access your funds by using the skrill mastercard without worrying about sending the funds to your bank account. Your skrill card balance is the same as in your skrill digital wallet. Opposed to other e-wallet providers today, the fees for skrill mastercard are low. Vips don’t pay still mastercard usage and order fees.

When you withdraw from an ATM using your skrill mastercard, you will be charged 1.75% fee. However, if you withdraw or make a purchase in a currency other than your skrill wallet currency, you will be charged an extra currency exchange fee of 3.99% on the top of 1.75%.

Therefore, it is advisable to withdraw money and make purchases in the same currency with your skrill wallet’s. For example, if your skrill digital wallet’s and skrill card’s currency is US dollars, I recommend you to find a ATM that dispenses US dollars.

You can order and activate your prepaid card after logging into your skrill account under the “skrill card” section. The card is accessible in four different currencies (GBP, PLN, EUR, and USD)

The skrill virtual mastercard

There is no withdrawal fee since you can’t use a virtual card to withdraw money from atms. However, the currency exchange fee applies to virtual card as well. If you make an online purchase in a currency other than your wallet’s currency, you will be charged a 3.99% currency conversion fee.

The major advantage of using this card is that you can decide how long you wish the card to be active. This feature will offer you an added level of security and prevent possible fraud compared to the standard plastic skrill mastercard.

Since september 2016, the platform doesn’t provide mastercard for people of NON-SEPA regions any longer, and these rules apply to their skrill virtual mastercard

Buy / sell skrill balance in bangladesh

Skrill is one of the most preferred electronic payment methods out there, unlike paypal opening and verifying a skrill account takes only a few minutes. You can buy skrill balance from us in bangladesh. Furthermore, we also provide our users with the benefits of making payments online from our skrill account where accepted.

You can also sell your skrill balance to us. However, if you are earning skrill balance as a freelancer or by other means you can transfer it directly to our skrill account. This is beneficial in saving you 1.9% charges. Most of you already know that paypal is widely used because you can make payments on almost any website you visit, nevertheless most top ranking sites making use of paypal also accept skrill.

Buy / sell skrill dollar in bangladesh

Once it was possible to withdraw dollar from skrill to local bank accounts in bangladesh, however that service is no longer available. They’ve even cancelled the mastercard option on new accounts. We aim to provide an alternate solution to these problems by helping online earners sell skrill dollar.

We clearly understand how important it is for website owners and marketers to pay invoices on time to keep their servers up and running. Even businesses that promote products or services on facebook and google need to make payments on a regular basis. Therefore we allow fast and stress free methods to buy skrill dollar in bangladesh.

How to buy skrill dollars in bangladesh

1. Sign up for a free account at payfastbd

Once you’ve registered you may easily deposit funds via bkash, rocket and bank transfer. Once you’ve placed an order and it has been approved and we’ve verified the payment from you. Your skrill account will be funded with the respective amount you ordered within 5-30 minutes.

2. Deposit balance to your account

You may also want to look at how to sell skrill dollars in bangladesh

If you’ve already registered for an account at payfastbd, then simply login and select the “SELL” tab on your dashboard. Once you’ve done that click on skrill and enter the amount you want to sell

3. Select skrill and enter preferred amount

You’ll then notice the cost has been automatically calculated and once

4. Leave the rest to us and allow up to 30 minutes

Usually it takes us no less than 5-15 minutes to fund your account once we’ve verified payment.

How to sell skrill dollars in bangladesh

1. Sign up for a free account at payfastbd

Once you’ve registered you may easily deposit funds via bkash, rocket and bank transfer. Once you’ve placed an order and it has been approved and we’ve verified the payment from you. Your skrill account will be funded with the respective amount you ordered within 5-30 minutes. In some cases there may be further delay, this may happen if you send money via bank transfer.

2. Deposit balance to your account

You may also want to look at how to sell skrill dollars in bangladesh

If you’ve already registered for an account at payfastbd, then simply login and select the “SELL” tab on your dashboard. Once you’ve done that click on skrill and enter the amount you want to sell

3. Select skrill and enter preferred amount

You’ll then notice the cost has been automatically calculated and once

4. Leave the rest to us and allow up to 30 minutes

Usually it takes us no less than 5-15 minutes to fund your account once we’ve verified payment.

If you’re uncomfortable with the registration process then simply call or join chat with us so that we may guide you on other ways to buy skrill dollar.

Skrill frequently asked questions

1. What is skrill?

Skrill enables customers with a valid email address to securely and cost-effectively send and receive payments online in real time.You can use skrill to:

- Send money via email from your credit card or bank account.

- Make online purchases.

- Collect money via email.

2. How do I fund my account using skrill?

To deposit using an existing skrill account, please follow the steps below:

- Log in to your account.

- Go to the 'cashier' tab and select 'deposit'.

- You will now see the skrill logo. To select this deposit option simply click on the icon.

- Enter or select your deposit amount and bonus code (if applicable), then click on 'deposit'.Note: this amount should be less than or equal to the amount in your skrill account.

- You will be directed to the skrill website where you are required to enter your skrill email address and password to log in.

- Complete the transaction on the skrill website.

- On the next screen you will receive an 'order approved' message. Click on 'OK', you will be transferred back to the cashier and will see a successful deposit message.

3. What currencies can I make a deposit with when using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD only.

4. How can I load my skrill?

You can load your skrill account by using your credit/debit card, making an online bank transfer, direct banking or via cheque.

Note:you will not be able to transfer the funds from skrill.Com to your account if you have funded them using master card.

5. Is it safe to use skrill?

Yes, skrill is totally secure. Through a combination of transaction monitoring, SMS transaction verification for cardholders and a dedicated anti-fraud team, skrill is an entirely safe online payment method.

6. Can I withdraw to my skrill account?

Yes, you may withdraw to your skrill account if you have made a successful deposit with it within the last 180 days. To request a withdrawal, visit the cashier, select the 'withdrawal' tab and then select the skrill logo. Enter the amount you would like to pay out and we will send it to your skrill account after we have reviewed your request.

7. What currencies can I withdraw in using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD only.

8. Can I withdraw more than my initial deposit using skrill?

Yes. However, please remember that all withdrawals are first approved by our internal review team.

Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your bank account.

9. What is the average processing time for skrill withdrawals?

All withdrawals are first approved by our internal review team, which takes approximately up to three business days. Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your skrill account.

10. Can I withdraw the same day I deposit through skrill?

11. Can I withdraw to skrill if I deposited using a different payment method?

Yes, to withdraw using skrill you need to have made a successful deposit with your skrill account within the last six months.If you have made a successful deposit within the last six months, visit the cashier, select the 'withdrawal' tab and then select the skrill logo.The amount of your withdrawal will be sent electronically to your skrill account after our internal procedure has been completed.

12. What is the minimum and maximum amount I can withdraw using skrill?

The minimum withdrawal amount that you can withdraw via skrill is 10.00 USD equivalent and the maximum withdrawal amount is 10000.00 USD equivalent.

13. Are there any transaction fees associated with skrill payments?

We won't charge for skrill deposits or withdrawals, but it's possible that skrill may charge you for either of these so we recommend you check with them directly.

Paypal to skrill transfer guide

There are several reasons that can prompt an individual to consider making a money transfer from paypal to skrill. The main reason is that many recipients prefer having money in their moneybookers account because they have no convenient way of withdrawing money from paypal. Another reason is based on the facts that some services offered by skrill are not available on paypal. For example, in most countries, it takes approximately two days to withdraw cash from paypal.

Paypal to skrill transfer

It is important to note that there is no legitimate and direct method of sending money from paypal to skrill and for the transfer to happen both parties have to form a partnership agreement. In the meantime, there are a few ways that people can use to move their funds from paypal to skrill, and they include:

Withdrawing from paypal to bank then to skrill

This method is the simplest, convenient and most secure method for people to send money paypal to skrill. Once the money is in your bank account, you can either send it to the recipient or upload it to skrill. However, your bank accounts and skrill must be linked, but this method is not available to all since paypal does not have banking partners in some countries.

Registration with a U.S. Payment service

Withdrawal of money from paypal to bank accounts is a nightmare to individuals residing outside the united states. Some people have to wait for about 8 working days for the cash to hit their bank accounts. However, with the assistance of a virtual U.S bank account, you can easily withdraw your cash from US payment companies. During weekdays, money from paypal will take 48 hours to load to the virtual account and immediately to the debit card. The process takes longer during US holidays or the weekends. Payoneer is one of the best companies that offer U.S payment services, and registration is free. However, you pay a one-time fee for activation once you receive your debit mastercard via the post office.

Exchange your balance with a friend

This method can work effectively if you know someone who has a skrill balance so that they can send money from their skrill account to your account. On the other hand, you will send the same amount from your paypal account to the other person's account. This method may not always be possible because you need to find a match, preferably someone who receives money in their skrill account.

Use online service providers

This method requires an individual to open a contractor and client account on a platform that supports paypal and skrill modes of payment. This technique requires you to register as a client and then offer jobs that require payment via paypal. Afterwards, you open a contractor account then select the payment option as skrill. For a paypal to skrill instant transfer, you need to withdraw money from your paypal account into your virtual account. After a couple of days, your issuer will email and inform you that your card has been credited with the amount. The next step is to go to your skrill account and select option for upload and enter the amount. This is considered as one of the most discreet and convenient methods of transferring cash from paypal to skrill.

Paypal vs skrill

Paypal and skrill are the most popular e-wallet services that most online casino players use. Both of the payment methods are easy to sign up and require your personal as well as banking information to complete and verify the registration process. The verification process does not take long as skrill's takes 24 hours whereas paypal's takes a couple of days to verify your details with the bank. Signing up on paypal and skrill is free of charge, but both of them charge transaction fees.

Paypal is the most preferred and used method in the online retail market and money transfers between individuals. Paypal is not accepted widely in the gambling market since few online casinos allow players to pay or withdraw using paypal. Skrill is accepted as a payment method in most of the online casinos and lesser in the retail industry.

In conclusion, the best way for a paypal to skrill exchange to take place is to withdraw money from paypal to your bank card or account and then send funds from your bank account or card to your skrill account. The most important thing is to use companies that are authorized and registered for money transfer services to ensure the security of your money. As a result, this will minimize the chances of getting involved with illegal brokers who may cause loss of funds. The U.S. Payment service is the best and most preferred option for a majority of people who move cash from paypal to skrill.

Top up skrill with topuptools

This product is currently not available.

You will receive the code directly by email, so that you can use the credit immediately.

Choice of more than 10 different designs.

Complete the checkout process safely and quickly with a choice of more than 70 payment methods.

Top up any skrill account with a topuptools voucher

Skrill deposit methods used to be very limited, but now we have topuptools vouchers. You can buy them online 24/7 with a wide range of payment methods. Your top up code will be instantly sent to you by email. With this innovative product you can also easily send money to someone else's online wallet. All you need is the email address of the skrill account you want to top up. Just try for yourself and see how easy it is to add funds to skrill with a topuptools voucher!

What is a skrill topuptools voucher?

Topuptools.Com is a new service that makes adding funds to online wallets more accessible and easier for everyone. Topuptools vouchers are innovative products that are not connected to the online wallet provider. They are entirely the responsibility of korsit. Do you still have questions about adding funds to skrill with a topuptools voucher? Don’t hesitate to contact our customer service for more information.

How to send money to skrill with a topuptools voucher

Once you’ve received your skrill topuptools voucher you can add funds to any skrill account of your choice. Simply visit the topuptools redeem page and enter the top up code along with receiver’s email address, that is linked to their skrill wallet. With your confirmation, the funds will be instantly transferred from topuptools to the skrill account. The new balance should be visible within a few seconds.

Note: once the payment has been authorized, it can not be undone, nor refunded. So please make sure to enter the correct email address of the e-wallet you want to add funds to.

Validity: please redeem your topuptools voucher code within one year after the purchase. After redeeming the code, the credit on the account can be used indefinitely.

What is skrill?

Electronic payment methods are very popular these days and skrill is one of the most popular ones. Digital wallets like paypal or advcash offer secure ways to pay online in thousands of webshops. Without a credit card, your sensitive data remains protected, allowing you to safely pay online for games, subscriptions or streaming services.

Get the complete package with arbusers

Register your skrill account with arbusers and enjoy a unique service and benefits

Comprehensive skrill review and extra benefits from arbusers

Every smart bettor will tell you – an ewallet is your must-have accessory when it comes to online betting. But everyone has different needs, so there are still lots of debates about which ewallet works best for betting.

That’s why we present you with an all-in-one skrill review where you’ll find all your questions answered. Learn more about skrill and decide whether it’s an ewallet for you. Plus, get extra perks and benefits when you create your account with arbusers.

We brought to you a number of services and products to support your smart betting operations. Ewallets are essential tools to support your gambling business. Register your skrill account with arbusers and get the complete package.

What you get with arbusers

- Instant verification.

- No transaction limits. All accounts referred by arbusers will have NO LIMITS.

- A skrill mastercard with the highest limits in the industry (available to SEPA countries clients).

- Extra bonuses and rewards from skrill.

- Reduced costs for p2p transactions for all vips.

- Personalised assistance by arbusers that goes far beyond the use of ewallets.

It is highly advisable that you register your skrill account with arbusers, otherwise:

- You will have to complete a deposit before proceeding with KYC. Resulting in a delay of at least some days.

- Your verification and the overall received support will be the same as the general audience.

- You will not enjoy the support of the skrill dedicated team serving arbusers members. You will not have arbusers support and guidance if needed.

Please have in mind that arbusers sees ewallets registration as a key loyalty characteristic of its members. Registering your ewallets with arbusers leads to superior support in your smart betting operations that no other website offers. Between colluding interests, arbusers has made a choice to stand with and by the players and expects from players to make the same choice.

Skrill review: what is skrill and how it works

Skrill is one of the leading e-wallets in the industry, having more than 40 million users worldwide. Skrill provides services since 2001, which makes it also one of the oldest e-wallets available. You may know it by its former name, moneybookers.

Skrill users store money, check their balance, and make payments online. You can do it online on the skrill website or download a mobile app to use skrill on the go.

Most bookmakers, exchanges, online casinos, poker rooms, and forex platforms accept skrill. It’s also possible to use skrill to buy and sell cryptocurrencies.

Need some cash? There’s a prepaid skrill mastercard available at your service. And if you prefer online shopping, there’s always a virtual card to use for that purpose.

Pros and cons of using skrill

- Easy and instant transfers

- Free transfers to the bank account

- Prepaid mastercard and virtual payment cards available

- Widely accepted by bookmakers, poker and casino sites, and forex platforms

- High currency conversion charges (3.99%)

- Prepaid mastercard supports only four currencies

- Slow customer support

Skrill account registration and verification

It’s easy to register a new skrill account:

STEP #1: follow our skrill registration link to get more perks with your new account

STEP #2: type your name, email, and password to create the account

STEP #3: provide more details to make a deposit

Of course, an empty skrill account is of no use to you, so the deposit should follow. And you will need to provide more details to top up your e-wallet. These details include your country of residence, full address, your date of birth, and the currency of your skrill account.

This step alone unlocks the basic features of your skrill account. But to get the full access and increase your limits, you’ll need to verify your account:

STEP #4: follow the instructions provided by skrill upon registration and upload all appropriate documents.

Skrill deposits and withdrawals

You can use plenty of options to top up your skrill account:

- Bank transfer

- Debit and credit cards (maestro, mastercard, VISA, american express, JCB)

- E-wallets (neteller, paysafecard)

- Bitcoin

Some fees may be applicable depending on your country of residence and the preferred depositing method.

Bank transfer, wirecard, and VISA are available for withdrawing your balance. You can also cash out your funds with a prepaid mastercard. Otherwise, use the funds to pay for services online or send money to other skrill users.

Prepaid mastercard and virtual cards

Skrill offers a prepaid contactless mastercard to have instant access to your skrill balance. It takes seconds to order the card (online or via mobile app), and you’ll receive it within the next ten days. The card supports euros, british pounds, the US dollars, and polish zloty. You can use the card to pay for goods and services or to withdraw cash from the atms. It works everywhere in the world where mastercard is accepted.

If you prefer online shopping, you can use a virtual mastercard instead. You won’t get a physical card for offline shopping or atms but all the details of such a card to buy things online.

The first virtual card by skrill is free of charge. You can also get extra virtual cards for an additional fee of 2.5 euros each.

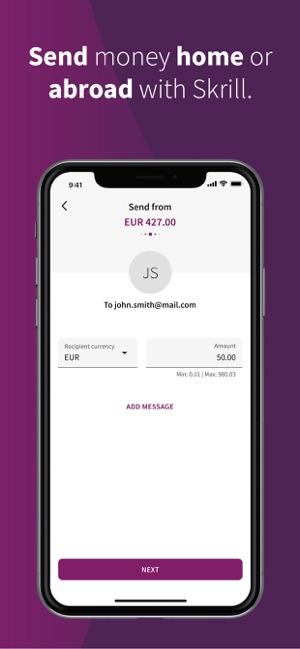

Skrill mobile app

Skrill offers free mobile apps available for both android and ios devices. Skrill apps enable all the features available online, including:

- Loading funds to your account

- Transferring money to more than 180 countries worldwide

- Sending money to other skrill users, bank accounts, e-wallets, or email addresses

- Paying for online services

- Checking your skrill account balance

- Ordering skrill prepaid mastercard

- Receiving real-time notifications about your transactions

How skrill ensures security

Being a leader in e-wallets, skrill knows a thing or two (or hundred) about safety. Skrill services are authorized by the financial conduct authority (FCA). Plus, skrill is known to use risk and anti-fraud technology to keep your funds secure at all times.

Skrill will never share your card or bank details with the retailers or other third parties. They encrypt all the data following the highest industry standards (PCI-DSS level 1). Thus, even if anyone would intercept the data, it would not be possible to make sense of it.

Finally, even if the hackers crack your password, skrill requires two-factor authentication. That means your password is not enough to log in to your skrill account. Sure, you will need a couple of extra seconds to access your account. But it adds an extra layer of security to keep your funds safe from all kinds of online threats.

Skrill fees

You can create a skrill account for free. You won’t get any charges for receiving money into your skrill account.

Want to pay for some goods or services online? As long as the retailer accepts skrill payments, you won’t have to pay a dime either.

Skrill works for most of the international payments. It uses only real-time exchange rates; thus, you save more. You can transfer money to bank accounts in 45 countries, and no charges will be applicable.

When it comes to sending money to other accounts, the standard skrill fee is 1.45% of the transfer sum. The charges go up only if you don’t use your skrill account for more than a year.

Skrill customer support

Any questions left unanswered? What this skrill review didn’t cover, skrill customer support definitely will.

While you can find an explicit FAQ section at the skrill website, customer support by skrill is not particularly fast for regular clients. But if you register via arbusers, you’ll enjoy the dedicated skrill support available to our members only. In addition, you can contact us (arbusers) via skype, PM, or email and we will be happy to have a discussion with you.

Account balance

In other languages:

US dollar balance

All second life® accounts have both a linden dollar balance and a US dollar balance. You can see both balances in the linden dollar summary and tilia account summary on your account page at secondlife.Com.

When you have a new second life account, your US dollar balance is $0. You can increase your US dollar balance by selling L$ on the lindex. The L$ can be used to make purchases inworld or on the second life marketplace; the US$ can be used for other purposes related to your account.

Using your US dollar balance

You can put your US dollar balance to work in several ways, explained below.

Pay for second life expenses

When you pay your premium membership fee, land use fees, private estate fees, buy linden dollars or buy a private region, linden lab charges your US dollar balance. If your US dollar balance does not cover your expenses, all available US$ credit is applied to the fee. Then we charge the remainder via your preferred payment method. (bill the full amount to your payment method by clicking "DON'T USE" next to your USD balance.) if you make enough linden dollars, you can sell them on the lindex to increase your US dollar balance. Some residents' premium accounts pay for themselves!

Process credit (withdrawal)

Update: as of june 6, 2016, turkish second life residents are unable to use paypal to process credit on their US dollar balances. It is, however, still possible for turkish residents to make purchases or to process credit using skrill. For more information about paypal's suspension of operations in turkey, please visit paypal's website (in turkish).

Net proceeds from your sales of linden dollars remain as credit on your second life account, and this credit is automatically applied to your account fees as described above. If you do not wish to apply your linden dollar sales proceeds to your fees, you may withdraw this portion of your account credit through a real-world credit process. (see process credit) note that you may only process credit due to net proceeds from sales of linden dollars. Purchases of account credits and credits due to gift codes or other promotional account credits are nonrefundable, and may not be processed as a payment to you.

You must be in full compliance with our terms of service to receive any payment through the credit payment process. This includes, without limitation, the requirement to have accurate and complete registration information, including verifiable billing information. Under certain circumstances, linden lab may request additional information from you before processing a request. If provided in a timely manner, this extra step should not significantly delay processing times.

Additionally, you must be in compliance with tilia's terms of service and provide tilia with adequate documentation for ID verification in order to process credit. Tilia is a subsidiary of linden lab that offers certain financial services to the second life community and helps second life comply with U.S. Laws and regulations. For additional information about tilia and the documentation required for ID verification, please see the tilia FAQ.

The following table provides an estimate for when you should receive your USD in your account based on the day of the week you submit your request. You should expect to see the USD in your account on or before the date listed. For most requests, you should receive payment to your paypal or skrill account within two business days. However, for a minority of requests, this process may take five business days.

Business holidays in the US will extend the two or five business day window by one day.

| Requested day | two business days later | five business days later |

| monday | wednesday | following monday |

| tuesday | thursday | following tuesday |

| wednesday | friday | following wednesday |

| thursday | following monday | following thursday |

| friday | following tuesday | following friday |

| saturday | following wednesday | following monday (eight calendar days later) |

| sunday | following wednesday | following monday (seven calendar days later) |

How can I withdraw USD credit from my account balance?

You may choose to credit your US dollar balance to a paypal or skrill account. This is known as a process-credit request, because you are requesting to process credit from the second life system to your real-world account.

Depending on which option you choose, you may be subject to fees and minimum withdrawal amounts.

How do I select a payout method?

When you request to process a credit from second life to your real-world account using the new system, you will be required to choose a payout method.

To place a process-credit request to paypal, you will need to select your paypal email address from the request form. The form lists the paypal account(s) you currently have on file at secondlife.Com, as well as the paypal account that you used for process-credit requests (if you have made previous requests in the old process-credit system).

To place a process-credit request to skrill, you need to select your skrill email address from the request form. The form lists the skrill account(s) you currently have on file at secondlife.Com, as well as the skrill accounts that you used for process-credit requests (if you have made previous requests in the older process-credit system).

Choose one of the existing accounts, or add a new paypal/skrill account as a payment method in the change payment method window:

Can I send funds to someone else's paypal or skrill account?

Process-credit requests must be sent to a paypal or skrill account that you control. They are not meant to be used to pay someone else.

Is there a minimum or maximum amount?

The minimum process-credit amount allowed is $10, plus any fees. The maximum amount per transaction is $9,999 minus fees. If necessary, you can process a larger amount over multiple smaller transactions.

If you are permanently closing your account, you may request a withdrawal of the full US dollar balance, even if it is less than $10. This is the only circumstance where the $10 minimum does not apply. To begin this process, please contact support for assistance.

How much does it cost to process credits?

There is a fee per process-credit transaction. Fees are subtracted from the amount you enter in the form, so you will receive less than that amount in your paypal or skrill account. You can view the relevant fee amounts on the transaction fees and payment priority page.

How long does it take to process credits?

For processing a credit to a paypal or skrill account, requests generally take up to five business days (monday-friday, not including U.S. Holidays) to be completed.

We always strive for quick turnaround; however, holidays and the volume of transactions may affect processing times. Also, in the event that linden lab requires additional information from a resident, the processing time will depend on the timely submission of the information by the resident.

How can I check on my previous and pending requests?

To view a full history of your process credit transactions, see the process credit history page. Any recent requests that have yet to be sent to paypal or skrill will say "processing" next to the timestamp. If the request looks to have been completed, but you haven't received funds in your paypal or skrill account, please contact support for assistance.

How can I cancel a process-credit request?

You might have entered the wrong amount or the wrong paypal/skrill account information when requesting a credit. If you think you've made a mistake, check your process credit history and then contact support for assistance. You'll need to tell us which request is to be canceled (use the date/time and the amount to identify it). Please notify us as soon as you can, so that we can reverse the request and restore the funds to your account balance. Afterward, you may request the withdrawal again, or you may use the funds to pay second life account fees.

Wire transfers

Sending money to linden lab

Linden lab is not currently able to accept payment from your bank via wire transfer. Please pay for balances through credit card, paypal, or skrill.

Receiving money from linden lab

Linden lab is not currently able to support payment to your bank via wire transfer. If you wish to credit your USD balance to an external account, please do so through paypal or skrill.

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Let us do for you !

Work seams so easy now

Emoneypk.Com

You can pay us easily in

- Standard chartered

- Allied bank ltd.

- Askari bank ltd.

- Easypaisa account

- UBL omni account

- Mobicash jazz account

Withdraw / sell skrill balance in pakistan

Today SKRILL cashout rate: updated on right side rate list.

Note: minimum you can cashout 50 skrill dollars

now you can easily cashout skrill to PKR with good rates, as many of you might be tired from the skrill default withdrawal system as they take time and deduct a lot of fees from you for the one successful withdraw. We do send you PKR for your skrill dollars instant according to our rates without any extra fees or hidden charges.

Procedure to withdraw skrill in pakistan

Short defined procedure to sell your skrill with us and receive PKR.

- First you will tell us that what is the source of your dollars? It mean where from you received that dollars, because we only buy the dollars that you received from the authentic legal websites like freelancer.Com, upwork.Com or from any other authentic platform. We don’t do cashout or buy if your dollars are not from the authentic websites. (to confirm that your fund is authentic we do check your skrill account transactions live through skype screen sharing or team viewer , that is why we recommend to you that contact us through skype always to make your transactions fast)

- After checking you will send skrill dollars to our skrill account, we will provide you our unique skrill account email whenever you wanted to exchange or withdraw your skrill fund. Usually you would be doing your regular transaction with us on skype, and for the transactions records you can create your account with us (register)

- After sending the dollars to our email, we will pay you instant into your bank or through easypaisa.

- You will provide details of your bank in which you need payment, you can receive payment in bank or through easypaisa, mobicash or UBL omni.

Withdraw skrill to bank in pakistan

To receive payment in bank you need to provide following,

- Bank name

- Account number

- Branch code

- Account title (owner name)

- Cell number

We do not charge any fees for bank transfer, in skrill to bank transfer there is no hidden fee or bank fees you will get the exact amount according to our daily rates of skrill.

Withdraw skrill to easypaisa in pakistan

To receive payment through easypaisa you need to provide,

- CNIC (identity card number)

- Cell number

- Address

Easypaisa charge the fees according to the amount in PKR you are going to receive from us, for the fee you can check the easypaisa fee table at the bottom of this page.

Sell skrill in pakistan now

So decided to withdraw your skrill fund through us, to cashout smoothly and instant you should use skype to talk live with us, skype is a fastest way to make your transaction fast & instant.

Easypaisa charges table

| slab start | slab end | total charges |

| 1 | 1000 | rs. 60 |

| 1001 | 2500 | rs. 120 |

| 2501 | 4000 | rs. 180 |

| 4001 | 6000 | rs. 240 |

| 6001 | 8000 | rs. 300 |

| 8001 | 10000 | rs. 360 |

| 10001 | 13000 | rs. 420 |

| 13001 | 15000 | rs. 480 |

147 responses to withdraw / sell skrill balance in pakistan

Admin mene kuch galat likh dia jo ap mujhe reply nahi karahay? Mujhe apne skrill account main se 55 aud dollar cashout karne hain kia ap kr sakte ho??

Yes we can, please contact through email.

Mujhe 120 doller pcm broker abodahabi ko bhejna hae .Ye kis trah mumkin hae.Mene skrill account aigne up ker liya hae .Ab kia kerna hoga .Me doller kis tarah bhejoon.

You can dollars in your skrill account, than you can utilize that dollars anywhere you want.

Mera aik client mujah ko website ki payment karna chatah haye skrill account say magar meray pass skrill account nahi haye, agar ma ap kaye skrill ma payment magwata hon tu app mujah easypaisa saye cashout kar saktay hain. Waiting for reply

NO, we not accept direct from your clients. You need to get in your own account than you can contact us for cashout. We prefer the dollar from any websites like odesk, freelancer.Com, fiver etc..

مجھے 1000ڈالر سکریل چاهے کس ریٹ پر ملے گا

Email with details sent to you.

Admin how much days will it take to get the money of cashout.

Hi, transaction not take days, our maximum transaction time is 2 hours,

I want 230 dollars in my skrill account please tell me your rates and details.As early as posible.Thankss

Yes available. I have sent you the rates & details. Kindly check that.

I have got 91.28 USD and 350 USD in my 2 skrill accounts. Kindly tell me the equivalent cash you are willing to exchange for this amount through easy paisa. I will be waiting for your response.

Hi, details sent to you through email. Kindly check that.

Bro ap mujh skrill kay dollar dado mujh 3o dollar zarurat hain badla main ap mra say pasy lalana jitna banain

Yes you can buy. Email sent to you with rates & details.

80$ ko easypaisa k through cashout krna hai bhai rate kia ho ga is ka.

Yes you can. Details sent to you through email.

Mujhy skirill ka 15$ dollrs chye kitna rate par mily gaa

Hi, I have sent you the rates & details , please check your email.

I want to sell skrill and transfer it to my bank account.

Can you plz send me details with processing time and gurantee.

Assalam-0-alaikum

janab mujhy skrill mein 50$ purchase karnay hien kya koi bata sakta hai k is website par bharosa kiya ja sakta hai ya nahi? And please admin tell me how I can buy skrill balance from you?

Wa.Alikum.Slaam, rates with details sent to you.

AOA,

I want to withdraw my 45 $ from elance . What would be your commission?

Kindly reply

Wa.Alikum.Slaam rates & details sent to you.

I want to buy some skill dollar, any one can contact me

Hi, rates & details sent to you.

I’m calling you’re number from friday but no answer no one is attending my call why?

Mujhai apnai skrill account main funds add krwanai hai agr kisi ko maloom hai to please tell

Yes you can buy the dollars from us.

Admin I made a skrill account today.Now I wanna deposit in skirl account..Can I deposit in it through any money exchange.Plz guide me..

Hi,

yes you can buy skrill dollars from us. You can pay us through bank or easypaisa.

I have 700 skrill i want to cash out how can i do kindly let me know.

Asslam u alaikum sir mai moneybooker dollors sale krna chahta hun ap kitny ka dollor len gy or payment kab tk mil skgti hai . Easy paisa se.

Wa.Alikum.Slaam kindly check your email.

Kindly tell me how i withdraw and whts ur commision

Hi, I wanna cashout my $ from moneybookers to bank alfalah can you plz send your rate and procedure and how long I received my money. Thanks

Yes you can get the payment in all actives banks in pakistan.

Hi,

I want to get USD into my skrill account, please tell me procedure.

I have sent you an email with rates & detail. Kindly check that.

Sir plz send me your contact number.

Contact number is already mentioned on contact us page.

Hi sir pla me you contect number i want discuse u some thing..

Skrill review: online money transfers & payments with debit card

Skrill is an online e-wallet service that allows you to transfer funds both domestically and internationally. The platform is often regarded as the nearest competitor to de-factor e-wallet paypal. However, as is the case with any online money transfer service, you need to have a full understanding of how the fee system works.

As such, we’ve created the ultimate guide to skrill. We’ll discuss everything you need to know, such as deposit methods, safety, mobile-friendliness, and of course, fees.

By the end of reading our review from start to finish, you’ll have all of the necessary information to assess whether skrill is right for your individual needs.

Let’s start by finding out who skrill is.

Who is skrill?

Launched way back in 2001, skrill become one of the first online e-wallets to facilitate internet-to-internet payments. The overarching aim of using skrill is to transfer funds online to another skrill user. As we will discuss further down, the skrill platform now offers a range of additional services, such as bank account withdrawals and prepaid debit cards.

Formally known as moneybookers, the company rebranded to skrill in 2011. The company was purchased by paysafe group in 2015, alongside rival e-wallet neteller. In terms of its customer base, skrill claims to now have over 40 million users worldwide. Not only this, but the platform supports 200 countries and over 40 currencies.

On top of its more traditional money transfer service, skrill is now accepted at a vast number of online merchants. Recent estimates place the number of merchants at over 120,000 globally, with the skrill payment gateway utilized by the likes of ebay and facebook. Although skrill offers its payment gateway services to a full range of industries, one of its main markets is that of the online gambling and forex brokers.

One of the key reasons for this is that paypal often prohibit online casinos that do not have a long-standing track record in the online gambling industry, and thus, the threshold with skrill is much lower.

So now that you have a better understanding of who skrill is, let’s take a look at how you can get started with skrill.

How do I get started with skrill?

Here’s a breakdown of the main steps that you will need to go through to get started with skrill.

Open an account

First and foremost, you will need to open an account with skrill. Simply head over to the official homepage by clicking on this link , and then click on the ‘register’ button. You’ll find this at the top-right-hand side of the screen.

Next, you will then need to enter your full name, email address, and then choose a strong password. Read and accept the terms and conditions, before clicking on the ‘register now’ button.

On the next page, you will then need to enter your country of residence, and your preferred currency. Make sure you choose your domestic currency to avoid any exchange rate fees.

On the next page, you will then need to choose the payment method that you want to use to deposit funds. Once you do, you will then be prompted to enter some more personal information.

You don’t actually need to verify your identity at this point, as long as you still within your account limits. However, in order to increase these limits, you will need to upload some identification.

Verify your identity

In order to verify your identity, and thus, increase your account limits, head over to the settings page, which you can access via the the left-hand-side bar. Then click on ‘verification’.

In order to confirm your identity, you will need to upload a copy of your government issued ID. This can be either a passport or driving license, or in some cases, a national ID card.

If you decide to do this through your desktop computer, then you can upload the document straight from your device. You will also need to upload a selfie of you holding a handwritten note with the current date. Alternatively, if you decide to verify your identity via your mobile app, you can use your smartphone camera to take a photo of your ID.

What payment methods does skrill support?

Once you have set-up your newly created skrill account, you will be presented with a range of payment options. This includes a traditional bank transfer, debit/credit card, and a number of alternative methods such as bitcoin or paysafecard.

Here’s the full list of supported deposit options.

- Bank transfer

- Debit/credit card

- Neteller

- Bitcoin and bitcoin cash

- Paysafecard

- Trustly

- Klarna

Regarding a bank transfer, you will be presented with the local bank account details that you need to transfer the funds to. You will also be shown a unique customer reference number.

It is imperative that you insert the customer reference number when you perform the bank transfer, or skrill might have issues linking the transfer to your account. In the vast majority of cases, the bank transfer deposit will show up in your skrill account within 2-3 working days.

Alternatively, if you’re from the UK, you can perform a rapid bank transfer via skrill. This allows you to deposit funds instantly, via the faster payments network.

The other option that you have available to you is a debit or credit card deposit. This is by far the easiest option, as the funds will be credited to your skrill account instantly.

If none of the above suffice, then you can make a deposit with one of the alternative payment methods listed above.

What fees does skrill charge?

One of the most important factors that will determine whether or not skrill is right for your needs is fees. This doesn’t just come in the form of transfer fees, but also the costs associated with depositing and withdrawing funds, as well as currency exchange fees. We’ve broken the fees down in more detail below.

Deposit fees

Regardless of which payment method you use to deposit funds into your skrill account, you will be charged a fee. For the benefit of simplicity, all payment methods carry a fee of 1%. As such, if you were to deposit £500 in to your account, you would be charged a £5 fee.

This amount is deducted from the gross amount that you deposit. Using the same example as above, you would receive £495 from your £500 deposit.

Withdrawal fees

One of the great things about skrill is that you have the option of withdrawing funds back to your chosen payment method.

If you choose to withdraw funds back to your bank account, then you will pay the local currency equivalent of 5.50 EUR. At the time of writing, this amounts to £4.82.

In comparison to paypal, this is actually very expensive. If you are from the UK and you withdraw funds from your paypal account back to your UK bank account, then this process is not only instant, but it’s free.

If you want to withdraw funds from your skrill account back to your visa debit/credit card, then skrill will charge you a mouth-watering 7.5%. This means that a £100 withdrawal would result in a £7.50 fee.

Transfer fees

When it comes to actually transferring money, skrill will charge you 1.45% of the transfer amount. So, if you were to transfer £400, you would end up paying £5.80 in fees. In comparison to rival e-wallet paypal, this is actually much cheaper, as paypal averages 2.90% (although this will vary depending on where you live).

However, it is important to note that if you are transferring funds to a person to utilizes a different currency, then you will need to pay exchange rate fees. Unfortunately, this is where things can begin to get a bit expensive.

Skrill charges an additional 3.99% on top of the current mid-market rate. When adding that on to the previously mentioned 1.45% transfer fee, you could end up paying as much as 5.44%.

On the other hand, skrill never charges you to receive money, which is definitely a plus-point. On the contrary, the likes of paypal will charge you a variable fee when receiving funds, unless you are from the UK and the person sending the funds is also from the UK.

So now that you have a better understanding of the fees charged, in the next part of our skrill review we are going to look at how safe the e-wallet is.

Is skrill safe?

If you’re not familiar with how e-wallets work, then you might be concerned with safety. However, established e-wallets such as skrill are extremely safe to use. Firstly, the platform is authorized by the UK’s financial conduct authority under the electronic money regulations 2011. This ensures that your funds are kept safe.

When it comes to keeping your account secure, it is highly advisable to set-up two-factor authentication. This is where you will need your mobile phone every time you want to log in or withdraw funds. Without it, nobody will be able to access your account.

You will also be asked to choose a 6-digit PIN number, which will also be required when you perform key account functions.

When you enter sensitive financial information (such as your debit/credit card details) in to the skrill website, the platform uses advanced encryption security. This means that even if the data was intercepted, nobody would be able to read it.

What you should be extra aware of is ‘phishing emails’. This is where scammers will impersonate skrill by sending you an email. They hope that you reply to the email with your login credentials, so that they can then gain access to your skrill account. However, skrill will never contact you by email asking for your account passwords, so be sure to tread with caution.

All in, skrill is a very safe e-wallet platform to use.

Skrill customer support

If you need assistance with your skrill account, it is always worth checking their extensive FAQ section first. We found that most account queries can be solved by reading the many help guides on offer. However, if you need to speak with the skrill team directly, then you have a couple options at your disposal.

You can contact skrill by telephone, and the platform offers a number of local toll numbers, including that of the UK and U.S. Before you call them, make sure that you write down your customer reference number so that the support agent can bring up your account. You’ll find this at the top-right-hand side of the screen.

Alternatively, you can send a direct message to the support team via your skrill account. The team usually reply within 24 hours, although if you need instant assistance, you’ll be best off contacting them via telephone.

If you are a VIP skrill member, then you will get access to 24/7 support via a dedicated telephone number. This will avoid having to hold for long periods.

Unfortunately, skrill does not offer a live chat facility.

Skrill mobile app

Skrill now offers a fully-fledged mobile application that you can download straight to your phone. The app is supported across both android and ios devices, however blackberry and windows aren’t supported. The app allows you to access all of the same account functions as you will find via the main skrill website.

This includes the ability to check balances, transfer funds, deposit and withdraw money, buy and sell crypto, and more. When we tested the app out ourselves, we found that the overall layout was very user-friendly. There were no issues navigating from section-to-section, and we were able to transfer money with ease.

The general consensus in the public domain is that the app operates without fault. Some users have complained about server issues when using the app via android devices, however these are few and far between.

The app also makes it easier to verify your identity, as you are not required to upload a selfie of you holding a piece of paper with the current date.

Skrill pre-paid debit card

Skrill also allows you to obtain a pre-paid debit card issued by mastercard. The card is linked directly to your main skrill account, which gives you more options when it comes to spending your balance. For example, you can use the skrill pre-paid debit card when making purchases in-store, free of charge.

You can also withdraw cash from an ATM machine, although you will be charged a 1.75% fee for this. On the other hand, the fees remains the same regardless of where you are, which makes the skrill pre-paid card useful when travelling abroad. The skrill pre-paid card comes with a fee of 10 euros, which you will need to pay every year.

Nevertheless, this actually makes it much cheaper to get money out of your skrill account, especially when you consider the 7.5% fee charged to withdraw funds to a visa debit/credit card.

Buying crypto via your skrill account

Skrill recently entered the cryptocurrency space by allowing registered users to buy and sell coins via their account.

It is important to note that when you buy cryptocurrencies from skrill, you are not actually buying the underlying asset. Instead, you are buying CFD-like (contract-for-difference) products.

This means that you are only speculating on whether the price of the cryptocurrency will go up or down. As a result, you can’t actually withdraw the coins to an external wallet outside of the skrill website.

Nevertheless, skrill currently supports eight different cryptocurrencies, which we’ve listed below.

- Bitcoin

- Ethereum

- Ethereum classic

- Bitcoin cash

- Litecoin

- Ripple

- Stellar lumens

- 0x

In terms of fees, if you are buying or selling cryptocurrencies with either the USD or EUR, you will pay 1.5% at each end of the transaction. If you are using an alternative currency like GBP, then this fee increases to 3%. Not only are these fees rather expensive, but skrill do not make it clear how they import their live pricing feeds.

Skrill review: the verdict?

In summary, skrill is a really useful tool to send and receive money online. No matter where the other person is located, you can transfer funds with ease. We really like that the platform supports a significant number of deposit methods, such as a bank transfer and debit/credit card, as well as alternative options like paysafecard.

While transfer fees of 1.45% are rather competitive, things can be a bit expensive when you need to transfer funds using a secondary currency. This is also the case if you need to withdraw funds back to a visa card, with the fees amounting to a whopping 7.5%

However, a simple workaround in this respect is to obtain the skrill pre-paid card. This way, you can withdraw your skrill funds out via your local ATM at a rate of just 1.75%. This is especially useful if you want to use your card in another country.

Что можно сказать в заключение: skrill balance CONVENIENCE send and receive money, store cards, link bank accounts and pay conveniently anytime and anywhere with your email address and password. CONFIDENCE по вопросу skrill balance

Комментариев нет:

Отправить комментарий