Help skrill

Yes. However, please remember that all withdrawals are first approved by our internal review team. Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD only.

Skrill frequently asked questions

1. What is skrill?

Skrill enables customers with a valid email address to securely and cost-effectively send and receive payments online in real time.You can use skrill to:

- Send money via email from your credit card or bank account.

- Make online purchases.

- Collect money via email.

2. How do I fund my account using skrill?

To deposit using an existing skrill account, please follow the steps below:

- Log in to your account.

- Go to the 'cashier' tab and select 'deposit'.

- You will now see the skrill logo. To select this deposit option simply click on the icon.

- Enter or select your deposit amount and bonus code (if applicable), then click on 'deposit'.Note: this amount should be less than or equal to the amount in your skrill account.

- You will be directed to the skrill website where you are required to enter your skrill email address and password to log in.

- Complete the transaction on the skrill website.

- On the next screen you will receive an 'order approved' message. Click on 'OK', you will be transferred back to the cashier and will see a successful deposit message.

3. What currencies can I make a deposit with when using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD only.

4. How can I load my skrill?

You can load your skrill account by using your credit/debit card, making an online bank transfer, direct banking or via cheque.

Note:you will not be able to transfer the funds from skrill.Com to your account if you have funded them using master card.

5. Is it safe to use skrill?

Yes, skrill is totally secure. Through a combination of transaction monitoring, SMS transaction verification for cardholders and a dedicated anti-fraud team, skrill is an entirely safe online payment method.

6. Can I withdraw to my skrill account?

Yes, you may withdraw to your skrill account if you have made a successful deposit with it within the last 180 days. To request a withdrawal, visit the cashier, select the 'withdrawal' tab and then select the skrill logo. Enter the amount you would like to pay out and we will send it to your skrill account after we have reviewed your request.

7. What currencies can I withdraw in using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD only.

8. Can I withdraw more than my initial deposit using skrill?

Yes. However, please remember that all withdrawals are first approved by our internal review team.

Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your bank account.

9. What is the average processing time for skrill withdrawals?

All withdrawals are first approved by our internal review team, which takes approximately up to three business days. Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your skrill account.

10. Can I withdraw the same day I deposit through skrill?

11. Can I withdraw to skrill if I deposited using a different payment method?

Yes, to withdraw using skrill you need to have made a successful deposit with your skrill account within the last six months.If you have made a successful deposit within the last six months, visit the cashier, select the 'withdrawal' tab and then select the skrill logo.The amount of your withdrawal will be sent electronically to your skrill account after our internal procedure has been completed.

12. What is the minimum and maximum amount I can withdraw using skrill?

The minimum withdrawal amount that you can withdraw via skrill is 10.00 USD equivalent and the maximum withdrawal amount is 10000.00 USD equivalent.

13. Are there any transaction fees associated with skrill payments?

We won't charge for skrill deposits or withdrawals, but it's possible that skrill may charge you for either of these so we recommend you check with them directly.

Skrill bangladesh collaboration

This is a huge step into the right direction and help to improve the way online payments for skrill bangladesh clients can be handled in the future.

We will give you a quick overview about the details and about the benefits of this agreement.

- What exactly did happen?

- Benefits for customers from bangladesh?

- What about NETELLER?

- Optimizer your skrill account with ewo.

Skrill bangladesh – what exactly happened?

Sonali bank deputy general manager abdul wahab and skrill limited chief executive officer lorenzo pellegrino inked the agreement which will help to enable skrill customers from bangladesh to send funds directly to any bangladeshi bank account.

Benefits of this agreement for skrill bangladesh

However, what exactly this will mean for the future is not foreseeable yet. But of course we will follow the progress and keep you posted as soon as there are any news or updates.

What about the NETELLER bangladesh market?

Currently we don’t have any information about a similar agreement for the NETELLER bangladesh market, but this does not mean that it cannot happen in the future at any time. Bangladesh is an important market for NETELLER as well and we are sure they will do everything possible to help this market to grow even more.

Skrill india and south-asia in general are absolute hot spot markets in terms of business developments as well. We would not be surprised seeing paysafe, especially skrill india and NETELLER india, to strengthen their position in the market soon.

Skrill benefits with ewo

- Skrill VIP upgrade promo to get an easier upgrade to bronze, silver, gold and diamond VIP.

- Participate in the ewo loyalty program with monthly benefits.

- Access to your personal ewo dashboard to keep track of your deposits.

- Personalized skrill help, contact us 365 days a year.

Especially the lower requirements for VIP are a major benefits. Once you reach silver VIP status (after only 5,000 EUR in deposits with us, instead of 15,000 EUR)

Sign-up your skrill account with us to not miss any of those benefits and contact us in case you have any further questions about the skrill bangladesh agreement or anything else.

I need help about skrill to payoneer transfer?

Comments

How many days or what is the ETA for the process of the payment. I am really interested for this. I have valid and verified payoneer and skrill account but somehow I am not able to complete my verification in skrill. May be i have to ask about live or another help in skrill. But before i do that i really needs to know what is the time duration between skrill to payoneer transfer

I've withdrawed 465 USD from skrill 5 days ago.

Today I call their customer support because they haven't processed the payment yet.

They said "we are having problems in sending payment to american bank accounts." so we cannot process the withdrawal payment we can offer you a refund "

What's going on mate.

US payment service isn't working for me. -.-

I have withdrawed from my skrill to US . I am completely verified .

So let's see what happens.

Did withdrawal today waiting for there processing email.

L've got email from skrill

saying that my withdrawal has been processed which means they're transfering money to my US payment service

Your recent withdrawal request is now on its way and should be with you soon.

The details are:

Amount: 550 USD

time & date: 16:09, 09 mar 2015 CET

transaction ID: 1xxxxxxx5

Bank transfer to the following account:

bank of america, national association

0xxxxxxxxxxxxxxx8

united states of america

Hope this helps other users.

I have done everything they asked . I have send ID again, even though my account is fully verified for over a year and I have been using the system in every month.

But from the last month and a half they have cancel all withdraws even after sending the email confirming the transaction is in process.

Now they don't even take my messages, help system does not send you a confirmation ticket any more , so basically they are screwing freelancer.

Please share your experience.

I have done everything they asked . I have send ID again, even though my account is fully verified for over a year and I have been using the system in every month.

But from the last month and a half they have cancel all withdraws even after sending the email confirming the transaction is in process.

Now they don't even take my messages, help system does not send you a confirmation ticket any more , so basically they are screwing freelancer.

Please share your experience.

Email support will take much longer to respond.

I will suggest you to call them from skype balance.

I've got my card uploaded with my money within 1-5 days.

Its working finee

I need help about skrill to payoneer transfer?

Comments

How many days or what is the ETA for the process of the payment. I am really interested for this. I have valid and verified payoneer and skrill account but somehow I am not able to complete my verification in skrill. May be i have to ask about live or another help in skrill. But before i do that i really needs to know what is the time duration between skrill to payoneer transfer

I've withdrawed 465 USD from skrill 5 days ago.

Today I call their customer support because they haven't processed the payment yet.

They said "we are having problems in sending payment to american bank accounts." so we cannot process the withdrawal payment we can offer you a refund "

What's going on mate.

US payment service isn't working for me. -.-

I have withdrawed from my skrill to US . I am completely verified .

So let's see what happens.

Did withdrawal today waiting for there processing email.

L've got email from skrill

saying that my withdrawal has been processed which means they're transfering money to my US payment service

Your recent withdrawal request is now on its way and should be with you soon.

The details are:

Amount: 550 USD

time & date: 16:09, 09 mar 2015 CET

transaction ID: 1xxxxxxx5

Bank transfer to the following account:

bank of america, national association

0xxxxxxxxxxxxxxx8

united states of america

Hope this helps other users.

I have done everything they asked . I have send ID again, even though my account is fully verified for over a year and I have been using the system in every month.

But from the last month and a half they have cancel all withdraws even after sending the email confirming the transaction is in process.

Now they don't even take my messages, help system does not send you a confirmation ticket any more , so basically they are screwing freelancer.

Please share your experience.

I have done everything they asked . I have send ID again, even though my account is fully verified for over a year and I have been using the system in every month.

But from the last month and a half they have cancel all withdraws even after sending the email confirming the transaction is in process.

Now they don't even take my messages, help system does not send you a confirmation ticket any more , so basically they are screwing freelancer.

Please share your experience.

Email support will take much longer to respond.

I will suggest you to call them from skype balance.

I've got my card uploaded with my money within 1-5 days.

Its working finee

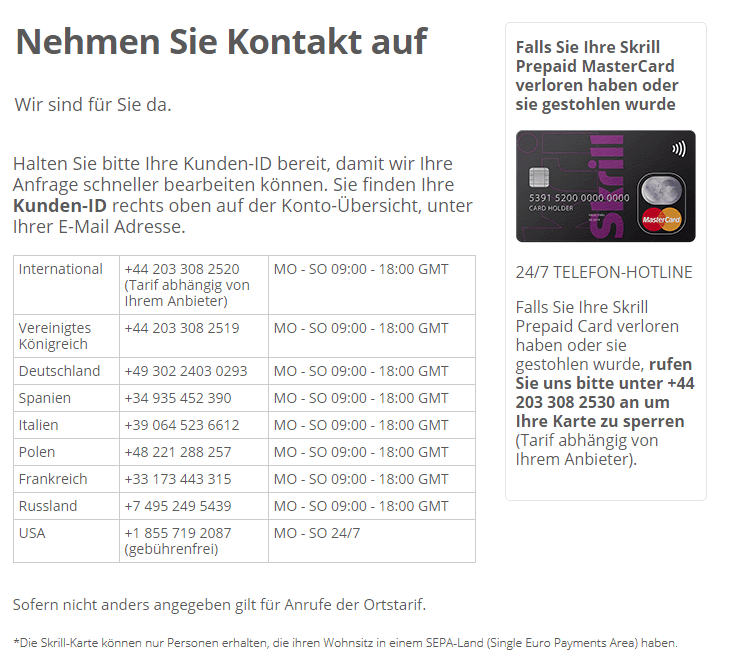

Skrill kontaktieren: kontakt zum skrill-kundenservice aufnehmen!

Wenn sie fragen an skrill haben oder technische probleme lösen möchten, können sie kontakt zum skrill-kundenservice aufnehmen. Der support ist sowohl schriftlich als auch telefonisch erreichbar. In diesem artikel zeigen wir ihnen, wie sie mit skrill in kontakt treten können.

Inhaltsverzeichnis des artikels

FAQ und selbsthilfe

Viele anliegen, die in den bereich kundenservice fallen, können sie im hilfeportal von skrill finden. In dieser datenbank sind viele fragen bereits ausführlich beantwortet. Sollten sie hier keine lösung für ihr problem finden, kann ihnen der persönliche kundenservice weiterhelfen.

Die fragen sind in unterschiedliche kategorien aufgeteilt, sie können aber auch nach stichwörtern suchen, um eine antwort auf ihre frage zu finden.

Kontakt per telefon

Damit ihr anliegen von skrill schnell gelöst werden kann, halten sie – falls vorhanden – ihre kundennummer bereit. Diese finden sie auf der kontoübersichtsseite. Je nach anliegen können sie unterschiedliche kontaktmöglichkeiten nutzen.

Skill hat keinen deutschen geschäftssitz, sondern leitet die geschäfte in deutschland von großbritannien aus. Um mit dem kundenservice in kontakt treten zu können, war es lange zeit nötig, eine telefonnummer in england anzurufen. Mittlerweile hat skrill auch eine deutsche hotline. Die internationale telefonnummer können sie aber nach wie vor nutzen, hier sind die kosten für das gespräch aber höher als bei inlandsgesprächen.

Telefonnummern

Skrill-hotline international: +44 203 308 2520

skrill-hotline deutschland: +49 302 2403 0293

montag – sonntag 10:00 – 19:00 uhr

Auch aus weiteren ländern können sie den skrill-kundenservice erreichen. Beachten sie dabei immer die zeitzone:

Kreditkarte sperren lassen

Im falle eines verlustes oder diebstahls der skrill prepaid card wenden sie sich umgehend telefonisch an skrill.

Sperrhotline: +44 203 308 2530

Auch hier können höhere kosten anfallen. Diese nummer ist rund um die uhr für sie erreichbar. Mehr über die skrill kreditkarte erfahren sie in unserem ratgeber: die skrill karte

Schriftlicher kundenservice

Während der telefonische kundenservice bei skrill gut erreichbar ist, kann es bei E-mails zu längeren wartezeiten kommen. Wenn sie schriftlich mit skrill in kontakt treten möchten, können sie dafür das kontaktformular auf der skrill-website nutzen oder eine E-mail schreiben.

E-mail: help@skrill.Com

kontaktformular: klicken sie hier

Mobiler support

Schriftliche antworten auf ihre fragen können sie auch (auf englisch) über twitter erhalten. Unter @ask_skrill erreichen sie die mitarbeiter im kundenservice.

Über facebook hilft ihnen der support im regelfall innerhalb einer stunde. Hier kommen sie zum skrill-facebookprofil. Sie können eine nachricht auf der skrill-seite hinterlassen oder eine private nachricht senden.

Beschwerde senden

Ihre beschwerden können sie über das kontaktformular senden. Sollte das problem nicht zu ihrer zufriedenheit gelöst werden, können sie mit dem financial ombudsman in großbritannien in kontakt treten. Dieser nimmt sich dann ihres anliegens an. Ein ombudsman ist eine art schlichter, der in streitfällen zum einsatz kommt.

Postadresse:

financial ombudsman service

exchange tower

london, E14 9SR

united kingdom

Zusammenfassung

Umfangreiche hilfeseiten, um lösungen für probleme zu finden telefonischer kontakt unter deutscher hotline möglich für schriftlichen kontakt das kontaktformular nutzen oder per E-mail, twitter oder facebook mit dem kundenservice kommunizieren bei beschwerden über skrill können sie mit dem ombudsman in großbritannien kontakt aufnehmen

Diese artikel können sie auch interessieren:

26 kommentare

Guten tag,

ich habe soeben ein skrill – konto eröffnet. Zu testzwecken wollte ich 10,00 euro überweisen.

Weder mit sofortige überweisung (giropay) noch mit klarna wurde der auftrag angenommen.

Bei giropay erscheint die fehlermeldung „das einzahlen mit giropay war nicht erfolgreich. Bitte versuchen sie es noch einmal“.

Bei klarna „die transaktion wurde abgelehnt. Bitte versuchen sie es erneut. Sollte das problem weiterbestehen, wenden sie sich an den kundendienst“.

Beim anklicken des links erscheint „fehler 404 page not found“.

Laut skrill-website gibt es keine mindesthöhe bei ein- und auszahlungen.

Wo liegt hier der fehler?

Sie haben recht, es gibt keine mindesthöhe. Haben sie auch die anderen möglichkeiten außer klarna oder giropay versucht?

Es kann gut sein, dass das problem nicht bei skrill liegt, sondern bei ihrer bank. Überprüfen sie, ob alle angaben richtig waren, die sie eingetippt haben oder kontaktieren sie ihre bank. Auf der skrill homepage steht zu fehlgeschlagenen geldeinzahlungen, dass folgendes der grund sein kann:

Eine beschränkung ihrer bank für bestimmte zahlungsarten, ein nicht ausreichendes guthaben zum zeitpunkt des zahlungsversuchs oder eine sicherheitsbeschränkung

Sollte es kein problem der bank sein, kann ihnen an dieser stelle nur der kundensupport von skrill weiterhelfen, sie können diesen per telefon oder email wie hier im artikel beschrieben erreichen.

Falls sie klarna erreichen wollen, können sie eine E-mail schreiben oder anrufen (0221 669 501 10).

Mit freundlichen grüßen

jana

Vor ca. 1mi. Sendete ich dieses nachfolgende schreiben. Jedoch wurde mein schreiben umgehend beantwortet mit der message, wurde nicht gesendet weil diese kontaktadresse nicht existiere! Ich bitte sie höflichst meinerm schreiben folge zu leisten bzw. Alles zu annulieren und mein eibezahlter betrag von 2×130. Auf mein corner card, visa zu retounieren!

Für ihre bemühung und folgeleistung meines schreiben bedanke ich mich zum voraus.

Mit freundlichen grüssen

anouk/ sun sandmeier

(fälschlicherweise habe ich eine anfrage vom browser (skrill) gesendet, was

jedoch nicht von mir gewollt war. Deswegen bitte ich sie höflich dies

wieder zu annulieren bzw. Zu ignorieren, demzufolge erübrigt sich die

begleichung von 2× 130.- .

Für die umstände entschuldige ich mich und bedanke mich bei ihnen für ihr

entgegen gebrachtes verständnis.

Mit freundlichen grüssen

anouk sandmeier)

Wir von bezahlen.Net haben nicht direkt mit skrill zu tun, sondern erstellen ratgeber.

Am besten rufen sie bei skrill an unter folgenden nummer: +49 302 2403 0293

Mit freundlichen grüßen

jana

Sehr geehrte damen und herren,

Wie gewohnt wollte ich diebezahlung einer rechnung von delcampe (E-mail des händlers: mozelturkay@gmail.Com) vornehmen. Nach dem klicken des button „weiterleiten“ erschien folgende nachricht: <„code“:“BAD_REQUEST“,“message“:“Invalid parameter“>

eine überweisung des betrages war somit nicht möglich.

Was ist zu tun? Erwarte umgehend eine antwort.

Dies bedeutet, dass der händler bei der implementierung des quick payments einen fehler gemacht hat. Da der zahlungsdienstleister skrill das nicht beeinflussen kann, sollten sie den händler darauf hinweisen.

Alternativ können sie versuchen skrill zu kontaktieren:

skrill-hotline deutschland: +49 302 2403 0293

montag – sonntag 10:00 – 19:00 uhr

Mit freundlichen grüßen

jana

Hat von euch jemand eine idee warum ich andauernd, wenn ich mit meinem skrill guthaben bezahlen will, eine fehlernachricht mit dem inhalt:

Ihre transaktion wurde abgelehnt. Bitte versuchen sie die transaktion erneut. Sollte das problem weiterhin bestehen, wenden sie sich an den skrill kundenservice zwecks unterstützung.

Bekomme? Ich habe wie beschrieben mich beim kundenservice gemeldet (per twitter, facebook und per kontaktformular) letzteres 3 mal weil sie die ersten zwei formulare ohne zu bearbeiten einfach geschlossen haben.

Aber auch bei den anderen möglichkeiten erhalte ich keine antwort! Und wenn ich mich telefonisch bei denen melde wird nach meinem anliegen gefragt und meiner ID diese gebe ich an danach wird aufgelegt. Hat jemand eine idee was ich tun soll? Oder liegt der fehler womöglich bei mir? Könnte ja sein…

Danke schon mal im voraus

Guten tag herr krassnitzer,

Diese fehlermeldung bedeutet meistens, dass ein problem mit ihrer bank vorliegt. Gründe können ein zu geringes guthaben, einschränkungen von ihrer bank für einige zahlungsmittel oder sicherheitsbeschränkungen sein. Außerdem sollten sie, falls sie eine karte zur einzahlung nutzen, das gültigkeitsdatum dieser überprüfen und ob die karte für diese art zahlung zugelassen ist, da abbuchungen bei manchen karten nicht unterstützt wird.

Sie können sich also an die bank wenden mit angaben zum genauen zahlungsversuch.

Bzgl. Des kundenservice von skrill kann ich leider keine angaben machen, weshalb dieser so reagiert. Wahrscheinlich hilft da nur, es weiter zu versuchen.

Mit freundlichen grüßen

jana

Guten tag

ich möchten einen grösseren betrag von einem broker-konto auf mein skrill-konto überweisen. Weiss jemand, ob es bei skrill eine limite gibt? Wenn ja, wie hoch ist diese limite?

Freue mich auf ein feedback. Vielen dank.

Ja, unter umständen gibt skrill limits für einzelne nutzer aus. Die hängt von mehreren faktoren ab, unter anderem dem wohnsitzland, prüfstatus des skrill-kontos und der einzahzlungsmethode. Diese limits können sie jedoch in ihrem kontoprofil einsehen.

Mit freundlichen grüßen

jana

Warum lässt sich mein neu erstelltes konto unter kontostatus nicht schliessen oder löschen?

Hab alles schon probiert.

Hier finden sie unsere anleitung: skrill konto löschen. Falls dies nicht gelingen sollte, finden sie am ende der anleitung die kontaktdaten des kundensupports, an diesen sollten sie sich dann wenden.

Mit freundlichen grüßen

jana

Hi, leute,

wollte euch nur vor dieser drescksbude warnen. Lest euch mal meine beschwerde durch, die

ich bei recla-box veröffentlicht habe.

Da bucht einer unautorisiert geld von meiner mastercard ab und ich lauf seit über 5 wochen meinem

geld hinterher und hab es immer noch nicht. Statt dessen friert skrill das konto ein. Den englischen

ombudsmann hab ich natürlich auch gleich eingeschaltet – bis jetzt ohne erfolg.

Eine riesensauerei ist das! Bei jeder bank kann man eine lastschrift ohne probleme zurückholen lassen

und hier musste ich mir noch dummdreiste ausreden anhören. Die emails kommen mittlerweile auch

auch zurück, unter beiden email adressen karl bareuther sagt:

Wieso buchen sie von meinen konto €90.00 ab, ich habe nichts gekauft bei ihnen. Ich habe die abbuchung als beruegerische verbindung bei meiner bank zurueck gefordert.

Das waren bestimmt nicht wir von der ratgeber-plattform bezahlen.Net, sondern skrill. Wenden sie sich mit ihrer beschwerde am besten direkt an skrill:

Skrill-hotline deutschland: +49 302 2403 0293

Mit freundlichen grüßen

jana

Das ist eine frechheit

ich warte über 40 minuten am telefon

Ich habe nicht mal ein konto eingerichtet und werde belästigt

was stimmt da nicht ?

Kontakt übers tel. Unmöglich

bitte schließen sie das konto wenn vorhanden. ( ich nutze skrill nicht zu unseriös )

Wir von bezahlen.Net haben nicht direkt mit skrill zu tun. Wenden sie sich direkt an skrill bitte. Wenn es nicht übers telefon funktioniert haben wir hier noch zwei schriftliche alternativen für sie aufgeführt.

Mit freundlichen grüßen

jana

Wie teuer ist der deutsche support ?

Hallo dominik,

bei der deutschen telefonnummer handelt es sich um eine festnetznummer. Die kosten für den anruf hängen von ihrem telekommunikationsvertrag ab. Bei einer festnetzflat fallen beispielsweise keine zusätzlichen kosten an. Ansonsten wird pro minute abgerechnet, eben nach dem normalen telefontarif.

Freundliche grüße

carolin von bezahlen.Net

Wann sind die genauen anrufzeiten? Ich hab nämlich gerade dort angerufen und mir wurde gesagt, dass ich außerhalb der sprechzeiten angerufen habe?

Wann sind die genauen anrufzeiten? Ich habe nämlich gerade eben also vor 19 uhr dort angerufen und mir wurde gesagt, dass ich außerhalb der sprechzeiten angerufen habe ?

Wann sind die genauen anrufzeiten, habe gerade nämlich dort angerufen also vor 19 uhr und keiner geht dran

Wann sind die genauen anrufzeiten, ist mo bis fr 10 bis 19 uhr noch aktuell?

Vorsicht ! Diese firma betrügt mit irreführender werbung. Kleine geldbeträge können nicht nach südafrika überwiesen werden, weil die gebühren das nötige limit auffressen, das hier willkürlich gesetzt wird, um überhaupt eine überweisung zu tätigen. Erst wenn man auf skrill eingezahlt hat, bekommt man mit, dass es nicht funktioniert. Dann ist das geld bei skrill und kann erst ausgelöst werden, wenn man noch mehr geld einzahlt. Das ist nötigung, wenn nicht sogar raub. +49 302 2403 0293 ruft man diese nummer an, landet man bei einem herrn gregori mit russischem akzent. Wenn man sich beschwert, landet man wieder bei ihm. Dieser britischen firma sollte man mit dem brexit in europa das handwerk legen. Sie hat unlautere geschäftsbedingungen und verhält sich nicht kulant zu ihren kunden. Skrill ist eine marke von paysafe, https://www.Paysafe.Com/paysafegroup/contact/ authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

CVC und blackstone sind die eigentümer. Zu geizig mir 518 ZAR zu erstatten

Vielen dank für das teilen ihrer erfahrung mit skrill.

Freundliche grüße

carolin von bezahlen.Net

Bitte beachten sie, dass dies keine rechtsberatung darstellt und lediglich ergebnis unserer eigenen recherche ist. Wenden sie sich für eine rechtsauskunft an einen fachspezialisten.

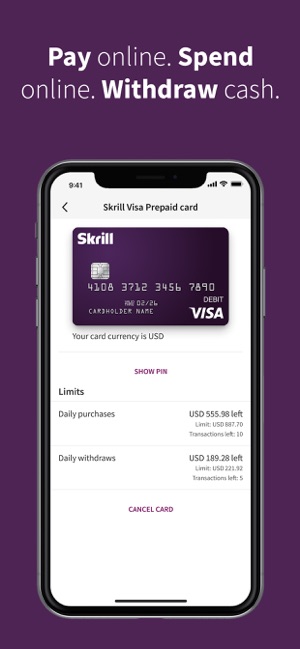

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Skrill frequently asked questions

1. What is skrill?

Skrill enables customers with a valid email address to securely and cost-effectively send and receive payments online in real time.You can use skrill to:

- Send money via email from your credit card or bank account.

- Make online purchases.

- Collect money via email.

2. How do I fund my account using skrill?

Yes, you can use your existing skrill account with us. To deposit using an existing skrill account, please follow the steps below:

- Log in to your account.

- Go to the 'cashier' tab and select 'deposit'.

- You will now see the skrill logo. To select this deposit option simply click on the icon.

- Enter or select your deposit amount and bonus code (if applicable), then click on 'deposit'.Note: this amount should be less than or equal to the amount in your skrill account.

- You will be directed to the skrill website where you are required to enter your skrill email address and password to log in.

- Complete the transaction on the skrill website.

- On the next screen you will receive an 'order approved' message. Click on 'OK', you will be transferred back to the cashier and will see a successful deposit message.

3. What currencies can I make a deposit with when using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD, ZAR only.

4. How can I load my skrill?

You can load your skrill account by using your credit/debit card, making an online bank transfer, direct banking or via cheque.

Note:you will not be able to transfer the funds from skrill.Com to your account if you have funded them using master card.

5. Is it safe to use skrill?

Yes, skrill is totally secure. Through a combination of transaction monitoring, SMS transaction verification for cardholders and a dedicated anti-fraud team, skrill is an entirely safe online payment method.

6. Can I withdraw to my skrill account?

Yes, to withdraw using skrill you need to have made a successful deposit with your skrill account within the last six months.If you have made a successful deposit within the last six months, visit the cashier, select the 'withdrawal' tab and then select the skrill logo.The amount of your withdrawal will be sent electronically to your skrill account after our internal procedure has been completed.

7. What currencies can I withdraw in using skrill?

Skrill transacts in AUD, CAD, CHF, DKK, EUR, GBP, HUF, NOK, PLN, RON, SEK, USD, ZAR only.

8. Can I withdraw more than my initial deposit using skrill?

Yes. However, please remember that all withdrawals are first approved by our internal review team. This process usually takes approximately up to three business days.

Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your bank account.

9. What is the average processing time for skrill withdrawals?

All withdrawals are first approved by our internal review team, which takes approximately up to three business days. Once we have processed your withdrawal, it will take 24 hours for the funds to appear in your bank account.

10. Can I withdraw the same day I deposit through skrill?

11. Can I withdraw to skrill if I deposited using a different payment method?

Yes, to withdraw using skrill you need to have made a successful deposit with your skrill account within the last six months.If you have made a successful deposit within the last six months, visit the cashier, select the 'withdrawal' tab and then select the skrill logo.The amount of your withdrawal will be sent electronically to your skrill account after our internal procedure has been completed.

12. Are there any transaction fees associated with skrill withdrawals?

There are no transaction fees associated with skrill withdrawals.

13. What is the minimum and maximum amount I can withdraw using skrill?

The minimum withdrawal amount that you can withdraw via skrill is 10.00 USD equivalent and the maximum withdrawal amount is 10000.00 USD equivalent.

Skrill verification

On initial opening of your skrill account we would highly recommend you to verify your skrill account immediately. Whilst you can still use the skrill money transfer service with full functionality, your ewallet transaction and deposit limits will not be completely removed until the skrill verification requirements, have been met.

Additionally, if you are transferring funds to meet the next threshold of a VIP membership level you will not face any interruptions to the flow of funds to and from your skrill account if you are a verified member.

In order to take advantage of our exclusive bronze VIP upgrade you will to verify your skrill account.

Please note if you already have a verified neteller account, your skrill account should be automatically verified when you sign-up, regardless of whether you are an ewalletbooster customer or not as both companies are operated by the same parent company paysafe group ltd so they already have your details on record.

How to verify my skrill account?

Please follow the easy steps below to verify your skrill account.

The skrill verification process is easy and fast. All you need to complete the process is either a well- established and verifiable facebook account for facebook verification or have valid photo ID and address documents ready before you begin the process.

One you are logged in to your skrill account you will be alerted to the fact that you need to verify your account by a message at the top of the screen.

Skrill identity verification

To verify your identity, you can upload either your passport, driving licence or identity card. The images you upload must be clear and show all 4 corners of the document.

Skrill address verification

To verify your address, you will need to provide proof of address which can be a bank statement, utility bill or another official document. The date of issue on the statement must not be older than 90 days. Once again, the images you upload must be clear and show all 4 corners of the document.

Skrill application form

Join skrill using the application form below or submit your existing skrill details to receive a FREE bronze VIP upgrade on your skrill account and take advantage of lower fees, increased limits and much more. New & existing skrill customers welcome.

NETELLER vs skrill: introduction

This is the most detailed and reliable NETELLER vs skrill comparison for personal accounts available on the net.

The “NETELLER vs skrill conclusion” covers the most important fees, VIP benefits and company comparison for skrill and NETELLER. All figures and data are updated whenever changes are required. NETELLER and skrill help us to compare the data to make it as detailed and correct as possible.

Nevertheless, please note no responsibility can be taken for the correctness of the details provided.

Please note that this is the general NETELLER vs skrill comparison.

Customers registering with us benefit of special bonuses, free VIP upgrades, higher NETELLER limits and much more.

Please contact us if you spot any missing or outdated info on this page.

NETELLER vs skrill: VIP programs

Skrill (moneybookers) as well as NETELLER offer special premium memberships with different VIP levels.

While at NETELLER the requirements are on a yearly basis, customers at skrill need to reach the required amount of transfers within a quarter of a year to reach and maintain the status for the next quarter.

Here is an overview of the required volumes of transactions made to merchants:

NETELLER vs skrill: fee comparison

UPDATE 22/07/2019 – skrill 15 USD sign-up bonus has been stopped until further notice.

Skrill

Accounts created between 4 april 2019 and 22 july 2019 (included)

Please keep in mind, like for NETELLER, this fee counts only for the first money transfer and only for accounts created after the 3rd april 2019 without making any deposit first (excluded deposit payment methods are NETELLER, paysafecard or bitpay). As soon as you make a deposit you will have the standard fee of 1.45% (min. 0.50 EUR) for your first money transfer.

A bangladeshi customer who makes his first transaction without depositing first sends 500 EUR from his skrill account (non-VIP) to another skrill account and will have to pay 27,50 euro in fees.

BUT: if this client makes a deposit to his skrill account first, then the fee will be reduced to 1.45% automatically and he only needs to pay 7.25 EUR fee.

* bangladesh is excluded from this and will not have free money transfer with silver VIP status.

NETELLER

Only accounts from a few certain countries created on or after 23rd july without a silver VIP or higher will have an increased fee. The following tables shows you which countries are affected and what the exact fees would be then:

Again, please keep in mind, this fee counts only for the first money transfer and only for accounts created on/after the 23rd july 2019 without making any deposit first (excluded upload options are NETELLER, paysafecard, bitpay). As soon as you make a deposit you will have he standard fee of 1.45% (min. 0.50 USD) for your first money transfer.

** uploads via all deposit options are for free if deposited amount is more than 20.000 $/€.

NETELLER vs skrill: mastercard comparison

NETELLER vs skrill: cashback & security comparison

NETELLER vs skrill – development

NETELLER was founded in 1996 and is owned and operated by optimal payments PLC (now paysafe group). Optimal payments PLC has been publicly traded on the london stock exchange since its initial public offering in 2004 and their stocks raise over last years consistently.

Skrill was founded in 2001 under the name “moneybookers”, took over paysafecard in february 2013 and was re-branded to “skrill” in march 2013. In august, corporate venture capital (CVC) announced the acquisition of skrill for 800 million USD.

The last half of 2012 NETELLER achieved a 21% increase in new member sign-ups. Skrill (moneybookers) was able to double their memberships to more than 35 million as well as their overall transfers to 55 billion EUR within last 2 years.

Both providers are aiming for the US market where NETELLER has been more popular before they pulled out in 2007. Both already got their license for new jersey and are investing many resources to get their licenses for more states very soon.

NETELLER vs skrill – benefits

In most parts skrill (moneybookers) and NETELLER are pretty much equal when it comes to their VIP membership. But there are still some differences, that should be considered before signing up. With recent fee changes, there is even less differences between the two companies. It can be expected that this trend continues and that the product will be mostly the same.

Pro NETELLER

- Currency exchange fees:

since skrill raised their skrill currency exchange fees in late 2013, NETELLER fees are now the clear winner in this part of the comparison with 1,29% to 3.99% FX fees depending on customers VIP status.

Skrill now differs currency exchanges in the following three categories depending on the customers NETELLER VIP status. - Support for NON-vips:

while skrill’s non-VIP support may take one to even two weeks to answer, NETELLER support handles their customers requests much faster and better. Trustpilot’s ratings of 2.5/10 for NETELLER and 4.6/10 for skrill seem to indicate a different result, but from our longtime experience NETELLER support is actually better. Also please note that this rating is based on normal customers review. The customer satisfaction for VIP customers is highly better for both providers, especially for those benefiting of the additional support by ewallet-optimizer.Com. - Cashback for high turnover customers:

for those planning to use their ewallet heavily and are interested in earning decent cashback every month, we suggest using NETELLER where ewallet-optimizer clients earn a monthly extra NETELLER cashback of up to 1.1% on all qualifying transfers.

Pro skrill

- Fees:

the most important fees like depositing and withdrawal fees, are lower at skrill (moneybookers) compared to NETELLER, with the exception of the currency exchange fees. - Promotions & cashback for smaller turnover:

skrill ran several cashback promotions up to 1.5% cashback for outgoing transfers until 2013, but stopped doing so in 2014. They also stopped the skrill loyalty club for their VIP customers in 2016 and currently there is no cashback paid directly from skrill.

For clients of ewallet-optimizer, skrill offers 1% cashback for 30days to become skrill VIP faster and clients also receive a monthly skrill cashback paid in addition for all their qualified transfers, leaving skrill as good option for those customers using their ewallet for smaller transfers.

Get additional bonuses & support for free

No matter if you decide to go with skrill or NETELLER, make sure to register with ewallet-optimizer to enjoy additional bonuses and better support.

If you have any questions about the NETELLER or skrill ewo bonus program and their benefits, please do not hesitate to contact us . We are here to help you.

NETELLER & ewo

Skrill & ewo

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Giropay by skrill frequently asked questions

1. What is giropay by skrill?

Giropay by skrill is an on-line banking facility in germany. It is a quick, secure and simple solution to process payments on the internet.

2. Which banks will allow me to deposit via giropay by skrill?

Please click here for a complete list.

3. I don't have a bank account with these banks?

Unfortunately, you can only use giropay by skrill with the banks specified above. Giropay is negotiating with other banks and more will be added here in the future.

4. Do I need to set up any account with giropay by skrill to deposit?

No, you only need to have a bank account with one of participating banks in question two (and funds in that bank account, of course!).

5. How do I fund my account using giropay by skrill?

- Log in to your account.

- Go to the 'cashier' tab and select 'deposit'.

- You will now see the giropay by skrill logo. To select this deposit option simply click on the icon.

- Enter or select your deposit amount and bonus code (if applicable), then click on 'deposit'.

- You will now be redirected to skrill. Enter your IBAN, swift code, first & last name and email address to proceed.

- You will be redirected to your bank website. Enter your online banking login details.

- Confirm the amount requested to be deposited to your account.

- You will receive an instant confirmation and you will be redirected back to the cashier.

6. In which currency is my giropay by skrill account debited?

Your giropay by skrill account will be debited in EUR.

7. Are there any fees associated with giropay by skrill?

We do not charge a fee for giropay by skrill deposits. Giropay by skrill may charge you a fee based on their fee structure. Please refer to http://www.Giropay.De/ for more details.

8. How long does it take to receive the money transferred into my account?

The money will be transferred to your account instantly.

9. Can I withdraw to giropay by skrill?

Giropay by skrill is currently only available as a deposit option.

10. Is it safe to use giropay by skrill?

With giropay by skrill, you can make totally secure online banking transactions. All your transactions and sensitive data are protected by the latest and most sophisticated security systems available.

Что можно сказать в заключение: skrill frequently asked questions 1. What is skrill? Skrill enables customers with a valid email address to securely and cost-effectively send and receive payments online in real time.You can по вопросу help skrill

Комментариев нет:

Отправить комментарий