Neteller vs skrill

The neteller e-wallet has also decided to partner with mastercard for their plastic card solution, and understandably so, considering the widespread use and availability of the card for payment purposes. After all, the net+ prepaid mastercard is initially provided for greater freedom of using the funds stored in respective neteller accounts. All you have to do to get it is apply, pay the one-off 10 USD fee and wait 2 to 10 business days. Skrill has a prepaid mastercard plastic card, which is issued on demand and delivered to your designated address between 5 and 10 business days, completely free of charge. Additional services, such as payment processing directly via card, online bank statement requests or PIN renewals are also free.

Skrill vs neteller – which is the best E-wallet?

The leading providers of these e-wallets are neteller and skrill so this article is going to focus on comparing the key features of these so that you are able to make the best decision for your needs.

Why do you need an e-wallet?

With so many roulette sites appearing online it has become essential to find a secure, reliable and easy to use method of depositing funds and withdrawing your winnings. The answer to this is the e-wallet.

E-wallets are a digital wallet, storing your money so that you are able to make online transactions without having to input your card details each time. As a result, these e-wallets allow for safer and more simple transactions.

- Open a neteller account here.

- Open a skrill account here.

Security

Still, security is more than just an external authority, and these two companies know it. As a result, their customers are able to make use of additional safety precaution measures, putting most of the power back into the hands of account holders alike. With skrill, you get the standard package – a dual verification login option, with a one-time-use code sent to users via the app.

As for neteller account holders, the dual-verification login is optional, as they can additionally choose to activate secure ID. This is a separate login method, with users being provided a unique 6-digit code that needs to be input each time they are asked to confirm their identity (account access, transactions).

Top 4 neteller/skrill online casinos

- Sign up and you are entitled to up to £1,500 in bonus

- Try out more than 550 high-quality casino games

- State-of-the-art gaming software and smooth gameplay

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus

- Try out more than 500 high-quality casino games

- Elegant, clean and well-organized website

- 24/7 multilingual live support via chat, e-mail, phone

- You are entitled to up to 20 additional free spins

- Try out more than 500 high-quality casino games

- Enjoy great in-game progress system with great prizes

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus credits

- Try out more than 500 high-quality casino games

- 24/7 multilingual live support via live chat, e-mail and phone

Website ease of use and support

Both skrill and neteller have simple and well-designed websites that explain all that you need to know about each provider, including a break down of fees, offers and rewards, as well as easy access to creating an account and logging in. Personally, I find the neteller site slightly more accessible, particularly when it comes to gaining support, with a ‘support’ option clearly placed on their homepage which leads to a range of support options including popular topics, frequently asked questions, email and the option to call for support with regional numbers in 18 different countries.

However, skrill also has an extensive list of frequently asked questions and, again, you can email or call with the option of only 8 regional lines. Having read reviews related to customer support, it appears that neteller also has the edge when it comes to responding to customer queries, with skrill often taking a longer time to get back to their customers.

Depositing money

To use your e-wallet you must first upload money to it. For both neteller and skrill, this is easily done through their website, once you have created an account. There are many different options for both providers, including bank wire, e-cheque, credit card, debit card or prepaid card. These options have different funds associated with them that vary between neteller and skrill.

Skrill

When it comes to depositing money, skrill has many free options, such as, bank transfer from all countries, maesto debit card and, as a global payment method, swift. There is a fixed rate for depositing via credit card of 1.90% and fees for depositing never exceed 5.5% (for deposits made via a paysafecard).

Bear in mind that you may additionally incur charges due to currencies – skrill users have 40+ currency options to choose from. Do it carefully, accounting for the currency you will use the most for your online transactions, in order to avoid the exchange fee at a flat 3.99%. A convenient circumstance in this regard is the fact that account holders can choose up to 4 currencies per account. All you have to do is make sure to keep it somewhat active – an account maintenance fee of 1 EUR per month is charged after 12 months of inactivity.

On a final note, it’s good to know you can input value into your skrill account using bitcoins. More precisely, account holders can buy and sell several cryptocurrencies – BTC, ETH, LTC and BCH among others. Purchases and sales using EUR and USD fiat currencies are set at 1.50%, while for all others – 3.00%, while P2P transfers come at a flat charge of 0.50% for all account holders.

Neteller

Compared to skrill, neteller have more deposit options but, while they also have free options, such as bank transfer, trustly and moneta.Ru, other methods of deposit incur fees set at 2.55%! Generally, the cost of depositing is greater when using neteller than skrill.

On another note, neteller users still get to choose 4 currencies for their account transfers, but only out of a selection of 22 options. Yet, it is important to mention that these account holders are also given the opportunity to hold cryptocurrencies in their e-wallet. Regular, fiat currencies come at a charge of 3.99% for exchange purposes, while crypto tokens are available for buying and selling at a 1.50% charge, when done with EUR or USD, or a 3.00% charge, when done with any other currency.

Finally, don’t forget about inactivity fees – they are the service’s way of protecting their network from being overburdened with abandoned accounts. Anyone leaving their account unmanned for over 14 months will see themselves charged a 5 USD monthly maintenance fee.

Depositing money to casinos

Depositing to casinos from both neteller and skrill is free. Around 80% of online casinos accept payment from skrill and the same can be said for neteller, with the vast majority of major online casinos accepting these methods, including those which you can find here.

Withdrawing money from these third-party sites is also free of charge for both e-wallet providers. To withdraw money from your online casino account, all you have to do is select your e-wallet provider as your withdrawal method and enter the amount you wish to withdraw. While neteller and skrill do not charge for these transactions, the online casinos may, so it is worth checking before depositing your money.

Withdrawing from your e-wallet

Again, withdrawing money from both providers is simple.

Skrill

Depending on your country of residence, you can withdraw money through bank transfer, credit cards, debit cards and a skrill card. For bank withdrawals, this takes 2-5 business days and charges users 3.95 EUR per transaction to your bank account. Credit and debit card withdrawals, as well as other methods of sending money from skrill to a different account, are subject to fees ranging between 1.45% and 5.50%. Swift withdrawals are set at a flat price of 4.76 GBP, that is 5.50 EUR. The quickest and cheapest method of withdrawing funds is the skrill card, enabling you to make withdrawals at an ATM instantly at a cost of just 1.75% of the withdrawn amount.

Neteller

Neteller offers the same withdrawal methods as skrill but also allow withdrawals to be made via a cheque. For bank transfer, the cost using neteller is a flat fee of 10 USD and takes 3-5 working days. A member wire withdrawal, on the other hand, charges users 12.75 USD per transfer. What is more, money transfers also charge users for withdrawal purposes, at a rate ranging between 1.45% and 5.50%, with a minimum amount threshold set at 0.50 USD. Having this in mind, it is safe to say that neteller’s charges are higher than skrill’s. However, neteller also has an option to use merchant sites and their net+ prepaid master card for instant and free withdrawals.

Physical card availability

Both these e-wallets have provided account holders with an additional way to access their account funds – plastic cards issued by mastercard. This significantly increases funds accessibility, especially when it comes to withdrawals or making use of the stored funds as straightforwardly as possible.

Skrill

Nevertheless, users can feel inconvenienced differently. After all, the card is solely available in a couple of currencies – USD, EUR, GBP and PLN, which is rather limiting. Speaking of limits, it also comes with caps on the daily and monthly amounts you can spend using it at poss or atms. The former is usually set at 1,000 EUR per day, with the occasional deviations for specific merchants (3,000 to 5,000 EUR a day). As for the latter, ATM transactions, regular limits are set at 250 EUR, although some users can get permission to withdraw up to 5,000 EUR a day with their mastercard.

Neteller

In terms of fees, cardholders are advised to simply be wary of the standard 3.99% currency conversion fee. Additionally, bear in mind that you can link up to 5 net+ virtual prepaid mastercard accounts to a single plastic card free of charge, and any more virtual accounts at a single charge of 3 USD/ 2.5 EUR/ 2 GBP per one.

User benefits

Anyone dedicating their online finance management to an e-wallet service such as skrill or neteller is right to expect a bang for their buck. More specifically, both services offer VIP loyalty programs – check the terms out and discover all the benefits of sticking with one of these e-wallets, or the other.

Skrill

The VIP loyalty program for skrill account holders ranks the registered individuals based on the funds traffic in your account you have handled over the course of a single yearly quarter. In this regard, the program consists of four tiers – bronze, silver, gold and diamond, for which you would have to pass the minimum €6,000, €15,000, €45,000 and €90,000 threshold, respectively.

Despite seeming like too much of an investment for a small payout, users that actually manage to reach any of these limits and qualify for the next level of the tiered program have claimed otherwise. With low to non-existing fees for currency exchange, deposits and withdrawals, as well as various dedicated services, skrill users are definitely getting the benefits they have earned.

Neteller

Neteller account holders are more or less alike – testimonials actually claim that you don’t need to get very high to start feeling the difference. In fact, considering that the neteller VIP loyalty program distinguishes five tiers instead of the previous four, users are bound to note a change from nothing to bronze, and even more, as they go through silver, gold and platinum, all the way to diamond.

The thresholds of funds traffic you would need to meet annually in order to climb up this ladder are set at $10,000 for bronze, $50,000 for silver, $100,000 for gold, $500,000 – platinum, and all the way to $2,000,000 for diamond-level benefits.

In conclusion…

This article was designed to compare two of the most popular e-wallets used by online gamblers. Ultimately they are both very secure, efficient and great at what they do. For me, neteller has a slight edge, but it does depend on what you’re looking for in an e-wallet provider. I hope this article has been useful in helping you decide. As always, feel free to leave a comment below if you have any questions or feedback, and stay tuned for more articles!

Neteller vs skrill

| Availability | 202 countries | 201 countries |

| currencies | 26 different currencies | 40 different currencies |

| deposit options: | 40+ deposit options Manual bank transfer ( free ) Neteller also accepts bitcoin (fee 5 %), astropay (5-7 %), banamex (7 %), bancomer (7%), effecty (5,5 %), ewire (1,5 %), trustly (free) and many other deposit methods. | 10+ deposit options Manual bank transfer ( free ) Skrill also accepts sofort überweisung (1,5 %), swift (free) and paysafecard (5,5 %) |

| withdrawing options: | bank draft (7,5 EUR) Merchant sites (free) Money transfer (free) | all bank withdraws (2,95 EUR) Skrill prepaid mastercard (1,8 EUR) |

| money transfer/P2P transactions | 1,45 % (min 0,5 EUR) | 1,45 % (min 0,5 EUR) |

| receive funds via P2P transactions | free | free |

| paying at a shop or transferring funds with any merchant | free | free |

| currency conversion | 2,95 % (down to 1,25 % for VIP members) | 2,99 – 4,99 % |

| join neteller HERE | join skrill HERE |

About us

NETELLER and skrill are two leading ewallet providers on the market. We have gathered information about them on one page to make the choice between them easier.

NETELLER vs skrill

NETELLER vs skrill: einleitung

Bei diesem vergleich handelt es sich um ein allgemeinen vergleich von NETELLER vs skrill. Kunden die sich über uns registrieren, erhalten andere konditionen und weitere vorteile, wie boni und niedrigere gebühren.

Letztes update: september, 2017.

NETELLER vs skrill: VIP programme

Skrill (moneybookers), sowie NETELLER, bieten ihren kunden spezielle premium mitgliedschaften, mit verschiedenen VIP leveln an.

Während NETELLER die bedingungen für ihre VIP level auf jahresbasis berechnet, werden sie bei skrill auf vierteljährlicher basis berechnet.

Im folgenden seht ihre eine übersicht über das benötigte umsatzvolumen für die verschiedenen VIP stufen, jeweils umgerechnet auf den benötigten umsatz pro monat

| NETELLER VIP (original/jahresbetrag) | skrill VIP | |

|---|---|---|

| bedingungen um ein VIP level zu erreichen & zu halten | auf jahres basis | vierteljährlich |

| bronze VIP | 800 EUR/monat (10,000 USD/jahr) | 2,000 EUR |

| silber VIP | 3,800 EUR/monat (50,000 USD/jahr) | 5,000 EUR |

| gold VIP | 8,400 EUR/monat (100,000 USD/jahr) | 15,000 EUR |

| platin VIP | 38,000 EUR/monat (500,000 USD/jahr) | n/a |

| diamant VIP | 155,000 EUR/monat (2,000,000 USD/jahr) | 30,000 EUR |

NETELLER vs skrill: vergleich der gebühren

| NETELLER (VIP) | skrill (VIP) | |

|---|---|---|

| spezieller VIP status in (klammern) | (bronze; silber; gold; platin; diamant) sofortiger silber VIP durch ewallet-optimizer | (bronze; silber; gold; diamant) |

| erlaubt konten pro kunde | 1 konto (1;2;2;2;2 zusätzliche währungskonten) | 1 konto (1;2;3;4 zusätzliche währungskonten) |

| verfügbare kontenwährungen | 22 | 41 |

| willkommensbonus | n/a | 15 USD willkommensbonus |

| kontoführungsgebühr | kostenlos | kostenlos |

| gebühren für inaktivität | nach 14 monaten inaktivität: 1.80 EUR/monat | nach 12 monaten inaktivität: 1 EUR/monat |

| wechselgebühr (FX) | 3,99% (3.79%; 3,19%; 2,79%; 2,39%; 1.29%) | 3.99% (3.79%; 2.89%; 2.59%; 1.99%) |

| geld erhalten | kostenlos | kostenlos |

| geld an privates skrill konto senden (p2p) | 1.9% bis zu 20 USD (1% max 10 USD bronze und kostenlos für silber, gold, platin und diamant vips). | 1.9%, max 20 EUR (1%, max 10 EUR für bronze; kostenlos für alle anderen VIP stufen) |

| einzahlungsgebühr | ||

| – banküberweisung | kostenlos | kostenlos |

| – SOFORT überweisung | 1.50% | kostenlos |

| – kreditkarte | 1.75 – 4.95% | 1.90% (1.25%; kostenlos; kostenlos; kostenlos) |

| auszahlungsgebühr | ||

| – banküberweisung | 7.50 EUR (kostenlos) | 3.95 EUR (3.95; kostenlos; kostenlos; kostenlos) |

| – scheck | 7.50 EUR | 3.50 EUR |

| – prepaid karte am geldautomaten | 1.75% (1.75%; 1.75%; kostenlos; kostenlos;kostenlos) | 1.75% (1.80 EUR; kostenlos; kostenlos; kostenlos) |

| – an skrill händler | kostenlos | kostenlos |

| prepaid karte |  net+ prepaid mastercard |  skrill prepaid mastercard |

| – gebühren für bestellung & jahresgebühr | 10 EUR (10; kostenlos; kostenlos; kostenlos; kostenlos) | 10 EUR (kostenlos) |

| – zahlungen in geschäften (POS) | kostenlos | kostenlos |

| – kontostand abfragen | kostenlos | kostenlos |

| – online kontoauszug | kostenlos | kostenlos |

| – neuer pin | 15 EUR | kostenlos |

| – neue prepaid karte | 10 EUR | 10 EUR (kostenlos) |

| – tageslimit für abhebung am automaten | 750 EUR (750; 750; 2,500; 2,500; 2,500) | 900 EUR (900;1,500; 3,000; 5,000) |

| – tageslimit für zahlungen in geschäften/online | 2,250 EUR | 2,700 EUR (3,000; 3,000; 5,000; 10,000) |

| – lieferzeit | 5-10 werktage | 5-10 werktage |

| – verfügbare währungen | EUR, USD, GBP, CAD, SEK, DKK, AUD, JPY | EUR, USD, GBP, PLN |

| – gültigkeit | 3 jahre | 3 jahre |

| – virtuelle mastercard | kostenlos NETELLER net+ virtual prepaid mastercard | n/a |

| cashback & promotions | keine (0; 0; 0; 0.25%; 0.5%) | keine |

| – promotions | keine (verlosungen mit kleineren preisen) | skrill VIP werden und bis zu 100 EUR bonus erhalten |

| bis zu 1% durch ewallet-optimizer | 0.3% durch ewallet-optimizer | |

| zwei-faktor-authentifizierung | zwei-faktor-authentifizierung | + zwei-faktor-authentifizierung |

| – preis | kostenlose app | kostenlose app |

| – lieferzeit | sofort nach installtionen der app verfügbar | sofort nach installtionen der app verfügbar |

| – geld-zurück-garantie im falle von missbrauch | für alle NETELLER kunden | für alle skrill kunden, die die 2-step-authentication/token verwenden |

| link zu den allgemeinen geschäftsbedingungen | NETELLER geschäftsbedingungen | skrill geschäftsbedingungen |

Beide ewallet anbieter sind bei der financial services authority (FSA) in england reguliert.

Anders als bei paypal handelt es sich bei den beiden jedoch nicht um eine bank und sie verleihen kein geld an ihre kunden. NETELLER erlaubt mittlerweile die einzahlung von bitcoins. Während skrill (moneybookers) bei händlern wie ebay, skype und facebook durch die SOFORT überweisung zur verfügung steht, kann man NETELLER nur mit der standard mastercard zahlungsoption nutzen.

Besonders für ihr VIP kunden haben beide anbieter ihren support stark verbessert. Während NETELLER ihren nicht-VIP kunden noch in einem vernünftigen zeitraum antwortet, kann es bei skrill schon mal eine woche oder länger dauern.

NETELLER vs skrill: entwicklung

NETELLER wurde 1996 gegründet und gehört der optimal payments PLC. (jetzt paysafe group) seit ihrem börsengang 2004, wird die optimal payments PLC öffentlich an der londoner börse gehandelt und konnte einen konstanten wachstum verzeichnen.

Skrill wurde 2001 unter dem namen “moneybookers” gegründet. Im februar 2013 übernahmen sie paysafecard, bevor sie sich 2013 zu “skrill” umfirmierten. Kurz darauf, im august 2013, kündigte die corporate venture capital (CVC) die übernahme von skrill für 800 millionen USD an.

In der zweiten jahreshälfte 2012 erreichte NETELLER einen wachstum von 21% im bereich neukunden. Skrill (moneybookes) konnte die anzahl seiner kunden, auf mehr als 35 millionen, verdoppeln. Ebenso konnten sie ihr gesamtes transfervolumen auf 55 millionen EUR innerhalb der letzten 2 jahre steigern.

Beide anbieter arbeiten bereits an einem wiedereinstieg in den US markt, wo NETELLER, vor seinem rückzug 2007, die nase leicht vorne hatte. Eine lizenz für new jersey haben beide firmen schon und an weiteren staaten wird bereits gearbeitet.

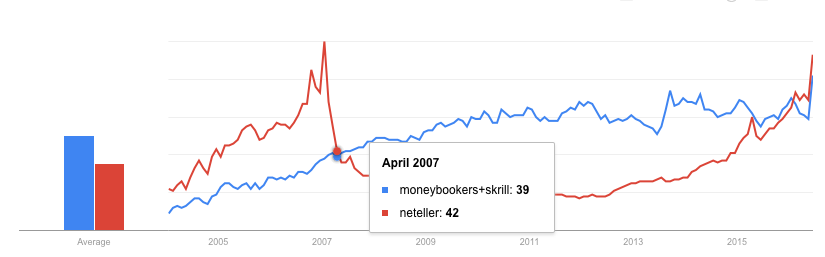

Google trends gibt euch einen überblick, über die entwicklung und popularität beider anbieter innerhalb der letzten zehn jahre:

Google trends vergleich von “skrill + moneybookers” vs “NETELLER”

Anfang 2015 wurde der zusammenschluss beider unternehmen bekanntgegeben. Seitdem ist auch ein direkter transfer zwischen beiden ewallets möglich. Skrill und NETELLER stehen nun als einzahlungsmethode, für eine geringe gebühr von 1.9%, in den entsprechenden konten zur verfügung.

NETELLER vs skrill: fazit

In vielen bereichen, besonders im aufbau ihrer VIP systeme, sind sich NETELLER und skrill sehr ähnlich. Besonders für nicht-vips gibt es allerdings einige unterschiede, die man beobachten sollte. Durch eine kürzliche anpassung verschiedener gebühren, wurden die unterschiede einmal mehr verringert und es ist davon auszugehen, dass sich dieser trend auch fortsetzt.

- Gebühren:

die wichtigsten gebühren, wie einzahlungs- und auszahlungsgebühren, sind besonders für nicht-VIP kunden bei skrill deutlich niedriger, als bei NETELLER. Einzige ausnahme sind die wechselgebühren. - Promotions & cashback bei niedrigem transfervolumen:

bis 2014 gab es bei skrill sehr regelmäßig spezielle cashback promotions, bei denen man bis zu 1.5% zusätzlich verdienen konnte. Diese wurden mittlerweile eingestellt. Unregelmäßig gibt es aber noch verschiedene promotions, über die alle kunden per mail informiert und eingeladen werden.

Ewallet-optimizer kunden können zusätzlich noch einen $15 willkommensbonus und 1% cashback für 30 tage (bis zu 100 EUR) bekommen. Ebenso bieten wir unseren kunden niedrige transferbedinungen für den bronze und silber VIP status an, und unseren monatlichen bonus. Das alles macht skrill, besonders für kunden mit geringerem transfervolumen, zu einer guten wahl bei der suche nach einem passenden ewallet anbieter.

Pro NETELLER:

- Mastercard für NICHT-vips:

die normalen NETELLER mastercard limits sind weitaus höher, als die von nicht-skrill-vips. Die gebühr für abhebungen am geldautomaten wurde mitterlweile angepasst und ist mit 1.75% für beide anbieter identisch. (kostenlos ist es weiterhin für gold vips und höher bei NETELLER; für silber vips und höher bei skrill). - Wechselgebühr:

seitdem skrill 2013 die wechselgebühr angehoben hat, ist NETELLER der klare gewinner im direkten vergleich (1,00-3,39% wechselgebühr – abhängig vom VIP status). - Support für NICHT-vips:

während skrill im schnitt ein bis zwei wochen für eine antwort an nicht-vips benötigt, ist die bearbeitungszeit bei NETELLER deutlich geringer. Auch wenn das trustpilot rating mit 2.5/10 für NETELLER und 4.6/10 für skrill auf das gegenteil schließen lässt, zeigt unsere langjährige erfahrung, dass NETELLER den besseren support bietet.

VIP kunden, und besonders kunden unsere ewo bonus programms, wird bei beiden anbietern deutlich schneller geholfen. - Cashback bei hohem transfervolumen:

sollte ihr euer ewallet sehr intensiv und mit hohem transfervolumen nutzen wollen, ist NETELLER die beste wahl für euch. In verbindung mit unserem monatlichen bonus, könnt ihr monatlich bis zu 1.1% extra cashback verdienen.

Sicher euch zusätzliche boni & kostenlosen support

Ganz egal für welchen anbieter ihr euch entscheidet, nutzt unser ewallet-optimizer bonus programm, um von allen vorteile und zusätzliche bonis in vollem umfang profitieren zu können.

Bei weiteren fragen zum NETELLER oder skrill ewo bonus programm, zögert bitte nicht uns jederzeit zu kontaktieren .

NETELLER vs skrill: introduction

This is the most detailed and reliable NETELLER vs skrill comparison for personal accounts available on the net.

The “NETELLER vs skrill conclusion” covers the most important fees, VIP benefits and company comparison for skrill and NETELLER. All figures and data are updated whenever changes are required. NETELLER and skrill help us to compare the data to make it as detailed and correct as possible.

Nevertheless, please note no responsibility can be taken for the correctness of the details provided.

Please note that this is the general NETELLER vs skrill comparison.

Customers registering with us benefit of special bonuses, free VIP upgrades, higher NETELLER limits and much more.

Please contact us if you spot any missing or outdated info on this page.

NETELLER vs skrill: VIP programs

Skrill (moneybookers) as well as NETELLER offer special premium memberships with different VIP levels.

While at NETELLER the requirements are on a yearly basis, customers at skrill need to reach the required amount of transfers within a quarter of a year to reach and maintain the status for the next quarter.

Here is an overview of the required volumes of transactions made to merchants:

NETELLER vs skrill: fee comparison

UPDATE 22/07/2019 – skrill 15 USD sign-up bonus has been stopped until further notice.

Skrill

Accounts created between 4 april 2019 and 22 july 2019 (included)

Please keep in mind, like for NETELLER, this fee counts only for the first money transfer and only for accounts created after the 3rd april 2019 without making any deposit first (excluded deposit payment methods are NETELLER, paysafecard or bitpay). As soon as you make a deposit you will have the standard fee of 1.45% (min. 0.50 EUR) for your first money transfer.

A bangladeshi customer who makes his first transaction without depositing first sends 500 EUR from his skrill account (non-VIP) to another skrill account and will have to pay 27,50 euro in fees.

BUT: if this client makes a deposit to his skrill account first, then the fee will be reduced to 1.45% automatically and he only needs to pay 7.25 EUR fee.

* bangladesh is excluded from this and will not have free money transfer with silver VIP status.

NETELLER

Only accounts from a few certain countries created on or after 23rd july without a silver VIP or higher will have an increased fee. The following tables shows you which countries are affected and what the exact fees would be then:

Again, please keep in mind, this fee counts only for the first money transfer and only for accounts created on/after the 23rd july 2019 without making any deposit first (excluded upload options are NETELLER, paysafecard, bitpay). As soon as you make a deposit you will have he standard fee of 1.45% (min. 0.50 USD) for your first money transfer.

** uploads via all deposit options are for free if deposited amount is more than 20.000 $/€.

NETELLER vs skrill: mastercard comparison

NETELLER vs skrill: cashback & security comparison

NETELLER vs skrill – development

NETELLER was founded in 1996 and is owned and operated by optimal payments PLC (now paysafe group). Optimal payments PLC has been publicly traded on the london stock exchange since its initial public offering in 2004 and their stocks raise over last years consistently.

Skrill was founded in 2001 under the name “moneybookers”, took over paysafecard in february 2013 and was re-branded to “skrill” in march 2013. In august, corporate venture capital (CVC) announced the acquisition of skrill for 800 million USD.

The last half of 2012 NETELLER achieved a 21% increase in new member sign-ups. Skrill (moneybookers) was able to double their memberships to more than 35 million as well as their overall transfers to 55 billion EUR within last 2 years.

Both providers are aiming for the US market where NETELLER has been more popular before they pulled out in 2007. Both already got their license for new jersey and are investing many resources to get their licenses for more states very soon.

NETELLER vs skrill – benefits

In most parts skrill (moneybookers) and NETELLER are pretty much equal when it comes to their VIP membership. But there are still some differences, that should be considered before signing up. With recent fee changes, there is even less differences between the two companies. It can be expected that this trend continues and that the product will be mostly the same.

Pro NETELLER

- Currency exchange fees:

since skrill raised their skrill currency exchange fees in late 2013, NETELLER fees are now the clear winner in this part of the comparison with 1,29% to 3.99% FX fees depending on customers VIP status.

Skrill now differs currency exchanges in the following three categories depending on the customers NETELLER VIP status. - Support for NON-vips:

while skrill’s non-VIP support may take one to even two weeks to answer, NETELLER support handles their customers requests much faster and better. Trustpilot’s ratings of 2.5/10 for NETELLER and 4.6/10 for skrill seem to indicate a different result, but from our longtime experience NETELLER support is actually better. Also please note that this rating is based on normal customers review. The customer satisfaction for VIP customers is highly better for both providers, especially for those benefiting of the additional support by ewallet-optimizer.Com. - Cashback for high turnover customers:

for those planning to use their ewallet heavily and are interested in earning decent cashback every month, we suggest using NETELLER where ewallet-optimizer clients earn a monthly extra NETELLER cashback of up to 1.1% on all qualifying transfers.

Pro skrill

- Fees:

the most important fees like depositing and withdrawal fees, are lower at skrill (moneybookers) compared to NETELLER, with the exception of the currency exchange fees. - Promotions & cashback for smaller turnover:

skrill ran several cashback promotions up to 1.5% cashback for outgoing transfers until 2013, but stopped doing so in 2014. They also stopped the skrill loyalty club for their VIP customers in 2016 and currently there is no cashback paid directly from skrill.

For clients of ewallet-optimizer, skrill offers 1% cashback for 30days to become skrill VIP faster and clients also receive a monthly skrill cashback paid in addition for all their qualified transfers, leaving skrill as good option for those customers using their ewallet for smaller transfers.

Get additional bonuses & support for free

No matter if you decide to go with skrill or NETELLER, make sure to register with ewallet-optimizer to enjoy additional bonuses and better support.

If you have any questions about the NETELLER or skrill ewo bonus program and their benefits, please do not hesitate to contact us . We are here to help you.

NETELLER & ewo

Skrill & ewo

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

The difference between neteller vs. Skrill

Neteller vs. Skrill

Real time money transfers

Fast deposit and withdrawals

Real time money transfers

Fast deposit and withdrawals

Read our detailed comparison between skrill vs. Neteller

About skrill

Skrill has been in operation since 2001 and there are synonymous for their quick, simple and secure services. The company is in about 200 countries all over the world and have a working force of more than 500 employees and 30 nationalities.

Skrill is owned by paysafe group plc. The company has been regulated by the financial conduct authority under the electronic money regulations. The company works hand in hand with paysafe financial services limited and wirecard solutions to issue their skrill prepaid mastercard.

The skrill master card gives you the possibility to have always access to your money. You can pay in a normal shop, rent a car, pay in the internet or just take cash at every ATM in the world where master card is accepted.

Skrill is the world-leader in developing global payment solutions for people’s business and pleasure, whether they’re depositing funds on a gaming site, buying online or sending money to family and friends. Skrill also meet the needs of businesses worldwide, helping them build a global customer base and drive growth.

Does not matter you like to make sports bets, poker, trading, online casinos, send money to friends or just use a cool master card. Skrill is a must have in our time to send and receive fast money.

As a customer, you enjoy a 24/7 support by phone and email in different languages. Also, the website is available in 12 different languages.

Important: as yourpokerdream user you have the possibility to get some exclusive offers if you create your skrill account over our site. All that you have to do is to click on “SIGN UP YOUR SKRILL ACCOUNT“ and you will be forwarded directly to skrill, where you can open your new account. Do not forget to inform us after that you have signed up through us at skrill to receive some exclusive extras. You can do this simply by register a free yourpokerdream account HERE and include your skrill email adress there. Thats all!

About neteller

Neteller has been in operation for over a decade and is known for their great services in the e-wallet industry. Their services have been widely used by forex traders and online gaming enthusiasts across the globe. They have a presence in about 200 countries.

Neteller is owned by paysafe financial services limited which is a subsidiary of paysafe group plc. They have been regulated to offer electronic money transactions by the financial conduct authority in the UK. Thanks to their anti-money laundering protocols, you will hardly have an encounter with third party hackers.

Neteller is proud to offer a truly international money transfer service, with more than 200 countries and 22 currencies supported. Neteller enables you to send money almost anywhere in the world with automatic currency conversion. If you use the neteller money transfer service, other neteller members around the world can accept the money instantly, as long as they have already a neteller account. If not it takes just a few seconds to create a new neteller account.

You need only the email address or mobile phone number to send money to another person, even if they don’t have an account yet.

When you send money through the neteller money transfer service, you’re protecting yourself with industry-leading secure payment systems.

As a UK financial conduct authority (FCA) authorized company, NETELLER holds more than 100% of your account balance in trust accounts, which means your money is always there when you need it and you never have to worry about it.

Neteller members get exclusive access to some of the best promotions in the business. A lot of famous only sites work already with neteller together and offers you some exclusive bonuses if you deposit or pay something with neteller. Join also the reward points program and earn points every time you move money in or out of your account, then redeem your points for cash! You also earn points if you are using your neteller master card.

Also, neteller offers a very interesting VIP program where vips receive even more extras.

Every member has the possibility to apply for the free master card. The net+ plastic card let you spend your money anywhere mastercard ® is accepted without risking your bank account or personal information. Chip and PIN technology has become a global standard for debit and credit cards, and for good reason. Combining a “smart” chip and personal identification number means your prepaid mastercard is protected like any other normal credit card with chip and PIN technology.

The neteller master card allows you to have always access to your balance and it looks like a really one. You can rent a car with it, go shopping and all you want.

The neteller site is available in 16 different languages and as a costumer, you enjoy a 24/7 support.

Does not matter you like to make sports bets, poker, trading, online casinos, send money to friends or just use a cool master card. Neteller is a must have in our time to send and receive fast money.

Important: as yourpokerdream user you have the possibility to get some exclusive offers if you create your neteller account over our site. All that you have to do is to click on “SIGN UP YOUR NETELLER ACCOUNT” and you will be forwarded directly to neteller, where you can open your new account. Do not forget to inform us after that you have signed up through us at neteller to receive some exclusive extras. You can do this simply by register a free yourpokerdream account HERE and include your skrill email adress there. Thats it.

Neteller vs. Skrill transaction fees

| payment method | neteller fees | skrill fees |

|---|---|---|

| bitcoin | 2,5% | 2,5% |

| rapid transfer | 2,5% | 2,5% |

| bank transfer | 2,5% | 2,5% |

| trustly | 2,5% | 2,5% |

| klarna | 2,5% | 2,5% |

| skrill/neteller | 2,5% | 2,5% |

| visa | 2,5% | 2,5% |

| euteller | 2,5% | – |

| eps | 2,5% | – |

| paysafecard | 2,5% | 2,5% |

| american express/dinners club | – | 2,5% |

| neosurf | 2,5% | – |

Neteller has much more deposit options compared to skrill but we have just highlighted those methods that compare to skrill for better and clearer comparison. If you would like to know more about the additional deposit methods of neteller, visit the transaction fees page for more on this.

As a VIP member, all your fees are much lower and you have automatically also much higher limits with your skrill or neteller master card. It is worth to be a VIP!

Additional fees/limits

| additional fees/limits | neteller | skrill |

|---|---|---|

| withdrawal balance to credit card | 7,50€-25€ | 7,50% |

| withdrawal balance to bank account | 7,50€ | 5,50€ |

| deposit money(poker,casino,sport,forex) | free | free |

| receive money | free | free |

| money transfers to other member | 1,45%(for vips no fees) | 1,45%(for vips no fees) |

| currency conversation | 3,99%(for vips lower fees) | 3,99%(for vips lower fees) |

| ATM fee(worldwide) | 1,75%(for vips lower fees) | 1,75%(for vips no fees) |

| shopping fee | free | free |

| fee to order the mastercard(once) | 10€ | 10€ |

| daily shopping limit mastercard | 2.700€(vips up to 10.000€) | 1.000€(vips up to 10.000€) |

| cash withdrawal every 24h ATM | 900€(vips up to 3.500€) | 250€(vips up to 5.000€) |

| mastercard validation | 36 months | 36 months |

| available currencies mastercard | EUR,USD,GBP,CAD,SEK,DKK,AUD,JPY | EUR,USD,GBP,PLN |

| virtual mastercard | free | not available |

| fees for not using the account | unused for 14 month(1,80€ per month) | unused for 12 month(1€ per month) |

Please note: you need to keep using your neteller or skrill account or you will be charged an administrative fee. Your account need not stay inactive for more than 12-14 months.

The difference on the VIP program levels

Skrill VIP system

| VIP status | bronze | silver | gold | diamond |

|---|---|---|---|---|

| transfer volume(quarter) | over €6.000 | over €15.000 | over €45.000 | over €90.000 |

| additional skrill account with different currencies | no | 1 | 2 | 3 |

| money transfer fee | 1,9% | no | no | no |

| money transfer fee(max) | €10 | no | no | no |

| fee deposit with credit card | 1.25%-2.5% | no | no | no |

| withdrawal ATM fee | 1,75% | no | no | no |

| skrill exchange fees(FX) | 3.79% | 2.89% | 2.59% | 1.99% |

Neteller VIP system

| VIP status | bronze | silver | gold | platinum | diamond |

|---|---|---|---|---|---|

| transfer volume(yearly) | $10,000 | $50,000 | $100,000 | $500,000 | $2,000,000 |

| additional neteller account with different currencies | nein | 1 | 2 | 3 | 3 |

| money transfer fee | 1,9% | – | – | – | – |

| money transfer fee(max) | $10 | – | – | – | – |

| withdrawal ATM fee | 1,75% | 1,75% | 4€ | 4€ | 4€ |

| neteller exchange fee(FX) | 3.79% | 3.19% | 2.79% | 2.39% | 1.29% |

Leave A comment cancel reply

You must be logged in to post a comment.

About the author

Latest changes

The last changes of the page “the difference between neteller vs. Skrill” was made by YPD on december 29, 2019

Neteller vs skrill 2019- which one is better?

Neteller and skrill are very popular payment method of the recent time. If you are a forex trader or recreational gambler, it’s almost certain that you are already familiar with them. As they are the most reliable source of payment method for gambling and forex trading to date. Today we are going to discuss some of there major aspects. In this article, we are trying to give a clear view of how they differ from each other, what they have in common and which one suit most for your purpose.

About skrill

Skrill has been in operation since 2001 and there are synonymous for their quick, simple and secure services. The company is in about 200 countries all over the world and have a working force of more than 500 employees and 30 nationalities.

Skrill is owned by paysafe group plc. The company has been regulated by the financial conduct authority under the electronic money regulations. The company works hand in hand with paysafe financial services limited and wirecard solutions to issue their skrill prepaid mastercard.

The skrill master card gives you the possibility to have always access to your money. You can pay in a normal shop, rent a car, pay in the internet or just take cash at every ATM in the world where master card is accepted.

Skrill is the world-leader in developing global payment solutions for people’s business and pleasure, whether they’re depositing funds on a gaming site, buying online or sending money to family and friends. Skrill also meet the needs of businesses worldwide, helping them build a global customer base and drive growth.

Does not matter you like to make sports bets, poker, trading, online casinos, send money to friends or just use a cool master card. Skrill is a must have in our time to send and receive fast money.

As a customer, you enjoy a 24/7 support by phone and email in different languages. Also, the website is available in 12 different languages.

Neteller has been in operation for over a decade and is known for their great services in the e-wallet industry. Their services have been widely used by forex traders and online gaming enthusiasts across the globe. They have a presence in about 200 countries.

Neteller is owned by paysafe financial services limited which is a subsidiary of paysafe group plc. They have been regulated to offer electronic money transactions by the financial conduct authority in the UK. Thanks to their anti-money laundering protocols, you will hardly have an encounter with third party hackers.

Neteller is proud to offer a truly international money transfer service, with more than 200 countries and 22 currencies supported. Neteller enables you to send money almost anywhere in the world with automatic currency conversion. If you use the neteller money transfer service, other neteller members around the world can accept the money instantly, as long as they have already a neteller account. If not it takes just a few seconds to create a new neteller account.

You need only the email address or mobile phone number to send money to another person, even if they don’t have an account yet.

When you send money through the neteller money transfer service, you’re protecting yourself with industry-leading secure payment systems.

As a UK financial conduct authority (FCA) authorized company, NETELLER holds more than 100% of your account balance in trust accounts, which means your money is always there when you need it and you never have to worry about it.

Neteller members get exclusive access to some of the best promotions in the business. A lot of famous only sites work already with neteller together and offers you some exclusive bonuses if you deposit or pay something with neteller. Join also the reward points program and earn points every time you move money in or out of your account, then redeem your points for cash! You also earn points if you are using your neteller master card.

Also, neteller offers a very interesting VIP program where vips receive even more extras.

Every member has the possibility to apply for the free master card. The net+ plastic card let you spend your money anywhere mastercard ® is accepted without risking your bank account or personal information. Chip and PIN technology has become a global standard for debit and credit cards, and for good reason. Combining a “smart” chip and personal identification number means your prepaid mastercard is protected like any other normal credit card with chip and PIN technology.

The neteller master card allows you to have always access to your balance and it looks like a really one. You can rent a car with it, go shopping and all you want.

The neteller site is available in 16 different languages and as a costumer, you enjoy a 24/7 support.

Does not matter you like to make sports bets, poker, trading, online casinos, send money to friends or just use a cool master card. Neteller is a must have in our time to send and receive fast money.

Unterschied neteller vs. Skrill

Neteller vs. Skrill

Schnelle ein- und auszahlungen

Schnelle ein- und auszahlungen

Der große neteller vs skrill vergleich

Über skrill

Skrill ( ehemals moneybookers ) gibt es seit 2001 und ist für einen schnellen und sicheren zahlungsverkehr bekannt. Das unternehmen ist in rund 200 ländern auf der ganzen welt vertreten und hat eine belegschaft von mehr als 700 mitarbeitern.

Skrill gehört der paysafe group plc. Das unternehmen wurde von der financial conduct authority unter den electrnic money regulations reguliert. Das unternehmen arbeitet hand in hand mit paysafe financial services limited und wirecard solutions, um ihren kunden auch die hochgeprägte skrill prepaid master card anbieten zu können.

Skrill ist auch die zusammenarbeit mit ebay bekannt und hat hat weltweit mehrere millionen zufriedene kunden. Skrill erlaubt es jedem user ganz schnell geld in echtzeit zu einem anderen user zu übertragen. Für online fans die gerne mal bei den sportwetten, casino oder am pokertisch vorbeischauen. Führt sowieso kein weg an skrill vorbei. Neben schnellen ein und auszahlungen, gibt es noch verschiedene promotions, die euch neben tollen preise sogar noch die möglichkeit gibt geld zu verdienen.

Also schnell geld ein und auszahlen und noch extra geld verdienen. Was will man mehr…….

Egal, ob sie sportwetten, poker, trading, online casinos, geld an freunde senden oder einfach nur eine prepaid masterkarte haben möchten. Skrillist ein muss in unserer zeit, um schnelles geld zu senden und zu erhalten, oder bei online anbietern ein- und auszuzahlen.

Skrill ist in 12 sprachen verfügbar und bietet kunden einen 24/7 support per telefon oder email.

Klicke auf den “bei skrill anmelden” button und melde dich über uns bei skrill an, so das du durch uns noch weitere exklusive vorteile erhältst, welche normale skrill user nicht erhalten. Sobald du auf den button klickst wirst zur hauptseite von skrill weitergeleitet.

Über neteller

Neteller ist seit über einem jahrzehnt in betrieb und bekannt für ihre großartigen dienstleistungen in der E-wallet-industrie. Ihre dienste wurden und werden weithin von forex-händlern und online-gaming-enthusiasten auf der ganzen welt verwendet. Neteller ist in rund 200 ländern vertreten.

Neteller gehört der paysafe financial services limited, die eine tochtergesellschaft der paysafe group plc ist. Sie wurden reguliert, um electronic money transaktionen von der financial conduct authority in großbritannien anzubieten. Dank ihrer anti-geldwäsche-protokolle, werden sie kaum eine begegnung mit drittanbietern hacker.

Wie auch skrill bietet neteller seinen usern eine kostenlose hochgeprägte master card , welche es ermöglicht das man immer sofort an sein geld kommt. Die neteller master card funktioniert an jedem geschäft oder bankautomaten weltweit.

Wie bei skrill auch kann der user in echtzeit geld zu einem anderen user transferieren oder ein und auszahlungen bei einem online anbieter vornehmen. Es gibt ein sehr interessantes VIP programm wo jeder kunde automatisch treuepunkte durch die benutzung der master card oder die einzahlung bei einem online anbieter sammelt. Diese punkte können dann gegen echtes geld oder andere tolle sachpreise eingetauscht werden.

Egal, ob sie sportwetten, poker, trading, online casinos, geld an freunde senden oder einfach nur eine prepaid masterkarte haben möchten. Neteller ist ein muss in unserer zeit, um schnelles geld zu senden und zu erhalten, oder bei online anbietern ein- und auszuzahlen.

Die neteller seite gibt es in 16 verschiedenen sprachen und auch der kunden support ist mehrsprachig und 24/7 erreichbar.

Klicke auf den “bei neteller anmelden” button und melde dich über uns bei neteller an, so das du durch uns noch weitere exklusive vorteile erhältst, welche normale neteller user nicht erhalten. Sobald du auf den button klickst wirst zur hauptseite von neteller weitergeleitet.

Skrill, neteller ou paypal ? Descobre qual o melhor de 2019

Quando o assunto é métodos de pagamento para apostadores ( moneybookers ), surgem inúmeras perguntas. Como tal decidi desenvolver uma análise detalhada & actualizada a todos os métodos de pagamento online.

Skrill o melhor moneybooker (método de pagamento para apostadores) de 2019.. Será mesmo ?

Bem o skrill , anteriormente conhecido como moneybookers , é uma carteira virtual tal como a neteller ou o paypal, que serve essencialmente para realizar pagamentos pela internet de forma segura. Contudo, a skrill oferece outros serviços bastante interessantes, como é o caso de poderes transferir dinheiro para outras contas skrill .. Posso dizer-te que pela minha experiência de utilização, é bastante rápida a passagem de fundos.

Normalmente, quando faço uma transferência de fundos na skrill o dinheiro passa imediatamente de uma conta para a outra conta.

No entanto o que nos interessa principalmente enquanto apostadores, é a possibilidade que a skrill nos oferece, de carregar a nossa conta de uma casa de apostas desportivas online, de forma segura e simples.

É óbvio que terás que ter em atenção alguns detalhes a quando da criação e, posteriormente da transferência dos lucros das casas de apostas, para a tua conta skrill .

Para que tudo corra de forma correcta e sem incidentes, vou dar-te algumas dicas, para que tudo seja o mais simples possível!

Como criar uma conta no skrill ?

O processo de criação de um conta é muito fácil, primeiramente precisas de um endereço de e-mail válido (fácil certo?)..

Não há nada mais simples nem imediato! A inscrição é feita aqui: website oficial skrill

Como depositar o dinheiro numa conta skrill ? ( 3 soluções possíveis )

Para depositar fundos, o skrill propõe três soluções (bastante práticas para ser sincero),

- O depósito por cartão, totalmente gratuito. Onde o dinheiro é instantaneamente transferido da tua conta bancária para a conta skrill . Na tua primeira vez é feita uma verificação à tua conta, só por questões de segurança (e ainda bem.. Estamos a falar de dinheiro, portanto toda a segurança é de louvar por parte destas empresas).

- A transferência também é totalmente gratuita. De acordo com o teu banco, a operação pode levar entre 2 e 3 dias.

- O velho cheque, também gratuito, mas devo dizer-te que só recomendo este processo, se tiveres algum tempo, pois a transação normalmente leva entre 7 e 10 dias! (..Pois eu sei, demasiado tempo certo?)

NOTA :: embora o processo de depósito de fundos seja bastante simples, a skrill impõe um limite de depósito de 1000€ por mês e de 600€ por cartão. Contudo, podes sempre aumentar este limite mediante algumas verificações de segurança dentro da plataforma.

Agora em relação a uma das perguntas que mais me fazem na minha página de facebook (se ainda não me segues, faz like! Terei todo o gosto em ajudar-te a lucrar com as apostas desportivas),

“como funciona quando tiver um dinheiro interessante na skrill e quiser retirar para a minha conta?”

Como retirar o dinheiro da skrill ?

Quando chegares ao momento de transferir o dinheiro para a tua conta bancária, o skrill propõe as mesmas opções que apresenta para o depósito de fundos, bem como os mesmos prazos:

- A transferência, onde cobram uma comissão de 1,80€.

- O pagamento por cheque que, para além do tempo de espera ser maior, cobram uma comissão de 3,50€ ( ..Mais uma razão para não gostar lá muito deste meio de pagamento ).

- O levantamento por cartão de crédito, onde cobram uma comissão de 1,80€.

O montante máximo de levantamento inicial é de 1000€ a cada 90 dias. Se fizeres as verificações mencionadas mais acima, este limite aumenta.

Existe também o cartão mastercard skrill (moneybookers) pré-pago , que está disponível a pedido. Graças a este cartão, podes ter acesso a todos os terminais bancários onde a rede mastercard for aceite, bem como pagares as tuas compras online sem qualquer tipo de problema.

A minha opinião

[4] ⭐⭐⭐⭐ na minha modesta opinião, acho que este serviço não vai mais longe das 4 estrelas, pela razão do valor que cobram nas comissões.

Neteller será o método de pagamento mais seguro para apostadores ?

A neteller , tal como o skrill ou o paypal, trata-se de outra carteira virtual que quero que conheças.

A plataforma neteller , nos últimos tempos tem desenvolvido uma grande relação de confiança com as casas de apostas e um vasto número de apostadores.

O principal factor prende-se com a sua fiabilidade e rapidez nas transações, o que para nós enquanto apostadores é um dos factores mais críticos (rapidez & disponibilidade de fundos).

Como criar uma conta segura no neteller ?

O registo inicia é muito rápido, basta acederes a este link : website oficial da neteller

Demora apenas o tempo de inserires o teu endereço de e-mail. A partir desse momento tens uma conta “neteller express” com possibilidades limitadas, ou seja, limite de depósito de 2 150€.

Contudo, podes e deves, aumentar as potencialidades que a neteller te oferece,

Upgrade à conta neteller

A tua conta pode ter os seus limites aumentados.

Para poderes beneficiar de todas as possibilidades que a tua conta neteller oferece, tens que fazer um upgrade. Basta enviares uma imagem digitalizada do teu bilhete de identidade ou passaporte, bem como responder à chamada do agente encarregado com a verificação das tuas informações.

Assim que o fizeres, os limites aumentam consideravelmente. Poderás depositar com a “carte bleue” um limite de 5 000 € por dia . O limite mensal é de 20 000 € sendo que as comissões baixaram para cerca de 1,75€ (é de aproveitar, certo?)

Se escolheres a opção de transferência bancária, o montante máximo passa a ser de 145 000 € por dia. A transferência tem um prazo entre dois a três dias, o que é normal para este tipo de serviço.

Cartão neteller net+ prepaid master card

O site propõe o seu próprio cartão de crédito (cartão neteller net+) válido em todos os sítios onde é aceite o cartão mastercard, ou sejam em grande parte das lojas. Como deves calcular, esta utilidade tem um preço. O cartão tem um custo de 15,00€, o mesmo valor da anuidade do mesmo.

Para levantares dinheiro para a tua conta bancária, os prazos são os mesmos do que os depósitos. Irá custar-te 7,50 € numa transferência ou cheque.

A minha opinião

[5] ⭐⭐⭐⭐⭐ este sem dúvida alguma é o meu método de eleição. Fácil, rápido e transparente.. Não tenho mesmo nada a apontar!

Paypal como método de pagamento em casas de apostas?

O paypal é um dos sistemas de pagamento em e-commerce com mais reconhecimento mundial. Este serviço permite que realizes pagamentos e transferências de dinheiro através da internet, evitando os métodos tradicionais de pagamento como os cheques e ordens de pagamento.

Como criar uma conta paypal de forma simples ?

Em primeiro lugar entramos no website da paypal e clicamos em criar conta, que se encontra no canto superior direito da página.

Terás que colocar a seguinte informação:

- Primeiro tens que definir o tipo de conta (pessoal ou comercial).

Nós iremos seguir pela conta do tipo pessoal porque é a que necessitamos para efectuar as nossas transações.

Após teres escolhido o teu tipo de conta deverão preencher os campos com os vossos dados e clicar no botão com a designação de “criar conta gratuita” que se encontra no final da página. Mas só o deves fazer assim que preencheres todos os campos, caso contrário a página vai dar sempre erro, a indicar que faltam campos.

Se seguires este processo de forma correcta irás concluir com sucesso a primeira parte do registo de uma conta no paypal . Mas ainda não terminou, pois é necessário activar a conta. Procura na tua caixa de entrada do email, um email de confirmação da paypal .

Por vezes esse email demora a chegar.

Depois de confirmares o teu email, falta o último passo, associar e verificar o cartão de crédito / débito. No canto superior direito tens um pequeno botão com os alertas. Ao clicares, aparece uma mensagem a dizer “adicionar / verificar cartão”.

Quando clicares aí serás encaminhado para uma página onde irá aparecer um botão de “adicionar um novo cartão”. Clica e insere os dados do teu cartão.

Depois de concluires este passo vai ser debitado da conta um montante baixo (à volta de um euro.) este débito pode demorar alguns dias. Assim que consultares o extracto e aparecer o tal débito, entra novamente na tua conta paypal e insere o montante que te foi debitado na área “verificar o meu cartão”. A conta fica assim verificada e o montante é devolvido para a tua conta bancária.

A minha opinião

[3] ⭐⭐⭐ na minha opinião não é o mais recomendado para um apostador profissional, não tem a melhor das integrações com as casas de apostas e, por outro lado, tem um processo de confirmação muito chato & complicado.

Ficas-te com alguma dúvida ?

Utiliza a caixa de comentários para alguma dúvida que tenhas, terei todo o gosto em ajudar-te!

Já agora..

.. Conta-me um pouco da tua experiência, gostava de saber como tem sido a tua jornada de apostador, já apostas-te online?

Forte abraço,

josé pedro trindade

NETELLER VS skrill – similarities and differences

Neteller and skrill are among the most widely used e-wallets in the world today, especially in the area of depositing and withdrawing online casino, and betting site accounts. In this neteller vs skrill article, I will demonstrate the in depth differences between both of them.

Both companies are registered in the united kingdom and are overseen by the united kingdom’s financial conduct authority. Bothe having been authorized with licenses to operate.

NETELLER vs skrill | about NETELLER

NETELLER is one of the safest and easiest e-wallet payment system in the market today. Founded in 1999, neteller has its headquarters in the UK and the isle of man. They are well experienced in various kinds of financial transaction, which is the secret of their success and, has made them very reputable and well trusted by many clients.

NETELLER provides its customers with safe and secure transaction by applying a high level standard of security encryption through the use of the most sophisticated software technologies.

NETELLER is a one of the best platforms to manage your money easily and safely alongside with successful funding of your online casino, betting poker site accounts.

It’s free to sign up for a NETELLER account. Some deposit options such as bank transfer are also free.

There are two types of accounts which you can operate in NETELLER:

The express account and the extended account (VIP account).

The “express account” is the easiest to open and it is possible to provide transactions through it in many currencies. It has depositing limit of 2,500 euro.

The extended account is an account that gives the owner the opporunity to make higher deposits as it has higher deposit limits.

Key features of NETELLER

- Opening a NETELLER account is easy and free

- NETELLER has a high level of security encryption

- Transaction are safe and speedy.

- NETELLER is best used in casinos, forex, binary options, stocks and trading sites.

It is worthy to note that there are charges and fee involved while using NETELLER for payment/withdrawals and other transactions.

NETELLER vs skrill | about skrill

Skrill started as moneybookers in united kingdom in the year 2001, the company was given permission to issue money transfer in 40 different currencies. With over 36 million users, skrill have attested to its trustworthiness.

To ensure the safety of its customers, skrill will require you to scan your passport or other form of identification as well as show proof of address if customers reach a certain limit.

They also require you to give a thorough account verification before funds are released to you.

They do not allow cash deposits.

Opening a skrill account is free and easy. The funding of your account is likewise safe, fast, and easy.

One outstanding advantage of skrill is that withdrawal of funds from your account is free. Furthermore there are no delays except for bank withdrawals on weekends and holidays.

However, there are charges and fees when exchanging different currencies using skrill.

Skrill has a standard account and a VIP account.

They are very good in online casinos, betting, gambling, forex, binary option etc.

Neteller vs skrill | similarities and differences

There are similarities as well as differences between NETELLER e-wallet and skrill e-wallet. We will like to delve into both e-currency payment platforms and dissect them both.

It is imperative to note that both payment platforms features and operations are usually affected by either country of usage or the type of online transactions done. With that in mind you can easily make a choice based on your geographical location or type of business engaged in.

Similarities between NETELLER and skrill e-wallets accounts

- Both payment platforms has being in operation for over a decade

- Both are of UK origin

- Both are recognized by the united kingdom FCA

- Both feature a free account sign up

- Both has presence in more than 200 countries

- There is a 1% bitcoin payment fee using either of the accounts

- The mutual transaction involving both accounts attract the same 3% transaction charges

- There is a 1.9% sofort payment fee using either NETELLER or skrill

- Both payment platforms attract a 1% P2P/transfer transaction fee

- There is a free P2P receive funds transaction charge on both accounts

- Manual bank transfer are free on both accounts

- Both NETELLER and skrill are best used for online casino, betting, poker, binary options, forex, stocks, and trading payments

Differences between NETELLER and skrill e-wallets accounts

| NETELLER payment method | fees | skrill payment method | fees |

| bitcoin | 1% | bitcoin | 1% |

| fast bank transfer | 1.5% | rapid | 0.5% |

| bank transfer/fast transferr | free | bank transfer/maestro/fast bank transfer | free |

| maestro | 2.5-4.95% | sofort | 1.9% |

| sofort | 1.5% | NETELER | 3% |

| skrill | 3% | swift | free |

| euteller | 2% | american express | 2.5% |

| eps | 2% | dinners club/JCB | 2.5% |

NETELLER vs skrill | further comparisons

NETELLER

The methods highlighted above were just to compare NETELLER to skrill for better clarifications. However, NETELLER has more deposit options compared to skrill. To know more about deposit methods, visit the transaction fee’s page on the site.

- Choosing a bank draft for your withdrawal will attract a fee of 7.5-25 euro

- If you choose to withdraw through bank transfer you will incur a fee of 7.5 euro

- A member wire withdrawal costs 10.5 euro

- Withdrawing to merchant site is free

- Money transfer costs 1.9% of the amount and the fee is capped at $20

Additional transaction fees

- Transactions that require currency conversion attracts extra 3.99%

- A VIP member gets a lower exchange rate of 1% in foreign exchange fees

- Your NETELLER account must not stay inactive for more than 13 months or you will be charged and administrative fee.

Skrill

- There is a variation between local and international withdrawal transactions.

- Bank transfer in local withdrawal transaction attracts a fee of 5.5 pounds

- When it comes to global withdrawal transactions we have swift which requires a transaction fee of 5.5 pounds

- Receiving money on your skrill account is free

- Sending money to other skrill users attract a fee of 1.9% on the amount you are sending. The fee has been capped at 17.32 pounds

- Transactions that require currency conversion using skrill will add a fee of 3.99% on the exchanger rate to the money you transact. The exchange rates to the currencies you transact might vary and will be applied immediately without any notice.

- If your account is not active for more than twelve months, there will a service fee of 3 pounds or equivalent that will be deducted from your account.

NETELLER vs skrill | verdict

If you are looking for a payment platform that suits you best in your online transaction, then I believe these comparisons between NETELLER e-wallet and skrill will help you make the best choice based on your geographical location and type of transactions you wish to do.

NETELLER vs skrill

Débat existant depuis que les deux sociétés existent, que faut-il choisir entre NETELLER et skrill ?

Avant tout, il faut savoir que depuis 2015, optimal payments, la maison mère de NETELLER, a racheté skrill pour 1.1mds € aussi la comparaison n’est plus autant d’actualité.

Dans l’équipe de parier-plus nous vous conseillons de vous orienter vers NETELLER. Nous avons étudié les deux solutions et voici les raisons pour lesquelles nous avons choisi cette solution :

- NETELLER est disponible pour un plus grand nombre de bookmaker

- Les retraits permis par NETELLER sont bien plus important que skrill

- Le support aux utilisateurs ne possédant pas un compte VIP est bien plus raisonnable avec NETELLER

Dans un soucis de transparence, nous vous proposons cependant ci-dessous la comparaison réalisée par ewallet-optimizer, plus grand ambassadeur de porte-feuilles en lignes depuis 2010.

NETELLER vs skrill : comparaison des frais

| NETELLER (VIP) | skrill (VIP) | |

|---|---|---|

| niveaux VIP | (bronze; argent; or; platine; diamant) | (bronze; argent; or; diamant) |

| nombre de compte par client | 1 compte (1;2;2;2;2 comptes avec des devises différentes) | 1 compte (1;2;3;4 comptes avec des devises différentes) |

| nombre de devises disponibles | 22 | 41 |

| frais de gestion de compte | gratuit | gratuit |

| frais de non utilisation | inutilisé pendant 14 mois: 1.80 EUR/mois | inutilisé pendant 12 mois: 1 EUR/month |

| comission dans une autre devise | 3,39% (3,09%; 2,59%; 2,19%; 1,99%; 1%) | 2.99-4.99% (2.49-3.49%; 2.25-3.25%; 1.99-2.99%; 1.99%) |

| argent reçu | gratuit | gratuit |

| envoie d’argent (p2p) | 1% jusqu’à 10 USD (1% jusqu’à 10 USD pour bronze et argent; 1% max 1 USD pour or et platine, gratuit pour un compte diamant) | 1%, max 10 EUR (1%, max 5 EUR pour bronze; 1%, max 1 EUR pour un compte supérieur) |

| frais de dépôt | ||

| – transfert de banque | gratuit | gratuit |

| – dépôt d’argent instantané | 1.50% | gratuit |

| – carte de crédit | 1.75 – 4.95% | 1.90% (1.25%; gratuit; gratuit; gratuit) |

| frais de retrait | ||

| – transfert de banque | 7.50 EUR (gratuit) | 3.95 EUR (3.95; gratuit; gratuit; gratuit) |

| – emission d’un chèque | 7.50 EUR | 3.50 EUR |

| – carte prépayée dans un distributeur de billet | 4.00 EUR (gratuit) | 1.80 EUR (1.80 EUR; gratuit; gratuit; gratuit) |

| – paiement sur un site marchant | gratuit | gratuit |

| prepaid card | ||

| – envoie d’une carte et frais de gestion annuel | 10 EUR (10; gratuit; gratuit; gratuit; gratuit) | 10 EUR (gratuit) |

| – paiement par carte | gratuit | gratuit |

| – vérification des fonds | gratuit | gratuit |

| – demande d’un justificatif de banque | gratuit | gratuit |

| – rénitialisation du code PIN | 15 EUR | gratuit |

| – demande d’une nouvelle carte | 10 EUR | 10 EUR (gratuit) |

| – retrait maximum aux guichets automatiques/24h | 750 EUR (750; 750; 2,500; 2,500; 2,500) | 250 EUR (750;1,500; 3,000; 5,000) |

| – paiement par carte maximum/24h | 2,250 EUR | 1,000 EUR (3,000; 3,000; 5,000; 5,000) |

| – temps de réception de la carte | 5-10 jours ouvrés | 5-10 jours ouvrés |

| – devises disponibles | EUR, USD, GBP, CAD, SEK, DKK, AUD, JPY | EUR, USD, GBP, PLN |

| – temps de validité de la carte | 3 ans | 3 ans |

| – carte virtuelle mastercard | gratuit | non disponible |

| identification par vérification en deux étapes | ||

| – frais d’enregistrement | application gratuite (google authenticator) | application gratuite (google authenticator) |

| – temps de réception | dès l’application téléchargée | dès l’application téléchargée |

| – garantie de remboursement en cas de fraude | pour tous les utilisateurs | pour tous les utilisateurs |

Commencer

1. Ouvrir un compte sur NETELLER

2. S'inscrire sur asianconnect

3. Parier sur pinnacle sports, le no.1 des sites de paris sportifs.

Что можно сказать в заключение: skrill and neteller are two of the biggest online e-wallets, but which offers the best service? I review the security, ease and features of both services. По вопросу neteller vs skrill

Комментариев нет:

Отправить комментарий