Skrill id

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative. Trusted by millions of people worldwide to make global payments simple, safe, and quick.

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

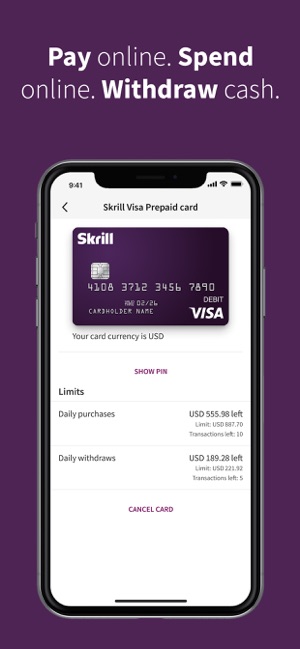

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

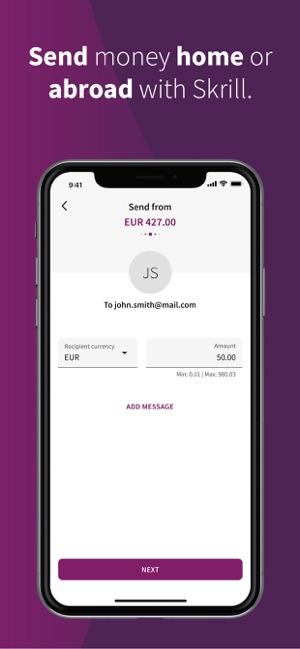

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Skrill verification

On initial opening of your skrill account we would highly recommend you to verify your skrill account immediately. Whilst you can still use the skrill money transfer service with full functionality, your ewallet transaction and deposit limits will not be completely removed until the skrill verification requirements, have been met.

Additionally, if you are transferring funds to meet the next threshold of a VIP membership level you will not face any interruptions to the flow of funds to and from your skrill account if you are a verified member.

In order to take advantage of our exclusive bronze VIP upgrade you will to verify your skrill account.

Please note if you already have a verified neteller account, your skrill account should be automatically verified when you sign-up, regardless of whether you are an ewalletbooster customer or not as both companies are operated by the same parent company paysafe group ltd so they already have your details on record.

How to verify my skrill account?

Please follow the easy steps below to verify your skrill account.

The skrill verification process is easy and fast. All you need to complete the process is either a well- established and verifiable facebook account for facebook verification or have valid photo ID and address documents ready before you begin the process.

One you are logged in to your skrill account you will be alerted to the fact that you need to verify your account by a message at the top of the screen.

Skrill identity verification

To verify your identity, you can upload either your passport, driving licence or identity card. The images you upload must be clear and show all 4 corners of the document.

Skrill address verification

To verify your address, you will need to provide proof of address which can be a bank statement, utility bill or another official document. The date of issue on the statement must not be older than 90 days. Once again, the images you upload must be clear and show all 4 corners of the document.

Skrill application form

Join skrill using the application form below or submit your existing skrill details to receive a FREE bronze VIP upgrade on your skrill account and take advantage of lower fees, increased limits and much more. New & existing skrill customers welcome.

About skrill

Skrill, formerly known as moneybookers, is an ewallet that allows online payments and money transfers for a large number of different merchants. You can choose from a variety of payment methods to withdraw or deposit funds. With the skrill mastercard you have access to your balance everywhere and at any time. You can also send money instantly to other account holders.

In 2015, optimal payments PLC, the mother company of competitor NETELLER, bought skrill and paysafecard and changed the name to paysafe group.

To learn more about skrill in general please check our detailed skrill review and make sure to join our exclusive ewo skrill promotion with easier skrill VIP status and additional cashback.

Skrill & ewallet-optimizer

Ever since ewallet-optimizer started to work with us in 2010, they have constantly delivered value for our product and brand, referring thousands of VIP clients through the exclusive skrill VIP promotion.

We hope that our partnership continues to grow and that ewallet-optimizer will continue to help our customers, provide additional support and explore new markets with us.

We started in 2010 by promoting skrill exclusively and quickly became one of their biggest affiliates. Thanks to skrill’s fantastic availability and usability, it is a great choice for any customer who wants to move online funds safely and easily.

We are happy about our long-lasting partnership with skrill and will continue to deliver the best benefits to our clients when signing up through us.

Reviews from our loyal clients

Partner network

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Shipping, payments + taxes

Manage shipping, payment methods, and taxes.

Skrill

If you're based in the US and need to update your payment method, please contact shopgate support.

Shopgate supports skrill as a payment service provider.

Getting started

To set up skrill in your shopgate mobile shop, you need to have a business account at skrill. If you don't already have one, follow the steps below:

1.1 creating a skrill business account

| 1. Go here and click sign up on the top right corner. |  |

| 2. On the registration page, select business as your account type. |  |

| 3. Another page will open. Please enter your email address so skrill can send you a link to continue the registration process immediately. |  |

| 4. Please fill out the most important information about your company and click continue. |  |

| 5. Now you can start creating your business account. Please follow the steps described on the following pages. |  |

| 6. You will be asked to specify the shopping cart you use. Choose shopgate from the drop down list. |  |

| 7. Please upload important documents. These are essential for the verification required by the financial conduct authority (FCA). |  |

|

1.2 activating the verified account

After skrill has verified and approved your business account, you will receive a verification of activation. Now follow the steps here to activate your account:

2. Go to the settings page. A new section named "developer settings" is now unlocked.

3. In this section, create a secret word for the purpose of encrypting your payments. Please note that your secret word must meet the following requirements:

- Max. 10 characters

- Lower case letters only

- No special characters

- Cannot be identical to your password

Now you have successfully created and activated your business account at skrill. Please continue to set up your skrill account at shopgate.

How do I set up skrill at shopgate?

To set up skrill as a payment provider, please complete the following steps:

- Log in to your shopgate admin page.

- Click settings from the menu bar, then select payment.

- In the "add payment method" section, start typing "skrill", and select a type of payment (credit card, sofort banking, direct debit, or ideal) from the drop-down list. If multiple types are used, repeat the steps until all accepted payment types are added.

In the pop-up window, enter your skrill merchant ID, pay to email, secret word, and password for MQI/API. Click save.

For more assistance, please read where can I find the required information?

What information is needed?

- Merchant ID: from your skrill account

- Pay to email: from your skrill account

- Secret word: important parameter used to verify payment responses from skrill.

- Password for MQI/API: important parameter used to refund an order automatically from your shopgate merchant admin site.

Where can I find the required information?

To find the required information, please log in to skrill first.

" merchant ID " and " pay to email " can be found on the top right corner of your skrill homepage.

" secret word " and " password for MQI/API " can be found under settings > developer settings. If you don't already have a secret word or password, create them here.

Skrill review: online money transfers & payments with debit card

Skrill is an online e-wallet service that allows you to transfer funds both domestically and internationally. The platform is often regarded as the nearest competitor to de-factor e-wallet paypal. However, as is the case with any online money transfer service, you need to have a full understanding of how the fee system works.

As such, we’ve created the ultimate guide to skrill. We’ll discuss everything you need to know, such as deposit methods, safety, mobile-friendliness, and of course, fees.

By the end of reading our review from start to finish, you’ll have all of the necessary information to assess whether skrill is right for your individual needs.

Let’s start by finding out who skrill is.

Who is skrill?

Launched way back in 2001, skrill become one of the first online e-wallets to facilitate internet-to-internet payments. The overarching aim of using skrill is to transfer funds online to another skrill user. As we will discuss further down, the skrill platform now offers a range of additional services, such as bank account withdrawals and prepaid debit cards.

Formally known as moneybookers, the company rebranded to skrill in 2011. The company was purchased by paysafe group in 2015, alongside rival e-wallet neteller. In terms of its customer base, skrill claims to now have over 40 million users worldwide. Not only this, but the platform supports 200 countries and over 40 currencies.

On top of its more traditional money transfer service, skrill is now accepted at a vast number of online merchants. Recent estimates place the number of merchants at over 120,000 globally, with the skrill payment gateway utilized by the likes of ebay and facebook. Although skrill offers its payment gateway services to a full range of industries, one of its main markets is that of the online gambling and forex brokers.

One of the key reasons for this is that paypal often prohibit online casinos that do not have a long-standing track record in the online gambling industry, and thus, the threshold with skrill is much lower.

So now that you have a better understanding of who skrill is, let’s take a look at how you can get started with skrill.

How do I get started with skrill?

Here’s a breakdown of the main steps that you will need to go through to get started with skrill.

Open an account

First and foremost, you will need to open an account with skrill. Simply head over to the official homepage by clicking on this link , and then click on the ‘register’ button. You’ll find this at the top-right-hand side of the screen.

Next, you will then need to enter your full name, email address, and then choose a strong password. Read and accept the terms and conditions, before clicking on the ‘register now’ button.

On the next page, you will then need to enter your country of residence, and your preferred currency. Make sure you choose your domestic currency to avoid any exchange rate fees.

On the next page, you will then need to choose the payment method that you want to use to deposit funds. Once you do, you will then be prompted to enter some more personal information.

You don’t actually need to verify your identity at this point, as long as you still within your account limits. However, in order to increase these limits, you will need to upload some identification.

Verify your identity

In order to verify your identity, and thus, increase your account limits, head over to the settings page, which you can access via the the left-hand-side bar. Then click on ‘verification’.

In order to confirm your identity, you will need to upload a copy of your government issued ID. This can be either a passport or driving license, or in some cases, a national ID card.

If you decide to do this through your desktop computer, then you can upload the document straight from your device. You will also need to upload a selfie of you holding a handwritten note with the current date. Alternatively, if you decide to verify your identity via your mobile app, you can use your smartphone camera to take a photo of your ID.

What payment methods does skrill support?

Once you have set-up your newly created skrill account, you will be presented with a range of payment options. This includes a traditional bank transfer, debit/credit card, and a number of alternative methods such as bitcoin or paysafecard.

Here’s the full list of supported deposit options.

- Bank transfer

- Debit/credit card

- Neteller

- Bitcoin and bitcoin cash

- Paysafecard

- Trustly

- Klarna

Regarding a bank transfer, you will be presented with the local bank account details that you need to transfer the funds to. You will also be shown a unique customer reference number.

It is imperative that you insert the customer reference number when you perform the bank transfer, or skrill might have issues linking the transfer to your account. In the vast majority of cases, the bank transfer deposit will show up in your skrill account within 2-3 working days.

Alternatively, if you’re from the UK, you can perform a rapid bank transfer via skrill. This allows you to deposit funds instantly, via the faster payments network.

The other option that you have available to you is a debit or credit card deposit. This is by far the easiest option, as the funds will be credited to your skrill account instantly.

If none of the above suffice, then you can make a deposit with one of the alternative payment methods listed above.

What fees does skrill charge?

One of the most important factors that will determine whether or not skrill is right for your needs is fees. This doesn’t just come in the form of transfer fees, but also the costs associated with depositing and withdrawing funds, as well as currency exchange fees. We’ve broken the fees down in more detail below.

Deposit fees

Regardless of which payment method you use to deposit funds into your skrill account, you will be charged a fee. For the benefit of simplicity, all payment methods carry a fee of 1%. As such, if you were to deposit £500 in to your account, you would be charged a £5 fee.

This amount is deducted from the gross amount that you deposit. Using the same example as above, you would receive £495 from your £500 deposit.

Withdrawal fees

One of the great things about skrill is that you have the option of withdrawing funds back to your chosen payment method.

If you choose to withdraw funds back to your bank account, then you will pay the local currency equivalent of 5.50 EUR. At the time of writing, this amounts to £4.82.

In comparison to paypal, this is actually very expensive. If you are from the UK and you withdraw funds from your paypal account back to your UK bank account, then this process is not only instant, but it’s free.

If you want to withdraw funds from your skrill account back to your visa debit/credit card, then skrill will charge you a mouth-watering 7.5%. This means that a £100 withdrawal would result in a £7.50 fee.

Transfer fees

When it comes to actually transferring money, skrill will charge you 1.45% of the transfer amount. So, if you were to transfer £400, you would end up paying £5.80 in fees. In comparison to rival e-wallet paypal, this is actually much cheaper, as paypal averages 2.90% (although this will vary depending on where you live).

However, it is important to note that if you are transferring funds to a person to utilizes a different currency, then you will need to pay exchange rate fees. Unfortunately, this is where things can begin to get a bit expensive.

Skrill charges an additional 3.99% on top of the current mid-market rate. When adding that on to the previously mentioned 1.45% transfer fee, you could end up paying as much as 5.44%.

On the other hand, skrill never charges you to receive money, which is definitely a plus-point. On the contrary, the likes of paypal will charge you a variable fee when receiving funds, unless you are from the UK and the person sending the funds is also from the UK.

So now that you have a better understanding of the fees charged, in the next part of our skrill review we are going to look at how safe the e-wallet is.

Is skrill safe?

If you’re not familiar with how e-wallets work, then you might be concerned with safety. However, established e-wallets such as skrill are extremely safe to use. Firstly, the platform is authorized by the UK’s financial conduct authority under the electronic money regulations 2011. This ensures that your funds are kept safe.

When it comes to keeping your account secure, it is highly advisable to set-up two-factor authentication. This is where you will need your mobile phone every time you want to log in or withdraw funds. Without it, nobody will be able to access your account.

You will also be asked to choose a 6-digit PIN number, which will also be required when you perform key account functions.

When you enter sensitive financial information (such as your debit/credit card details) in to the skrill website, the platform uses advanced encryption security. This means that even if the data was intercepted, nobody would be able to read it.

What you should be extra aware of is ‘phishing emails’. This is where scammers will impersonate skrill by sending you an email. They hope that you reply to the email with your login credentials, so that they can then gain access to your skrill account. However, skrill will never contact you by email asking for your account passwords, so be sure to tread with caution.

All in, skrill is a very safe e-wallet platform to use.

Skrill customer support

If you need assistance with your skrill account, it is always worth checking their extensive FAQ section first. We found that most account queries can be solved by reading the many help guides on offer. However, if you need to speak with the skrill team directly, then you have a couple options at your disposal.

You can contact skrill by telephone, and the platform offers a number of local toll numbers, including that of the UK and U.S. Before you call them, make sure that you write down your customer reference number so that the support agent can bring up your account. You’ll find this at the top-right-hand side of the screen.

Alternatively, you can send a direct message to the support team via your skrill account. The team usually reply within 24 hours, although if you need instant assistance, you’ll be best off contacting them via telephone.

If you are a VIP skrill member, then you will get access to 24/7 support via a dedicated telephone number. This will avoid having to hold for long periods.

Unfortunately, skrill does not offer a live chat facility.

Skrill mobile app

Skrill now offers a fully-fledged mobile application that you can download straight to your phone. The app is supported across both android and ios devices, however blackberry and windows aren’t supported. The app allows you to access all of the same account functions as you will find via the main skrill website.

This includes the ability to check balances, transfer funds, deposit and withdraw money, buy and sell crypto, and more. When we tested the app out ourselves, we found that the overall layout was very user-friendly. There were no issues navigating from section-to-section, and we were able to transfer money with ease.

The general consensus in the public domain is that the app operates without fault. Some users have complained about server issues when using the app via android devices, however these are few and far between.

The app also makes it easier to verify your identity, as you are not required to upload a selfie of you holding a piece of paper with the current date.

Skrill pre-paid debit card

Skrill also allows you to obtain a pre-paid debit card issued by mastercard. The card is linked directly to your main skrill account, which gives you more options when it comes to spending your balance. For example, you can use the skrill pre-paid debit card when making purchases in-store, free of charge.

You can also withdraw cash from an ATM machine, although you will be charged a 1.75% fee for this. On the other hand, the fees remains the same regardless of where you are, which makes the skrill pre-paid card useful when travelling abroad. The skrill pre-paid card comes with a fee of 10 euros, which you will need to pay every year.

Nevertheless, this actually makes it much cheaper to get money out of your skrill account, especially when you consider the 7.5% fee charged to withdraw funds to a visa debit/credit card.

Buying crypto via your skrill account

Skrill recently entered the cryptocurrency space by allowing registered users to buy and sell coins via their account.

It is important to note that when you buy cryptocurrencies from skrill, you are not actually buying the underlying asset. Instead, you are buying CFD-like (contract-for-difference) products.

This means that you are only speculating on whether the price of the cryptocurrency will go up or down. As a result, you can’t actually withdraw the coins to an external wallet outside of the skrill website.

Nevertheless, skrill currently supports eight different cryptocurrencies, which we’ve listed below.

- Bitcoin

- Ethereum

- Ethereum classic

- Bitcoin cash

- Litecoin

- Ripple

- Stellar lumens

- 0x

In terms of fees, if you are buying or selling cryptocurrencies with either the USD or EUR, you will pay 1.5% at each end of the transaction. If you are using an alternative currency like GBP, then this fee increases to 3%. Not only are these fees rather expensive, but skrill do not make it clear how they import their live pricing feeds.

Skrill review: the verdict?

In summary, skrill is a really useful tool to send and receive money online. No matter where the other person is located, you can transfer funds with ease. We really like that the platform supports a significant number of deposit methods, such as a bank transfer and debit/credit card, as well as alternative options like paysafecard.

While transfer fees of 1.45% are rather competitive, things can be a bit expensive when you need to transfer funds using a secondary currency. This is also the case if you need to withdraw funds back to a visa card, with the fees amounting to a whopping 7.5%

However, a simple workaround in this respect is to obtain the skrill pre-paid card. This way, you can withdraw your skrill funds out via your local ATM at a rate of just 1.75%. This is especially useful if you want to use your card in another country.

Transfer to a skrill wallet

What is the transfer to a skrill wallet withdrawal option and how to use it?

The transfer to a skrill wallet is an instant withdrawal option allowing you to transfer funds from your NETELLER account to your skrill account. The transaction is initiated into the skrill wallet as a deposit and the funds are instantly transferred to your skrill account.

To initiate a transfer to a skrill wallet, follow the steps below:

- Log into your skrill account and click on deposit.

- Chose NETELLER as a deposit option and click on next.

- Enter the amount you want to deposit, the email address registered in your NETELLER account and your secure ID or your google authenticator code (if you have activated the two-step authentication option) and click on upload.

Once the transaction has been successfully completed, it will appear in the history section of your NETELLER account.

What are the fees and limits of the transfer to a skrill wallet?

In order to know what are your limits of transfer from your NETELLER account to your skrill wallet, please check into your skrill account.

The best place to check the limits for any upload option is the deposit section of your skrill wallet.

If there is a currency conversion, 3.99% foreign exchange (FX) fee will be charged.

I have transferred money to my skrill wallet, but they have not received it. What sould I do?

If you have transferred funds from your NETELLER account to your skrill wallet but you have not received it, please contact the skrill support in order to solve the issue.

Get skrill VIP STATUS

WITH VIPDEPOSITS

- Account verification within 24 hours

- Fast track VIP status

- Skrill prepaid mastercard®*

- Free P2P transfers

- Free withdrawal to visa

- Special terms for obtaining VIP status for active accounts

WHY JOIN VIPDEPOSITS LOYALTY PROGRAM?

| Vipdeposits customers | regular customers | |

|---|---|---|

| silver** customer can get 2 skrill cards in different currencies for free | application fee – €10 | |

| P2P transfer fee for silver accounts – 0% | P2P transfer fee 1,45% | |

| withdrawal to visa for silver** accounts – 0% | withdrawal to visa – 7,5% | |

| withdrawal to bank account for VIP silver** – 0% | withdrawal to bank account – €5,5 | |

| second account in another currency for VIP silver** | only 1 account | |

| fast account verification within 24 hours | account verification takes 5-7 days | |

| Assistance with solving any complex issues | general assistance according to FAQ and regular instructions | |

| our customers get VIP status on special terms – after making deposits to merchants totaling: | regular customers get VIP according to standard skrill terms – after deposits totaling: *skrill prepaid mastercard® is only available to residents of the EEA countries: ** if silver is issued in the first or second month of the calendar quarter, it will be active until the end of that quarter; if silver is issued in the third month of the quarter, it will be valid in the next quarter Join SKRILL + VIPDEPOSITS LOYALTY PROGRAM If you already have a skrill account, Skrill indonesiaJual beli saldo skrill indonesia Minggu, 24 september 2017Apa itu skrill dan manfaat mempunyai akun skrill Akun skrill merupakan salah satu aplikasi pembayaran yang kini banyak digemari para pebisnis online maupun trader. Selain karena sistemnya yang sangat terpercaya, aplikasinya pun cukup mudah, baik untuk anda sebagai pemilik akun maupun konsumen anda dalam melakukan pembayaran. Apa sebenarnya skrill dan manfaat mempunyai akun skrill? Berikut ini uraian lengkapnya. Apa itu skrill?Skrill merupakan suatu metode pembayaran yang biasanya digunakan para pebisnis online maupun para pialang. Dengan kata lain, skrill merupakan nomor rekening online yang sudah mendunia. Sebenarnya, skrill mempunyai manfaat yang sama dengan bank nasional. Hanya saja, di skrill, anda dapat bertransaksi dengan menggunakan uang dollar. Tak heran jika para pebisnis online yang notabene mempunyai jaringan konsumen mendunia ini lebih nyaman menggunakan skrill daripada bank nasional. Sebelum muncul skrill, orang lebih mengenal sistem ini dengan moneybookers. Sebuah sistem penerimaan maupun pengiriman uang secara online yang memerlukan keberadaan dompet digital. Semua uang digital yang diperoleh seseorang akan dikumpulkan dalam dompet tersebut, kemudian dapat dimanfaatkan atau dicairkan dengan prosedur tertentu.Saat ini, solusi pembayaran online yang berbasis di london ini sudah memiliki lebih dari 20 juta pemegang rekening (nasabah). Hal ini menunjukkan betapa besar antusias masyarakat dalam menyambut sistem pembayaran modern ini. Kegunaan skrillSeperti telah dijelaskan sebelumnya, kegunaan utama dari skrill adalah untuk menerima sekaligus mengirim uang dalam bentuk digital. Jika ditanya mengapa harus menggunakan skrill, alasannya hanya satu “aman”. Uang dalam skrill tidak akan dipalsukan karena berbentuk digital. Selain itu, maraknya bisnis online yang memaksa penjual serta pembeli tidak bertemu secara langsung, membuat pembayaran seperti ini akan lebih efektif dilakukan.Belum lagi dengan aktivitas para pialang dan trader forex. Setiap saat dan setiap waktu mereka akan selalu melakukan transaksi. Dengan menggunakan skrill, lalu lintas transaksi ini akan menjadi lebih lancar dan aman. Fasilitas yang diperoleh dengan memiliki akun skrillKelebihan dan kekurangan skrillTak ada gading yang tak retak. Segala hal di dunia ini pasti ada kelebihan dan kelemahannya, termasuk skrill. Adapun kelebihan dari skrill antara lain:

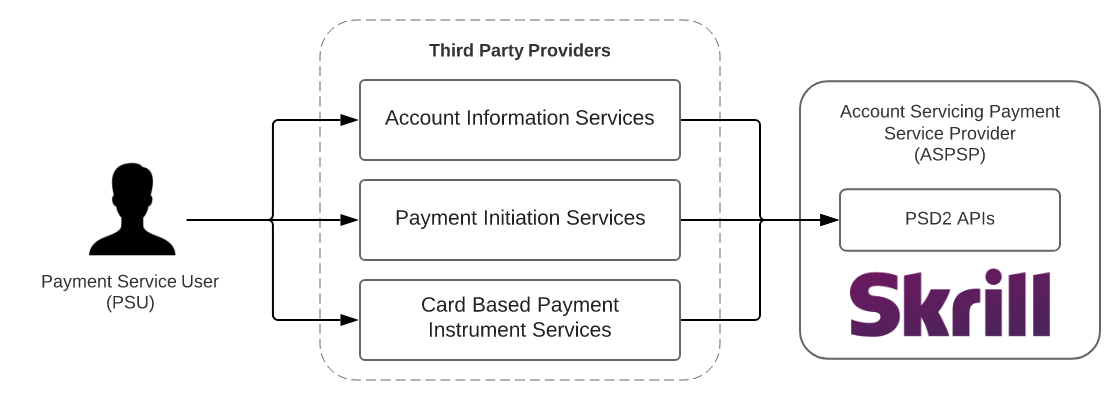

Adapun kelemahannya hanya satu, yaitu adanya pembekuan secara otomatis jika terendus adanya tindakan penipuan. Hal ini untuk mencegah terjadinya kasus penipuan atas penggunaan akun skrill. Sabtu, 23 september 2017Cara deposit bwin dengan skrill Mengenai bwinBwin di pimpin tim manajemen yang sudah berpengalaman dan juga profesional di dunia gaming. Sehingga bisa berkembang dengan pesat dan juga beriringan dengan perkembangan grub yang sangat dinamis. Sehingga tidak heran apabila sekarang ini bwin juga menjadi salah satu situs judi online terpercaya dan juga terbesar di dunia. Sebagai perusahaan yang terbilang sangat besar, tentu saja bwin juga sudah mensponsori berbagai macam pertandingan sepak bola, basket, moto GP, dan lain sebagainya.  Seperti yang sudah anda ketahui, bahwa bwin sekarang ini juga menjadi sponsor utama dari club sepak bola yang sudah sangat populer di spanyol yakni real madrid. Selain itu bwin juga menjadi official partner dari club sepak bola dari inggris yakni manchester united. Bukan hanya menyediakan perjudian dalam bidang olah raga saja, bwin juga memberikan pusat judi casino dan juga poker online. Untuk mendaftar bwin juga terbilang cukup mudah dan cepat. Namun karena bwin di indonesia di larang, maka anda harus mengubah alamat IP anda agar bisa tetap mengakses situs bwin. Anda bisa menggunakan mozilla dan pilih add-ons. Kemudian anda cari anonymox dan install. Anda bisa mengaktifkan dengan klik tanda X pada kanan atas browser mozilla anda dan otomatis IP anda akan berubah. Cara deposit di bwinMemang sebelum anda melakukan betting di bwin, anda harus mempunyai uang pada akun bwin yang anda miliki. Untuk mengisi deposit anda pada akun bwin, maka anda bisa melakukan dengan menggunakan tiga cara. Yang pertama yakni dengan menggunakan skrill atau moneybookers, transfer bank, dan juga melalui freebet card. Anda bisa melakukan berbagai macam cara untuk mengisi ulang deposit anda. Namun akan lebih baik jika anda menggunakan skrill atau moneybookers yang lebih mudah dan juga lebih murah. Jika anda menggunakan deposit menggunakan transfer bank, maka anda memerlukan waktu yang cukup lama yakni sekitar 7 hari prosesnya. Selain itu juga biayanya cukup mahal yakni 150 ribu rupiah setiap kali transfer.   Sehingga jika deposit bwin menggunakan skrill atau moneybookers akan lebih mudah dan murah. Sebelum melakukan deposit maka anda harus punya akun skrill terlebih dahulu dan jika tidak punya anda harus mendaftar terlebih dahulu. Jika sudah membuat akun maka selanjutnya anda mengisi saldo moneybookers anda melalui exchange atau paypal. Anda harus mengisi sekitar $10 untuk bisa melakukan deposit bwin anda. Selanjutnya anda masuk akun bwin anda kemudian pilih deposit, dan selanjutnya anda bisa memilih sistem pembayaran skrill atau moneybookers dan proses pembayaran bisa anda isi dan klik pay for my balance dan konfirmasi. Setelah sukses maka secara otomatis uang yang ada di akun bwin anda akan terisi. Proses cara deposit bwin dengan skrill atau moneybookers memang terbilang mudah dan cepat. Selain itu anda juga tidak memerlukan waktu yang lama. Cara deposit bet365 dengan skrill Banyaknya yang menggunakan situs perjudian ini tentu saja membuat anda semakin penasaran bagaimana cara deposit bet365 dengan skrill atau moneybookers yang tentu saja akan lebih mudah jika dilakukan. Layanan dengan menggunakan berbagai macam bahasa bisa membantu klien untuk memudahkan mereka dalam menggunakan bet365 ini. Dengan tersedianya banyak pilihan bahasa tentu semakin memudahkan anda sebagai klien untuk mengaksesnya. Pilihan sistem pembayaranUntuk sistem pembayaran bisa dilakukan dengan menggunakan berbagai macam cara. Anda bisa menggunakan pembayaran dengan dollar amerika atau dengan menggunakan peso argentina, dan yang lainnya. Apabila anda memerlukan penukaran mata uang, maka untuk nilai dari mata uang yang akan ditukarkan ialah pada tingkat menengah yang sudah dikutip financial times. Untuk semua deposit yang dilakukan atau withdraw bisa menggunakan semua jenis kartu kredit dan juga debit mayor, visa, guru, master card, elektron, laser, dan juga neteller. Untuk pembayaran deposit atau withdraw dengan menggunakan cara lain bisa menggunakan moneybookers atau skrill, paypal, instadebit, bank transfer cek, dan lain sebagainya.   Anda bisa mengubah atau juga mengirim batas dari deposit, maka anda bisa mengubahnya sendiri melalui akun anda. Setiap penarikan atau semua transaksi yang di proses dari akun anda sama dengan akun yang anda gunakan untuk melakukan deposit. Anda juga tidak akan merasa kesulitan dalam melakukan penarikan. Sebab dengan menggunakan bet365 anda akan diberikan kemudahan daripada situs lainnya, sebab bet365 mempunyai waktu pembayaran yang sangat cepat. Untuk anda yang ingin melakukan pembayaran melalui paypal maka anda bisa menggunakan moneybookers atau bisa anda sebut sebagai skrill. Anda hanya perlu waktu sekitar 2 sampai 3 jam untuk transaksi penarikan hingga uang bisa sampai kepada akun anda. Namun jika menggunakan kartu kredit atau debit dan juga transfer bank memerlukan waktu sekitar 2 sampai 3 hari proses. Daftar, deposit, dan withdraw bet365Anda bisa mendaftar terlebih dahulu di www.Bet365.Com dan mengubah situs kedalam bahasa yang anda pahami dan join now. Kemudian anda bisa mengisi data diri anda. Setelah anda selesai mendaftar maka selanjutnya ialah melakukan deposit ke akun anda. Anda akan diberi pilihan untuk memilih metode dari deposit apa yang anda gunakan. Meskipun pada dasarnya bet365 masih belum bekerja sama dengan bank lokal indonesia, namun anda masih bisa menggunakan metode pembayaran deposit lainnya yakni dengan menggunakan neteller atau juga moneybookers.   Anda bisa klik deposit dan pilih metode pembayaran yakni dengan memilih skrill. Jika sudah memilih skrill maka sebaiknya anda menggunakan mata uang yang sama dari akun skrill supaya bisa lebih menghemat biaya transaksi anda saat anda melakukan deposit atau withdraw dari akun bet365 milik anda. Setelah itu anda bisa memasukkan jumlah uang yang akan anda deposit. Setelah itu anda masukkan password dan juga klik make deposit. Anda bisa masuk ke akun skrill anda untuk bisa menyelesaikan proses penyetoran yang anda lakukan. Cara deposit bet365 dengan skrill memang cukup mudah dan lebih praktis, mengingat cara deposit dengan bank lokal di indonesia juga masih belum disediakan. Cara melakukan withdrawal pada akun skrill Nah, selain cara mendepositkan sejumlah dana ke akun skrill, hal yang perlu diketahui oleh pengguna skrill adalah cara withdrawal atau mencairkan dana yang tersimpan di akun tersebut. Bagi anda yang masih awam atau belum terlalu paham, berikut cara sederhana untuk melakukannya. 1. Login ke akun skrill andaLangkah pertama yang harus ditempuh adalah melakukan login ke skrill.Com dengan menggunakan alamat email beserta password akun anda. Jika berhasil, anda akan langsung diarahkan ke dashboard akun. Karena sangat vital, anda disarankan untuk selalu menjaga kerahasiaan password akun skrill tersebut supaya tidak dipergunakan oleh pihak lain. 2. Pilih metode yang akan digunakanPilihlah menu “withdraw” (yang terletak di sebelah menu “deposit”) untuk melakukan withdrawal. Di halaman ini, anda akan melihat 2 metode yang tersedia untuk melakukan penarikan dana, yaitu mobile wallet dan transfer bank. Untuk opsi mobile wallet, terlebih dahulu anda perlu menambahkannya pada menu add mobile wallet. Sementara itu, untuk opsi transfer bank, anda bisa menambahkan add bank account. Kemudian, pada kotak di bawahnya, masukkan jumlah dana yang ingin dicairkan. Pada tahap ini, anda perlu memperhatikan 2 hal, yaitu limit pencairan dan biaya transaksi. Tidak ada batasan terendah jumlah dana yang bisa dicairkan, asalkan lebih besar daripada biaya transaksi. Biaya transaksi berbeda-beda tergantung pada metode yang dipilih. Jika anda menggunakan kartu skrill dan melakukan penarikan uang melalui ATM, biaya yang dikenakan adalah 1.75% dari nominal transaksi. Sementara itu, untuk penarikan melalui bank, biayanya €5.50. Jika menggunakan kartu kredit atau kartu debit, biayanya 7,5%. 3. Lakukan konfirmasiSupaya bisa melihat lagi data dan informasi yang dimasukkan, anda akan diminta melakukan konfirmasi. Salah satunya, mengisi data tanggal lahir. Langkah ini juga dibutuhkan untuk menambah perlindungan terhadap akun anda. Jika sudah lengkap, klik tombol “withdraw money”. Nah, pencairan dana sudah berhasil dilakukan dan anda akan mendapatkan pemberitahuan pada halaman dashboard, mulai dari tanggal penarikan hingga jumlah penarikan. Pada kolom balance pun, saldo akan terlihat berkurang atau terpotong secara otomatis. Pemberitahuan juga akan terkirim ke email anda. Skrill idEuropean payment services directive 2015/2366 (also known as PSD2) defines the following actors and roles: Payment service user (PSU) - psus are the end-users of the services provided by tpps and aspsps. They are either physical persons or entities (organisations, companies, administrationsвђ¦). They do not interact directly with the PSD2 API. Account servicing payment service provider (ASPSP) - these are payment service providers (psps) which are in charge of holding payment accounts for their customers (PSU). Third party provider (TPP) - these actors can intermediate between psus and aspsps, acting on behalf of PSU. Depending on the services they provide tpps fall in one of the following categories;

Skrill acts as account servicing payment service provider (ASPSP) in PSD2 terms.  Skrill payment service directive complianceIn compliance PSD2, skrill provides modified customer interface (mobile apis) to qualified third party payment service providers for the following purposes:

The apis are modified existing customer interfaces fulfilling the following PSD2 requirements:

Qualified third party providersIn the context of PSD2, being a qualified third party provider (TPP) means:

In order for a third party to qualify for production API access, both steps must have been completed and they must have matching data (the NCA delivers a registration number that must written in the certificate data).

Third party provider oauth client registrationIn order to access skrill apis, the third party providers are required to register oauth 2 clients for their applications. Registration and management of oauth 2 clients is provided by PSD2 oauth2 and client management apis. Client management API calls require mutual TLS authentication, with a qualified website authentication certificate (QWAC) issued to the TPP by a qualified trust service provider. Client registration is performed through POST request on /psd2-oauth2/v1/registrations resource in client management API endpoint with JSON body containing the following properties:

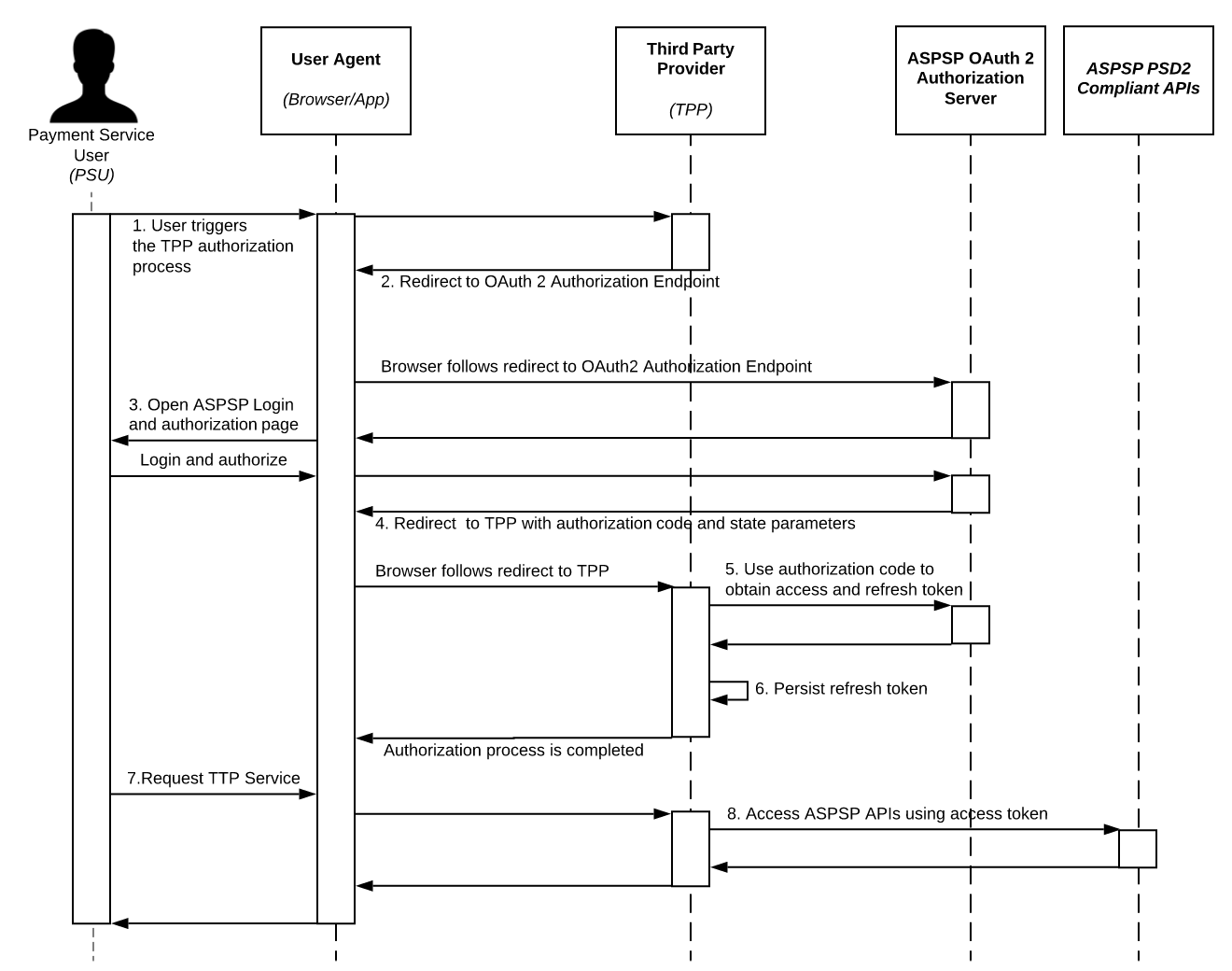

Authentication and authorization flowAuthentication and authorization is implemented as specified in oauth 2.0 authorization code grant flow RFC 6749. The essential prerequisities for setting up the authorization flow for TPP applications are the following:

The detailed authorization flow proceeds as described in the sequence diagram:

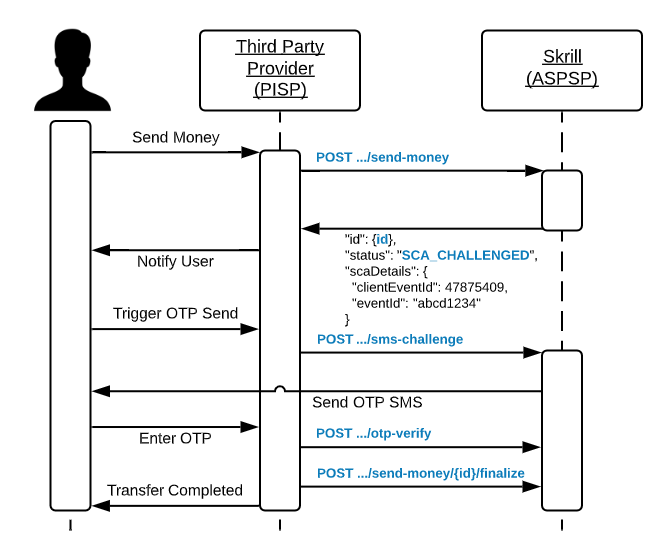

Strong customer authenticationStrong customer authentication (SCA) is a requirement for payment actions. Upon initiation of money transfer, the transfer will get SCA challenge in the response and can not be finalized until SCA challenge is resolved by the user.  One time password generation is triggered and send directly to the user according to his account configuration. The OTP is passed over from the user to the third party provider and used to confirm the OTP challenge. After that the transaction can be finalized. User presence and offline account accessTpps are required upon calling skrill apis for AISP and PISP use cases to attach PSU original IP address as HTTP header. The following HTTP header should be present and carry the PSU origin: The absense of the PSU IP address is interpreted as TPP accessing user data without user presence and such calls are subject to the following restrictions

Account information services apisThe apis allow accessing PSU account and transaction history information using the below listed apis. The apis requires one of the following scopes:

Payment initiation services apisThe apis allow performing transactions to other skrill accounts. The apis requires pisp scope for access. During money transfer SCA challenge will be triggered. Card based payment instrument use cases supportSkrill mobile apis does not provide dedicated api for funds confirmation. API documentation and supportServer API endpoints can be found in their respective API reference documentation: что можно сказать в заключение: read reviews, compare customer ratings, see screenshots, and learn more about skrill - transfer money. Download skrill - transfer money and enjoy it on your iphone, ipad, and ipod touch. По вопросу skrill id

Подписаться на:

Комментарии к сообщению (Atom)

|

Комментариев нет:

Отправить комментарий