Skrill.

Millions of people use skrill to send and receive money around the world. You can also send money instantly with just an email address.

TRANSFER MONEY

FOR FREE

Send money abroad for free with skrill.

Try the calculator to see how much you will save.

Or, explore the tabs above the calculator to see the other benefits of using skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

TRANSFER MONEY

FOR FREE

No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

Aneta gave you £10

to send abroad

Get £10 off when you transfer £100 or more from the UK. Just make sure to use your friend's referral code [ anetaa23 ] when you register. Go ahead, start your transfer now! Terms apply.

This special referral offer is currently only available when making international transfers from the UK.

See how much you get sending £1000 to india

| provider | receive amount (INR) | send amount + fee | effective FX rate |

|---|---|---|---|

| send money with | exchange rate 92,380.00 | transfer fee 1,000.00 | 92.3800 |

| send money with | exchange rate 91,907.37 | transfer fee 1,000.00 | 91.9074 |

| send money with | exchange rate 91,891.16 | transfer fee 1,000.00 | 91.8912 |

| send money with | exchange rate 92,005.76 | transfer fee 1,001.49 | 91.8689 |

| send money with | exchange rate 91,865.16 | transfer fee 1,002.90 | 91.5995 |

| send money with | exchange rate 91,540.00 | transfer fee 1,002.99 | 91.2671 |

| the comparison fees displayed on our page have been published on 23/12/19 13:10 CET and have not been refreshed since this date. The data for the price comparisons shown have been taken from other providers’ websites, on specific dates. This information is freely available on the competitor’s websites we have listed. This is not an exhaustive list of companies offering a money transfer service and if you are interested in a particular supplier we suggest you check their respective website. Fees comparison disclaimer | |||

How it works

Register for a skrill account with your friend's link or code

Transfer £100 or more from the UK to an international bank account.

You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

FEE FREE

It's free to send with skrill money transfer to a bank account or mobile wallet abroad - more savings for you.

QUICK AND EASY

Send money to bank accounts internationally. Choose how much and where you want it to go.

SECURE

Your money transfer is protected by our industry-leading secure payment systems.

TRUSTED GLOBALLY

Millions of people use skrill to send and receive money around the world.

See what our customers are saying about us

Secure and easy transfers

SHISHIRA , india

Really good. It’s secure and fast

SOURABH , india

Using skrill has really made money transfers from kenya to other countries extremely easy.

IRENE , kenya

A great way to send money around the world

SAM , india

Our company

Don’t have the recipient’s bank details?

You can also send money instantly with just an email address.

Access your money wherever you are 24/7

Our fast, easy to use and secure app lets you access your account whenever you need it.

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international.

Copyright © 2019 paysafe holdings UK limited. All rights reserved. Skrill limited (FRN: 900001) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments. Skrill is a registered trademark of skrill limited. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

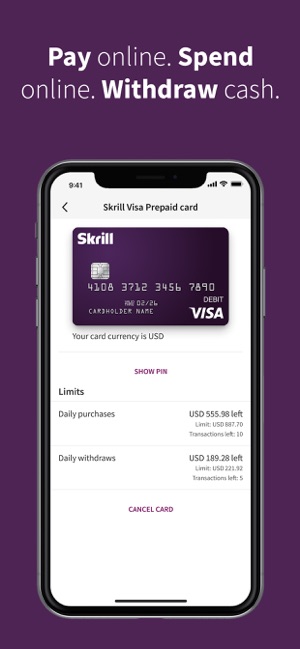

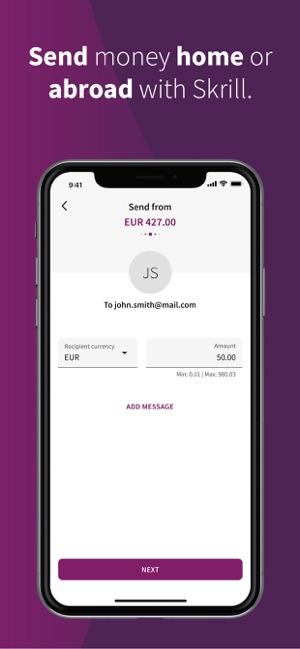

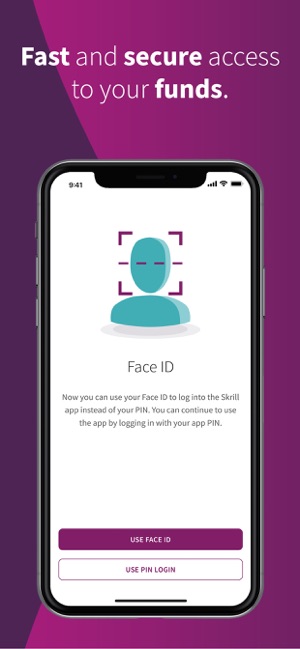

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Is skrill safe or is it a scam? 7 jaw dropping facts (2020)

Last updated : 1 dec 2019 (skrill fee calculator added)

Is skrill safe, or is it a scam?

If you regularly buy and sell products online, particularly with cryptocurrency, you’ve probably heard of skrill. While many reviewers seem to be happy with their service, there are also a lot of posts out there about skrill scams.

So, is skrill legitimate? Or is it a scam?

I’ve done my research. I’ve scoured the net, and read a lot of good and a lot of bad, including some pretty frank remarks by a former skrill developer. I’ve tried to cover all relevant points, so everything you need to know is right here.

What is skrill?

First, let me give you a quick overview of skrill.

Skrill is an internet payment processor, similar to paypal. When it was originally founded in the UK in 2001, it was called moneybookers. Originally, the company focused on gambling and e-sports transactions.

Can you guess how much the company grew in just 8 years?

By 2009, moneybookers was worth £365 million, and they announced that they would be offering services to all customers and business, not just gambling and e-sports.

In 2011, the company announced that they would be rebranding themselves as skrill. To be honest, I could not find the exact reason for their rebranding.

In 2013, the newly-rebranded skrill purchased paysafecard, an australian prepaid card program, and was in turn acquired by CVC capital partners. In 2015, they merged with neteller, one of their largest competitors.

So how many currencies can you use on skrill?

Skrill currently accepts payments in over 40 world currencies. I was also amazed to learn that they also accept transactions in cryptocurrency.

Skrill also issues a debit card that can be linked to your account. These cards can be issued in four currencies: british pounds, US dollars, euros and polish zloty.

Have you decided to set up a skrill account? Click here. It takes just a few minutes.

Still want to dig deep? Let’s continue.

Is skrill legitimate?

Before we talk about skrill’s features, let me tell you what I’ve learned about the company.

From the day it was founded, skrill has been registered with the UK’s financial conduct authority. Their stock is traded on the FTSE 250.

They also have a european e-money license which allows them to operate everywhere in the world outside the US. In the US, they’re licensed in all 50 states.

Yes, skrill is a legitimate business. But there’s more to learn.

So, what should you be concerned about?

A lot of skrill’s reputation issues stem from the time when they were strictly a gambling payment processor. Gambling is a risky business, and even honest bookmakers will have angry customers.

I’m willing to give them a pass on bad reviews from their moneybookers era.

Let’s look at what their current customers are saying.

Skrill currently has a lot of negative reviews from reputable sites. Cardpaymentoptions.Com has given them a grade of C, and the better business bureau has given them a grade of B.

So, who is leaving the negative reviews?

During my research, most of the customer-written skrill reviews I’ve seen have been written in broken english, though, which leads us to believe that US and UK customers are mostly happy.

So what were the unhappy customers upset about?

I’ll go into this more when I talk about security, but I suspect that these complaints are related to skrill’s obligation to verify their customers’ identity.

This is easier to do in western countries, which may be a big part of their users’ problems.

While some customers were unhappy about skrill’s identity verification procedures, I appreciate them. They keep their users safe by making sure people are who they say they are.

While some customers were unhappy about skrill’s identity verification procedures, I appreciate them. They keep their users safe by making sure people are who they say they are.

Yes, absolutely, skrill is a legitimate business. But before you sign up for skrill, you may want to learn about their fees.

How high are skrill fees?

Another common complaint is that skrill fees are too high. Are they? Let’s take a look.

When I first looked into this, it seemed like a silly complaint. Let’s say you use your skrill account to receive money. Your transaction fee will be 1.9% of the payment plus an additional €0.29, which is about $0.33 at current exchange rates. This is comparable to paypal.

So why are people upset? Another complaint was their charge back fees.

Chargeback fees on skrill are €25, or about $28.36 as of february, 2019. That’s a bit high compared to paypal’s $20 chargeback fee, but it’s not exactly highway robbery either. Like paypal, they don’t charge for account setup or fraud protection, so you get that for free.

So where are these so-called high fees coming from? It looks like this is happening on withdrawals.

Skrill currently charges $5.50 for withdrawals. That’s a significant fee if you’re withdrawing a small amount of money. Even if you’re withdrawing large amounts, this is far more expensive than paypal, which doesn’t charge anything for withdrawals.

Skrill fee calculator

Want to know how much does skrill charge per transaction? Try our free skrill fee calculator

There’s also a fee for currency conversion.

Skrill charges a 3.99% currency conversion fee if you’re doing business with someone overseas.

What other fees does skrill charge?

There’s a $0.55 charge on returns, and a hefty €5 (currently $5.69) monthly charge on accounts that have been inactive for more than 12 months.

By now you’re probably asking yourself if it’s free to load funds. The answer is no.

There’s an additional fee for loading funds into your account, unless you’re doing it from a checking account. These range from a 1% charge on bitcoin deposits, up to 7.5% for deposits from a paysafecard debit card, which is mystifying, since paysafecard is part of the same company.

Finally, there’s a special service fee for merchants who pay less than €10 per month in transaction fees. There’s no information available on exactly how much that service fee is, but it may be substantial.

Let’s use a real world example to see how all this pans out.

Suppose you want to sell a guitar for $1,000. Out of that $1,000, you’ll pay the following fees:

Currency exchange fee (if applicable) – $39.90

So you could end up paying $74.88 in fees. Compared to paypal, that’s fairly high.

Honestly, a lot of the frustration with skrill seems to come from the fact that their rates aren’t transparent.

I had to look through several articles and reviews to get all the fee information, and even then, nobody seems to know how much the fee is for merchants who don’t get charged $11.34 per month. Except skrill, and they’re not telling.

Of course, paypal has its own issues, like being unavailable in several countries. Let’s look at more of skrill’s features.

What countries are supported?

A better question would be, what countries aren’t supported?

Skrill is authorized to process payments to and from every country on earth, except countries that have been sanctioned by the world bank or the UN.

This puts them a cut above the competition, which likes to play it safe and stay in mostly developed countries.

How many people use skrill?

I was amazed to learn that as of january, 2019, skrill had over 156,000 active merchants, and over 32 million active users.

I’m not saying it’s universally accepted – it’s not – but it’s accepted by a lot of people, including people who, for whatever reason, can’t use paypal.

Here is the list of non-serviced countries:-

Is skrill safe & secure?

Security is probably your biggest concern, so let’s take a look.

Because skrill has to comply with US, UK and EU financial regulations, they have very strict standards for identity verification.

How does verification work?

As part of the verification process, users have to make a deposit with a bank account, debit card or bitcoin. Generally, that’s sufficient for verification, but I’ve seen several stories about people being asked for photos of their government ID or bills sent to their home.

It sounds like this could be challenging if you live in a country with lower levels of infrastructure.

Response time on identity verification cases seems to vary from a few weeks to several months, with users’ money stuck in their account until that time.

If I were starting an online store and couldn’t get paid for months on end, I’d be pretty upset too.

What about encryption?

This is where skrill really shines. In terms of being hacker-proof, skrill is slightly better than the competition.

Before wrapping up, let’s look at some other reasons you should use skrill.

7 the jaw dropping facts known by very few

You might be thinking, given everything I’ve written, it might sound like there’s no reason to use skrill unless you’re a masochist? Not at all! Keep reading.

I think it would be a shame to put out a skrill review without talking about why someone might want to use their service. To be as fair as possible, I’m also going to tell you everything good I learned about skrill.

#1 they do business where other internet payment processors won’t

If you’re trying to business with someone in a politically unstable area – or you live in one yourself – skrill may be your only option for doing business online.

As I’ve already mentioned, skrill does business in a lot of developing countries where more mainstream payment processors simply refuse to do business.

They accept payments to and from literally every country on the planet that isn’t being sanctioned by the UN or the world bank.

#2 business in industries other processors won’t touch

What if you’re looking to buy or sell services that paypal and others don’t support?

I’ve talked about how skrill started out as a gambling payment processor. While they’ve expanded their business since then, they still specialize in dealing with riskier businesses.

This is one reason why their fees are higher than the competition; they’re more vulnerable to losses.

In addition to gambling, skrill also processes payments for pornographic content and firearms. These are industries that most online payment processors won’t touch with a 10-foot pole.

Once again, if you’re doing this kind of business, you may find that skrill is the only company willing to work with you.

#3 variety of payment methods

What currencies can you use on skrill?

I’ve complained about skrill’s currency exchange fees, but what I didn’t mention is that skrill currently accepts over 40 world currencies, as opposed to paypal’s 20.

You can also use bitcoin, bitcoin cash, ether, etherium classic, XRP, ox or litecoin.

If you’re using US dollars or other western currencies, this probably won’t make a difference to you. But if you do business on a truly global scale and work with cryptocurrency, skrill beats the competition by a mile.

#4 support transactions for apps

If you’re an app developer, you’ll love skrill.

Unlike most competitors, skrill allows you to accept micro transactions from apps.

This is extremely popular for gambling apps in particular, but can also be used for games, business apps, or any other app you’re developing.

This is a great way to accept mobile payments from users who don’t have skrill, but do have your app.

#5 seamless integration with online retailers

If you’re running an online store on a third-party platform, skrill is a payment option on many of them.

Shopfactory, shopify, magneto, woocommerce, wifeo and hundreds of other websites partner with skrill so their sellers can accept payments.

This is yet another way to accept payments from customers who don’t personally have skrill accounts.

#6 one-click checkout

How convenient is skrill for your customers? As convenient as pushing a button.

A lot of online payment processors have this feature, but I’ve listed it anyway because it’s a huge convenience for your customers. Anyone who uses the skrill wallet can send payments with the touch of a button.

In today’s fast-paced world, this kind of efficiency is essential for retaining customers.

#7 recurring payments

Another good thing about skrill is that they support recurring payments.

No, the phone company or the power company won’t accept your payments through skrill. Gambling sites will, though, as will a lot of adult websites.

Most payment services support recurring payments, but nobody else will let you work with these kinds of businesses to begin with.

Mass payments

If you regularly send out mass payments, skrill is extremely convenient.

Suppose you need to send several identical payments to different people. They may be contractors, employees or vendors.

You can either send several payments individually, or you can use skrill to send a whole batch of payments at once.

How does a skrill debit card work?

If you want to use your skrill account to make in-person purchases, it’s easy to do with a skrill debit card.

Skrill debit cards are tied directly to your skrill account, so you can instantly access any money in your account by using your card, without waiting for a transfer.

This is an improvement over paypal, which requires you to transfer money from your regular paypal account to your paypal debit card.

Paypal also only offers service to US customers, while skrill debit cards are available in four currencies: US dollars, british pounds, euros, and the polish zloty.

If your outside of those currency zones, you’ll still be out of luck, but that’s still a lot more flexibility than paypal offers.

There are no transaction fees for using a skrill debit card, including for paying bills. If you rarely use cash, you can use your skrill card for everyday purchases without paying the $5.69 withdrawal fee.

That said, for ATM withdrawals, skrill is expensive. They charge a $2.40 fee for withdrawals. They also charge a €10 ($11.34) annual fee for debit account maintenance.

Wrapping up

I was hoping to answer the question “is skrill safe?” with a simple yes or no. I’ll bet you were also expecting a simple answer.

However, it depends on what that question means.

If it means “is my skrill payment secure,” the answer is yes. Their security policies are stronger that most payment processors, including paypal.

If it means “is skrill a merchant services scam?” the answer is no. They’re a legitimate corporation that abides by all the same regulations paypal and other online payment processor have to follow.

If it means “am I safe from skrill scams?” it depends on who you’re dealing with. Like with any other payment processor, most merchants and customers are good people trying to do honest business. And then there are a handful who aren’t.

Skrill isn’t the best payment processor out there. They charge high fees and their ID verification process can be challenging if your country’s infrastructure is poor.

On the other hand, they’re the only company who services many companies and industries. If you need to do business in these areas, skrill is a secure service that will get the job done.

Creating an account is quick and easy, so why not give them a shot?

What’s your experience with skrill? Leave a comment below and let us know.

Is skrill safe or is it a scam? 7 jaw dropping facts (2020)

Last updated : 1 dec 2019 (skrill fee calculator added)

Skrill.

| | |||||||||||||

Комментариев нет:

Отправить комментарий