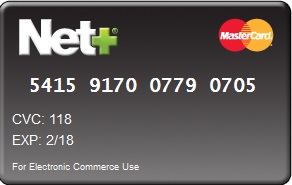

Neteller virtual card

Am I able to withdraw cash at an ATM with my net+ virtual prepaid mastercard®?

I am an unverified member, am I still able to get the net+ virtual prepaid mastercard®?

What is the net+ virtual prepaid mastercard® and how can I get one?

How does the net+ virtual prepaid mastercard®* work?

The net+ virtual prepaid mastercard® allows you to use the funds in your NETELLER account to make online purchases wherever mastercard is accepted. As it is a virtual card, it cannot be used offline or at atms.

The first net+ virtual prepaid mastercard® card you apply for is free. You can have up to 5 active virtual cards at a time. A fee of 2.50 EUR will be applied for each additional card.

How can I get the net+ virtual prepaid mastercard®?

1. Simply click on the net+ cards option on the left hand side of your NETELLER account.

2. Wclick on virtual card.

3. Fill out the form by selecting the following options:

• card currency – we recommend that you create your card in your NETELLER account currency to avoid foreign exchange fees

• card name – card name can be 25 characters long and must not be the same as an existing virtual card name.

• lifetime limit – you can set a limit for your card (optional)

• NETELLER secure ID

• administrative fee – your first card is FREE and is included with your NETELLER account

You should have a notification that your new net+ virtual prepaid mastercard® is ready to use showing the card name and lifetime limit

I am an unverified member, am I still able to get the net+ virtual prepaid mastercard®?

No, only verified members are eligible to apply for the net+ virtual prepaid mastercard®.

As a verified member, can I add additional net+ virtual prepaid mastercard® cards?

Verified members can add up to 5 net+ virtual prepaid mastercard® cards. The first card is free of charge, and each additional net+ virtual prepaid mastercard® is 2 GBP/2.50 EUR/3 USD.

Am I able to withdraw cash at an ATM with my net+ virtual prepaid mastercard®?

No, ATM terminals require a plastic card to process a cash withdrawal. Cash withdrawals at an ATM are available using you net+ prepaid mastercard®.

Can I use my net+ virtual prepaid mastercard® to book a hotel room, book a flight or rent a car?

We do not recommend that you use your net+ virtual prepaid mastercard® to book a hotel room, book a flight or rent a car as these merchants generally need a plastic card to verify. Since the net+ virtual prepaid mastercard® number is not the same number as that of a plastic card, they will not be able to confirm your booking.

Please use your net+ prepaid mastercard® when performing these types of transactions- click here to learn more about the net+ prepaid mastercard®.

*net+ prepaid mastercard® is only available to residents of authorized european economic area (EEA) countries.

NETELLER net+ mastercard

The NETELLER net+ prepaid mastercard is a plastic card that is sent to you that you can use for cash withdrawals at thousands of supported mastercard atms worldwide or pay in any shop that accepts mastercards. With the net+ prepaid mastercard the available balance of your card is the same as the balance of your NETELLER ewallet account and cannot be exceeded.

NETELLER card fees

There are no ongoing costs like monthly/yearly fees or inactivity fees with the NETELLER card. The card can be ordered for a one-time shipping and handling fee of 10.00€ in your NETELLER account after logging in.

For ATM withdrawals there is a 1.75% fee. Paying in shops (POS – point of sale) is free as long as the currencies match. When using a NETELLER card in a different currency than your NETELLER account or when performing a transaction in a different currency than your net+ card you are charged with a 3.99% FX currency exchange fee.

To avoid FX fees, choose the currency of the country that you want to use the card primarily. All fees are charged directly from your NETELLER account. The net+ prepaid mastercard is available in eight currencies: GBP, USD, EUR, CAD, SEK, DKK, AUD and JPY.

For more information on the NETELLER net+ prepaid mastercard, please check netellers website and check our page about the NETELLER fees.

NETELLER card limits

Members of ewallet-optimizer enjoy the highest ATM limits of 3,300 USD/day including the highest transfer limits (check 2nd table below).

For more information on limits for regular account holders, please check the following tables and also visit our NETELLER limits comparison.

NETELLER mastercard limits for non-VIP clients

NETELLER mastercard limits for VIP & gold VIP clients or higher

Order NETELLER mastercard

To order your NETELLER prepaid mastercard, please log into your account and select “net+ cards” -> “get a plastic card“.

NETELLER net+ virtual prepaid mastercard

The virtual prepaid mastercard is a non-phsyical prepaid mastercard. Therefore, you do not need to receive a physical card.

Instead, you can create virtual card details from within your NETELLER account and use them to shop online.

Please keep in mind also the privacy concerns that come with a virtual mastercard in general.

Fees

The first virtual prepaid mastercard created within your account is FREE.

You can then add up to 5 more net+ virtual prepaid NETELLER mastercards and even set limits how much you are allowed to spend (optional). After the first free virtual card, each next card created costs 2.50 EUR. When using different currencies, there is a FX fee of 3.99% of the amount spent.

Limits

You can spend up to 6,300 EUR per 24h with the net+ virtual prepaid mastercard. Please check the following tables for more information about the limits.

Net+ virtual prepaid mastercard® unverified limits

Net+ virtual prepaid mastercard® verified limits

Order NETELLER card

To order your NETELLER net+ virtual prepaid mastercard, please log into your account and select “net+ cards” -> “get a virtual card“.

NETELLER net+ mastercard and virtual card – availability

Since the end of september 2016 NETELLER does not offer mastercards for residents of NON-SEPA countries any longer. Besides the fact that those clients are not able to receive a new NETELLER mastercard, all other services will stay available.

The NETELLER card is available in the following countries:

NETELLER mastercard – comparison and summary

The net+ virtual prepaid mastercard can only be used to shop online. ATM cash withdrawals are not possible. When shopping online, a higher security level is achieved through the individual setting of spending limits and protection against unauthorized use. It also has higher spending limits than the physical card.

The net+ physical prepaid mastercard is necessary to get cash from atms and is s safe way to pay in online shops also. When dealing with unknown shops, a net+ virtual prepaid mastercard can be used for extra caution.

Please contact us if you have further questions about the NET+ mastercard.

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Best free virtual credit card (VCC) provider for verifying sites

Top free VCC provider ( free virtual credit card ) is issued by major banks and derived from the original credit card. By using vcc you can transact with safer and easier, especially if it does not have a physical credit card. Due to the difficult and complex requirements for credit cards to a local bank.

Get free virtual credit card from any one of the payment processing company and use for buy any product. Before going forward we must have knowledge about benefits and cons about the buying virtual credit card like mastercard, visa and other.

Online free virtual credit card (free VCC) pros and cons:

Let, start with well-known advantages of free virtual credit card ( free VCC ). Buy virtual credit card name is like they have many pros.

- It’s free without any extra fee.

- This is best way to protect bank account information

- We can put limitations.

- Time and payment limits.

- User feel safer while transaction.

- Virtual card widely acceptable.

- Fraud protection

- Easy replacement of VCC

- Fixed exchange rates (USD, EUD, INR etc)

List of top free VCC provider verifying online sites

1. Neteller:

Neteller is a popular payment gateway sites are often used by traders to transact either to deposit or withdraw the balance.

User review: neteller is an excellent payment processor which I am using since 2013. Only one time I faced trouble when trying to money out via international bank transfer. But, customer care solved my issue within 1 business day. And finally I got my money in my bank account.

It is also widely used to create or generate VCC to verify paypal by the online business that does not have a credit card, can use neteller as an alternative VCC.

How to get a NETELLER VCC very easy. You only need to register NETELLER and verification using the scan ID and then you are able to make VCC up to 5 pieces.

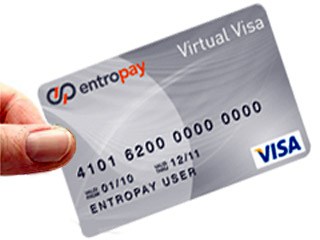

2. Entropay:

Entropay is a website online record and VCC supplier of the most prominent as I would like to think in light of the fact that most bloggers talk about the entropay as boundless vcc supplier destinations.

To have the capacity to utilize VCC from entropay, you should enlist and check your record and store a few assets into the record entropay around 20 that later record can be utilized and can to make a VCC.

3. Payoneer:

Payoneer had the privilege itself as an online gateway payment that we can apply for a bank account creation in america. It is used by the master affiliates mainly india is to receive payment from amazon.

The system is the same as NETELLER and entropay, that you can register an account and then payoneer deposit funds.

- Month-to-month billing with no early termination fee

- Free payments between payoneer accounts

- Best for freelancers and international businesses

4. Netspend:

Netspend is a popular vcc provider in the united states. The site which provides the VCC with mastercard and visa types are very commonly used in the world.

User review: I have enjoyed netspend for quite some time now. The few times that I have had to call customer service the reps have always been very helpful and I feel have gone above and beyond in order to help me. I did have a frustrating situation shortly after I opened my account with a double charge though. Netspend was quick to correct the issue and my funds were back in my account quickly.

Netspend is quite long in the market, they keep their reputation with great customer care support. They serve over 68million underbanked customer who doesn’t have bank traditional account.

5. American express:

American express is a financial institution that provides a physical or virtual credit card. It is unquestionable because it is a well-known brand that is parallel to the visa and mastercard.

It is typically used by those elite as millionaires or billionaires.

6. Bank freedom:

Bank freedom offers many types of VCC that you can use, in its filing requirements are not so complicated.

In addition, the bank freedom also guarantees that the card belongs to them can be used worldwide to any transaction.

7. Card.Com – US only

What makes card.Com service unique is the design of the cards- you get to choose your own. There are so many choices, divided into 17 categories such as animals, celebrities, cartoons, fashion, sports, TV, video games, movies… you will unquestionably find the right design for you.

8. Privacy

Privacy creates secure virtual cards and completes checkout forms for you, saving you time and money while masking your real card details. We have been looking around for some best alternative for entropay and came across this site in past few days with some great features. You can opt to create unlimited free vcc with this privacy.

May not be best in class with the amount of review it gets. But you can expect great customer support from privacy VCC site.

However, you also have to be careful when transacting to avoid fraud and deception from the provider vcc which could possibly occur.

About NETELLER

Founded in 1996, NETELLER quickly became the biggest ewallet on the market. They are owned and operated by the paysafe group (formerly known as optimal payments PLC) and are publicly traded on the london stock exchange since 2004.

With NETELLER, you can easily and securely move your funds online to and from a huge number of available merchants, send money to friends and also access your balance with the net+ prepaid NETELLER mastercard, paying everywhere where mastercard is accepted, or simply getting cash from the ATM.

As of 2015, optimal payments as the mother company of NETELLER bought skrill and are now working closely together. Those changes also made it possible to transfer funds from your NETELLER account to your skrill account and vice versa.

NETELLER & ewallet-optimizer

Ewallet-optimizer is our biggest and valued affiliate partner for NETELLER, offering customers the very best treatment, fastest support and additional benefits without any extra fees.

NETELLER’s partnership with ewallet-optimizer since 2014 has been an important factor in our growth and brand building all over the world.

We are very happy with the ongoing long-year partnership and look forward to continuing and growing our partnership even more in the future.

In may 2014 we started the partnership with NETELLER to be able to offer another great ewallet provider to our customers. NETELLER is available at almost all poker sites, forex providers, casino sites and sportsbooks. In combination with our ewo bonus program, NETELLER is the perfect choice for any customer who is looking for a safe, fast and easy solution to move their funds.

We will continue our great partnership with NETELLER and always strive to offer the best benefits for all clients who sign up through us.

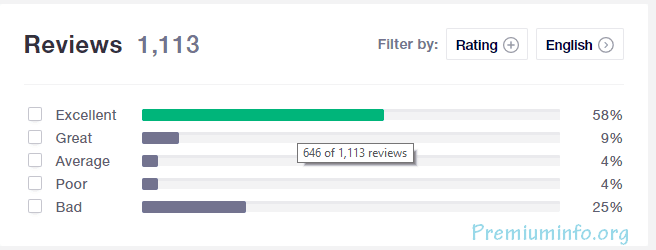

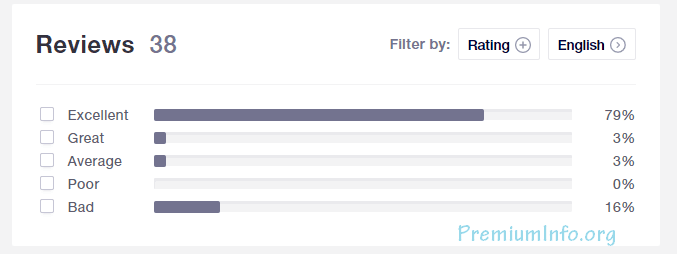

Reviews from our loyal clients

Partner network

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Virtual credit card generator 2020 (generate credit card numbers)

Virtual credit card generator 2020 – the world is changing fast. The technology works very fast. Then, the way of life should follow. The ease of payment now comes in a modern way.

Before you know the virtual credit card generator 2020, the first thing to do is to know what the virtual credit card is. Read the short description on this topic and find the virtual credit card generator 2020. There are also looking for credit card generator hack

What is a virtual credit card?

What is a virtual credit card (VCC)? Is this already common for you? Yes, it’s just a digitally generated number of 16 digits. Here is virtual credit card generator

It is used for transactions that are usually done online. This is becoming a trend in payment today because it is a “cardless” payment method.

The virtual credit card is also called electronic payment. It is considered efficient for its transaction method for both buyers and suppliers.

They do not have to go to the counter to pay. Just need to buy and pay to nearby suppliers. Virtual credit card generator, the virtual credit card is used by anyone in the world to make payments abroad, including payment for work, trading and other types of transactions. Do you want to know more?

What is a virtual credit card generator?

A credit card number consists of complex wording. There are the numbering system and the application and registration procedures that you must follow.

This is the industry primary identifier or MII prefix, 6-digit issuer identification number or INN, 7-digit personal account number, and 3-digit security code such as CVV and CVV2.

The main identity of the industry or MII is placed at the first digit of your credit card. Look at the table below to check:

| MII digit | category |

| 1 | ISO / TC 68 and other industry transfer |

| 2 | airlines |

| 3 | airlines, financial allocation, and other future industry |

| 4 | travel, entertainment |

| 5 | bank and finance |

| 6 | bank and finance |

| 7 | merchandising and bank / financial |

| 8 | health care. Telecommunications and other future industry divestitures |

| 9 | award by the national standardization bodies |

Meanwhile, the issuers are companies in which the credit card has been launched, such as visa, mastercard, JCB, and american express. Here is virtual credit card generator

Virtual credit card generator 2020, get it “free” in neteller

The virtual credit card can be easily generated now in neteller. No need to buy it for unreasonably. Here are the steps to follow:

- The first thing to do is to access netteler.Com.

- Find words join for free and take the option.

- Some new columns will appear after choosing the options. Make sure to fill them all.

- It is suggested to fill in the columns with valid data, including full name, address, postal code and other personal data. Take note of the question-answer you will need for verification.

- After finishing with the columns, click “continue” under the column.

- Click “continue” again for the next step. Your clean account is ready.

- Do not forget to take note of your username and your ID with netteler. A confirmation will be sent to your email address to activate the clean account.

- To obtain the virtual credit card, click net + cards. On this page, find and choose the get a virtual credit card option.

- A new column appears to fill in your full name and your secure login. Then click on “submit” and “continue”.

- The last step is to click on the green-reading icon. Take note of the data provided, such as the expired VCC, CVC, and VCC ID card. If you complete these steps, it means that you already manage to create your own VCC for free. Virtual credit card generator

Generate credit card numbers using virtual credit card generator 2020

Now that you have a virtual credit card, here are some benefits to know:

- Simplicity. The validation of the generated credit card number is only once for transactions made online. It will be expired if it is already used.

- Ease. Virtual credit cards are now commonly used for online transactions and online purchases. Most merchants facilitate the freedom of users regarding the transaction and purchases abroad. Therefore, the facility plays an important role in interacting with users of virtual credit cards.

- Security and protection there is great protection if you use a virtual credit card here. You will have a minimum risk of fraud and theft. The number of your virtual credit card is invisible to traders when you make an online transaction.

- Relative anonymity. Personal data on the internet is considered insecure. As a result, users are paying more attention to data protection. And the virtual credit card is the only solution. It’s safe, simple and not doubtful.

- Cost. The use of virtual credit cards is cheaper than any other real transaction, for example when you have to go to the bank. In addition, the internet facilitates the delivery of the card. It does not take costs.

Homemade just sit at home to ask for a virtual credit card. No need to go to the bank to create an account and wait for the approval. Again, you can use the internet. You can simply request the account via the internet. - Time-saving. When time is precious, the virtual credit card is the solution for your business, even for your daily needs. Getting a virtual credit card does not take your time.

Summary

A virtual credit card is very easy to obtain. By understanding what it is, how it is created and what the benefits are, you will come to the fact that the virtual credit card generator 2020 is everyone’s lifestyle.

You need it for your daily activities, your daily work, your daily business. Think about it and you must now do it. Have a good life!

Net+ prepaid card review | prepaid365

NETELLER net+ prepaid mastercard review

PLASTIC GBP CARD

- Monthly fee £0.00

- UK POS £0.00

- UK ATM £3.00

- FX FEE 2.95%

- INTL POS £0.00

- INTL ATM £3.00

- LOAD 1.75% via debit or credit card, free via bank transfer

Find out more

If you would like to find out more about the different fees on the net+ prepaid card in all currencies including GBP, USD, EUR, CAD, SEK, DKK, AUD and JPY - visit the net+ fees help section.

These cards have rightly been lauded as being one of the only true online gaming prepaid credit cards in the market but these amazing new prepaid credit cards actually deliver a whole lot more.

One of the best-priced prepaid cards on the market; both the physical prepaid card and the virtual prepaid card carry no dormancy or annual fees and POS transactions are FREE making these prepaid cards perfect for online shopping, gaming as well as travel enthusiasts. Furthermore, there is added benefit of keeping your spending private with no telltale statements sent to your home. Now that is priceless indeed! The prepaid mastercard also serves as an excellent credit card alternative for those keen on staying debt free and controlling their spending.

With 8 currencies to choose from on the the chip and PIN plastic net+ prepaid mastercard and the ability to hold as many as 5 unique virtual cards at a time, these prepaid cards are changing the face of the prepaid industry.

Application process

You can apply for the net+ plastic prepaid mastercard and the net+ virtual prepaid mastercard online via the NETELLER website.

- Sign up for a NETELLER account

- Apply for a net+ prepaid mastercard note: in some cases, you may be required to verify your identity first by submitting identity documents or registering your bank account

- NETELLER members can expect to receive their plastic prepaid credit card within 5 – 21 working days. The virtual card is instantly available upon signing up for the account and the first virtual card is free.

Card features

- Available in 8 fantastic currencies- GBP, USD, EUR, CAD, SEK, DKK, AUD and JPY

- Chip and PIN technology for secure spending

- Privacy & identity protection as transactions are kept private in the your online NETELLER account and your identity is protected as your net+ card is not attached to your bank account.

Card design

One seriously attractive piece of plastic and a snazzy NETELLER account!

Card fees

- Card issue fee – £8.00 for shipping and handling (plastic card only)

- Monthly fee – free

- Transaction fee UK – free

- ATM withdrawal fee UK – £3.00 (plastic card only)

- Reload fee – free via bank transfer and 1.75% via debit or credit card.

Account management

The net+ plastic prepaid mastercard and the net+ virtual prepaid mastercard are linked directly to the member’s NETELLER account, which gives them instant access to their money and the ability to:

- Check their net+ card balance

- Reload their card

- Track their transactions via the NETELLER account.

Using abroad

With 8 currencies to choose from you really cannot go wrong with using net+ prepaid cards abroad – plastic or virtual. The cards from NETELLER are mastercard branded and can be used at over 30 million retailers worldwide that accept mastercard. Members are encouraged to select the currency of the country they plan to use the card most in.

A foreign exchange fee of 2.95% is applied to transactions made in a currency other than the card currency.

Reload options

The net+ prepaid mastercard and the net+ virtual prepaid mastercard from NETELLER can be loaded in a number of convenient ways these include the following.:

- Local/international bank deposit – free

- Credit card – 1.75%

- Debit card – 1.75%

- Quick bank transfer – 1.50%

- Paysafe card – 9.90%

- Ukash – 3.00%

Customer services

There are a few different ways you can get in touch with the NETELLER team to discuss your net+ prepaid card and net+ virtual mastercard card accounts.

- By email: via the NETELLER web form

- By telephone: +44 203 478 5296

- Lost and stolen cards: +1 403 202 3025

You can also try the online FAQ’s on the NETELLER website to resolve customer service issues or get in touch with the NETELLER team on facebook and twitter.

- Facebook: http://www.Facebook.Com/NETELLER

- Twitter: http://twitter.Com/neteller

Complaints procedure

For general account complaints you can contact NETELLER customer service team through phone or email to discuss your net+ prepaid mastercard or net+ virtual prepaid mastercard accounts.

If the concern is not addressed to your satisfaction and you wish to initiate a formal complaint, you can contact the NETELLER complaint officer via email at complaints@neteller.Com, by telephone or by mail at the address below.

NETELLER complaints team

compass house

vision park

chivers way

cambridge

CB24 9AD

united kingdom

You may be able to take unresolved complaints to the financial ombudsman service at south quay plaza, 183 marsh wall, london E14 9SR. Telephone: 0845 080 1800 or +44 (0)20 7964 1000 (for calls from outside the UK) and e-mail: enquiries@financial-ombudsman.Org.Uk.

Please note that the FOS will only investigate your complaint after the NETELLER team have attempted to resolve your complaint through their internal resolution process.

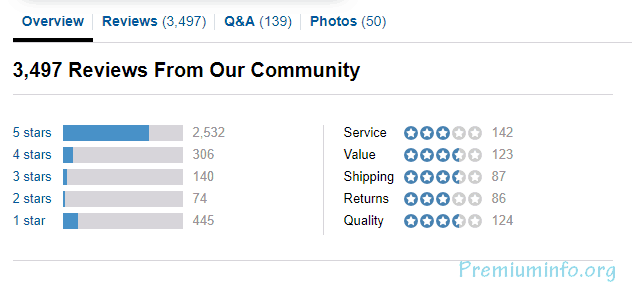

Awards

The NETELLER team and the net+ prepaid cards have won or been nominated for the following awards

- Best overall prepaid card – winner – prepaid365 awards 2013

- Best general spend prepaid card – winner – prepaid365 awards 2013, 2012, 2011

- Best gaming prepaid card – winner – prepaid365 awards 2013, 2012, 2011, 2010

- Best new prepaid card product launch – winner – cards and payment europe, 2009

- Nominated for best prepaid marketing campaign – prepaid awards, 2010

Overall card rating

The gaming and shopping credit card alternative par excellence in 8 currencies.

Pockit prepaid

Orange cash

Virgin prepaid

What net+ cardholders say.

I congratulate you for the excellent service that you have provided me.

Nicola S., italy

Many thanks for that. Excellent customer service!

It was really super. We used them in taxis, hotels, shops, airports. Really convenient.

Malachy O., ireland

I found out about ukash through the money saving expert websitevand it is truly great for when travelling in europe. I got the euro pre-paid travel mastercard, which you get for free and no charge for delivery. It says on the website 5-7 days for delivery and I got mine in 5 days exactly. So simple to register the card and you get the PIN immediately via text, so you can use straight away. You use it just like you would your own card but no charges for using abroad and was by far the best rate I could find when I was topping it up with euros. Easy to top up and view your balance using an online account and secure as anytime an important transaction was made you get an email. Couldn't recommend this any more!!

I decided to get a ukash card as my son was off to the USA on a school trip and I didn't want him taking money or travellers' cheques. It tuned out to be a great decision as he lost cash but fortunately not the card so he still had a good time.

Having read the positive reviews about the ukash travel money card, I decided to give it a go and I am now very happy I did. The exchange rates are fantastic and good value for money. The website was very simple to use and I got my card within 5 days. I will tell all my family and friends about ukash.

Not usually one to leave reviews, however this product was really useful. Used it to exchange some euros for a short trip and was cheaper than the airport. Also didnt incur any charges while out there.

Trouble free, decent telephone support. Have used the card without problems.

James cummins

Been using them for some time now and I've been pretty happy with the transaction process thus far. Some ecommerce store only accept them instead of paypal especially stores from the asia region. Verification can take some time but since it's for our own protection, I guess it's acceptable.

James darronte

Have been using for a month to pay online stores that do not accept paypal. Fairly good security/verification processes leave me feeling confident my finances are secure.

Mark hewetson

So far it was the best and easiest way for me to make online transactions and payments. I ditched paypal and alertpay, cause there were too much hustle and online policies, which ruined online shopping, at least for me.

I've used the T24 blackcard for about two years now, and I recommend it to friends and clients whenever I can. It's easy to use and they've got extremely forthcoming and personal service. My firm has chosen to implement the card as part of our partner packages as the obvious way of managing our payrolls and travel expenses.

Michael philips

My experience using T24 blackcard could not be better. It is secure, worldwide accepted and high available. But what is exceptional is the support provided by the T24 black card team. I feel myself a premium customer. I recommend it.

Christoph schulz

I chose pockit because it is easy and safe to use both online and in-store, since you can only spend what is available on the card you can really manage your money. The cashback offers are an additional benefit!

Maurice, kilmarnock

We use the pockit prepaid card for all our household expenses as it is easy to keep track of what is being spent. We try and use it at participating retailers as much as possible so we save on a weekly basis

Vaneesha, london

The card works great, I’ve mainly been using it for the cashback deals, I buy as much as I can from M&S instead of other places. I have found it so easy to setup and use. I remind myself of where I can save by looking on the website every so often

Meheen, london

Just wanted to say what a fab idea this is, I can now have the convenience of using a card when I have funds – it’s brilliant. Thank you.

Janice, worcester

I really like my pockit card, it rewards me for doing my shopping at places like M&S and halfords

Sue, chichester

Great features, looks and feels great to use compared to most banking apps

Brian crook

Easy to use. Easy to transfer funds from my bank to the card. Notifications are good. All round good app. Thanks.

Adrian stainton

Really quick to use - I can load my card in the queue for train tickets!! It makes keeping track of my spending dead simple.

Downloaded the app, added a card and loaded money all in one breath. No hassle. Even logged in online to make sure everything was ok. And it was! As a frequent orange cash user this app is PERFECT.

Marie davis

Being an orange card heavy user this app is a god send! Very simple and easy to use. Immediate money upload too. Just what this excellent card needed to compliment it.

Peter butterworth

So far so good! Easy to access my account on line, or check the balance at the ATM ecept the nearest local one which is visa and link only! Able to add standing orders to companies at my convienience, make transferrs or use the card as a debit card. Follow up has also been good with a couple of calls to make sure I'm happy with the service and am able to gain access without problems. Much more helpful than my previous TSB bank who I'd been with from childhood. I'm now 55. I've never done internet banking til I started with clearcash. They made the transition so easy.

I have had troubles in getting a bank in the high street, and going through troubles with my debt i was left in disarray with my finances! I found that no high street would touch me with my awful credit rating.. Yet when i stumbled upon clearcash i found it was the thing i was waiting sooo long for! They gave me instant approval and no credit checks, i now have my very little salary paid in (lol) and have child benefits etc put in.. Very happy with all at clearcash! Best thing is they have an account called pay monthly, this is helping my credit rating get boosted :) yaaay! 10/10

Joethedon1958

I have had a clearcash card for a few years now and recently received an email saying they are changing the service. They are now utilising cashplus who are quite a large outfit but the card is still clearcash. Simple process to transfer and clearcash call centre there to help. Cashplus customer service wasnt as good - but answered my queries. Got lots of confidence with clearcash, unlike others, they listen to your feedback! Now got my own account number and sort code which is really helpful too!

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

This is was afad fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam. Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Fusce dapibus, tellus ac cursus commodo, tortor mauris condimentum nibh, ut fermentum massa justo sit amet risus. Cras mattis consectetur purus sit amet fermentum. Maecenas faucibus mollis interdum. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Top free virtual credit card (VCC) providers (working )

A VCC or virtual credit card is a prepaid card, with A free VCC, you can buy hosting, domain shop online and also you can use it for paypal verification. There are lots of benefits of the virtual prepaid card, basically, a hacker can’t hack your card and you can add limit balance depending on how much you want to use. There are many types of VCC master card, visa card, and others.

For many payment transactions on the internet, you need a credit card. However, many clients do not accept debit cards. So virtual credit card is an alternative way for payment transactions on the internet.

There are lots of prepaid card online shop available on the internet, but here I write about some very popular providers.

What is a virtual credit card (VCC)?

You should know about VCC or virtual credit card:

- VCC is a non-physical card

- We can add balance and withdraw the balance

- Full security protection

- Only for online shopping

- Virtual card worldwide acceptable

Best free virtual credit card providers list

1. Netelle r

Neteller is also the best credit card provider. It offers prepaid mastercard that can be utilized as VCC for secure online exchanges. It takes little charges on exchanges. You can make neteller prepaid card free of expense by joining the site.

The neteller virtual card is accepted at thousands of online shops and sites. Millions of buyers around the world have been using NETELLER to send money and receive money around the world.

How to generate VCC or international virtual create card from neteller

- Go to neteller site this signup link

- Fill in the required details ( name, address ETC )

- Click on your open account

- You will get a confirmation mail, open your mail

- Click sign in link in the mail inbox

- Provide the login details and sign in

- Click on money in option

- Choose a preferred method and add the minimum fund designated.

- After that select, the net+ cards link found on the left side of your screen

- Select the net+ virtual prepaid mastercard® section

- Click on add a card

- Select the desired currency. Please choose the currency that you do most of your shopping with as there will be a currency exchange rate fee of 3.99% if there is currency conversion.

- Name your card (optional).

- Fill in a lifetime limit (optional).

- Once you generate the net+ prepaid mastercard®, you will notice the 16-digit card number appear, along with the security code (CVV) and the expiry date.

You can now use that net+ virtual generated card number at your favorite merchant.

2. Privacy – keep your money safe

Privacy is a free credit card provider and its good thing is that they have no extra fee for using their credit cards. Privacy has good security and they don’t leak your card details or other on the internet. With their cards, you can subscribe netflix spotify and also amazon prime.

3. Entropay

Entropay is one of the best VCC providers that can help you to create your prepaid card free of cost. You can generate unlimited free virtual credit card with your location address. You can put the money from your bank account on the entropay account.

Note: entropay is not accepting new account so here is another method to get the best quality free credit card

It is also extensively used to create or generate VCC to verify paypal accounts. It is also using by a blogger for buying domains and hosting.

How to generate VCC from entropay

- Goto this entropay signup link

- Fill in all the details form

- After clicking on submit, you will get a welcome email in your mailbox

- Click on the “cards” in the navigation menu

- Click on the “create card”

- Type your “card nick name”

- Then click “create”

- That’s all, your first VCC has been created.

To top up your card click on the “top up card” and choose any of the methods you wish to choose and fill up the details accordingly. Once the top-up has been completed you will get the card number, CVV number in that card itself and you can use it for online payments.

For more information how to create and topup entropay with debit card, you check this post how to add balance on entropay cards

4. Payoneer

Payoneer is the most popular payment service. They offer prepaid master card which can be used as a virtual credit card to pay for the shopping and verification.

Payoneer worked to be one great alternative to paypal back in the days, as it used to offer debit card, which can utilize for taking out cash from the ATM.

5. Worldcore

Worldcore company provides a free prepaid debit card within 24 hours of submitting the required documents. The card can load funds, withdraw funds from any bank account instantaneously and can be used for paypal, payza verification.

Worldcore card allows to get paid through bank, load balance with any visa/mastercard credit or debit card, make online payments, make withdrawals to the worldcore prepaid debit card and pay bills or buy any goods on the internet.

6. Netspend

Netspend is one of the best prepaid credit card providers for US residents. They provide processing and marketing services for prepaid mastercard and visa debit cards.

Netspend is a provider of prepaid cards for personal & commercial use. You can order your own prepaid card for free.

- Netspend visa ® prepaid card

- Netspend prepaid mastercard

- Small business prepaid mastercard

7. Spectrocard

Spectrocard is another best provides free VCC, you can receive the virtual prepaid card in just less than one minute. There is no annoying paperwork or complicated verification. You can also order multiple virtual cards.

The prepaid card works everywhere, including amazon, aliexpress, and other websites.

- Deposit funds by cash, credit or debit card, bank transfer or any other payment option.

- Get your virtual mastercard and use them to pay everywhere.

Sign-up at spectrocard.Com and order your virtual mastercard

8. Ecopayz

9. YANDEX MONEY free VCC

Yandex money is a payment service based in russia company. There is no limit for other countries to use the services and free vcc there.

The thing you need to do is simply translate this website using a google translator.

Yandex money feature

- Safe and protected customer data

- Get used in various online payments

- Virtual wallet application

- Easy transactions

Conclusion

In this tutorial, you can now easily create a virtual credit card for free of cost. I am using VCC to buy a domain, hosting, and online shopping. Also if you want multiple account or multiple VCC, then you can create there. It is also beneficial for people who do not have an international credit card or do not want to use card in international sites.

SKRILL VIRTUAL PREPAID MASTERCARD®

Skrill virtual prepaid mastercard® is a convenient tool for online payments at sites where mastercard is accepted for payment.

Currently, skrill virtual card is only available to residents of the european economic area* and a few other countries, who verified their accounts.

Transactions are conducted only by skrill virtual prepaid mastercard® card number, and transfer information and personal data are equated to anonymous online payment methods.

WHEN CONVENIENT TO USE SKRILL VIRTUAL PREPAID MASTERCARD®

It’s best to use your skrill virtual card when you are shopping online today or now. There is no need to wait for the delivery of a physical card, which takes almost 1-2 weeks.

Paying with a skrill virtual prepaid mastercard® is possible wherever mastercard cards are accepted. Even where there is no possibility of payment through the skrill wallet.

By the way, you can delete or block a virtual card in your account at any time.

BENEFITS OF THE SKRILL VIRTUAL CARD:

INSTANT CARD

Creating a new virtual card in the account – a couple of seconds;

VIRTUAL CARD BALANCE = ACCOUNT BALANCE

Virtual card balance is equal to skrill wallet balance;

CARD IS IMMEDIATELY READY FOR USE

No need to wait for the delivery and activation of the card, as in the case of the plastic skrill prepaid mastercard®;

HIGH TRANSACTION LIMIT

Daily limit for payment by virtual card: € 6,300 / $ 7,000, which is higher than the limit on skrill plastic card;

FREE CARD ISSUING

For one account you can create one card for free. Two accounts – free two cards;

FREE USE OF THE CARD

No fees for servicing a virtual card.

HOW DOES SKRILL VIRTUAL PREPAID MASTERCARD® WORK?

With a virtual skrill card, user can pay for goods and services on the internet wherever both skrill and mastercard® are accepted.

In order to apply for a virtual card you need to verify your account.

With the skrill virtual card, you can pay in the online store, but it does not withdraw cash from an ATM and does not work in a regular store.

The skrill virtual prepaid mastercard® card services have small limitations: it is not used to book a hotel room, purchase a ticket or rent a car, since this type of transaction requires a verified plastic card.

TARIFFS AND LIMITS OF THE SKRILL VIRTUAL PREPAID MASTERCARD® CARD

| service | cost |

| applying the first card for one account | free |

| issuing of the second and other cards | €2,5 |

| conversion fee | 3,99% |

| available currency for card | PLN, GBP, USD, EUR |

| daily limit for payment of | EUR: 6300, PLN: 23000, USD: 7000, GBP: 4550 |

HOW TO GET A SKRILL VIRTUAL PREPAID MASTERCARD® VIRTUAL CARD?

You can order the first skrill virtual card in your skrill account website only if you have a positive account balance. The user can remove the card at any time and issue a new one.

TO ORDER SKRILL VIRTUAL MASTERCARD®:

GO TO YOUR SKRILL ACCOUNT …

SELECT “SKRILL PREPAID CARD”. IN THE “VIRTUAL SKRILL CARD” SECTION, CLICK “ADD A CARD” BY SELECTING THE DESIRED CURRENCY …

VIEW THE VIRTUAL SKRILL CARD DETAILS …

ENTER THE SECURITY CODE FOR YOUR ACCOUNT SKRILL …

GET ALL THE DATA ON THE VIRTUAL MAP SKRILL …

*the EEA includes: austria, belgium, bulgaria, croatia, republic of cyprus, czech republic, denmark, estonia, finland, france, germany, greece, hungary, iceland, ireland, italy, latvia, liechtenstein, lithuania, luxembourg, malta, netherlands, norway, poland, portugal, romania, slovakia, slovenia, spain, sweden and the UK.

Skrill wallet and skrill prepaid mastercard® plastic card and skrill virtual card are more advantageous when connecting to the vipdeposits + skrill loyalty program!

Join SKRILL + VIPDEPOSITS LOYALTY PROGRAM

If you already have a skrill account,

please proceed to step 2 and fill out the form.

3 best website to create free virtual debit card (VCC) 2018

Let’s create a free virtual debit card now! VCC stands for virtual credit card(also known as a virtual debit card). A virtual debit card is much useful when you don’t want to use your original bank details on a website.Also, you can use it to buy from international websites. I will teach you how to create a free virtual debit card.

Unlike other websites, I didn’t just copy-paste content here! These virtual debit cards are tested by myself!

What is a virtual debit card/virtual credit card

Simply put VCC is a debit card without the physical plastic card, but you will get the card holders name, from and to date, card number, cvv number all in online. This can be used for online transactions only.

You can recharge the VCC(virtual debit card) using local bank account transfer, international bank account transfer and more even easier ways such as credit or debit card transfer. Advantages of a virtual debit card is that it can be used internationally without revealing any of your personal data or banking data. However the virtual debit card provider will have your billing address with them.

Virtual debit card comes from virtual card technology which is derived from card not present idea.

Now there are many virtual debit card providers are out there. Some of them allows us to create an account and issue a virtual debit card for free but for each transaction they will levy some charges like 1.9% to 4.5% from your account. This percentage varies according to providers and it will come to a lower percentile once the amount you transferred is higher than their limit.

Why you need free VCC (virtual debit card)?

Virtual debit card has many advantages.Here I discuss some major use of entropay

- Hassle free purchase frominternational online shopping website.Getting a credit card from bank isn’t easy.Even though you may fail in card decline problems.So virtual debit card is best solution for you.

- You can add money to betting website.Some countries decline transfer from bank to online betting website.So virtual debit card help here.

- Add money to popular website for business purpose. Some websites : flippa, paypal, google developer console, upwork, fiverr, etc

- Easy money transfer. Actually its help to transfer money.Create a virtual debit card and give card number and cvv your friend who need money across country.They can use simple like a visa card

How to create free VCC (virtual debit card)

Here i will explain best free virtual debit card providers, they are

1. Entropay free virtual debit card

Entropay offers free of charge for opening an account, creation of card and online transactions.

Entropay is my favourite vcc to make payment online.

With no credit checks, extra costs, or administrative delays, entropay offer a simple virtual prepaid card solution designed with corporate online transactions in mind. Entropay purchasing allows you to create, manage, edit or delete prepaid virtual cards through a simple, instant, online interface.

Entropay virtual debit card features

- Multiple currencies support: use entropay virtual cards to pay like a local in €EUR, £GBP and $USD.

- Accepted globally: use entropay cards to shop online anywhere visa is accepted in +120 countries.

- Fair fees: top up from as low as 1%. Plus, it’s always free to create a card and make an online purchase with a card

- Unlimited virtual cards: you can create unlimited virtual cards over the lifetime of your account.With an entropay account, you can have 10 active cards at any time. Deleting and creating new cards is a snap!

- Protect from frauds: use one entropay card per merchant. If a merchant is ever compromised, breaches are contained.Delete entropay cards instantly to protect yourself from fraud and fishy charges.

- Set limits:set individual card limits for ultimate control over your money. Adjustable card limits stop runaway subscription charges and help you budget better.

Creation of VCC in entropay

- Goto entropay.Com & sign up

- Complete the sign up form

- After clicking on submit, you will get a welcome email

- Click on the “cards” in the navigation menu

- Click on “create card”

- Type your “card nick name”

- Then click “create”

- Thats all, your first VCC has been created.

To top up the card click on “top up card” and choose any of the methods you wish to choose and fill up the details accordingly. Once the top up has been completed you will get the card number, cvv number in that card itself and you can use it for online payments.

To add more than one card you have to upgrade your account to standard or pro.

2. Neteller free virtual debit card

Neteller also offers free of charge account creation and card creation as well. One additional plus point is that it doesn’t charge any fess for local bank deposit and international bank transfer.Vcc also call virtual debit card!

Neteller virtual debit card features

pay with confidence:NETELLER makes paying online easy – even where debit and credit cards may not work.

Spend your money on thousands of international sites

Creation of virtual debit card in neteller

- Goto this signup link

- Fill in the required details

- Click open account

- You will get a confirmation mail, open the mail

- Click sign in link in the mail

- Provide the details and sign in

- Click on money in option

- Choose preferred method and add the minimum fund designated.

- After that select the net+ cards link found on the left side of your screen

- Select the net+ virtual prepaid mastercard® section

- Click on add a card

- Select the desired currency. Please choose the currency that you do most of your shopping with as there will be a currency exchange rate fee of 3.99% if there is currency conversion.

- Name your card (optional).

- Fill in a lifetime limit (optional).

- Once you generate the net+ prepaid mastercard®, you will notice the 16-digit card number appear, along with the security code (CVV) and the expiry date.

You can now use that net+ virtual generated card number at your favorite merchant.

Neteller net+ vcc available on limited countries only!

Note: even though the first net+ virtual prepaid mastercard® is free of charge, every next card will cost 3 USD (2.5 EUR/ 2 GBP). You can have up to 5 active net+ virtual prepaid mastercard® cards at a time.

3.Yandex money free virtual debit card

Yandex money is a russian based payment service comapany.There is no restriction for other countries to use there service and vcc for free.

When you enter there website.You would be like “what the hell is this,I don’t know this language”

“cool…….” just translate this website using google translator ��

Creation of yandex money virtual debit card

- Go to yanedex money & sign up

- Signup with your google account, social profile, or email.Also, provide phone number

- While registration you will get OTP to your mobile. So, enter OTP on the website and finish the registration.

- Then, select yandex.Money cards on left side of your homescreen.

- Select order a card or create a card (may be shown as ‘virtualmap‘ means virtual card.There may be translation error I think)

- Enter your name and create your card!

- You will receive a CVV number on your registered mobile number.

Conclusion

This is a tutorial on how to create a virtual debit card for free of cost. I have explained the best providers out there for virtual debit card and its step by step procedure for creating a new card as well. These tutorials made after check almost virtual debit card provider on the internet and provide you best one!

Hope you enjoyed it and if found useful share it with your friends as well.

Net+ virtual prepaid mastercard®

What is the net+ virtual prepaid mastercard® and how can I get one?

What is the net+ virtual prepaid mastercard?

Net+ cards are prepaid cards that operate on the mastercard® platform. Net+ cards provide you with instant access to the funds in your NETELLER account. Net+ cards are available in two types: a physical card and a virtual card.

How does the net+ virtual prepaid mastercard work?

Net+ virtual card (net+ virtual prepaid mastercard)the net+ virtual card allows you to use the funds in your NETELLER account to make online purchases wherever mastercard is accepted.

What are the fees for using the net+ card?

You can use the net+ virtual prepaid mastercard regardless of your NETELLER account currency. Learn more about changing your NETELLER account currency.

How can I get the net+ virtual prepaid mastercard?

- Simply click on the net+ cards option on the left hand side of your NETELLER account.

- Within the net+ virtualcards section, simply click on “add a card”

- Fill out the form by selecting the following options:

- Card currency – we recommend that you create your card in your NETELLER account currency to avoid NETELLER account to card FX fees

- Card name – card name can be 25 characters long and must not be the same as an existingvirtualcard name.

- Lifetime limit – this is lifetime limit, lifetime limit you can define how much money to designate to different purchase types

- NETELLER secure ID

- Administrative fee – your first card is FREE and is included with your NETELLER account

You should have a notification that your new net+ virtual prepaid mastercard is ready to use showing the card name and lifetime limit

I am an unverified member, am I still able to get the net+ virtual prepaid card?

Yes, unverified members can apply to get the net+ virtual prepaid mastercard. Unverified members can add only one net+ virtual card to their NETELLER account and have a lifetime limit of 500.00USD or equivalent currency.

You must have a positive balance before you can start using the net+ virtual prepaid mastercard.

As a verified member, can I add additional net+ virtual prepaid mastercards with an optional lifetime limit?

- Your first card is FREE and is included with your NETELLER account

- Each additional net+ virtualcard is 2 GBP/2.50 EUR/3 USD

- Verified members can add up to 5 net+ virtualcards

- Verified members can set optional lifetime limits to help them manage spending.

What are the benefits of having lifetime limits for the net+ virtual prepaid mastercard?

- Manage your spending

- With multiple virtualcards and optional user-defined card limits, you can create online shopping budgets that you can easily stick to

- Add a card for even more control

- Limit your subscription charges

- With a net+ virtualcard and optional user-defined card limit you can restrict the number of times a subscription service is withdrawn from your account

- Add a card and set a limit to avoid unwanted subscription charges.

How can I tell if I am close to reaching the lifetime limit?

When viewing the net+ virtual cards section, you will notice a lifetime limit tracker for each card. It will show you the remaining amount on each of your net+ virtual cards.

You should see a colour coded bar to visually inform you how close you are to reaching the lifetime limit.

Example: if the lifetime limit bar is yellow, you have 25% limit remaining on your net+ card. If the bar is red, you have 5% limit remaining on your net+ virtual card.

When the lifetime limit is reached, you will no longer be able to make purchases with that card.

Lifetime limit tracker sample:

Foreign exchange (FX) fees charged on the net+ virtual prepaid mastercard

- If your net+ card is in a different currency than your NETELLER account, you will be charge the NETELLER FX fee of 2.95% for each net+ transaction.

- If you perform a net+ transaction in a currency different from your net+ card, you will be charged the net+ (FX) fee of 2.95%

- If your NETELLER account is in a different currency from your net+ virtualcard, and you use your card to make transactions in a different currency again, you may be charged 2 (FX) fees, as the currency will be converted twice.

- The net+ virtual prepaid card is available in either of these currencies: EUR, GBP, USD, CAD, SEK, DKK, AUD, or JPY. We do recommend that you choose your NETELLER account currency that matches the currencies available for the net+ virtual prepaid mastercard to avoid any currency feesof 2.95%

*VIP members receive a different rebate on all net+ virtual prepaid mastercard purchases.*

How do I load funds to the net+ virtual prepaid mastercard?

Both net+ prepaid mastercard and net+ virtual prepaid mastercard are directly connected to your NETELLER account, therefore no loading is required. When you attempt a purchase using a net+ card the funds will automatically be debited from your NETELLER account. As long as you have sufficient funds in your NETELLER account to cover your purchases and any fees, the net+cards can give you instant access to your money.

Am I able to withdraw cash at an ATM with my net+ virtual prepaid mastercard?

No, since ATM terminals need a physical card to process a cash withdrawal.Cash withdrawals at an ATM are available using you net+ physical prepaid mastercard. To learn more about the net+ physical card, you can click here.

I was given a choice to choose a currency conversion while I was at the merchant store or ATM. Why was I given this choice?

Mastercard has introduced a scheme called “dynamic currency conversion” (DCC), also known as “point of sale” (POS) currency conversion, whereby you as the customer are given the choice of currency conversion options by the merchant. When you use your net+ mastercard for a transaction in a different currency than your net+ card’s nominated currency, instead of having to accept the card scheme FX rate, you can choose to convert to your card currency at the terminal either by taking the merchant’s currency conversion rate or NETELLER’S net+ currency conversion rate. Not all merchants offer this but if they do, then the rules are very clear.

Merchants must:before initiation of the transaction, the merchant must provide the pre- and post- conversion currency and amount and offer the cardholder the choice of currency conversion. The choice expressed by the cardholder must then be respected.If the merchant fails to do that and you have a concern with the currency conversion aspect of the purchase then you must take this up with the merchant.

Can I use my net+ virtual prepaid mastercard to book a hotel room, book a flight or rent a car?

We do not recommend that you use your net+ virtual prepaid mastercard to book a hotel room, book a flight or rent a car as these merchants generally need a physical card to verify. Since thevirtual card number is not the same number as your net+ physical card, they will not be able to confirm your booking.Please use your net+ physical card when performing these types of transactions.

Can I use the net+ virtual prepaid card when there is no available balance in my NETELLER account?

Net+ cards debit funds directly from your NETELLER account, therefore you must have sufficient funds in the account to cover transactions and related fees. If sufficient funds are not in your NETELLER account, then you will not be able to complete any purchases

How do I add a new net+ virtual prepaid card?

- Select the “net+ cards” link found on the left-side of your screen

- Select the net+ virtual prepaid mastercard section

- Click on "add a card"

- Select the desired currency. Please choose the currency that you do most of your shopping with as there will be a currency exchange rate fee of 2.95%.

- Note: if you are a verified member, you will have the option to have up to 5 net+ virtualcards. (the first card is free, and a fee of 2.50 EUR will be applied for each additional card).

- Name your card (optional).

- Once you generate the net+ virtual mastercard, you will notice the 16-digit card number appear, along with the security code (CVV) and the expiry date. You can now use that net+virtual generated card number at your favorite merchant.

Verified members have the option to have more than one card. (A fee of 2.50 EUR will be applied for each additional card). Your NETELLER account must have enough funds to cover the fee.

How do I cancel my net+ virtual prepaid mastercard?

- Select the “net+ cards” link found on the left-side of your screen

- Select the net+ virtual prepaid mastercard section

- Click on "cancel card". A pop-up message will ask you to confirm the action. *A fee of 2.50 EUR will applied for a new card*

Is there a fee if I do not use my net+ virtual prepaid card?

Unlike other similar prepaid cards, there is no fee if you do not use your net+ card.

I have a reason to believe that someone has access to my net+ prepaid virtual mastercard what do I do?

If you believe your net+ virtual prepaid mastercard® has been compromised, contact us immediately at +1.403.212.3025

что можно сказать в заключение: what is the net+ virtual prepaid mastercard® and how can I get one? How does the net+ virtual prepaid mastercard®* work? The net+ virtual prepaid mastercard® allows you to use the funds in по вопросу neteller virtual card

Комментариев нет:

Отправить комментарий