Skrill pin

Vous chargez le crédit de votre skrill digital wallet rapidement et facilement avec my paysafecard. Vous payez ensuite dans plus de 156 000 boutiques en ligne à travers le monde grâce à skrill. Vous pouvez en outre envoyer et recevoir de l'argent avec skrill digital wallet, et ce, dans 200 pays et 40 devises. Ajoutez les codes PIN paysafecard dans my paysafecard. Si vous n'avez pas encore my paysafecard, inscrivez-vous gratuitement.

Chargement du skrill digital wallet avec paysafecard

Vous chargez le crédit de votre skrill digital wallet rapidement et facilement avec my paysafecard. Vous payez ensuite dans plus de 156 000 boutiques en ligne à travers le monde grâce à skrill. Vous pouvez en outre envoyer et recevoir de l'argent avec skrill digital wallet, et ce, dans 200 pays et 40 devises.

Pour charger votre skrill digital wallet avec my paysafecard, c'est très simple :

Acheter

Ajoutez les codes PIN paysafecard dans my paysafecard. Si vous n'avez pas encore my paysafecard, inscrivez-vous gratuitement.

Charger le wallet

Chargez du crédit sur votre skrill digital wallet via my paysafecard : lors du paiement, choisissez pour ce faire my paysafecard et introduisez votre nom d'utilisateur et votre mot de passe my paysafecard.

Limites de chargement de my paysafecard vers skrill digital wallet

Limite globale statut « standard »

Limite journalière statut « unlimited »

Limite 30 jours statut « unlimited »

Frais associés au chargement

Lors du chargement de votre skrill digital wallet avec my paysafecard, des frais s'élevant à 1% du montant du chargement sont dus.

Vous trouverez un aperçu des limites supplémentaires éventuelles par statut de votre skrill digital wallet dans votre compte skrill digital wallet. Attention : vous pouvez uniquement recharger votre compte skrill digital wallet avec my paysafecard. Les deux comptes doivent également être enregistrés dans le même pays.

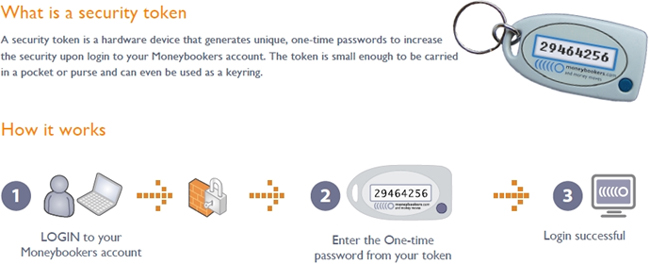

About the skrill security token

When skrill (former moneybookers) offered their security token in 2009, they were one of the first within the business offering this important security upgrade. When using the security token you will need to enter a specific generated login number every time you log into your skrill account. The skrill security token is a powerful tool and a must-have for every skrill (moneybookers) customer. If you use the security token, skrill offers a 100% money-back guarantee in case of unauthorized account access.

The skrill security token works with batteries that should not be changed. The installed source has a lifespan of around 5-7 years. When it dies, you need to contact support to let you access your account and provide another token. The same stands if the skrill security token gets broken or lost.

Please note, the security token is no longer available and all clients should activate the two-step authentication in their accounts to guarantee the safety of their funds.

(re-designed token after company rebrand)

100% money-back guarantee by using the security token

Skrill guaranteed the safety of your online funds by offering a “100% money-back guarantee” if you were using the skrill security token.

Skrill terms and conditions:

Skrill (moneybookers) offers a 100% money-back guarantee. In the unlikelihood that you suffer a financial loss as a direct result of unauthorized access to your account, we will reimburse you in full, with respect to the funds in your account. To clarify, for the purpose of the 100% money-back guarantee, “unauthorized access” means a transaction that is processed in your account (as defined in clause 3.1 of the skrill account terms of use) through the skrill (moneybookers) website without your permission, authorization, or knowledge and where it can be established that you are a victim of fraud or theft.

Get in touch for questions

Not registered with skrill yet?

As you can see, the skrill security token was the perfect tool to protect your skrill account.

However, it was replaced by the skrill two-step authentication which adds the same level of security to your account, is free and is fast and easy to set up. It will also help you to protect your funds and makes a refund more likely in most cases if anything goes wrong at some point.

If you have any questions or issues with the skrill two-step authentication or questions about the old security token, just let us know and please proceed by following our instructions on how to join us, if you are not added to our free bonus program yet.

For any further questions, please do not hesitate to contact us .

Easier & faster VIP status upgrades.

0.3% cashback on your transfers.

15 USD welcome bonus (only new clients!).

1% cashback for new VIP clients (up to 100 EUR).

Fast-track account verification.

Additional & personal support – 365 days a year.

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Skrill vs neteller – which is the best E-wallet?

The leading providers of these e-wallets are neteller and skrill so this article is going to focus on comparing the key features of these so that you are able to make the best decision for your needs.

Why do you need an e-wallet?

With so many roulette sites appearing online it has become essential to find a secure, reliable and easy to use method of depositing funds and withdrawing your winnings. The answer to this is the e-wallet.

E-wallets are a digital wallet, storing your money so that you are able to make online transactions without having to input your card details each time. As a result, these e-wallets allow for safer and more simple transactions.

- Open a neteller account here.

- Open a skrill account here.

Security

Still, security is more than just an external authority, and these two companies know it. As a result, their customers are able to make use of additional safety precaution measures, putting most of the power back into the hands of account holders alike. With skrill, you get the standard package – a dual verification login option, with a one-time-use code sent to users via the app.

As for neteller account holders, the dual-verification login is optional, as they can additionally choose to activate secure ID. This is a separate login method, with users being provided a unique 6-digit code that needs to be input each time they are asked to confirm their identity (account access, transactions).

Top 4 neteller/skrill online casinos

- Sign up and you are entitled to up to £1,500 in bonus

- Try out more than 550 high-quality casino games

- State-of-the-art gaming software and smooth gameplay

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus

- Try out more than 500 high-quality casino games

- Elegant, clean and well-organized website

- 24/7 multilingual live support via chat, e-mail, phone

- You are entitled to up to 20 additional free spins

- Try out more than 500 high-quality casino games

- Enjoy great in-game progress system with great prizes

- 24/7 multilingual live support via chat, e-mail, phone

- Sign up and you are entitled to up to £1,250 in bonus credits

- Try out more than 500 high-quality casino games

- 24/7 multilingual live support via live chat, e-mail and phone

Website ease of use and support

Both skrill and neteller have simple and well-designed websites that explain all that you need to know about each provider, including a break down of fees, offers and rewards, as well as easy access to creating an account and logging in. Personally, I find the neteller site slightly more accessible, particularly when it comes to gaining support, with a ‘support’ option clearly placed on their homepage which leads to a range of support options including popular topics, frequently asked questions, email and the option to call for support with regional numbers in 18 different countries.

However, skrill also has an extensive list of frequently asked questions and, again, you can email or call with the option of only 8 regional lines. Having read reviews related to customer support, it appears that neteller also has the edge when it comes to responding to customer queries, with skrill often taking a longer time to get back to their customers.

Depositing money

To use your e-wallet you must first upload money to it. For both neteller and skrill, this is easily done through their website, once you have created an account. There are many different options for both providers, including bank wire, e-cheque, credit card, debit card or prepaid card. These options have different funds associated with them that vary between neteller and skrill.

Skrill

When it comes to depositing money, skrill has many free options, such as, bank transfer from all countries, maesto debit card and, as a global payment method, swift. There is a fixed rate for depositing via credit card of 1.90% and fees for depositing never exceed 5.5% (for deposits made via a paysafecard).

Bear in mind that you may additionally incur charges due to currencies – skrill users have 40+ currency options to choose from. Do it carefully, accounting for the currency you will use the most for your online transactions, in order to avoid the exchange fee at a flat 3.99%. A convenient circumstance in this regard is the fact that account holders can choose up to 4 currencies per account. All you have to do is make sure to keep it somewhat active – an account maintenance fee of 1 EUR per month is charged after 12 months of inactivity.

On a final note, it’s good to know you can input value into your skrill account using bitcoins. More precisely, account holders can buy and sell several cryptocurrencies – BTC, ETH, LTC and BCH among others. Purchases and sales using EUR and USD fiat currencies are set at 1.50%, while for all others – 3.00%, while P2P transfers come at a flat charge of 0.50% for all account holders.

Neteller

Compared to skrill, neteller have more deposit options but, while they also have free options, such as bank transfer, trustly and moneta.Ru, other methods of deposit incur fees set at 2.55%! Generally, the cost of depositing is greater when using neteller than skrill.

On another note, neteller users still get to choose 4 currencies for their account transfers, but only out of a selection of 22 options. Yet, it is important to mention that these account holders are also given the opportunity to hold cryptocurrencies in their e-wallet. Regular, fiat currencies come at a charge of 3.99% for exchange purposes, while crypto tokens are available for buying and selling at a 1.50% charge, when done with EUR or USD, or a 3.00% charge, when done with any other currency.

Finally, don’t forget about inactivity fees – they are the service’s way of protecting their network from being overburdened with abandoned accounts. Anyone leaving their account unmanned for over 14 months will see themselves charged a 5 USD monthly maintenance fee.

Depositing money to casinos

Depositing to casinos from both neteller and skrill is free. Around 80% of online casinos accept payment from skrill and the same can be said for neteller, with the vast majority of major online casinos accepting these methods, including those which you can find here.

Withdrawing money from these third-party sites is also free of charge for both e-wallet providers. To withdraw money from your online casino account, all you have to do is select your e-wallet provider as your withdrawal method and enter the amount you wish to withdraw. While neteller and skrill do not charge for these transactions, the online casinos may, so it is worth checking before depositing your money.

Withdrawing from your e-wallet

Again, withdrawing money from both providers is simple.

Skrill

Depending on your country of residence, you can withdraw money through bank transfer, credit cards, debit cards and a skrill card. For bank withdrawals, this takes 2-5 business days and charges users 3.95 EUR per transaction to your bank account. Credit and debit card withdrawals, as well as other methods of sending money from skrill to a different account, are subject to fees ranging between 1.45% and 5.50%. Swift withdrawals are set at a flat price of 4.76 GBP, that is 5.50 EUR. The quickest and cheapest method of withdrawing funds is the skrill card, enabling you to make withdrawals at an ATM instantly at a cost of just 1.75% of the withdrawn amount.

Neteller

Neteller offers the same withdrawal methods as skrill but also allow withdrawals to be made via a cheque. For bank transfer, the cost using neteller is a flat fee of 10 USD and takes 3-5 working days. A member wire withdrawal, on the other hand, charges users 12.75 USD per transfer. What is more, money transfers also charge users for withdrawal purposes, at a rate ranging between 1.45% and 5.50%, with a minimum amount threshold set at 0.50 USD. Having this in mind, it is safe to say that neteller’s charges are higher than skrill’s. However, neteller also has an option to use merchant sites and their net+ prepaid master card for instant and free withdrawals.

Physical card availability

Both these e-wallets have provided account holders with an additional way to access their account funds – plastic cards issued by mastercard. This significantly increases funds accessibility, especially when it comes to withdrawals or making use of the stored funds as straightforwardly as possible.

Skrill

Nevertheless, users can feel inconvenienced differently. After all, the card is solely available in a couple of currencies – USD, EUR, GBP and PLN, which is rather limiting. Speaking of limits, it also comes with caps on the daily and monthly amounts you can spend using it at poss or atms. The former is usually set at 1,000 EUR per day, with the occasional deviations for specific merchants (3,000 to 5,000 EUR a day). As for the latter, ATM transactions, regular limits are set at 250 EUR, although some users can get permission to withdraw up to 5,000 EUR a day with their mastercard.

Neteller

In terms of fees, cardholders are advised to simply be wary of the standard 3.99% currency conversion fee. Additionally, bear in mind that you can link up to 5 net+ virtual prepaid mastercard accounts to a single plastic card free of charge, and any more virtual accounts at a single charge of 3 USD/ 2.5 EUR/ 2 GBP per one.

User benefits

Anyone dedicating their online finance management to an e-wallet service such as skrill or neteller is right to expect a bang for their buck. More specifically, both services offer VIP loyalty programs – check the terms out and discover all the benefits of sticking with one of these e-wallets, or the other.

Skrill

The VIP loyalty program for skrill account holders ranks the registered individuals based on the funds traffic in your account you have handled over the course of a single yearly quarter. In this regard, the program consists of four tiers – bronze, silver, gold and diamond, for which you would have to pass the minimum €6,000, €15,000, €45,000 and €90,000 threshold, respectively.

Despite seeming like too much of an investment for a small payout, users that actually manage to reach any of these limits and qualify for the next level of the tiered program have claimed otherwise. With low to non-existing fees for currency exchange, deposits and withdrawals, as well as various dedicated services, skrill users are definitely getting the benefits they have earned.

Neteller

Neteller account holders are more or less alike – testimonials actually claim that you don’t need to get very high to start feeling the difference. In fact, considering that the neteller VIP loyalty program distinguishes five tiers instead of the previous four, users are bound to note a change from nothing to bronze, and even more, as they go through silver, gold and platinum, all the way to diamond.

The thresholds of funds traffic you would need to meet annually in order to climb up this ladder are set at $10,000 for bronze, $50,000 for silver, $100,000 for gold, $500,000 – platinum, and all the way to $2,000,000 for diamond-level benefits.

In conclusion…

This article was designed to compare two of the most popular e-wallets used by online gamblers. Ultimately they are both very secure, efficient and great at what they do. For me, neteller has a slight edge, but it does depend on what you’re looking for in an e-wallet provider. I hope this article has been useful in helping you decide. As always, feel free to leave a comment below if you have any questions or feedback, and stay tuned for more articles!

Skrill review: online money transfers & payments with debit card

Skrill is an online e-wallet service that allows you to transfer funds both domestically and internationally. The platform is often regarded as the nearest competitor to de-factor e-wallet paypal. However, as is the case with any online money transfer service, you need to have a full understanding of how the fee system works.

As such, we’ve created the ultimate guide to skrill. We’ll discuss everything you need to know, such as deposit methods, safety, mobile-friendliness, and of course, fees.

By the end of reading our review from start to finish, you’ll have all of the necessary information to assess whether skrill is right for your individual needs.

Let’s start by finding out who skrill is.

Who is skrill?

Launched way back in 2001, skrill become one of the first online e-wallets to facilitate internet-to-internet payments. The overarching aim of using skrill is to transfer funds online to another skrill user. As we will discuss further down, the skrill platform now offers a range of additional services, such as bank account withdrawals and prepaid debit cards.

Formally known as moneybookers, the company rebranded to skrill in 2011. The company was purchased by paysafe group in 2015, alongside rival e-wallet neteller. In terms of its customer base, skrill claims to now have over 40 million users worldwide. Not only this, but the platform supports 200 countries and over 40 currencies.

On top of its more traditional money transfer service, skrill is now accepted at a vast number of online merchants. Recent estimates place the number of merchants at over 120,000 globally, with the skrill payment gateway utilized by the likes of ebay and facebook. Although skrill offers its payment gateway services to a full range of industries, one of its main markets is that of the online gambling and forex brokers.

One of the key reasons for this is that paypal often prohibit online casinos that do not have a long-standing track record in the online gambling industry, and thus, the threshold with skrill is much lower.

So now that you have a better understanding of who skrill is, let’s take a look at how you can get started with skrill.

How do I get started with skrill?

Here’s a breakdown of the main steps that you will need to go through to get started with skrill.

Open an account

First and foremost, you will need to open an account with skrill. Simply head over to the official homepage by clicking on this link , and then click on the ‘register’ button. You’ll find this at the top-right-hand side of the screen.

Next, you will then need to enter your full name, email address, and then choose a strong password. Read and accept the terms and conditions, before clicking on the ‘register now’ button.

On the next page, you will then need to enter your country of residence, and your preferred currency. Make sure you choose your domestic currency to avoid any exchange rate fees.

On the next page, you will then need to choose the payment method that you want to use to deposit funds. Once you do, you will then be prompted to enter some more personal information.

You don’t actually need to verify your identity at this point, as long as you still within your account limits. However, in order to increase these limits, you will need to upload some identification.

Verify your identity

In order to verify your identity, and thus, increase your account limits, head over to the settings page, which you can access via the the left-hand-side bar. Then click on ‘verification’.

In order to confirm your identity, you will need to upload a copy of your government issued ID. This can be either a passport or driving license, or in some cases, a national ID card.

If you decide to do this through your desktop computer, then you can upload the document straight from your device. You will also need to upload a selfie of you holding a handwritten note with the current date. Alternatively, if you decide to verify your identity via your mobile app, you can use your smartphone camera to take a photo of your ID.

What payment methods does skrill support?

Once you have set-up your newly created skrill account, you will be presented with a range of payment options. This includes a traditional bank transfer, debit/credit card, and a number of alternative methods such as bitcoin or paysafecard.

Here’s the full list of supported deposit options.

- Bank transfer

- Debit/credit card

- Neteller

- Bitcoin and bitcoin cash

- Paysafecard

- Trustly

- Klarna

Regarding a bank transfer, you will be presented with the local bank account details that you need to transfer the funds to. You will also be shown a unique customer reference number.

It is imperative that you insert the customer reference number when you perform the bank transfer, or skrill might have issues linking the transfer to your account. In the vast majority of cases, the bank transfer deposit will show up in your skrill account within 2-3 working days.

Alternatively, if you’re from the UK, you can perform a rapid bank transfer via skrill. This allows you to deposit funds instantly, via the faster payments network.

The other option that you have available to you is a debit or credit card deposit. This is by far the easiest option, as the funds will be credited to your skrill account instantly.

If none of the above suffice, then you can make a deposit with one of the alternative payment methods listed above.

What fees does skrill charge?

One of the most important factors that will determine whether or not skrill is right for your needs is fees. This doesn’t just come in the form of transfer fees, but also the costs associated with depositing and withdrawing funds, as well as currency exchange fees. We’ve broken the fees down in more detail below.

Deposit fees

Regardless of which payment method you use to deposit funds into your skrill account, you will be charged a fee. For the benefit of simplicity, all payment methods carry a fee of 1%. As such, if you were to deposit £500 in to your account, you would be charged a £5 fee.

This amount is deducted from the gross amount that you deposit. Using the same example as above, you would receive £495 from your £500 deposit.

Withdrawal fees

One of the great things about skrill is that you have the option of withdrawing funds back to your chosen payment method.

If you choose to withdraw funds back to your bank account, then you will pay the local currency equivalent of 5.50 EUR. At the time of writing, this amounts to £4.82.

In comparison to paypal, this is actually very expensive. If you are from the UK and you withdraw funds from your paypal account back to your UK bank account, then this process is not only instant, but it’s free.

If you want to withdraw funds from your skrill account back to your visa debit/credit card, then skrill will charge you a mouth-watering 7.5%. This means that a £100 withdrawal would result in a £7.50 fee.

Transfer fees

When it comes to actually transferring money, skrill will charge you 1.45% of the transfer amount. So, if you were to transfer £400, you would end up paying £5.80 in fees. In comparison to rival e-wallet paypal, this is actually much cheaper, as paypal averages 2.90% (although this will vary depending on where you live).

However, it is important to note that if you are transferring funds to a person to utilizes a different currency, then you will need to pay exchange rate fees. Unfortunately, this is where things can begin to get a bit expensive.

Skrill charges an additional 3.99% on top of the current mid-market rate. When adding that on to the previously mentioned 1.45% transfer fee, you could end up paying as much as 5.44%.

On the other hand, skrill never charges you to receive money, which is definitely a plus-point. On the contrary, the likes of paypal will charge you a variable fee when receiving funds, unless you are from the UK and the person sending the funds is also from the UK.

So now that you have a better understanding of the fees charged, in the next part of our skrill review we are going to look at how safe the e-wallet is.

Is skrill safe?

If you’re not familiar with how e-wallets work, then you might be concerned with safety. However, established e-wallets such as skrill are extremely safe to use. Firstly, the platform is authorized by the UK’s financial conduct authority under the electronic money regulations 2011. This ensures that your funds are kept safe.

When it comes to keeping your account secure, it is highly advisable to set-up two-factor authentication. This is where you will need your mobile phone every time you want to log in or withdraw funds. Without it, nobody will be able to access your account.

You will also be asked to choose a 6-digit PIN number, which will also be required when you perform key account functions.

When you enter sensitive financial information (such as your debit/credit card details) in to the skrill website, the platform uses advanced encryption security. This means that even if the data was intercepted, nobody would be able to read it.

What you should be extra aware of is ‘phishing emails’. This is where scammers will impersonate skrill by sending you an email. They hope that you reply to the email with your login credentials, so that they can then gain access to your skrill account. However, skrill will never contact you by email asking for your account passwords, so be sure to tread with caution.

All in, skrill is a very safe e-wallet platform to use.

Skrill customer support

If you need assistance with your skrill account, it is always worth checking their extensive FAQ section first. We found that most account queries can be solved by reading the many help guides on offer. However, if you need to speak with the skrill team directly, then you have a couple options at your disposal.

You can contact skrill by telephone, and the platform offers a number of local toll numbers, including that of the UK and U.S. Before you call them, make sure that you write down your customer reference number so that the support agent can bring up your account. You’ll find this at the top-right-hand side of the screen.

Alternatively, you can send a direct message to the support team via your skrill account. The team usually reply within 24 hours, although if you need instant assistance, you’ll be best off contacting them via telephone.

If you are a VIP skrill member, then you will get access to 24/7 support via a dedicated telephone number. This will avoid having to hold for long periods.

Unfortunately, skrill does not offer a live chat facility.

Skrill mobile app

Skrill now offers a fully-fledged mobile application that you can download straight to your phone. The app is supported across both android and ios devices, however blackberry and windows aren’t supported. The app allows you to access all of the same account functions as you will find via the main skrill website.

This includes the ability to check balances, transfer funds, deposit and withdraw money, buy and sell crypto, and more. When we tested the app out ourselves, we found that the overall layout was very user-friendly. There were no issues navigating from section-to-section, and we were able to transfer money with ease.

The general consensus in the public domain is that the app operates without fault. Some users have complained about server issues when using the app via android devices, however these are few and far between.

The app also makes it easier to verify your identity, as you are not required to upload a selfie of you holding a piece of paper with the current date.

Skrill pre-paid debit card

Skrill also allows you to obtain a pre-paid debit card issued by mastercard. The card is linked directly to your main skrill account, which gives you more options when it comes to spending your balance. For example, you can use the skrill pre-paid debit card when making purchases in-store, free of charge.

You can also withdraw cash from an ATM machine, although you will be charged a 1.75% fee for this. On the other hand, the fees remains the same regardless of where you are, which makes the skrill pre-paid card useful when travelling abroad. The skrill pre-paid card comes with a fee of 10 euros, which you will need to pay every year.

Nevertheless, this actually makes it much cheaper to get money out of your skrill account, especially when you consider the 7.5% fee charged to withdraw funds to a visa debit/credit card.

Buying crypto via your skrill account

Skrill recently entered the cryptocurrency space by allowing registered users to buy and sell coins via their account.

It is important to note that when you buy cryptocurrencies from skrill, you are not actually buying the underlying asset. Instead, you are buying CFD-like (contract-for-difference) products.

This means that you are only speculating on whether the price of the cryptocurrency will go up or down. As a result, you can’t actually withdraw the coins to an external wallet outside of the skrill website.

Nevertheless, skrill currently supports eight different cryptocurrencies, which we’ve listed below.

- Bitcoin

- Ethereum

- Ethereum classic

- Bitcoin cash

- Litecoin

- Ripple

- Stellar lumens

- 0x

In terms of fees, if you are buying or selling cryptocurrencies with either the USD or EUR, you will pay 1.5% at each end of the transaction. If you are using an alternative currency like GBP, then this fee increases to 3%. Not only are these fees rather expensive, but skrill do not make it clear how they import their live pricing feeds.

Skrill review: the verdict?

In summary, skrill is a really useful tool to send and receive money online. No matter where the other person is located, you can transfer funds with ease. We really like that the platform supports a significant number of deposit methods, such as a bank transfer and debit/credit card, as well as alternative options like paysafecard.

While transfer fees of 1.45% are rather competitive, things can be a bit expensive when you need to transfer funds using a secondary currency. This is also the case if you need to withdraw funds back to a visa card, with the fees amounting to a whopping 7.5%

However, a simple workaround in this respect is to obtain the skrill pre-paid card. This way, you can withdraw your skrill funds out via your local ATM at a rate of just 1.75%. This is especially useful if you want to use your card in another country.

كيف تحمي حسابك في skrill ب pin code

تتعدد طرق الحماية لملفات البنوك الالكترونية، وسوف نتطرق من على موقع صناع المال خلال مقال كيف تحمي حسابك في skrill ب pin code، إلي كيفية تفعيل الحساب بالبنك وطرق السحب والإيداع للأموال.

:: بنك skrill ::

يعد أحد أشهر البنوك الالكترونية على المستوى العالمي، ويتميز بمستوى عالي من الأمان والموثوقية وان جميع الملفات محمية، إمكانية تفعيل الحساب للعديد من الدول مع سهولة ويسر العملية حتى مع الدول العربية.

بنك skrill من البنوك التي لا تفرض رسوم عمولة عند إرسال أموال من بنك skrill إلى الحساب البنكي، كما أن جميع الرسوم التي يفرضها معلن عنها.

:: كيفية تفعيل حساب في بنك skrill ::

يمكننا تفعيل حساب في بنك skrill من خلال الخطوات التالية:-

- يظهر لنا صفحة من أجل إدخال البريد الإلكتروني وكلمة المرور ثم ننتقل للصفحة التي تليها لملئ البيانات الشخصية.

- بعد ملئ البيانات سننتقل إلى الصفحة التالية، حيث تتضمن العنوان والمدينة التابع إليها والرمز البريدي.

- بعد ملئ البيانات المطلوبة ننتقل إلى المرحلة النهائية والتي تتمثل في ملء بيانات عملة الحساب، وعلينا الموافقة للشروط والأحكام التي يضعها بنك skrill من خلال الصفحة ونضغط على OPEN ACCOUNT.

- وبذلك تم انشاء الحساب بنجاح.

:: طرق إيداع الأموال في بنك skrill ::

سنذكر طرق إيداع الأموال في بنك skrill فيما يلي:-

- عن طريق التحويلات البنكية.

- الإيداع باستخدام البطاقة الائتمانية.

- الإيداع باستعمال نظام نتلر الالكتروني.

- الإيداع عن طريق البنوك الالكترونية.

:: طرق سحب الأموال في بنك skrill ::

طرق سحب الأموال في بنك skrill تتم من خلال نوعين إما سحب الأموال من البطاقة إلى الحساب البنكي أو من خلال سحب الأموال إلى البطاقة الائتمانية.

:: إرسال الأموال من حساب بنك skrill ::

وتتم عملية إرسال الأموال من خلال القيام بإرسال الأموال من محفظة الحساب في بنك skrill إلى محفظة أخرى في بنك skrill، أو من خلال إرسال الأموال من الحساب الخاص بنا في بنك skrill أو من خلال البطاقة الائتمانية في بنك skrill إلى حساب بنكي آخر.

:: كيف تحمي حسابك في skrill ب pin code ؟::

سنذكر كيفية حماية حسابك في skrill ب pin code فيما يلي:-

- بعد الانتهاء من إنشاء الحساب في بنك skrill ستظهر لنا الشاشة الخاصة بحماية الحساب، ونضغط على CREATE A PIN.

- ستظهر شاشة الحماية و نقوم بتدوين رقم مكون من ستة أرقام وعلينا حفظه خلال الصفحة، وننتظر رسالة بنك skrill على الموقع.

- وبكل سهولة ويسر علينا بالضغط على رابط التفعيل وسوف يتم التفعيل فورا.

- وبذلك تم حماية الحساب ب pin code.

:: طرق شحن حساب skrill ::

سنوضح طرق شحن حساب skrill فيما يلي:-

- شحن حساب skrill عن طريق البنك الالكتروني نتلر بحد أقصى 500 يورو وعمولتها 3%.

- شحن الحساب عن طريق التحويل البنكي ويكون بدون رسوم كما أنه ليس له حد معين.

- عن طريق الفيزا والماستر كارد وعمولتها 1.9%.

- شحن الحساب عن طريق البيتكوين بحد أقصى 500 يورو و عمولة تحويل 1%.

:: كيفية التعامل مع دعم بنك skrill ::

سنوضح طرق التواصل بالدعم الفني لدى بنك skrill فيما يلي:-

- ندخل على موقع الدعم الفني لدى بنك skrill من خلال الصفحة المخصصة لذلك.

- ثم نقوم بتحديد نوعية الشئ المراد الاستعلام والتواصل من أجله بالصفحة.

- ثم من خلال تتابع الخانات نقوم بتحديد السؤال الموجه إليهم.

- من خلال الخانة التالية نقوم بسرد الرسالة بصورة مفصلة.

- وأخيرا نقوم بإرسال الرسالة لمركز الدعم الفني للإفادة.

- مع العلم انه في حالة أردنا تواصل الدعم الفني عبر الهاتف لابد من ذكر اسم الدولة وان لم تكن موجودة علينا باختيار international.

وفي نهاية موضوعنا عن كيف تحمي حسابك في skrill ب pin code ، نتمنى أن نكون تحت حسن ظنكم، وان تكونوا استفدتم من موضوع المقال، وان تدعمونا بمشاركتكم الموضوع لاستفادة أكبر عدد ممكن، ونحن في انتظار ردودكم وتعليقاتكم.

Skrill vs paypal: introduction

The paypal vs skrill comparison is different to the NETELLER vs skrill comparison. Skrill (former moneybookers) and paypal aim for different customers in some parts of their e-wallet businesses and therefore offer different conditions.

Most important: paypal does not provide most poker, sports betting and casino rooms as merchants.

We try our best to keep all data up to date, but nevertheless, please note no responsibility can be taken for the correctness of the details provided.

Please contact us if you spot any missing or outdated info on this page.

Skrill vs paypal: VIP programs

Paypal does not offer a VIP program like skrill, NETELLER or ecopayz do. The information in [brackets] in the following fee comparison shows the benefits of skrill VIP members.

Skrill vs paypal: fee comparison

The fees at paypal are very complicated and different for many cases. The following comparison provides information for personal usage with lower fees than the paypal business accounts. Please check the anchored links to paypal’s user agreement in the following paypal vs skrill comparison for more information.

UPDATE 22/07/2019: skrill 15 USD sign-up bonus has been stopped until further notice.

* for some countries there are higher fees – please contact us for more information and details.

** uploads via all deposit options are for free if deposited amount is more than 20.000 $/€.

Skrill vs skrill: mastercard comparison

Skrill vs paypal: cashback & security comparison

Skrill vs paypal – development

Skrill (moneybookers) was able to double their memberships to more than 35 million as well as their overall transfers to 55 billion EUR within last 2 years. Compared to paypal with “128 million active registered accounts” and 110 billion EUR value of transactions in 2012, skrill (moneybookers) is still the much smaller competitor. But with a growing rate of around 20% paypal grew slower than skrill (moneybookers) did with more than 50% last years.

Skrill (moneybookers)was able to team up with biggest global players, such as facebook, skype and ebay. Ebay acquired paypal in 2002 and is benefiting from their own e-wallet provider. Paypal revenues represented 40% of ebay inc. Revenues in 2012, showing the strength of that acquisition a decade ago. As of 2015, paypal is now seperated from the mother company ebay.

Paypal will probably keep growing with a rate of 20% within the next years. Regarding much smaller fees for personal accounts, but especially for merchants, it will be interesting to see how skrill (moneybookers) will compete with paypal having ebay as the strongest supporting website. Aiming for the US market, especially the huge online gambling market could be a way for skrill (moneybookers) to outperform paypal within the next 5-7 years. The full consequences of paypal leaving the ebay. Inc. Group cannot be foreseen at this time.

Skrill vs paypal – benefits

Pro skrill

- Usage for online gambling:

paypal is not offered by most online gambling providers while skrill (moneybookers) is the #1 in that segment. - Fees:

even though the fees in this paypal vs skrill comparison are provided for personal accounts and are much lower than those for business accounts at paypal, it is easy to see the huge advantage of skrill (moneybookers) over paypal when it comes to their fees. Especially the fees for receiving money and using the prepaid card cannot compete with the much lower fees of skrill (moneybookers). - VIP program:

paypal does not offer any VIP program, while skrill is almost 100% free for any use with easy to reach skrill VIP status. - Cashback:

beside the $15 sign up bonus for new customers, there are some promotions from time to and time and cashback is available with ewallet-optimizer. Paypal does not offer any kind of cashback for transfers to merchants at all.

Pro paypal

- Biggest ewallet provider:

with the acquisition of ebay paypal became the best known and biggest e-wallet provider on the net. Because of this, most merchants accept the higher fees and offer paypal as their payment service to be able to reach as many customers as possible. - Safety:

with having an official bank status as luxembourg-based bank, paypal is a very safe e-wallet provider.

Get additional bonuses & support for free

Most people have a paypal account for smaller transfers or when they buy things at ebay. But when it comes to bigger transactions, especially for online gamblers and forex traders, skrill (moneybookers) is the way better option. The fees are not even comparable for these two ewallet providers.

We only provide skrill, NETELLER and ecopayz with our value added ewallet-optimizer program, because we want our clients to benefit from the best conditions available.

If you want to learn more about it, please have a look at our skrill + ewallet-optimizer program or contact us .

Skrill & ewo

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Mastercard skrill

Caractéristiques de la mastercard skrill

Quelle mastercard skrill choisir?

Skrill propose deux cartes mastercard prépayées différentes: skrill mastercard prépayée et la carte virtuelle skrill. Si vous un compte VIP ( qui est gratuit), vous aurez également droit à une skrill mastercard prépayée gratuite – vous permettant d’économiser 10 € sur les frais annuels.

Posséder une carte prépayée mastercard skrill vous permet de bénéficier d’un accès instantané au solde de votre compte skrill n’importe où dans le monde où mastercard est acceptée. Vous pouvez dépenser le solde de votre compte en ligne ou dans des magasins habituels.

Les cartes prépayées skrill sont disponibles dans quatre devises: EUR, GBP, USD, PLN. La mastercard skrill est disponible pour tous les résidents de l’espace économique européen (EEE).

| Programmes | non VIP | BRONZE | SILVER | GOLD | DIAMOND |

|---|---|---|---|---|---|

| prix de la mastercard skrill par an | 10€ | gratuit | gratuit | gratuit | gratuit |

| retrait en cash / jour | 900€ | 1200€ | 1500€ | 3000€ | 5000€ |

| frais de retrait | 1.75% | €1.80 | gratuit | gratuit | gratuit |

| paiement maximum / jour | €2,700 | €3,000 | €3,000 | €5,000 | €10,000 |

| frais de change | 3.99% | 3.79% | 2.89% | 2.59% | 1.99% |

| coût en cas de perte | €10 | gratuit | gratuit | gratuit | gratuit |

| frais annuel | €10 | gratuit | gratuit | gratuit | gratuit |

Prix et frais de la mastercard skrill

- GRATUIT pour payer des biens dans les magasins, les restaurants et en ligne

- GRATUIT pour recevoir de l’argent

- Demandes de solde GRATUIT

- Relevés en ligne GRATUITS

- Changement du code PIN GRATUIT

- 10 € de cotisation annuelle (sauf VIP où c’est gratuit)

- 10 € pour le remplacement de la carte perdue ou volée

- 1,75% de frais de retrait en espèces à un distributeur

- 3,99% de frais de change

Puis-je utiliser ma carte prépayée skrill mastercard pour jouer en ligne?

Malheureusement, vous ne pouvez pas utiliser la carte mastercard prépayée skrill pour des activités de jeu en ligne. Cependant, vous pouvez l’utiliser pour les jeux hors ligne tels que les casinos et les boutiques de paris où mastercard est acceptée.

Comment alimenter votre compte?

| Transfert d’argent | frais | durée de transfert |

|---|---|---|

| virement bancaire | 1% | jusqu’à 5 jours |

| cartes de crédit / débit | 1% | immédiat |

| rapid transfer | 1% | immédiat |

| neteller | 1% | immédiat |

| bitcoin & bitcoin cash | 1% | immédiat |

| paysafecard | 1% | immédiat |

| trustly | 1% | immédiat |

| klarna | 1% | immédiat |

| fast bank transfer | 1% | immédiat |

Frais de retrait de skrill

Vous pouvez retirer votre argent de votre compte skrill par virement bancaire, carte de débit / crédit. Si vous devenez VIP skrill , ces frais seront réduits ou supprimés complètement. Le délai de retrait par virement bancaire est rapide et est généralement traité dans un délai de 3 à 5 jours ouvrables.

| Type de retrait | frais |

|---|---|

| virement bancaire | 5,5€ |

| visa | 7,5% |

| rapide | 5,5% |

L’envoi d’argent de skrill à neteller et inversement entraîne des frais supplémentaires de 1%.

Qu’est-ce que skrill?

Skrill est l’une des système de paiement les plus populaires aujourd’hui dans le monde entier. Skrill est un service de paiement qui vous permet d’envoyer de l’argent à vos clients ou amis plus efficacement sans vous soucier des retards de paiement.

Skrill a commencé ses services de paiement électroniques en 2001. Elle a conquis le marché mondial et compte actuellement parmi ses clients certaines des plus grandes marques au monde.

Bien que le portefeuille électronique proposé par skrill reste leur principal produit, le service de transfert de fonds proposé est hautement concurrentiel et se compare facilement à celui de transferwise en termes de frais et de fonctionnalité, sans aucun frais pour les virements vers des comptes bancaires.

Les comptes skrill peuvent être détenus dans n’importe laquelle des principales devises, mais une fois la première transaction effectuée, il n’est pas possible de changer la devise du compte. Les clients peuvent acheter une carte prépayée skrill, liée à votre compte skrill, dans l’une des quatre devises suivantes: USD, EUR, PLN et GBP.

Skill a également récemment introduit un nouveau service vous permettant d’acheter de la crypto monnaie à partir de votre compte skrill. Les crypto disponibles sont : bitcoins, bitcoins cash, ethereum, litecoin, XRP et 0x.

Comment fonctionne skrill?

Afin d’utiliser skrill et la mastercard skrill, vous devez d’abord créer un compte skrill. C’est un processus très simple et il ne faut que quelques minutes pour ouvrir votre compte.

Une fois votre compte enregistré avec succès, vous pourrez immédiatement effectuer des virements de fonds sans qu’aucune sécurité ou vérification supplémentaire ne soit nécessaire, et utiliser l’ewallet de skrill pour transférer des fonds vers vos sites de jeu, de change, de trading, etc.

Afin d’augmenter vos limites de transactions sur le portefeuille électronique et de commander une carte prépayée mastercard ou une mastercard virtuelle, vous devez avoir un compte skrill vérifié.

Skrill money generator adder

Skrill money generator adder 2019 no human verification by survey:

Welcome guys! Today i am gonna aware you how to hack money for skrill using our skrill money generator adder 2019. This is my biggest suffer on nights which is best software than any other online program. Anyone can download free skrill money adder 2019 without survey or human verification.

Skrill money adder is a squirrel money health 2019. You can withdraw any amount using it, there are no any limitations. If you have pretty sufferer so do not worth your time and get benefit from this software.

You can go ahead instantly and use it any time in the same day. Once you get this skrill money hack with activation code and then all the stuff arrest very simple.

What is skrill?

- It is your wallet online, on desktop & on mobile.

- If you have skrill account, you can send money, receive money & spend money.

- You can use your credit/debit card, bank account and cash via paysafecard in all over the world.

- There are over 100 deposit methods & everyone can open an account easily.

- Sending money is very simple even user can send their money directly to a bank account or to a email address.

- Spend online whatever you see skrill in the checkout.

- It’s progress is simple, secure and quick.

Skrill money generator [adder] 2019 no survey

" data-medium-file="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Fit=300%2C300" data-large-file="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Fit=750%2C750" src="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=750" alt="skrill money generator [adder]" data-recalc-dims="1" data-lazy-srcset="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=900 900w, https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?Resize=768%2C244 768w" data-lazy-sizes="(max-width: 750px) 100vw, 750px" data-lazy-src="https://i2.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder.Png?W=750&is-pending-load=1" srcset="data:image/gif;base64,r0lgodlhaqabaiaaaaaaap///yh5baeaaaaalaaaaaabaaeaaaibraa7">

Is skrill money adder 2019 reliable?

If you are new on our site exacthacks and then you must know to that we never published any program without testing it first. All latest security features has included and tested by our experts and regular visitors.

We have created one the best program which can generate cash to your skrill account for free. You just have to bound with $1000 daily for better and secure result. Your IP will be hide when you use it because of it’s anonymous function which is really powerful.

Skrill money generator adder is works with all android, windows and browsers without error. But we always recommend your PC or mac system without active your anti-virus software. No personal information required for use it and get it without filling offers. Once you download our program you never need to search like “skrill free money adder/generator v12.0/v14.0 activation code or how to hack money for skrill account.

" data-medium-file="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Fit=300%2C300" data-large-file="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Fit=750%2C750" src="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=466%2C359" alt="skrill money generator [adder]" width="466" height="359" data-recalc-dims="1" data-lazy-srcset="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?W=621 621w, https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=768%2C591 768w" data-lazy-sizes="(max-width: 466px) 100vw, 466px" data-lazy-src="https://i0.Wp.Com/www.Exacthacks.Com/wp-content/uploads/2019/03/skrill-money-generator-adder-2019-no-survey.Jpg?Resize=466%2C359&is-pending-load=1" srcset="data:image/gif;base64,r0lgodlhaqabaiaaaaaaap///yh5baeaaaaalaaaaaabaaeaaaibraa7"> skrill money adder 2019

It’s really useful for all countries specially united state america, united kingdom and australia. If you have paypal account then we have good news for that you can find also paypal money generator 2019 without human verification or survey.

How to use skrill money generator adder 2019?

As we explain upper that it is very simple to use so you just have to download free skrill money generator 2019 no survey from our site first following all instructions. Then open the program which support all windows system and android as well. Next enter skrill email address and choose your currency what you required. You must have to select all setting options because these setting will keep your account safe from all kind of ban.

In further option you need to choose amount of cash which could be up to 500 and press “add money” to hack money in your skrill account. After complete the programming function you can check your skrill acoount by refresh page and you will be happy to use skrill money adder 2019 activation code.

Carta prepagata skrill

Ultimo aggiornamento: 21/02/2020

Skrill è tra le carte prepagate più conosciute al mondo. Ma quali sono le sue caratteristiche? Scoprile:

Tipo: carta prepagata

Circuito: mastercard

Canone annuale: 10 € / anno

Limite di spesa: - € / giorno

Limite di prelievo: - € / giorno

Uso: personale

Contactless: no

Colore (standard, nera, oro): standard

Adatta alle aziende: no

Quota di rilascio: GRATIS

Vantaggi di questa carta:

- Una delle prepagate più famoso

- Mastercard ne garantisce la sicurezza

- Commissioni più basse della media

Non sai da dove iniziare? Queste sono le sezioni della recensione:

Recensione carta prepagata skrill - mastercard

La carta prepagata skrill è un metodo di pagamento che può essere usato ovunque, in tutti i negozi o e-commerce in cui viene esposto il marchio mastercard.

Ami recarti spesso presso negozi fisici o ristoranti, ma al tempo stesso non sai fare a meno dello shopping presso gli store online? Allora prova a scoprire insieme a noi quali sono le caratteristiche di questa carta.

Non si tratta di una carta di credito o di debito, ma permette in modo facile di sfruttare una serie di servizi davvero completi e interessanti.

La carta può essere disponibile in quattro valute: euro, sterlina inglese, dollaro e zloty polacco. Servono mediamente dai 7 ai 10 giorni per poterla ricevere e a quel punto potrai usarla per pagare online o presso i negozi che hanno il marchio mastercard.

Puoi comodamente per prelevare denaro dagli sportelli bancomat in ogni parte del mondo. Dopo aver effettuato l'accesso al saldo del conto è possibile usare il tuo denaro anche mentre ti trovi in vacanza.

Come si richiede la prepagata skrill

Potrai però richiedere la tua carta skrill solo se hai compiuto 18 anni e se sei residente nell'unione europea (sono esclusi i dipartimenti d'oltremare e i territori autonomi).

Al momento dell'apertura del conto, ti verrà chiesto di fornire documenti d'identità e il tuo indirizzo.

Dopo questa prima fase, possono essere eseguiti dei controlli elettronici per verificare i tuoi dati. Se la richiesta è accettata, sarà poi inviata la carta skrill direttamente all'indirizzo che è stato fornito nel momento dell'apertura del tuo account. Per attivarla è necessario effettuare l'accesso sul sito e seguire le istruzioni.

Le transazioni effettuate devono essere autorizzate personalmente inserendo il tuo codice PIN o andando a firmare la ricevuta del commerciante. Attenzione però: dovrai sempre controllare che i fondi siano sufficienti a coprire il valore della transazione e le commissioni applicate.

Commissioni applicate sui servizi della carta

Le commissioni della carta skrill sono trasparenti e facilmente consultabili attraverso il sito ufficiale della carta. Per usare la skrill prepaid mastercard sono previsti i seguenti costi:

- Pagamenti nei negozi fisici e online: gratis;

- Ricarica dal conto corrente bancario: gratuita;

- Ricevere contanti: gratis;

- Rendiconto online: zero spese;

- Riemissione del PIN: gratuita;

- Commissione annuale: 10 €;

- Conversione valuta: commissione del 3,99%;

- Commissione bancomat: 1,75 %.

I conti che saranno considerati inattivi, dopo un periodo che equivale o supera i 12 mesi, il titolare dovrà passare al pagamento di un canone mensile di 3 euro.

Sei in cerca delle migliori carte prepagate del 2020?

Guarda la classifica cliccando qui o sul bottone.

Se vuoi vedere direttamente la carta prepagata n.1, clicca qui!

Sicurezza offerta dalla carta skrill

La skrill può essere considerata completa e dall'utilizzo immediato, proprio come se fosse denaro contante, e inoltre permette di conservare e gestire in modo sicuro le tue finanze.

E' nominativa, personale e non prevede l'utilizzo da parte di terzi. Non a caso, come è precisato dalla banca che emette la carta, se il titolare crede che il PIN sia stato scoperto, è possibile contattare tempestivamente il numero verde, attivo 24 ore su 24, +44 (0) 207 117 6017.

E' buona abitudine cercare sempre di verificare, come detto, il saldo e la cronologia delle transazioni del conto skrill, così da riconoscere eventuali movimenti sospetti che potrebbero non coincidere con quanto da te speso.

Se la tua carta viene smarrita o rubata, è possibile chiamare la linea dedicata “smarrimenti e furti” in modo da farla subito bloccare.

Servizi e funzionalità della carta

Le operazioni di trasferimento di denaro avvengono sulla stessa piattaforma; ti registri e sarà possibile trasferire fondi sul tuo account skrill, oppure usare il servizio per la ricezione di denaro.

Ti stai ancora chiedendo perché dovresti scegliere questa carta? La risposta è facile: con skrill trovi il tuo perfetto alleato se vuoi ridurre i costi previsti per l'uso e la gestione di una prepagata offerta da banche. Il discorso cambia sicuramente nel momento in cui si vogliono effettuare delle operazioni di bonifico estero, sfruttando un valuta diversa dall'euro.

In questo caso, infatti, le commissioni sono alte e vi sono anche delle maggiorazioni sul tasso di cambio.

Avendo valutato da vicino la funzionalità, i servizi e i costi della carta, possiamo dire che, in linea generale, il servizio di money transfer può essere considerato conveniente. Il discorso però riguarda tutte quelle operazioni che sono svolte al di fuori dell'area SEPA/euro.

Anche a livello europeo, risulta essere un rapido aiuto, grazie ai suoi costi davvero contenuti.

Sei in cerca delle migliori carte prepagate del 2020?

Guarda la classifica cliccando qui o sul bottone.

Se vuoi vedere direttamente la carta prepagata n.1, clicca qui!

Skrill & paysafecard - kann man skrill per paysafecard aufladen?

Die prepaid PIN für sicheres onlinebezahlen paysafecard und das digitale portemonnaie skrill gehören seit 2013 zur gleichen unternehmensgruppe. Häufig taucht darum die frage auf, ob man sein skrill-guthaben per paysafecard aufladen kann und wie das funktioniert. Alles rund um skrill und paysafecard haben wir in diesem artikel für sie zusammengefasst.

Inhaltsverzeichnis des artikels

Skrill-konto mit paysafecard-guthaben aufladen – geht das überhaupt?

Www.Skrill.Com und www.Paysafecard.Com gehören zu den sicheren zahlungsarten im internet. Bei der paysafecard erwerben sie eine 16-stellige PIN, mit der sie bei teilnehmenden onlinehändlern bezahlen können. Die eingabe von persönlichen zahlungsdaten ist nicht mehr nötig. Auch bei skrill können sie nur über eine E-mailadresse geld senden und empfangen. Das aufladen von skrill mit einer paysafecard ist auf direktem weg aber nicht möglich.

Mehr fragen rund um die paysafecard?

Obwohl es in deutschland nicht möglich ist, skrill-konten per paysafecard aufzuladen, ist diese methode um online zu bezahlen sehr vielseitig und bei einer großen zahl anderer seiten anwendbar. Welche vor- und nachteile es gibt und viele weitere infos können sie in unseren ratgebern nachlesen.

Problem in deutschland: geldwäschegesetz

In vielen ländern ist es seit anfang 2014 möglich, guthaben über den my paysafecard-account auf die skrill digital wallet zu übertragen. Aber auch wenn skrill und PSC seit 2013 zur gleichen unternehmensgruppe gehören, gibt es in deutschland derzeit keine möglichkeit, das skrillkonto über paysafecard-guthaben aufzuladen. Auch andersherum können sie online ihr PSC-guthaben nicht über skrill bezahlen.

Aufgrund der strengen deutschen geldwäschebestimmungen gibt es weitreichende beschränkungen bei der nutzung von online-zahlungsmethoden. Auch eine identifikation, die häufig nötig ist, sorgt nicht immer dafür, dass diese beschränkungen aufgehoben werden.

Bei skrill und paysafecard ist problematisch, dass beide weitestgehend anonym genutzt werden können, da paysafecard-pins gegen bargeld ohne identitätsvorlage erstanden werden können.

In diesen europäischen ländern können sie ihr skrill-konto über ein my paysafecard-konto aufladen:

- Belgien

- Bulgarien

- Dänemark

- Finnland

- Frankreich

- Irland

- Italien

- Lettland

- Luxemburg

- Malta

- Niederlande

- Norwegen

Es gibt diverse andere möglichkeiten, das skrill-guthaben aufzuladen. Mit der PSC geht dies nur über umwege.

Alternativen zum aufladen von skrill-guthaben

Da das direkte aufladen von skrill-guthaben in deutschland über eine paysafecard nicht möglich ist, können sie ihr skrill-konto nur anderweitig mit guthaben aufladen oder einen umweg nutzen, um einzahlungen über die PSC vorzunehmen.

Skrillkonto regulär aufladen

Skrill bietet unterschiedliche kostenlose und kostenpflichtige möglichkeiten, das konto aufzuladen. Einzahlungen sind per banküberweisung, aber auch über kreditkarten und weitere anbieter möglich.

Banküberweisung und auslandsüberweisung: kostenlos rapid transfer: 0,5% gebühren bitcoin: 1% gebühren fast bank transfer: 1,5% gebühren sofort überweisung oder giropoay: 1,9% gebühren neteller: 3% gebühren kreditkarte:VISA 1,9% gebühren, mastercard 2,25% gebühren, american express, diners club und JCB 2,5% gebühren

Auf umwegen PSC-guthaben auf skrill laden

Auch wenn in deutschland eine direkte umwandlung von PSC-guthaben zu skrill-guthaben nicht möglich ist, gibt es eine möglichkeit, das geld über umwege in die digital wallet zu laden. Bei einigen wettanbietern können sie guthaben per paysafecard aufladen und haben später unterschiedliche möglichkeiten, sich das geld auszahlen zu lassen. Teils ist das dann per skrill möglich.

Teilweise fallen sowohl für die ein- als auch für die auszahlung von guthaben gebühren kann. Eine kostenlose guthabenumwandlung ist in den meisten fällen nicht möglich. Beachten sie auch die möglichen mindest- und maximalhöhen für ein- und auszahlungen beim jeweiligen anbieter.

Wichtiger hinweis

Die meisten wettanbieter erlauben es nicht, geld direkt nach dem einzahlen auszahlen zu lassen. In der regel muss das guthaben zunächst für glücksspielaktivitäten genutzt werden und kann dann erst ausgezahlt werden. Beachten sie daher die jeweiligen AGB des anbieters.

Zusammenfassung

Skrill-konto nicht direkt über paysafecard aufladbar (in deutschland) möglichkeit der einzahlung über PSC, wenn skrill-account und PSC-konto in großbritannien registriert sind reguläre einzahlung von skrill-guthaben über bankkonto nutzen umweg über einige wettanbieter möglich: geld per PSC einzahlen und an skrill wallet auszahlen

Diese artikel können sie auch interessieren:

что можно сказать в заключение: chargement du skrill digital wallet avec paysafecard vous chargez le crédit de votre skrill digital wallet rapidement et facilement avec my paysafecard. Vous payez ensuite dans plus de 156 000 по вопросу skrill pin

Комментариев нет:

Отправить комментарий