Registration skrill

Below you have specify your personal data. It should be as stands in your passport. Only real details should be specified, otherwise you’ll fail to complete account and identity verification procedure. After you’ve entered all the information, press the 'continue to step 2' button. Oftentimes players face difficulties when using skrill because they’ve failed to create an account properly. Therefore we’ve decided to elaborate a detailed instruction on registration a new skrill account with highlights on key points that should be taken into account. As a matter of fact, registration at skrill is quite simple.

Skrill account registration - how to sign up for skrill

Oftentimes players face difficulties when using skrill because they’ve failed to create an account properly. Therefore we’ve decided to elaborate a detailed instruction on registration a new skrill account with highlights on key points that should be taken into account. As a matter of fact, registration at skrill is quite simple.

Please note! Before creating an account at skrill, we strongly recommend you to open a credit card (in euro or dollar) in a bank - VISA electron or VISA classic with an option to carry out internet transactions. This is necessary in order to activate your skrill account. Fill up the account and adjust online banking mode. It’s very important because will be charged a certain amount of money (from $1.01 up to $2.99) as verification of the account. You’ll need to specify the sum you’ve been charged. In case you have specified the sum correctly your bank card will be attached to the account. Afterward the money will be transferred to your skrill account.

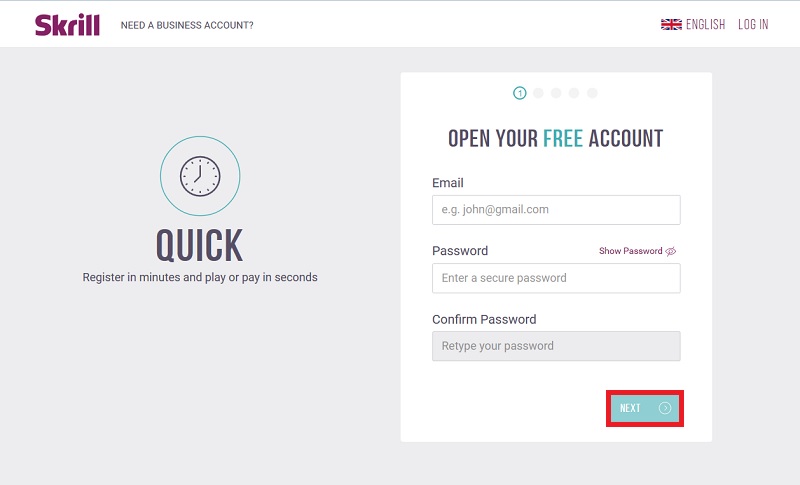

Step 1. Go to skrill website. You’ll find yourself on the account sighn up webpage at skrill.

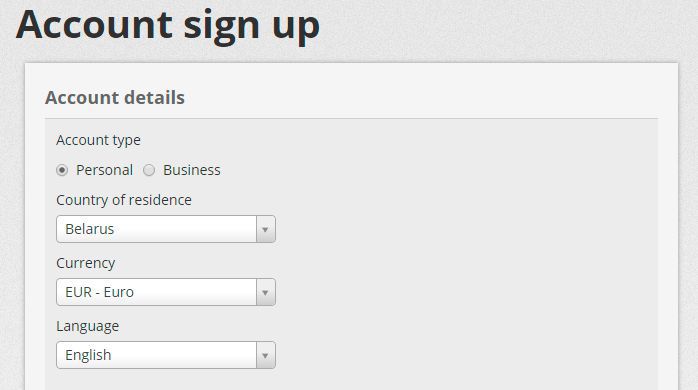

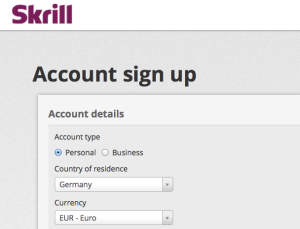

Step 2. Skrill - account sign up.

In order to complete the first step when registering your skrill account, you have to enter your account details. Choose 'account type' - personal, your country of residence, currency (remember, that you won’t be able to change it in future) and also the language.

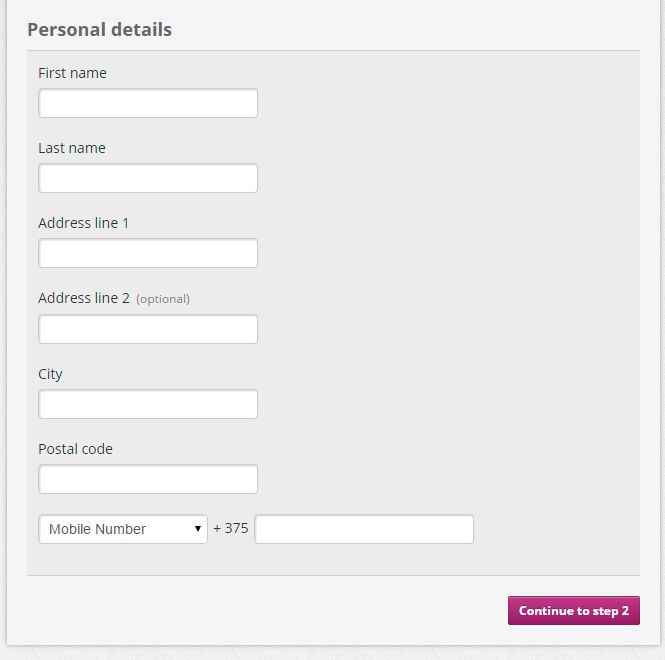

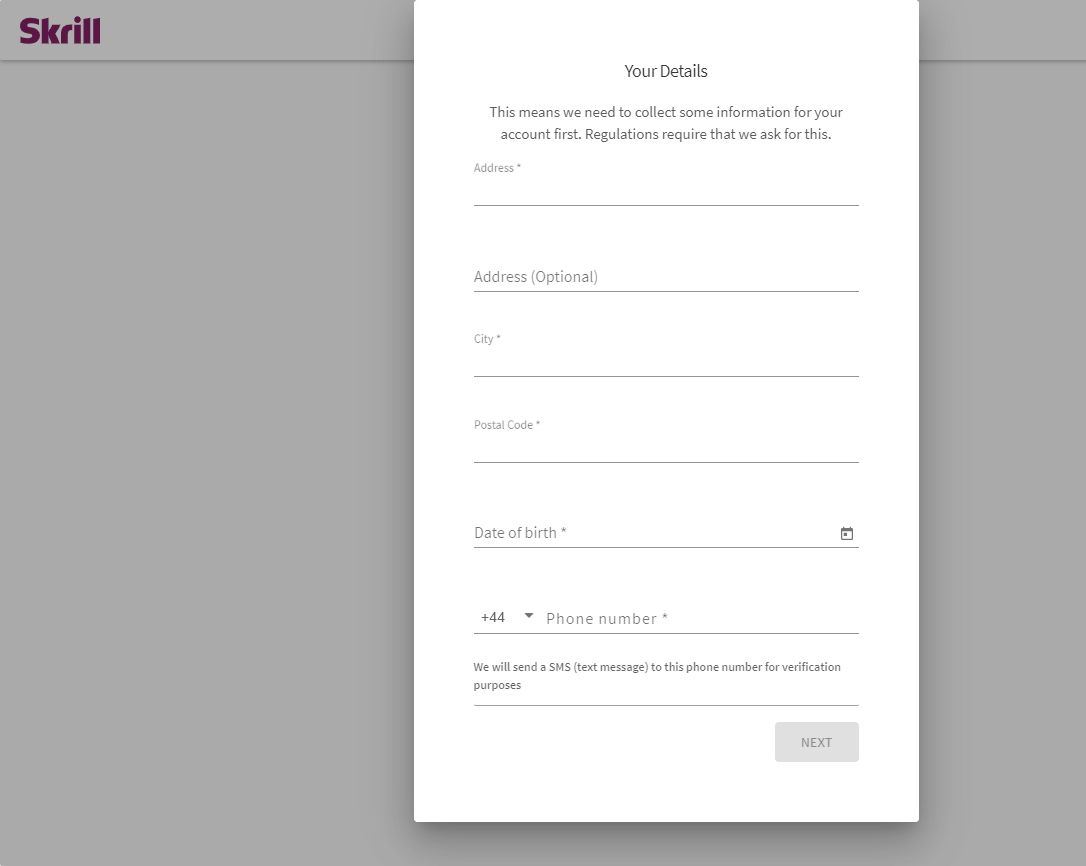

Step 3. Skrill personal details

Below you have specify your personal data. It should be as stands in your passport. Only real details should be specified, otherwise you’ll fail to complete account and identity verification procedure. After you’ve entered all the information, press the 'continue to step 2' button.

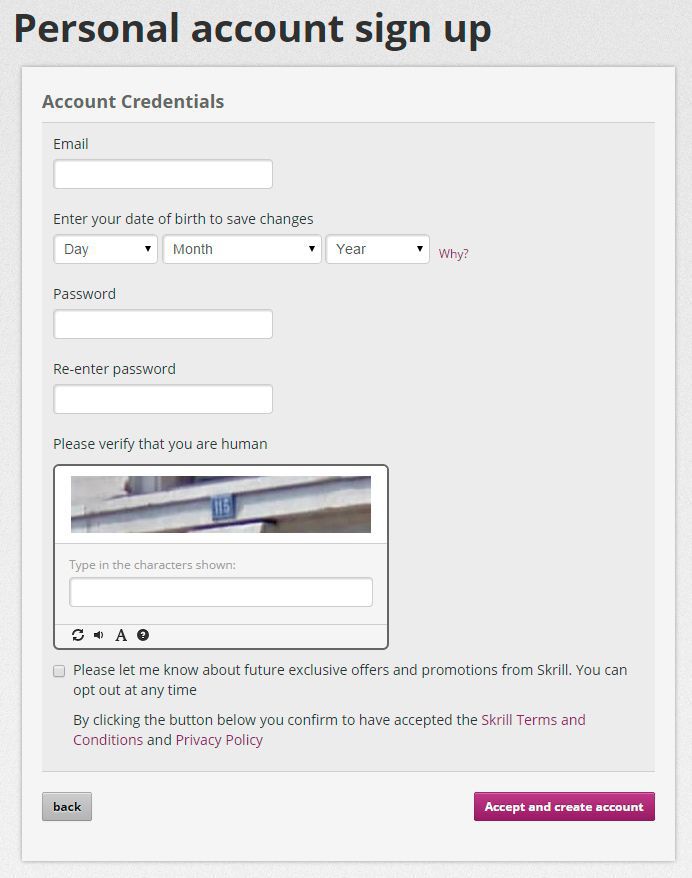

Step 4. Account credentials

At this point you’ll have to enter you email address, date of birth and also invent the password. Pay attention, that the email address you’ve named will be used as your login to sign up to the skrill website and carry out money transactions. Therefore use your main email address. Your birth date information will be necessary for making payments - this will be the confirmation of all your transactions.

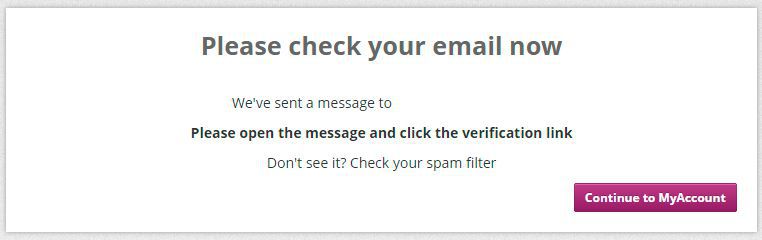

Step 5. Email address confirmation

You’ve successfully created an account at skrill and its ready for use. All you have to do is to confirm the email address you’ve mentioned previously.

Step 6. Now you can verify your identity and use skrill payment system and have a good time!

Skrill registration with $15 signup bonus

Skrill registration – register a 2nd currency account

As skrill silver VIP or higher, you are able to register additional currency accounts.

Skrill silver vips are allowed to have two currency accounts at the same time, skrill gold vips can have three and skrill diamond vips can even have four skrill currency accounts the same time.

Before proceeding with your additional skrill registration for another currency account, please make sure you fulfill these requirements, otherwise your new skrill account would be automatically suspended.

- Use our skrill registration link to setup your new skrill account:

https://www.Ewallet-optimizer.Com/go/skrill-signup/ - Enter your account data with your new preferred skrill account currency. Every skrill account is linked to one email address, so please choose another email address to the one you chose for your main skrill account. You might also need to enter a different last phone number digit that will be corrected by our skrill support later on.

- When you are done with the new skrill registration, please do not forget to send us your new skrill account data, so we can ensure this new skrill account is also part of our additional ewallet-optimizer program as well.

- Please note that the skrill system will most likely automatically freeze your new account.

To unlock your 2nd currency account, please send an email to [email protected] to request the activation of your 2nd currency account. The skrill VIP team will then transfer your verification and VIP upgrade from your 1st account and your new account will be ready within 1 day. - Once your new skrill account is linked to your old one, you can also order a new skrill mastercard for free for your new account.

- Make sure to hit the required transfer amounts to maintain your skrill VIP status and to benefit from our monthly ewallet-optimizer loyalty program.

Skrill registration – switch account currency

If you need to register another skrill currency account instead of your actual one, please follow the instructions below. By following all steps, you will NOT need to verify your account again and you will become member of our free additional ewo loyalty program.

- Log into your existing skrill account. Transfer any funds left to a friend of yours or withdraw them before you proceed so the account is completely empty.

- Go to your account → “account settings” and click “close” at the lower right corner to close your current skrill account.

- Use our skrill registration link to setup your new skrill account:

https://www.Ewallet-optimizer.Com/go/skrill-signup/

enter your address and preferred new skrill currency for your skrill account and use a different email address and phone number. Our skrill support will be able to correct this manually later on. - Your new skrill account will now be created and ready to use. Please enter your new skrill account details to join our additional ewallet-optimizer program for FREE to enjoy all additional benefits and services.

- Please note that your new accounts needs to be fully verified again. To start your skrill account verification, please login to your account and upload your documents directly from within it. To fully verify your account you need to upload a copy of your passport or ID with both sides and all four corners visible, a selfie of your face holding a handwritten note with “skrill” and the date of the verification process next to it as well as a document which verifies your address (like a utility bill) – our clients can directly upload their documents – no deposit or webcam needed!

When done, you are then able to use your new skrill currency account as your old one. If you want to use your old skrill account’s email address again, please make sure the skrill support deletes it completely from your old account and add it by going to account settings at:

My account -> settings -> personal info -> email addresses

In most cases, that’s it and you can enjoy your new skrill currency account with hopefully less future exchange fees.

Sometimes, you need to contact the support again about old bank accounts that were linked with your old skrill account. If so, please send another email to our skrill support team at [email protected] and they will take care of it.

If you have any questions or problems with your skrill registration or about our free ewo loyalty program, please do not hesitate to contact us .

Skrill – join us for FREE

Join us for free

New skrill account

Existing account

Enter your account data

Existing skrill account

New skrill account

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Get the complete package with arbusers

Register your skrill account with arbusers and enjoy a unique service and benefits

Comprehensive skrill review and extra benefits from arbusers

Every smart bettor will tell you – an ewallet is your must-have accessory when it comes to online betting. But everyone has different needs, so there are still lots of debates about which ewallet works best for betting.

That’s why we present you with an all-in-one skrill review where you’ll find all your questions answered. Learn more about skrill and decide whether it’s an ewallet for you. Plus, get extra perks and benefits when you create your account with arbusers.

We brought to you a number of services and products to support your smart betting operations. Ewallets are essential tools to support your gambling business. Register your skrill account with arbusers and get the complete package.

What you get with arbusers

- Instant verification.

- No transaction limits. All accounts referred by arbusers will have NO LIMITS.

- A skrill mastercard with the highest limits in the industry (available to SEPA countries clients).

- Extra bonuses and rewards from skrill.

- Reduced costs for p2p transactions for all vips.

- Personalised assistance by arbusers that goes far beyond the use of ewallets.

It is highly advisable that you register your skrill account with arbusers, otherwise:

- You will have to complete a deposit before proceeding with KYC. Resulting in a delay of at least some days.

- Your verification and the overall received support will be the same as the general audience.

- You will not enjoy the support of the skrill dedicated team serving arbusers members. You will not have arbusers support and guidance if needed.

Please have in mind that arbusers sees ewallets registration as a key loyalty characteristic of its members. Registering your ewallets with arbusers leads to superior support in your smart betting operations that no other website offers. Between colluding interests, arbusers has made a choice to stand with and by the players and expects from players to make the same choice.

Skrill review: what is skrill and how it works

Skrill is one of the leading e-wallets in the industry, having more than 40 million users worldwide. Skrill provides services since 2001, which makes it also one of the oldest e-wallets available. You may know it by its former name, moneybookers.

Skrill users store money, check their balance, and make payments online. You can do it online on the skrill website or download a mobile app to use skrill on the go.

Most bookmakers, exchanges, online casinos, poker rooms, and forex platforms accept skrill. It’s also possible to use skrill to buy and sell cryptocurrencies.

Need some cash? There’s a prepaid skrill mastercard available at your service. And if you prefer online shopping, there’s always a virtual card to use for that purpose.

Pros and cons of using skrill

- Easy and instant transfers

- Free transfers to the bank account

- Prepaid mastercard and virtual payment cards available

- Widely accepted by bookmakers, poker and casino sites, and forex platforms

- High currency conversion charges (3.99%)

- Prepaid mastercard supports only four currencies

- Slow customer support

Skrill account registration and verification

It’s easy to register a new skrill account:

STEP #1: follow our skrill registration link to get more perks with your new account

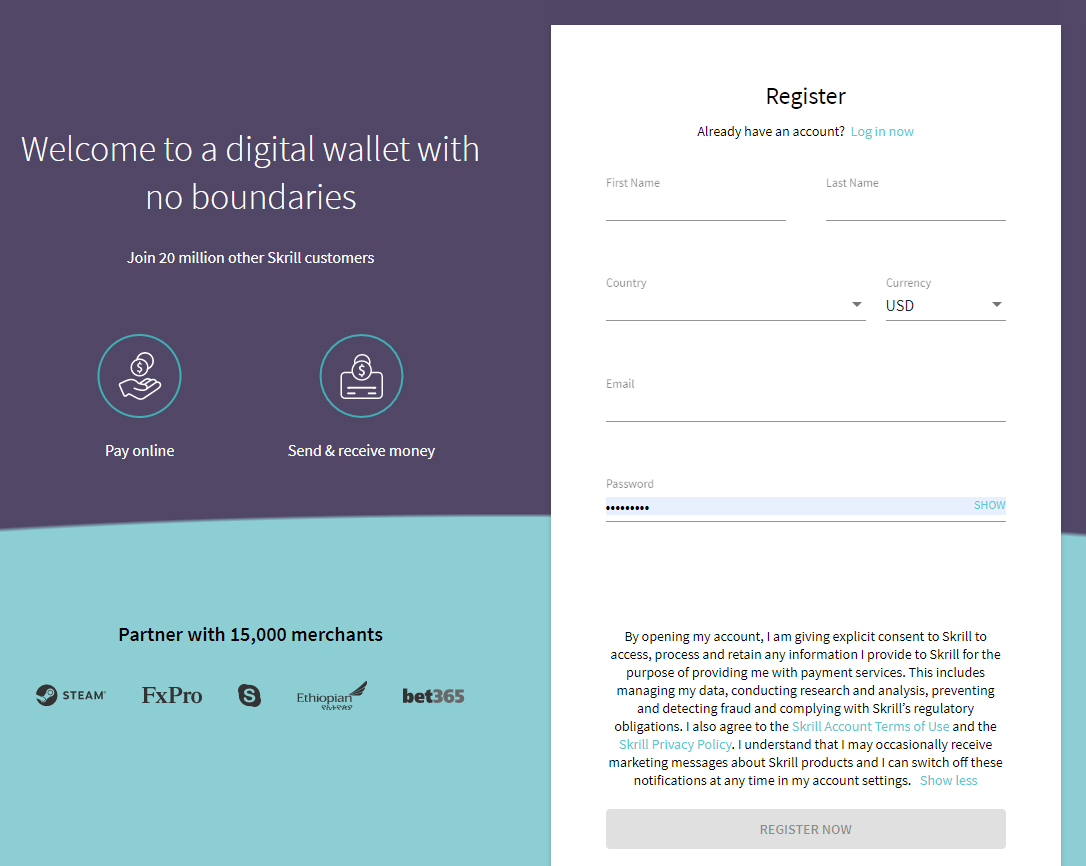

STEP #2: type your name, email, and password to create the account

STEP #3: provide more details to make a deposit

Of course, an empty skrill account is of no use to you, so the deposit should follow. And you will need to provide more details to top up your e-wallet. These details include your country of residence, full address, your date of birth, and the currency of your skrill account.

This step alone unlocks the basic features of your skrill account. But to get the full access and increase your limits, you’ll need to verify your account:

STEP #4: follow the instructions provided by skrill upon registration and upload all appropriate documents.

Skrill deposits and withdrawals

You can use plenty of options to top up your skrill account:

- Bank transfer

- Debit and credit cards (maestro, mastercard, VISA, american express, JCB)

- E-wallets (neteller, paysafecard)

- Bitcoin

Some fees may be applicable depending on your country of residence and the preferred depositing method.

Bank transfer, wirecard, and VISA are available for withdrawing your balance. You can also cash out your funds with a prepaid mastercard. Otherwise, use the funds to pay for services online or send money to other skrill users.

Prepaid mastercard and virtual cards

Skrill offers a prepaid contactless mastercard to have instant access to your skrill balance. It takes seconds to order the card (online or via mobile app), and you’ll receive it within the next ten days. The card supports euros, british pounds, the US dollars, and polish zloty. You can use the card to pay for goods and services or to withdraw cash from the atms. It works everywhere in the world where mastercard is accepted.

If you prefer online shopping, you can use a virtual mastercard instead. You won’t get a physical card for offline shopping or atms but all the details of such a card to buy things online.

The first virtual card by skrill is free of charge. You can also get extra virtual cards for an additional fee of 2.5 euros each.

Skrill mobile app

Skrill offers free mobile apps available for both android and ios devices. Skrill apps enable all the features available online, including:

- Loading funds to your account

- Transferring money to more than 180 countries worldwide

- Sending money to other skrill users, bank accounts, e-wallets, or email addresses

- Paying for online services

- Checking your skrill account balance

- Ordering skrill prepaid mastercard

- Receiving real-time notifications about your transactions

How skrill ensures security

Being a leader in e-wallets, skrill knows a thing or two (or hundred) about safety. Skrill services are authorized by the financial conduct authority (FCA). Plus, skrill is known to use risk and anti-fraud technology to keep your funds secure at all times.

Skrill will never share your card or bank details with the retailers or other third parties. They encrypt all the data following the highest industry standards (PCI-DSS level 1). Thus, even if anyone would intercept the data, it would not be possible to make sense of it.

Finally, even if the hackers crack your password, skrill requires two-factor authentication. That means your password is not enough to log in to your skrill account. Sure, you will need a couple of extra seconds to access your account. But it adds an extra layer of security to keep your funds safe from all kinds of online threats.

Skrill fees

You can create a skrill account for free. You won’t get any charges for receiving money into your skrill account.

Want to pay for some goods or services online? As long as the retailer accepts skrill payments, you won’t have to pay a dime either.

Skrill works for most of the international payments. It uses only real-time exchange rates; thus, you save more. You can transfer money to bank accounts in 45 countries, and no charges will be applicable.

When it comes to sending money to other accounts, the standard skrill fee is 1.45% of the transfer sum. The charges go up only if you don’t use your skrill account for more than a year.

Skrill customer support

Any questions left unanswered? What this skrill review didn’t cover, skrill customer support definitely will.

While you can find an explicit FAQ section at the skrill website, customer support by skrill is not particularly fast for regular clients. But if you register via arbusers, you’ll enjoy the dedicated skrill support available to our members only. In addition, you can contact us (arbusers) via skype, PM, or email and we will be happy to have a discussion with you.

How to open a skrill account

(1)click the logo or link below to access skrill (formerly moneybookers)

(2)click “sign up” in the upper right-hand corner

If the site is not shown in your preferred language, you can change the language by going to the upper right-hand corner of the screen to select your language of choice.

(3)after clicking “sign up”, the following screen will appear for you to enter your details

When choosing the currency of your account, we recommend that you select the same currency as your betting currency at the online bookmakers where you have registered to save on transaction fees when depositing and withdrawing.

Click “continue to step 2” to move on to the next screen.

After entering in all your details, click the purple “accept and create account” button.

(4)registration complete

After completing your registration, you will be shown a screen similar to the one above instructing you to check your registered email address account.

(5)skrill verification email

After accessing your registered email address account’s inbox, find the email from skrill and click the purple “verify your email address” button as indicated above.

Get the complete package with arbusers

Register your skrill account with arbusers and enjoy a unique service and benefits

Comprehensive skrill review and extra benefits from arbusers

Every smart bettor will tell you – an ewallet is your must-have accessory when it comes to online betting. But everyone has different needs, so there are still lots of debates about which ewallet works best for betting.

That’s why we present you with an all-in-one skrill review where you’ll find all your questions answered. Learn more about skrill and decide whether it’s an ewallet for you. Plus, get extra perks and benefits when you create your account with arbusers.

We brought to you a number of services and products to support your smart betting operations. Ewallets are essential tools to support your gambling business. Register your skrill account with arbusers and get the complete package.

What you get with arbusers

- Instant verification.

- No transaction limits. All accounts referred by arbusers will have NO LIMITS.

- A skrill mastercard with the highest limits in the industry (available to SEPA countries clients).

- Extra bonuses and rewards from skrill.

- Reduced costs for p2p transactions for all vips.

- Personalised assistance by arbusers that goes far beyond the use of ewallets.

It is highly advisable that you register your skrill account with arbusers, otherwise:

- You will have to complete a deposit before proceeding with KYC. Resulting in a delay of at least some days.

- Your verification and the overall received support will be the same as the general audience.

- You will not enjoy the support of the skrill dedicated team serving arbusers members. You will not have arbusers support and guidance if needed.

Please have in mind that arbusers sees ewallets registration as a key loyalty characteristic of its members. Registering your ewallets with arbusers leads to superior support in your smart betting operations that no other website offers. Between colluding interests, arbusers has made a choice to stand with and by the players and expects from players to make the same choice.

Skrill review: what is skrill and how it works

Skrill is one of the leading e-wallets in the industry, having more than 40 million users worldwide. Skrill provides services since 2001, which makes it also one of the oldest e-wallets available. You may know it by its former name, moneybookers.

Skrill users store money, check their balance, and make payments online. You can do it online on the skrill website or download a mobile app to use skrill on the go.

Most bookmakers, exchanges, online casinos, poker rooms, and forex platforms accept skrill. It’s also possible to use skrill to buy and sell cryptocurrencies.

Need some cash? There’s a prepaid skrill mastercard available at your service. And if you prefer online shopping, there’s always a virtual card to use for that purpose.

Pros and cons of using skrill

- Easy and instant transfers

- Free transfers to the bank account

- Prepaid mastercard and virtual payment cards available

- Widely accepted by bookmakers, poker and casino sites, and forex platforms

- High currency conversion charges (3.99%)

- Prepaid mastercard supports only four currencies

- Slow customer support

Skrill account registration and verification

It’s easy to register a new skrill account:

STEP #1: follow our skrill registration link to get more perks with your new account

STEP #2: type your name, email, and password to create the account

STEP #3: provide more details to make a deposit

Of course, an empty skrill account is of no use to you, so the deposit should follow. And you will need to provide more details to top up your e-wallet. These details include your country of residence, full address, your date of birth, and the currency of your skrill account.

This step alone unlocks the basic features of your skrill account. But to get the full access and increase your limits, you’ll need to verify your account:

STEP #4: follow the instructions provided by skrill upon registration and upload all appropriate documents.

Skrill deposits and withdrawals

You can use plenty of options to top up your skrill account:

- Bank transfer

- Debit and credit cards (maestro, mastercard, VISA, american express, JCB)

- E-wallets (neteller, paysafecard)

- Bitcoin

Some fees may be applicable depending on your country of residence and the preferred depositing method.

Bank transfer, wirecard, and VISA are available for withdrawing your balance. You can also cash out your funds with a prepaid mastercard. Otherwise, use the funds to pay for services online or send money to other skrill users.

Prepaid mastercard and virtual cards

Skrill offers a prepaid contactless mastercard to have instant access to your skrill balance. It takes seconds to order the card (online or via mobile app), and you’ll receive it within the next ten days. The card supports euros, british pounds, the US dollars, and polish zloty. You can use the card to pay for goods and services or to withdraw cash from the atms. It works everywhere in the world where mastercard is accepted.

If you prefer online shopping, you can use a virtual mastercard instead. You won’t get a physical card for offline shopping or atms but all the details of such a card to buy things online.

The first virtual card by skrill is free of charge. You can also get extra virtual cards for an additional fee of 2.5 euros each.

Skrill mobile app

Skrill offers free mobile apps available for both android and ios devices. Skrill apps enable all the features available online, including:

- Loading funds to your account

- Transferring money to more than 180 countries worldwide

- Sending money to other skrill users, bank accounts, e-wallets, or email addresses

- Paying for online services

- Checking your skrill account balance

- Ordering skrill prepaid mastercard

- Receiving real-time notifications about your transactions

How skrill ensures security

Being a leader in e-wallets, skrill knows a thing or two (or hundred) about safety. Skrill services are authorized by the financial conduct authority (FCA). Plus, skrill is known to use risk and anti-fraud technology to keep your funds secure at all times.

Skrill will never share your card or bank details with the retailers or other third parties. They encrypt all the data following the highest industry standards (PCI-DSS level 1). Thus, even if anyone would intercept the data, it would not be possible to make sense of it.

Finally, even if the hackers crack your password, skrill requires two-factor authentication. That means your password is not enough to log in to your skrill account. Sure, you will need a couple of extra seconds to access your account. But it adds an extra layer of security to keep your funds safe from all kinds of online threats.

Skrill fees

You can create a skrill account for free. You won’t get any charges for receiving money into your skrill account.

Want to pay for some goods or services online? As long as the retailer accepts skrill payments, you won’t have to pay a dime either.

Skrill works for most of the international payments. It uses only real-time exchange rates; thus, you save more. You can transfer money to bank accounts in 45 countries, and no charges will be applicable.

When it comes to sending money to other accounts, the standard skrill fee is 1.45% of the transfer sum. The charges go up only if you don’t use your skrill account for more than a year.

Skrill customer support

Any questions left unanswered? What this skrill review didn’t cover, skrill customer support definitely will.

While you can find an explicit FAQ section at the skrill website, customer support by skrill is not particularly fast for regular clients. But if you register via arbusers, you’ll enjoy the dedicated skrill support available to our members only. In addition, you can contact us (arbusers) via skype, PM, or email and we will be happy to have a discussion with you.

Topics

How to verify my account and increase my limits?

Increasing your limits is usually a matter of providing additional account verifications which is quick and easy.

Once you have started using your account to make transactions, you will be given the option to provide an additional verification of your identity, by uploading a clear, legible, valid and unaltered scanned colour copy or photo of one of the following documents:

• the front and back of your driving license

• the photo page of your passport

• front and back of your national ID card

• address verification document

• face match/selfie picture of you

Fund account

Funding your skrill account is part of the verification process. You can complete the verification of your account ONLY after a successful funding. You can fund your skrill account by using any of upload options available in the deposit section of your account or by receiving money from other skrill customer or merchant.

You can start the process of uploading a copy of your photo identification documents by clicking on the banner, visible after you login to your skrill wallet or via the settings section of your account, under verification.

* click to enlarge the image

This will take you to the verify your account page where all remaining verification steps will be displayed.

You can choose to verify your account via your facebook profile or to follow the standard verification flow.

* click to enlarge the image

** depending on your country of residence this option may not be available to you

Once you start the verify ID process, you will be presented with 2 options allowing you complete the ID verification:

* click to enlarge the image

1.Download our mobile app – this is the fastest option allowing you to download our app and use your phone camera to take photos and upload them to our secure verification system. You can download the skrill application (skrill google play/skrill apple app store) and use your smartphone camera in order to easily complete this verification step.

* click to enlarge the image

2. Upload photos – this is a fast option allowing you to use your webcam to capture images or upload photos of the front and back of your ID, as well as a selfie of you holding a handwritten note with the phrase generated on screen during the verification.

By clicking on upload photos, you will be given the option to choose your document type and country of issuance.

* click to enlarge the image

Next you will be required to upload your documents or use your webcam to capture a new copy of your document and a selfie with a handwritten note with the phrase generated on screen during the verification.

* click to enlarge the image

After successfully uploading/using your webcam to submit your documents and an image of you holding a note, the verify your ID step will be IN REVIEW.

You will then receive a success message and can continue to any remaining verification steps.

* click to enlarge the image

Verify address

If you have not yet shared your browser location, you will be prompted to do it to fulfill the verify your address requirement.

* click to enlarge the image

The geolocation service is available for selected countries only. If your country is not supported, we'll give you the chance to manually upload an address verification document.

* click to enlarge the image

On the summary page you will see that certain steps have been completed and that the submitted documents are being reviewed.

* click to enlarge the image

Once the verification process is fully completed you will receive an email confirmation.

Additional information on the account verification process you can find here.

How to create a new skrill account?

You only have to create an account, pass the verification process and make the deposits three times lower than the ordinary users.

To ensure that our link works correctly, please clean cache and cookies, turn VPN and private mode in your browser off (if you’re using one of them) before clicking on it.

To sign up a new account, click here. Already have an account? Just fill in the form.

- Enter your email, password, and click next (screenshot 1).

- Fill in your personal info: first and last name, country, date of birth, and click next

(screenshot 2). - Provide your address information (street, house, city, region, post code) and click next

(screenshot 3). - Choose account currency (screenshot 4).

That’s it, the account is created! (screenshot 5).

But before you move to account verification, do not forget to fill in the application form on our website.

Wait for our response with further instructions!

If you do not receive any email from us within 2 business days, please contact our support.

- Do not make any deposits to merchants from your account, until you receive the confirmation letter!

- Verificate your account in 7 days from the moment of the registration a new account.

- Make a deposits according to our special terms:

Start the verification after receiving the confirmation letter from vipdeposits.

Join SKRILL + VIPDEPOSITS LOYALTY PROGRAM

If you already have a skrill account,

please proceed to step 2 and fill out the form.

Registration skrill

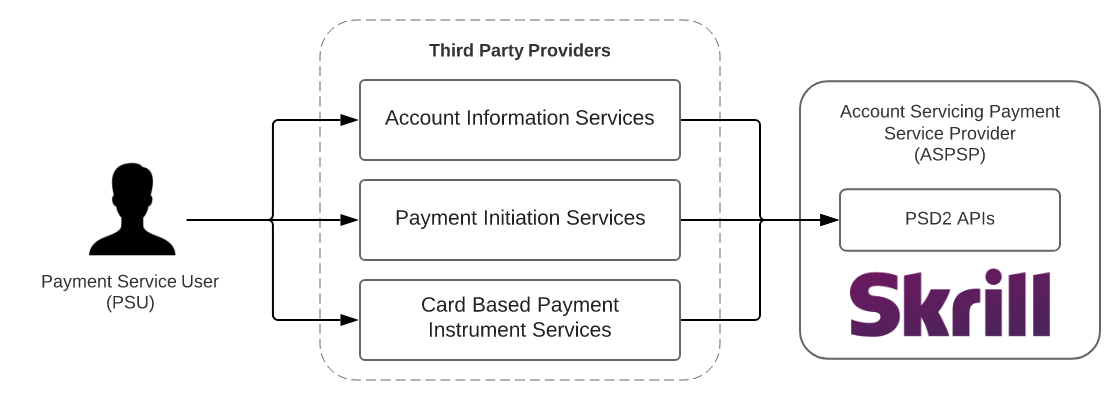

European payment services directive 2015/2366 (also known as PSD2) defines the following actors and roles:

Payment service user (PSU) - psus are the end-users of the services provided by tpps and aspsps. They are either physical persons or entities (organisations, companies, administrationsвђ¦). They do not interact directly with the PSD2 API.

Account servicing payment service provider (ASPSP) - these are payment service providers (psps) which are in charge of holding payment accounts for their customers (PSU).

Third party provider (TPP) - these actors can intermediate between psus and aspsps, acting on behalf of PSU. Depending on the services they provide tpps fall in one of the following categories;

- Account information services (AISP role) will allow the PSU to get information, through a single interface, about all of his/her accounts, whatever the ASPSP holding this account.

- Payment initiation services (PISP role) for requesting a payment request approval by the PSU and requesting the subsequent execution through a credit transfer.

- Card based payment instrument issuers (CBPII role) that will check the coverage of a given payment amount by the psuвђ™s account.

Skrill acts as account servicing payment service provider (ASPSP) in PSD2 terms.

Skrill payment service directive compliance

In compliance PSD2, skrill provides modified customer interface (mobile apis) to qualified third party payment service providers for the following purposes:

- Account and transaction information for account information service providers (aisps)

- Payment initiation for payment initiation service providers (pisps)

Card-based payment instrument issuers (cbpiis) use cases are not supported by skrill

The apis are modified existing customer interfaces fulfilling the following PSD2 requirements:

- API access is restricted only to qualified third party providers.

- TPP API access is restricted to their respective regulated roles

- Access to PSU account and data from TPP requires explicit user conscent, that can be revoked

- Transaction operations require strong customer authentication

Qualified third party providers

In the context of PSD2, being a qualified third party provider (TPP) means:

- Having obtained the authorization from a national competent authority (NCA) to operate as a payment services provider, with the roles it requires (AISP, CBPII, PISP). The list of national register entities can be found on the open banking europe website.

- Having obtained from a qualified trust service provider (QTSP), qualified website authentication certificates (QWAC) and qualified sealing certificates (qsealc), that have a PSD2 eidas certificate profile. Details on qualified trust service providers and the PSD2 eidas certificate profile can also be found on the open banking europe website.

Skrill supports only qualified website authentication certificates (QWAC) certificates for API access

In order for a third party to qualify for production API access, both steps must have been completed and they must have matching data (the NCA delivers a registration number that must written in the certificate data).

It is possible for a qualified third party to lose its qualification, either because the certificate becomes invalid, or because the NCA decides to revoke the tppвђ™s authorization.

Third party provider oauth client registration

In order to access skrill apis, the third party providers are required to register oauth 2 clients for their applications. Registration and management of oauth 2 clients is provided by PSD2 oauth2 and client management apis.

Client management API calls require mutual TLS authentication, with a qualified website authentication certificate (QWAC) issued to the TPP by a qualified trust service provider.

Client registration is performed through POST request on /psd2-oauth2/v1/registrations resource in client management API endpoint with JSON body containing the following properties:

- Client_name - A human-readable name for the client, that will be shown to the user during the consent process.

- Scope - REQUIRED A space-separated list of scopes, that the client has (or requests) access to. In a PSD2 context, the following values are available:

- Aisp - account information and recent transaction history apis

- Pisp - payment initiation service providers use cases apis

- Cbpii - card-based payment instruments issuers use cases apis

- Logo_url - OPTIONAL URI string that specifies a logo for the client, as a data scheme URI. If available, the data will be used to show the user a logo during the consent process.

- Token_endpoint_auth_method - token endpoint authentication method. Use urn:paysafe:oauth:token-endpoint-auth-method:eidas-qwac:psd here.

- Redirect_uris - REQUIRED A list of HTTPS urls that describes the redirection endpoints for the client.

- Grant_types - REQUIRED restricted to authorization_code and refresh_token . Other grant types are not supported in a PSD2 context.

- Response_typesREQUIRED - use code as a value here.

- Jwks - A JSON web key set object, that describes the public keys and certificates related to the given client. In the scope of PSD2, the JWK set must be the set of qualified sealing certificates (qsealc) that can be used by the client to sign requests.

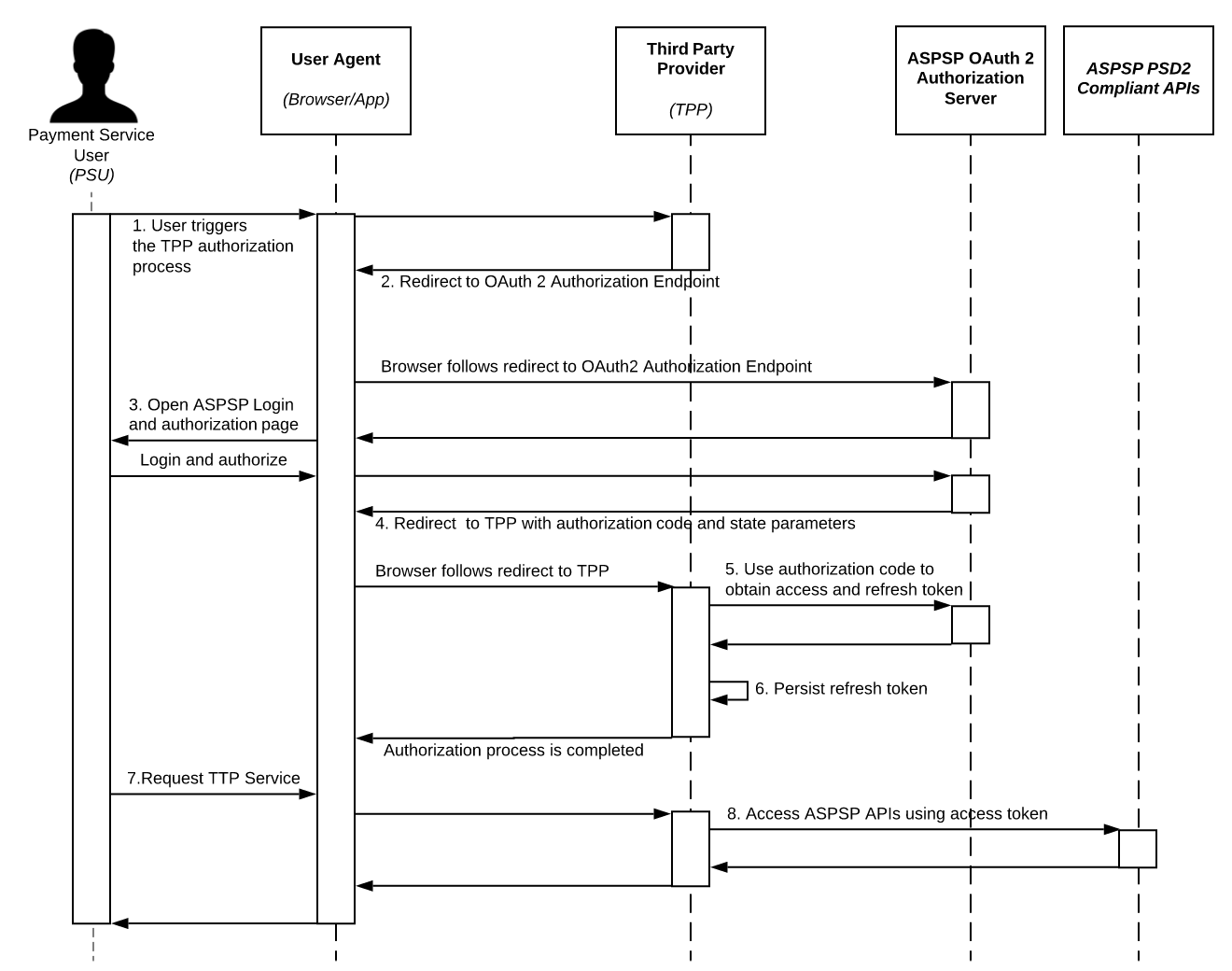

Authentication and authorization flow

Authentication and authorization is implemented as specified in oauth 2.0 authorization code grant flow RFC 6749.

The essential prerequisities for setting up the authorization flow for TPP applications are the following:

- Oauth 2 client must be registered for the TPP applicaion

- TPP application must integrate with the PSD2 oauth2 authorization server and token endpoints.

- Use of the oauth 2 PKCE extension is mandatory, with the SHA-256 method

The detailed authorization flow proceeds as described in the sequence diagram:

- From the third party provider (TPP) website/application, the payment service user (PSU) triggers the authorization process in order to allow access to his skrill account resources

- The TPP website/application redirects the browser to the ASPSP (skrill) oauth 2 authorization server, with the required oauth 2 client parameters

- Response_type - equals to code

- Client_id - the oauth client ID registered by TPP during onboarding

- Scope - the desired access scope. The scope must be one of client scopes defined during client registration.

- Redirect_url - the redirect url provided by TPP, to which to return the authorization code.

- State - the TPP session state parameter

- Code_challenge - SHA-256 code challenge parameter as defined in section 4.2 of oauth 2 PKCE extension

- The ASPSP (paysafe) oauth 2 authorization server provides the user login and conscent interface. At this point the payment service user, must authorize the third party provider.

- The browser gets redirected back to TPP redirect URL with the authorization code and state request parameters

- Third party provider (TTP) application uses the authorization code and PCKE secret (code_verifier) to obtain access and refresh token from oauth authorization server. The following parameters are passed to the oauth authorization server

- Client_id - the TPP oauth 2 client id

- Client_secret - the TPP oauth 2 client secret

- Grant_type - use authorization_code as value

- Code - the authorization code

- Redirect_uri - should match the oauth client redirect url

- Code_verifier - PCKE code verifier

- Refresh token can be persisted by TPP application and used for re-issuing access tokens as specified in section 6 of RFC6749. Access tokens obtained in this way only provide access to information for which an SCA is not necessary.

- Payment service user uses the related TPP functionality, that requires ASPSP

- TPP can access the corresponding ASPSP (skrill) apis on user behalf using the obtained access token.

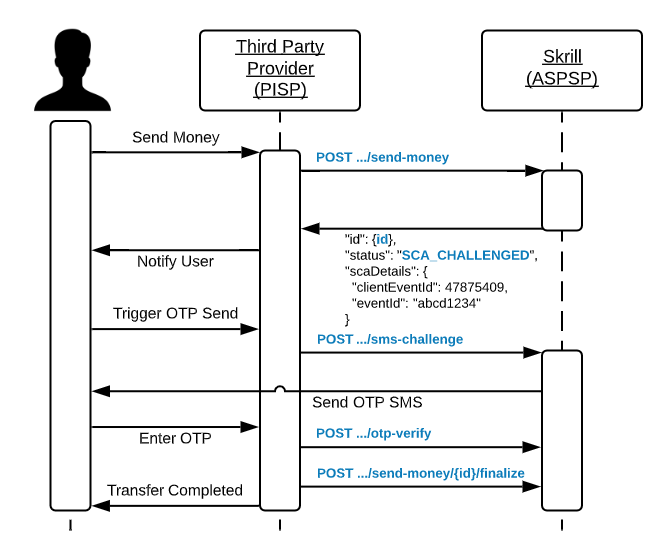

Strong customer authentication

Strong customer authentication (SCA) is a requirement for payment actions. Upon initiation of money transfer, the transfer will get SCA challenge in the response and can not be finalized until SCA challenge is resolved by the user.

One time password generation is triggered and send directly to the user according to his account configuration. The OTP is passed over from the user to the third party provider and used to confirm the OTP challenge. After that the transaction can be finalized.

User presence and offline account access

Tpps are required upon calling skrill apis for AISP and PISP use cases to attach PSU original IP address as HTTP header.

The following HTTP header should be present and carry the PSU origin:

The absense of the PSU IP address is interpreted as TPP accessing user data without user presence and such calls are subject to the following restrictions

- AISP shall not access PSU account data in unattended mode more than 4 times in 24 hours unless it has collected the user consent for that.

Account information services apis

The apis allow accessing PSU account and transaction history information using the below listed apis.

The apis requires one of the following scopes:

- Aisp - allows accessing customer account information and recent transaction history

Payment initiation services apis

The apis allow performing transactions to other skrill accounts.

The apis requires pisp scope for access. During money transfer SCA challenge will be triggered.

Card based payment instrument use cases support

Skrill mobile apis does not provide dedicated api for funds confirmation.

API documentation and support

Server API endpoints can be found in their respective API reference documentation:

Skrill registration changes – phone authentication

Update 25th september, 2019:

The phone authentication is live now, but currently only for the following countries:

More countries will follow step by step and we will of course keep you posted about the progress.

Please note: you will have the option to completely skip this step – however, we highly recommend to finish the authentication to avoid any issues later.

Skrill registration changes – details

We already informed you about the PSD2 (payment service directive) in our latest news and we now have an update for you from skrill. Let’s start with some good news: there are NO changes expected for NETELLER & ecopayz in the near future. Of course this can (and most likely will change) at some point, because all banks and payment providers are forced to increase their security, but we don’t expect anything in the near future. As soon as there is any update for the other providers we will inform you accordingly.

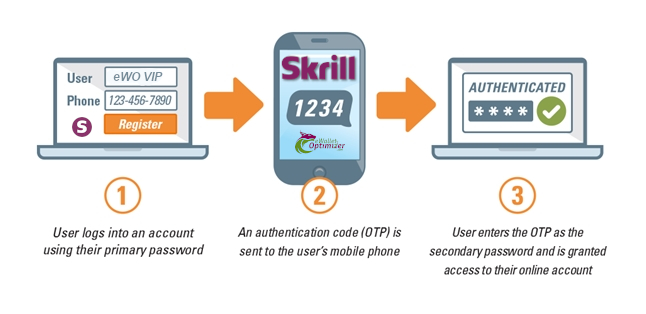

However, for skrill the so called “stronger customer authentication” goes live on 24th september of 2019 which will add an additional security check for your login and your transfers. We have summarized all details here and will give you a quick overview about the changes and also why it become even more important to sign-up with ewallet-optimizer.

Let’s check out all the details:

All accounts will be affected by those changes (old and new accounts). The new account and transfer verification is mandatory for all new accounts and you can choose between SMS and E-mail authentication.

NETELLER & ecopayz are NOT affected and should now be used primarily for those who do not want to use the phone verification on skrill.

Skrill registration changes – what exactly changes?

The strong customer authentication (SCA) basically forces skrill to add an additional layer of security to their accounts to protect their clients. Skrill is now going to introduce this by adding an SMS authentication to their accounts. SMS authentication means that all clients have to enter a valid and unique phone number for their registration and will then receive an authentication code to this number which is needed to activate the account:

Besides that, an additional code is also needed for:

- Each time you login to your skrill account.

- Each time you make a money transfer, withdrawal or deposit.

So basically all interactions with your account will need this code which you then receive by SMS. Therefore a valid phone number has to be used. However, for all ewo clients & partners there is of course some good news:

Please note, all clients will have the option to switch from SMS authentication to E-mail authentication after the account creation.

This new SMS/E-mail authentication will also replace the old 2-factor authentication. So, once you have set up for the new feature the 2-factor authentication code is no longer needed for your accounts.

Skrill registration changes – SMS or E-mail authentication

Please note that this will only after you make the appropriate changes in your skrill account and can be done directly from within your account settings.

Skrill registration changes – NETELLER & ecopayz

If you do not feel comfortable to use this additional SMS/E-mail authentication method, we highly recommend to take a look at NETELLER or ecopayz instead as those can be used without it. With our ewo program you will also have some great additional benefits like increased limits, free VIP right after your verification and lower fees.

Benefit from the best deal & the ewo dashboard

Again, we are also happy to remind you to check our ewo dashboard. Check your ewo bonus and commission earnings, request VIP upgrades, refer new friends and partners to us & earn some extra cash and much more.

You don’t have your personal dashboard access yet? Sign-up today and create your own account now!

Please contact us for any further questions. No matter if it is about the skrill registration changed or NETELLER and ecopayz, our ewo bonus or ewo partner program and our dashboard. We are always happy to help

Get skrill VIP STATUS

WITH VIPDEPOSITS

- Account verification within 24 hours

- Fast track VIP status

- Skrill prepaid mastercard®*

- Free P2P transfers

- Free withdrawal to visa

- Special terms for obtaining VIP status for active accounts

WHY JOIN VIPDEPOSITS LOYALTY PROGRAM?

| Vipdeposits customers | regular customers | |

|---|---|---|

| silver** customer can get 2 skrill cards in different currencies for free | application fee – €10 | |

| P2P transfer fee for silver accounts – 0% | P2P transfer fee 1,45% | |

| withdrawal to visa for silver** accounts – 0% | withdrawal to visa – 7,5% | |

| withdrawal to bank account for VIP silver** – 0% | withdrawal to bank account – €5,5 | |

| second account in another currency for VIP silver** | only 1 account | |

| fast account verification within 24 hours | account verification takes 5-7 days | |

| Assistance with solving any complex issues | general assistance according to FAQ and regular instructions | |

| our customers get VIP status on special terms – after making deposits to merchants totaling: | regular customers get VIP according to standard skrill terms – after deposits totaling: *skrill prepaid mastercard® is only available to residents of the EEA countries: ** if silver is issued in the first or second month of the calendar quarter, it will be active until the end of that quarter; if silver is issued in the third month of the quarter, it will be valid in the next quarter Join SKRILL + VIPDEPOSITS LOYALTY PROGRAM If you already have a skrill account, Что можно сказать в заключение: skrill account sign up instructions - how to register with skrill payment system по вопросу registration skrill

Подписаться на:

Комментарии к сообщению (Atom)

|

Комментариев нет:

Отправить комментарий