Skrill review

The company has gained a plethora of remarkable awards throughout the years. This includes winning titles at the financial sector technology award, international gaming awards, and EGR B2B awards among others. It’s easy for skrill wallet holders to send and receive money – you just need an email address.

Skrill review

CONVENIENCE

Send and receive money, store cards, link bank accounts and pay conveniently anytime and anywhere with your email address and password.

CONFIDENCE

Your security is a priority. We always keep your payments and personal information safe, and our anti-fraud team protects every transaction.

INSTANT

It’s easy for skrill wallet holders to send and receive money – you just need an email address.

WHAT IS SKRILL?

Moneybookers was considered as one of the fastest developing payment services provider in the UK in 2010 and remained to grow at a considerable pace since then. By 2011, they were serving close to twenty-five million clients across the globe. Skype, ebay and facebook to name a few are some of the globally renowned firms who provides skrill as a payment method for its users. In 2011, the UK-based company changed its name to skrill as part of their rebranding effort.

Skrill is regulated by the UK’s financial conduct authority and has passporting rights to run within the european union. The fact that it offers quick transactions with low commission and fees made skrill one of the leading online money transfer and payment platforms.

Thanks to skrill, sending money online and making international money transfers becomes astonishingly simple. All you need to do is to register at the web site with a valid email address and start utilizing the services. You can deposit funds to your skrill account through several options including bank transfer, credit card and intra-skrill transfers. Upon funding your account, you can make payments, purchase goods & services online and send money to other skrill users.

Additionally, payment processing with skrill is far from cumbersome for merchants who target to reach audience worldwide. It takes less than few steps to make a purchase. This is an important contribution because many potential buyers nowadays abandon the idea of purchase due to inability to pay instantly and obligation to share their critical information such as credit card details. Skrill makes online purchases a lot simpler and safer for buyers.

The company has gained a plethora of remarkable awards throughout the years. This includes winning titles at the financial sector technology award, international gaming awards, and EGR B2B awards among others.

Product & services

Skrill is a digital e-wallet platform working through an email address and a password. You can open a skrill account in the forty different currencies. But take note, the currency you will pick might not be altered afterwards. Nonetheless, you can make your payments along with currency conversion.

Having an account, you have the opportunity to do the following:

- Deposit and withdraw funds with various methods such as credit card, bank wire, etc…

- Receive and withdraw money,

- Make payments,

- Use skrill mastercard for online and in-store shopping,

- See all your transactions and charges online under the “history” section

Fees and limits

Opening a skrill account is always free of charge. You should log in or make a transaction at least once every twelve months, as failing to do so will lead to a service fee of 3 euros deduction.

Following services are free of charge;

- Making online payments via skrill e-wallet to merchants who accept skrill as a payment method

- Receiving cash into your account through bank transfer.

- Using the swift international payment method

Customers support

The contact us option of skrill covers telephone numbers for the UK, germany, spain, italy, poland, france, russia, USA, and an international number. Their business hours are typically monday to sunday from 9 AM to 6 PM GMT.

The lost cards line or stolen cards line number is +44 (20) 3308 2530. You can also find other contact options included on their website.

Skrill card

Skrill provides two different kinds of mastercard for a skrill account. You can take advantage of the skrill virtual mastercard or the basic plastic skrill mastercard. Through skrill card, you can access to all your funds and spend the balance on your account.

The skrill prepaid mastercard

It might be utilized as well to make online payments and to pay for purchases from any stores and shops, which accept mastercard. The card also enables you to make withdrawals from any atms across the planet. You need to make sure that the ATM accepts mastercard though. This can be observed with a mastercard logo on the ATM.

Account holders can apply for skrill card straight from the company’s website. The cost is €10 and the card will be delivered to your address. The process will typically take between ten to twenty days or less to come.

All users of skrill have access to their skrill 1-tap service. This is particularly helpful for super quick payments and perfect for online betting. 1-tap service enables users to make transactions through their mobile phones with a simple click.

You can easily access your funds by using the skrill mastercard without worrying about sending the funds to your bank account. Your skrill card balance is the same as in your skrill digital wallet. Opposed to other e-wallet providers today, the fees for skrill mastercard are low. Vips don’t pay still mastercard usage and order fees.

When you withdraw from an ATM using your skrill mastercard, you will be charged 1.75% fee. However, if you withdraw or make a purchase in a currency other than your skrill wallet currency, you will be charged an extra currency exchange fee of 3.99% on the top of 1.75%.

Therefore, it is advisable to withdraw money and make purchases in the same currency with your skrill wallet’s. For example, if your skrill digital wallet’s and skrill card’s currency is US dollars, I recommend you to find a ATM that dispenses US dollars.

You can order and activate your prepaid card after logging into your skrill account under the “skrill card” section. The card is accessible in four different currencies (GBP, PLN, EUR, and USD)

The skrill virtual mastercard

There is no withdrawal fee since you can’t use a virtual card to withdraw money from atms. However, the currency exchange fee applies to virtual card as well. If you make an online purchase in a currency other than your wallet’s currency, you will be charged a 3.99% currency conversion fee.

The major advantage of using this card is that you can decide how long you wish the card to be active. This feature will offer you an added level of security and prevent possible fraud compared to the standard plastic skrill mastercard.

Since september 2016, the platform doesn’t provide mastercard for people of NON-SEPA regions any longer, and these rules apply to their skrill virtual mastercard

Skrill review: online money transfers & payments with debit card

Skrill is an online e-wallet service that allows you to transfer funds both domestically and internationally. The platform is often regarded as the nearest competitor to de-factor e-wallet paypal. However, as is the case with any online money transfer service, you need to have a full understanding of how the fee system works.

As such, we’ve created the ultimate guide to skrill. We’ll discuss everything you need to know, such as deposit methods, safety, mobile-friendliness, and of course, fees.

By the end of reading our review from start to finish, you’ll have all of the necessary information to assess whether skrill is right for your individual needs.

Let’s start by finding out who skrill is.

Who is skrill?

Launched way back in 2001, skrill become one of the first online e-wallets to facilitate internet-to-internet payments. The overarching aim of using skrill is to transfer funds online to another skrill user. As we will discuss further down, the skrill platform now offers a range of additional services, such as bank account withdrawals and prepaid debit cards.

Formally known as moneybookers, the company rebranded to skrill in 2011. The company was purchased by paysafe group in 2015, alongside rival e-wallet neteller. In terms of its customer base, skrill claims to now have over 40 million users worldwide. Not only this, but the platform supports 200 countries and over 40 currencies.

On top of its more traditional money transfer service, skrill is now accepted at a vast number of online merchants. Recent estimates place the number of merchants at over 120,000 globally, with the skrill payment gateway utilized by the likes of ebay and facebook. Although skrill offers its payment gateway services to a full range of industries, one of its main markets is that of the online gambling and forex brokers.

One of the key reasons for this is that paypal often prohibit online casinos that do not have a long-standing track record in the online gambling industry, and thus, the threshold with skrill is much lower.

So now that you have a better understanding of who skrill is, let’s take a look at how you can get started with skrill.

How do I get started with skrill?

Here’s a breakdown of the main steps that you will need to go through to get started with skrill.

Open an account

First and foremost, you will need to open an account with skrill. Simply head over to the official homepage by clicking on this link , and then click on the ‘register’ button. You’ll find this at the top-right-hand side of the screen.

Next, you will then need to enter your full name, email address, and then choose a strong password. Read and accept the terms and conditions, before clicking on the ‘register now’ button.

On the next page, you will then need to enter your country of residence, and your preferred currency. Make sure you choose your domestic currency to avoid any exchange rate fees.

On the next page, you will then need to choose the payment method that you want to use to deposit funds. Once you do, you will then be prompted to enter some more personal information.

You don’t actually need to verify your identity at this point, as long as you still within your account limits. However, in order to increase these limits, you will need to upload some identification.

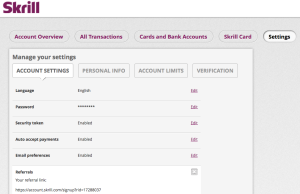

Verify your identity

In order to verify your identity, and thus, increase your account limits, head over to the settings page, which you can access via the the left-hand-side bar. Then click on ‘verification’.

In order to confirm your identity, you will need to upload a copy of your government issued ID. This can be either a passport or driving license, or in some cases, a national ID card.

If you decide to do this through your desktop computer, then you can upload the document straight from your device. You will also need to upload a selfie of you holding a handwritten note with the current date. Alternatively, if you decide to verify your identity via your mobile app, you can use your smartphone camera to take a photo of your ID.

What payment methods does skrill support?

Once you have set-up your newly created skrill account, you will be presented with a range of payment options. This includes a traditional bank transfer, debit/credit card, and a number of alternative methods such as bitcoin or paysafecard.

Here’s the full list of supported deposit options.

- Bank transfer

- Debit/credit card

- Neteller

- Bitcoin and bitcoin cash

- Paysafecard

- Trustly

- Klarna

Regarding a bank transfer, you will be presented with the local bank account details that you need to transfer the funds to. You will also be shown a unique customer reference number.

It is imperative that you insert the customer reference number when you perform the bank transfer, or skrill might have issues linking the transfer to your account. In the vast majority of cases, the bank transfer deposit will show up in your skrill account within 2-3 working days.

Alternatively, if you’re from the UK, you can perform a rapid bank transfer via skrill. This allows you to deposit funds instantly, via the faster payments network.

The other option that you have available to you is a debit or credit card deposit. This is by far the easiest option, as the funds will be credited to your skrill account instantly.

If none of the above suffice, then you can make a deposit with one of the alternative payment methods listed above.

What fees does skrill charge?

One of the most important factors that will determine whether or not skrill is right for your needs is fees. This doesn’t just come in the form of transfer fees, but also the costs associated with depositing and withdrawing funds, as well as currency exchange fees. We’ve broken the fees down in more detail below.

Deposit fees

Regardless of which payment method you use to deposit funds into your skrill account, you will be charged a fee. For the benefit of simplicity, all payment methods carry a fee of 1%. As such, if you were to deposit £500 in to your account, you would be charged a £5 fee.

This amount is deducted from the gross amount that you deposit. Using the same example as above, you would receive £495 from your £500 deposit.

Withdrawal fees

One of the great things about skrill is that you have the option of withdrawing funds back to your chosen payment method.

If you choose to withdraw funds back to your bank account, then you will pay the local currency equivalent of 5.50 EUR. At the time of writing, this amounts to £4.82.

In comparison to paypal, this is actually very expensive. If you are from the UK and you withdraw funds from your paypal account back to your UK bank account, then this process is not only instant, but it’s free.

If you want to withdraw funds from your skrill account back to your visa debit/credit card, then skrill will charge you a mouth-watering 7.5%. This means that a £100 withdrawal would result in a £7.50 fee.

Transfer fees

When it comes to actually transferring money, skrill will charge you 1.45% of the transfer amount. So, if you were to transfer £400, you would end up paying £5.80 in fees. In comparison to rival e-wallet paypal, this is actually much cheaper, as paypal averages 2.90% (although this will vary depending on where you live).

However, it is important to note that if you are transferring funds to a person to utilizes a different currency, then you will need to pay exchange rate fees. Unfortunately, this is where things can begin to get a bit expensive.

Skrill charges an additional 3.99% on top of the current mid-market rate. When adding that on to the previously mentioned 1.45% transfer fee, you could end up paying as much as 5.44%.

On the other hand, skrill never charges you to receive money, which is definitely a plus-point. On the contrary, the likes of paypal will charge you a variable fee when receiving funds, unless you are from the UK and the person sending the funds is also from the UK.

So now that you have a better understanding of the fees charged, in the next part of our skrill review we are going to look at how safe the e-wallet is.

Is skrill safe?

If you’re not familiar with how e-wallets work, then you might be concerned with safety. However, established e-wallets such as skrill are extremely safe to use. Firstly, the platform is authorized by the UK’s financial conduct authority under the electronic money regulations 2011. This ensures that your funds are kept safe.

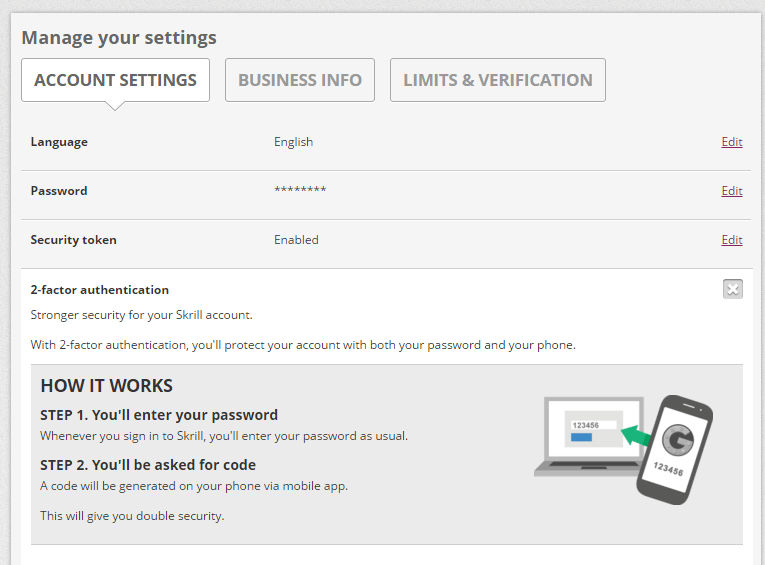

When it comes to keeping your account secure, it is highly advisable to set-up two-factor authentication. This is where you will need your mobile phone every time you want to log in or withdraw funds. Without it, nobody will be able to access your account.

You will also be asked to choose a 6-digit PIN number, which will also be required when you perform key account functions.

When you enter sensitive financial information (such as your debit/credit card details) in to the skrill website, the platform uses advanced encryption security. This means that even if the data was intercepted, nobody would be able to read it.

What you should be extra aware of is ‘phishing emails’. This is where scammers will impersonate skrill by sending you an email. They hope that you reply to the email with your login credentials, so that they can then gain access to your skrill account. However, skrill will never contact you by email asking for your account passwords, so be sure to tread with caution.

All in, skrill is a very safe e-wallet platform to use.

Skrill customer support

If you need assistance with your skrill account, it is always worth checking their extensive FAQ section first. We found that most account queries can be solved by reading the many help guides on offer. However, if you need to speak with the skrill team directly, then you have a couple options at your disposal.

You can contact skrill by telephone, and the platform offers a number of local toll numbers, including that of the UK and U.S. Before you call them, make sure that you write down your customer reference number so that the support agent can bring up your account. You’ll find this at the top-right-hand side of the screen.

Alternatively, you can send a direct message to the support team via your skrill account. The team usually reply within 24 hours, although if you need instant assistance, you’ll be best off contacting them via telephone.

If you are a VIP skrill member, then you will get access to 24/7 support via a dedicated telephone number. This will avoid having to hold for long periods.

Unfortunately, skrill does not offer a live chat facility.

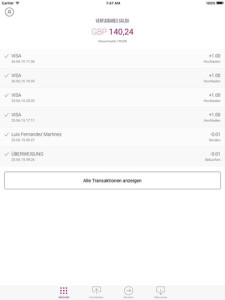

Skrill mobile app

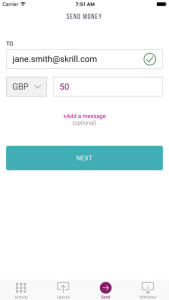

Skrill now offers a fully-fledged mobile application that you can download straight to your phone. The app is supported across both android and ios devices, however blackberry and windows aren’t supported. The app allows you to access all of the same account functions as you will find via the main skrill website.

This includes the ability to check balances, transfer funds, deposit and withdraw money, buy and sell crypto, and more. When we tested the app out ourselves, we found that the overall layout was very user-friendly. There were no issues navigating from section-to-section, and we were able to transfer money with ease.

The general consensus in the public domain is that the app operates without fault. Some users have complained about server issues when using the app via android devices, however these are few and far between.

The app also makes it easier to verify your identity, as you are not required to upload a selfie of you holding a piece of paper with the current date.

Skrill pre-paid debit card

Skrill also allows you to obtain a pre-paid debit card issued by mastercard. The card is linked directly to your main skrill account, which gives you more options when it comes to spending your balance. For example, you can use the skrill pre-paid debit card when making purchases in-store, free of charge.

You can also withdraw cash from an ATM machine, although you will be charged a 1.75% fee for this. On the other hand, the fees remains the same regardless of where you are, which makes the skrill pre-paid card useful when travelling abroad. The skrill pre-paid card comes with a fee of 10 euros, which you will need to pay every year.

Nevertheless, this actually makes it much cheaper to get money out of your skrill account, especially when you consider the 7.5% fee charged to withdraw funds to a visa debit/credit card.

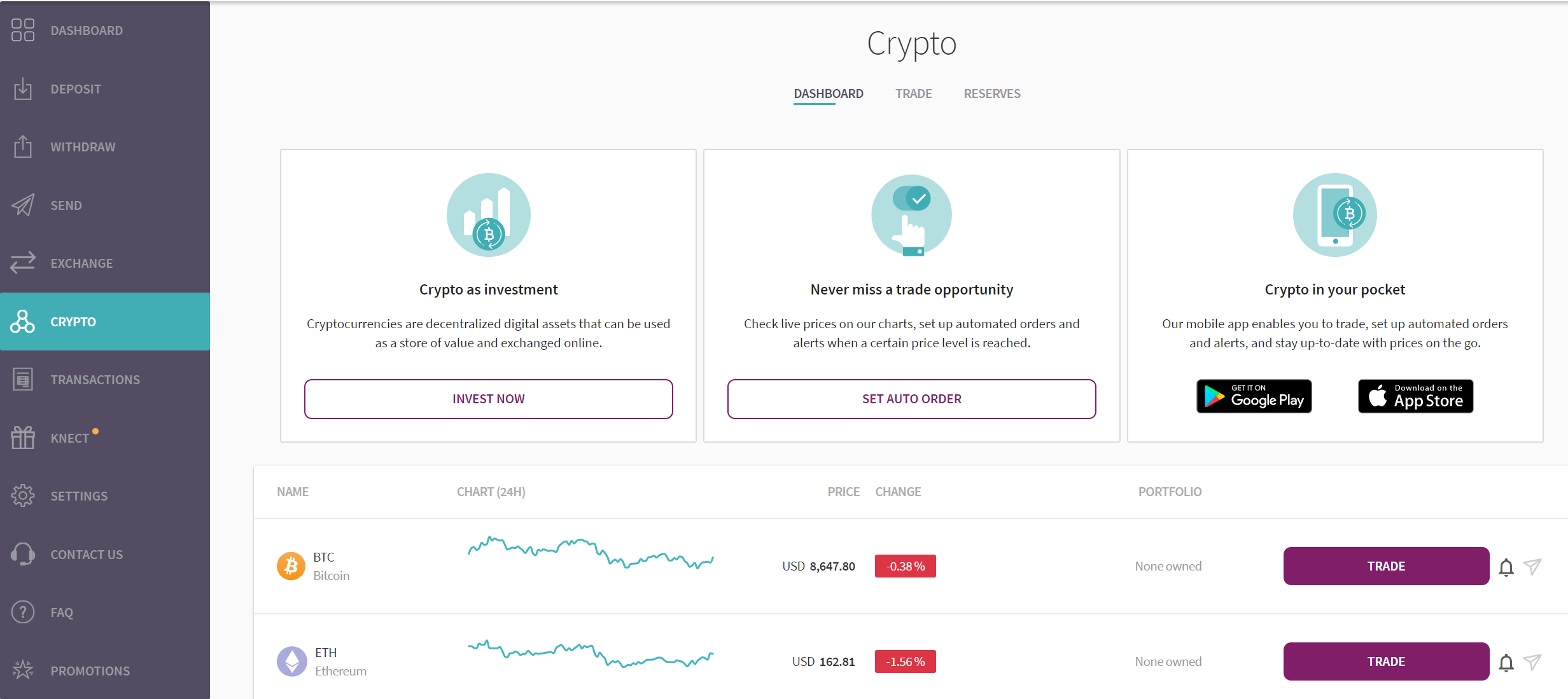

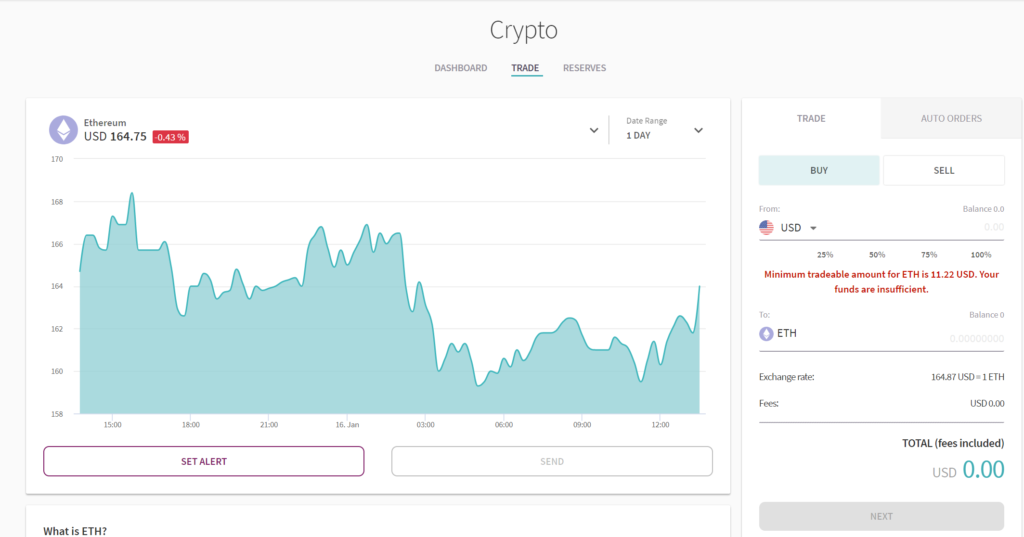

Buying crypto via your skrill account

Skrill recently entered the cryptocurrency space by allowing registered users to buy and sell coins via their account.

It is important to note that when you buy cryptocurrencies from skrill, you are not actually buying the underlying asset. Instead, you are buying CFD-like (contract-for-difference) products.

This means that you are only speculating on whether the price of the cryptocurrency will go up or down. As a result, you can’t actually withdraw the coins to an external wallet outside of the skrill website.

Nevertheless, skrill currently supports eight different cryptocurrencies, which we’ve listed below.

- Bitcoin

- Ethereum

- Ethereum classic

- Bitcoin cash

- Litecoin

- Ripple

- Stellar lumens

- 0x

In terms of fees, if you are buying or selling cryptocurrencies with either the USD or EUR, you will pay 1.5% at each end of the transaction. If you are using an alternative currency like GBP, then this fee increases to 3%. Not only are these fees rather expensive, but skrill do not make it clear how they import their live pricing feeds.

Skrill review: the verdict?

In summary, skrill is a really useful tool to send and receive money online. No matter where the other person is located, you can transfer funds with ease. We really like that the platform supports a significant number of deposit methods, such as a bank transfer and debit/credit card, as well as alternative options like paysafecard.

While transfer fees of 1.45% are rather competitive, things can be a bit expensive when you need to transfer funds using a secondary currency. This is also the case if you need to withdraw funds back to a visa card, with the fees amounting to a whopping 7.5%

However, a simple workaround in this respect is to obtain the skrill pre-paid card. This way, you can withdraw your skrill funds out via your local ATM at a rate of just 1.75%. This is especially useful if you want to use your card in another country.

A detailed skrill review: is skrill the right payment platform for you?

Skrill has an interesting history. I've had some merchants ask me whether or not it's a scam. Let's be clear–I can be certain it's a legitimate payment processor. However, it does have some problems with transparency–especially in the united states.

And you're going to find that the fees are often less than desirable. However, this is often because skrill does take on risk by supporting merchants that aren't supported by paypal and other more popular processors. So, in this skrill review, we'll learn about this interesting company and whether or not you should consider it at all.

Skrill review: who is it for?

Skrill used to primarily be used for storing and transferring online gambling winnings. The company was initially called moneybookers, and although gambling is still supported on skrill, it's evolved to include several other products and services.

For instance, a mobile wallet is provided by skrill, and you also have the option to sign-up for ecommerce merchant services, also known as payment processing.

The main advantage of considering skrill is how easy it is to send, accept, and store payments to a wide range of countries. Skrill seems to be driven by international transactions, and that's why sometimes a business in a more “risky” country may have no choice but to go with skrill.

So, the advantages are that skrill takes on more risk than other payment processors such as paypal. It's known for excellent security measures to make up the risk being taken on.

Another thing to consider is that skrill has been known to allow payments for more risky industries. This includes gambling, adult services, and firearms. It's not a guarantee, but several user reviews note that you'll have a much easier time partnering with skrill than paypal if selling something like that.

But, this type of risk comes with a price. The services and products are pretty much the same compared to the competition, so you're not getting anything extra. Yet, the pricing and fees aren't competitive, and I tend to assume this has something to do with the risk being taken on by skrill.

So, if you're running a business in a country or industry that isn't supported by paypal (read our full paypal review), skrill starts to look more appealing. But it doesn't make much sense for companies in the US or most regular european countries.

Skrill review: fees and other expenses

You'll quickly find that the fees and expenses are yet another reason US companies should typically avoid skrill. To start, the website doesn't show any information about merchant fees or rates. None at all.

You have to contact the sales team, which to me shows that skrill isn't being transparent for a reason.

In addition to that, skrill has a currency conversion fee of 3.99%.

This means that if I accept a payment in another currency outside my country, and would like to have it converted to my own currency, I then get charged 3.99%.

When running a business in some countries you'll have to simply eat this cost. Skrill provides a debit card that can be used to store your funds, but it's only available for those in the european economic area. So, once again, US merchants don't have that small bonus.

But now that we've covered how US businesses shouldn't consider skrill, let's look at the rates and fees for european businesses–since those are the only rates I was able to find.

- Chargeback fees are €25.

- Transactions with the digital wallet are 1.9% + €0.29.

- Quick checkouts on an ecommerce store are also 1.9% + €0.29.

The conversion rates obviously matter, but as of right now you're not saving money compared to paypal in the US dollar.

The good news is that skrill doesn't charge any money for fraud protection, account maintenance, and account configuration.

There don't seem to be any monthly fees associated with a skrill account, but the website does have some vague statements about how each merchant is different (so the fees could change). But, in general, you should only have to pay the transaction-based fees as you go along with your business.

And this is a big but. Skrill doesn't disclose on its website that some type of fee is charged if your online store generates less than €10 per month in transactional fees.

Based on some of the competition, this fee could be extremely high. Therefore, it's disappointing to see yet another example of skrill not being transparent with merchants.

A few more fees

If you've ever used paypal to send money to your bank, you know that it's free, regardless of being a consumer or merchant. In fact, many processors stick to this model. They charge for processing but let you send money to your bank without a charge.

Skrill, on the other hand, has a fee of €4 for when you'd like to move money from your skrill wallet to a bank. This is a little ridiculous, unless, once again, you're not able to use paypal because of your country, currency, or industry.

Finally, merchant refunds have a fee attached to them as well. Compared to other processors, this is another example of how skrill's fees are a little out of control. Most of the time a processor sends back the money and transaction fee so you're not stuck eating all of those costs.

However, skrill tags on a €0.49 fee for every refund that comes back to you. So, you better hope that your customers aren't returning many products.

Skrill review: products and services

As we've mentioned a few times in this article, skrill's basic functionality is rather similar to that of paypal. It works as an online wallet and a merchant payment processor. So, a regular person could send or receive money from a friend, or you have the option to accept or receive payments for your business.

However, there's a fee to send money to a friend. As of right now, that fee is 1.9% of the money sent, and it caps out at $20.

Many gamblers and consumers of more risky products and services have become used to these fees, but regular consumers would scoff at anything more than the 0% fee to send a payment to a friend with paypal.

However, we're not all that concerned with the consumer fees, since this is a blog about the best ecommerce platforms and payment processors.

Unfortunately, skrill strikes again with its lack of information online, at least in terms of its merchant services.

But here's what we could dig up for you:

Two types of merchant services are offered–what they call hosted payments and wallet payments.

The wallet payments are like the “lite version” of hosted. The service essentially says that merchants can accept payments from any customers with the wallet, as long as that customer is using the skrill wallet as well.

The hosted payments, on the other hand, are either embedded on your ecommerce site or processed through a skrill checkout page. It's not that hard to embed skrill on your site, so I would assume that you would opt for this instead of having customers redirected to an external page.

What else can you expect from skrill?

- Support for some interesting payment methods – 20 local payment methods are supported, along with 80 direct bank connections.

- A one-click checkout option – similar to what you'd find while shopping on amazon, skrill wallet users are able to click on one button and complete a purchase on your store. This feature isn't that unique, but it's included.

- Support for recurring payments – once again, it's nice to see this feature included with skrill, but it doesn't stand out compared to any of the competition. However, the combination of recurring payments and the one-click checkout make lots of sense for those gambling sites.

- Sending out payments to lots of people – this allows you to choose a large group of people and send payments to all of them at once. It might come in handy if you're working with several manufacturers or suppliers.

- Small transactions for apps – if you're managing a gaming website you might also have an app for that game. I guess this could also work for an ecommerce store with its own app. Basically, skrill lets customers send you micropayments inside of a smartphone app.

- Integrations with many ecommerce platforms – many competitors have this as well, but you should know that skrill has apps and support for platforms like shopify, magento, woocommerce, and many more.

Skrill review: how's the customer support?

The quality of customer support for a payment processor is usually determined by the resources on its website and what past customers have said. However, I tend to not put as much weight on user reviews since I find reviews are seldom written when people are in good moods.

That said, the reviews are fairly mixed, so I'll talk mainly about the online resources.

A help center is provided, but the articles aren't that detailed or plentiful. There's an email address for you to contact, which is most likely your best route. US merchants have no phone support, yet european merchants do.

A final word

With limited information about the features and fees online, it's no wonder skrill does have its fair share of disgruntled customers. It's clear that US merchants should avoid skrill, but europeans might find it more useful with the dedicated customer support and debit card offering. I still think the only reason you would go with skrill is if you're gambling, gaming, or maybe making some risky investments. The same might be said for companies in “risky” countries for paypal to get into.

Other than that, there's no reason to put up with the high fees.

If you have any questions about this skrill review, let us know in the comments.

Skrill review

What is skrill?

Skrill is one of today’s most popular payment gateways worldwide that understands that modern business is all about facilitating customers. Especially when it comes to payment processing and money transfer, not all services are up to the mark. However, skrill is one payment service that allows you to serve your customers more efficiently without having to worry about late payments.

Skrill started its services for electronic payments in 2001. It has captured global market and at the moment, it has some of the top brands in the world as its customers. With innovative solutions and facilities on offer, skrill has customers belonging from various fields.

Having won prestigious recognitions and awards such as deloitte technology fast 50 award, EGP B2B award and several others, skrill is one of the trusted names in the field of payment processing and money transfer services.

Overview of skrill benefits

Payment processing with skrill becomes incredibly simple. There are several options such as credit cards, cash and email- transactions. All you need to do is sign up at the web and avail the services. With transaction capabilities for more than 30 currencies around the globe, skrill lets you target audience worldwide.

Of course one always looks for security and transparency in payment processing. With skrill, you get the ultimate security that safely transfers high value money to your account. Your passwords and critical information is kept confidential to make sure there are no chances of any mishaps. With anti-fraud screening features, each and every transaction to and from your account is monitored which ensures high security.

All you need to do is open an account at the website. Your account works on mobiles devices too which lets you make transactions and payments from almost anywhere. One amazing feature in this service is that you can withdraw cash from atms too.

Since the online features are so facilitating, skrill becomes quite a handy tool for POS businesses and online stores. You can pay for stuff online with your account. This is a valuable addition because many customers abandon the idea of purchase because of inability to pay instantly. With skrill at the service, it becomes a lot simpler for the users to carry out their online purchases.

Overview of skrill features

Skrill position in our categories

Bearing in mind companies have special business-related needs, it is only wise that they steer clear of adopting a one-size-fits-all, ideal software solution. Nevertheless, it is troublesome to pinpoint such a software system even among popular software solutions. The sensible step to undertake would be to spell out the several key aspects that call for a consideration like crucial features, plans, technical skill competence of staff, company size, etc. Then, you must double down on the research through and through. Go over some skrill evaluations and look into each of the software products in your shortlist more closely. Such well-rounded product investigation makes sure you drop unsuitable applications and subscribe to the system which provides all the features you require business requires.

Position of skrill in our main categories:

Skrill is one of the top 20 payment gateway products

If you are interested in skrill it might also be sensible to check out other subcategories of payment gateway collected in our base of B2B software reviews.

Every business has its own characteristics, and can need a special payment gateway solution that will be fit for their business size, type of clients and staff and even individual niche they deal with. You should not count on finding a perfect services that will work for each company regardless of their history is. It may be a good idea to read a few skrill payment gateway reviews first and even then you should keep in mind what the software is intended to do for your company and your employees. Do you require an easy and intuitive app with only elementary functions? Will you actually use the complex tools required by experts and big enterprises? Are there any particular features that are especially useful for the industry you work in? If you ask yourself these questions it is going to be much easier to locate a trustworthy app that will match your budget.

How much does skrill cost?

Skrill pricing plans:

Skrill is a money transfer service that charges either free or low fees for different types of transactions. Your account is free as long as you stay active by logging in and making transactions at least every 12 months. If you’re inactive, skrill will charge you a €3 service fee that will be taken from your account’s funds every month.

Here’s an overview of skrill’s fees and charges:

Here are the transactions you can do in skrill for free:

- Receiving money into your skrill account

- Paying a retailer online that accepts skrill using your skrill wallet

- Funding your skrill account (usually free, but other options may charge small fees which will be clearly stated)

- Using the local payment method fast bank transfer in uploading funds

- Using the global payment method swift in uploading funds

Uploading funds

- Rapid! Paycard – 0.50% of the amount funded

- Bitcoin – 1% of the amount funded

- Klarna – 1.90% of the amount funded

- Trustly – 1.95% of the amount funded

- Neteller – 3% of the amount funded

- BOKU – 15% of the amount funded

- VISA credit card – 1.90% of the amount funded

- Credit cards: american express, JCB, and diners – 2.50%

- Paysafecard – 7.5%

Withdrawing funds

- Bank transfer (local) and swift (global) – £4.76 or €5.50

- VISA credit card – 7.50% of the amount

Sending funds – 1.45% of the amount; minimum fee of £0.43

Currency conversion – 3.99% fee on skrill’s wholesale exchange rates

User satisfaction

We realize that when you make a decision to buy payment gateway it’s important not only to see how experts evaluate it in their reviews, but also to find out if the real people and companies that buy it are actually satisfied with the product. That’s why we’ve created our behavior-based customer satisfaction algorithm™ that gathers customer reviews, comments and skrill reviews across a wide range of social media sites. The data is then presented in an easy to digest form showing how many people had positive and negative experience with skrill. With that information at hand you should be equipped to make an informed buying decision that you won’t regret.

Video

Technical details

- Small business

- Large enterprises

- Medium business

- Freelancers

What support does this vendor offer?

Useful skrill resources

Popular skrill alternatives

Top competitors to skrill by price

Trending payment gateway reviews

Skrill comparisons

Skrill user reviews

I can transfer money safely and conveniently

This is great option for sending/receiving money

Skrill is flexible solution for transferring money, but the withdraw fee is extremely high

What are skrill pricing details?

Skrill pricing plans:

Skrill is a money transfer service that charges either free or low fees for different types of transactions. Your account is free as long as you stay active by logging in and making transactions at least every 12 months. If you’re inactive, skrill will charge you a €3 service fee that will be taken from your account’s funds every month.

Here’s an overview of skrill’s fees and charges:

Here are the transactions you can do in skrill for free:

- Receiving money into your skrill account

- Paying a retailer online that accepts skrill using your skrill wallet

- Funding your skrill account (usually free, but other options may charge small fees which will be clearly stated)

- Using the local payment method fast bank transfer in uploading funds

- Using the global payment method swift in uploading funds

Uploading funds

- Rapid! Paycard – 0.50% of the amount funded

- Bitcoin – 1% of the amount funded

- Klarna – 1.90% of the amount funded

- Trustly – 1.95% of the amount funded

- Neteller – 3% of the amount funded

- BOKU – 15% of the amount funded

- VISA credit card – 1.90% of the amount funded

- Credit cards: american express, JCB, and diners – 2.50%

- Paysafecard – 7.5%

Withdrawing funds

- Bank transfer (local) and swift (global) – £4.76 or €5.50

- VISA credit card – 7.50% of the amount

Sending funds – 1.45% of the amount; minimum fee of £0.43

Currency conversion – 3.99% fee on skrill’s wholesale exchange rates

What integrations are available for skrill?

Write your own review of this product

The most favorable review

PROS: what I really love about skrill is its professional and reliable service. It provides me with opportunity to transfer money from skrill account directly to mobile money account, in very low cost. Great tool for sending and receiving money effortlessly. Also, it provide robust security system so you don’t have to worry about stammers and spammers.

CONS: they could add other mobile networks such as airtel or vodafon.

The least favorable review

PROS: the best aspect of the product for me was that skrill quite quickly withdrawed funds to credit cards, within several hours.

CONS: as for GUI, I had to face a variety of limitations like it was not possible to add a new card or some bank account. Mobile app has not got all the functions like withdrawing was possible to VISA only. But the main problematic points are their policy and attitude to their customers. It is quite difficult to create a request to support as it is necessary to search email or phone contact through the list of pages. When at least you have managed to submit a request via email it could take them several days to reply useless. Attitude to the users is disrespectful. When I started to transfer more funds and recieved VIP user status with pseudo favorable terms, they started verification of my person by asking for the list of documetns. I have filled one document, they requested another one, I have provided the second document they requested more documents, I have provided the third document with a list of screenshots from my accounts to which the funds were being transfered, they answered me that my account is closed due to violating terms and conditions. I have not recognized any facts of violating terms and conditions and started to clarify real facts and provments of my violation to accept it by writing them straight questions and calling to them to get any adequate explanations. But in a result my questions were ignored and they said that they are not obliged to explain me anything. So after this case I have found the company as unreliable and tricky. Taking into account the sequence of events they seem to promote VIP conditions motivating people to spent more through their service but when someone reaches favorable terms within VIP status s/he becames unprofitable as promised discounts should be provided. In order not to provide cheap service they stage the violations and block the user.

More reviews from 10 actual users:

I can transfer money safely and conveniently

PROS: what I like about skrill is the accessibility, the security in making transactions, and the exceptional services it gives to users. It is free and doesn’t require any complicated processing during the registration. The system is synced and ensures confidentiality of my payment and withdrawal history. Withdrawing my funds is highly convenient as well. I can safely and conveniently transact or pay online with this app.

CONS: skrill is only limited to selected countries and not so reliable, which might force users to use other online payment services like paypal. No financial support also as it is not backed by banks. You even have to pay for transaction charges when making withdrawals. For new accounts, skrill may work a little bit rough.

This is great option for sending/receiving money

PROS: skrill is professional and reliable service , it provides great options for transfering money from skrill account to mobile money account for a very low cost. We can send and receive money without some additional requirements or troubles. It has great security system and we don’t have to worry about spammers.

CONS: I’d like to see other mobile networks like vodafon and airtel.

PROS: I like that I can buy stuff and move my money at the comfort of my home even if I don't have an account overseas.

CONS: I don't like that the app is missing too many affiliations across the world.

Skrill is flexible solution for transferring money, but the withdraw fee is extremely high

PROS: I like skrill because it’s simple online money transfer solution. I can receive and sent payments and purchase products online. The fees for sending money are low unlike those for withdrawing money. Also, I like that we can use pre-paid credit card when sending or receiving money.

CONS: skrill is more focused in europe and its customers, they could expand their business in other parts of the world. In addition, when you withdraw money from atms fees are extremely high and it is not flexible at all.

PROS: what I really love about skrill is its professional and reliable service. It provides me with opportunity to transfer money from skrill account directly to mobile money account, in very low cost. Great tool for sending and receiving money effortlessly. Also, it provide robust security system so you don’t have to worry about stammers and spammers.

CONS: they could add other mobile networks such as airtel or vodafon.

As for me, skrill has appered to be unreliable system with disgusting attitude to their customers.

PROS: the best aspect of the product for me was that skrill quite quickly withdrawed funds to credit cards, within several hours.

CONS: as for GUI, I had to face a variety of limitations like it was not possible to add a new card or some bank account. Mobile app has not got all the functions like withdrawing was possible to VISA only. But the main problematic points are their policy and attitude to their customers. It is quite difficult to create a request to support as it is necessary to search email or phone contact through the list of pages. When at least you have managed to submit a request via email it could take them several days to reply useless. Attitude to the users is disrespectful. When I started to transfer more funds and recieved VIP user status with pseudo favorable terms, they started verification of my person by asking for the list of documetns. I have filled one document, they requested another one, I have provided the second document they requested more documents, I have provided the third document with a list of screenshots from my accounts to which the funds were being transfered, they answered me that my account is closed due to violating terms and conditions. I have not recognized any facts of violating terms and conditions and started to clarify real facts and provments of my violation to accept it by writing them straight questions and calling to them to get any adequate explanations. But in a result my questions were ignored and they said that they are not obliged to explain me anything. So after this case I have found the company as unreliable and tricky. Taking into account the sequence of events they seem to promote VIP conditions motivating people to spent more through their service but when someone reaches favorable terms within VIP status s/he becames unprofitable as promised discounts should be provided. In order not to provide cheap service they stage the violations and block the user.

Skrill review – overview

In our detailed skrill review we show you how easily it is to set up and verify your new account in 2020. Additionally, we also give you more details about the benefits that come with such an ewallet account like their VIP system, the mastercard and much more.

You will also learn how we can help you to optimize your account and which great benefits you enjoy by signing up with us.

Ewo VIP program – benefits

By signing up with our free ewo program you will have lower VIP requirements to get upgraded to bronze VIP (only 3,000 EUR within 30 days) and silver VIP (only 5,000 EUR within 30 days) including other special benefits.

Besides that you benefit from our additional support. Through our longstanding business relationship we are able to help you to solve most issues or at least speed up the processes for you.

Please contact us if you have any questions about the ewallet or our free ewo program

Last updated: january, 2020

Pros & cons

Ewo benefits

Skrill review – facts & history

Skrill is one of the oldest ewallet operators on the market. With 15 years (founded 2001) it is one of the most recognised names on the ewallet market. They were founded under the name “moneybookers”, took over paysafecard in february 2013 and were re-branded in march 2013. In august, corporate venture capital (CVC) announced the acquisition of skrill for 800 million USD. The ewallet provider now belongs to the paysafe group PLC. It is regulated by the financial conduct authority in the UK and is allowed to issue electronic money and payment instruments.

The last half of 2012 we saw NETELLER achieve a 21% increase in new member sign-ups. The paysafe company was able to double their memberships to more than 35 million as well as their overall transfers to 55 billion EUR within the last 2 years.

Skrill is widely accepted at most poker sites, sportsbooks, casino operators and forex providers. It is safe to say that there is no way around the former moneybookers to be able to move your money around fast and easy between different merchants.

Skrill review – screenshots

Registration

Register your new account will only take a few minutes and by using the following steps you will create an account easy and fast.

3 steps to register your new account

- Make sure to use our signup link to sign up.

- Enter your personal details like name, residential address, email address, password on the registration form.

- Submit your account details (account ID, currency, email address) to

become a member of our ewo program.

After these steps your account is almost ready. The last step is the verification process, which is necessary to remove all restrictions and enjoy all our benefits.

You already have an account and you want to join our program with your existing account? Just submit your account details. We will be happy to check if we can get your account added to us as well.

Existing skrill customers can also apply to join our free ewo program. Just submit your data at our website and we will be happy to check and get back to you via email.

Verification

Only a fully verified account can enjoy all of the services without any restrictions. So it is important to verify your account to enjoy lower VIP requirements, remove all transaction limits from your account and to enjoy much more benefits.

Documents to verify your account

You can upload your verification documents directly in your account. To fully verify your account you need to send

- The front and back side of your ID card or passport.

- A selfie of your face holding a handwritten note with “skrill” and the date of the verification process next to it.

- A recent utility bill (gas, electricity or any other household bill) or a bank statement, showing your full name and address and not older than 90 days.

Please make sure to send clear and legible copies of your documents to ensure a fast verification for your account.

For more details about the verification process just check our skrill verification page or contact us for any question

Skrill review – fees

There are different fees which can apply depending on how you use your skrill account.

Therefore, it is important to make sure what exactly are the fees are for your case and of course if there is a way to avoid or at least lower the fee.

The easiest way to lower your fees or remove them is by reaching a higher VIP level which is way easier with us.

The VIP requirements of our program are much lower compared to regular skrill clients.

Since the fees are quite a big topic you should check out our detailed skrill fees 2020 page for all details and information about deposit and withdrawals, currency conversion, mastercard fees, withdrawal, crypto fees and much more.

You will also find all details how joining ewo will help you to lower them and safe you lots of money in the long run.

Skrill review – limits

Similar to the fees, there are also lots of different limits connected to your ewallet accounts.

Let’s start with the good news, by joining ewallet-optimizer you enjoy really low VIP requirements which will result in increasing or even removing your limits completely.

Money transfer between your ewallet accounts will therefore be no problem anymore and not limits to any specific amount.

At least as long as your account is fully verified, but more details about this you can find on our verification section.

The deposit limits will also be increased, but not for all deposit options.

Depending on your country of residence and your VIP status you will have different options and also the limits can vary.

In our detailed skrill limit review we have gathered all information for you to give you a quick and easy overview about how to increase your limits and more about the benefits with our ewo program.

Security

Security is an important topic in general, but especially for ewallet customers it is even more important to keep your funds as safe as possible. The ewallet provider offers a great in-house security feature, which helps you to secure your account.

Two-step authentication (2FA)

Every time you sign into your account or make a transaction your smartphone or tablet will generate a one-time-use code. This code comes in addition to standard login details and changes every 30 seconds. This makes it almost impossible for someone to break into your account. In combination with strong password you have a really safe place to keep your fuds.

You can find a quick step-by-step guide about how to set up this additional security feature on our security page.

There was also a hardware security token available some years ago to protect your account. This token is no longer available and was replaced by the two-step authentication. However, customers who still have an old token are able to use it.

There are also a lot of skrill phishing on the web, so make sure to check our security article about this topic. You will find some more details about how to detect those sites and some general information about your security.

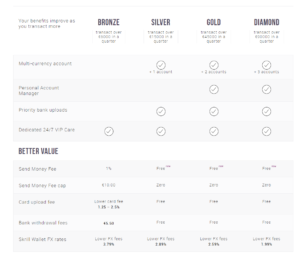

VIP program

Skrill offers a really simple and straightforward VIP system. With this reward system you can get rid of most of your fees or at least lower them drastically.

| Transfer 6,000 EUR to merchants per quarter to reach bronze VIP status. → only 3,000 EUR with ewo. |

| Transfer 15,000 EUR to merchants per quarter. → only 5,000 EUR with ewo. |

| Transfer 45,000 EUR to merchants per quarter. → only 15,000 EUR with ewo. |

| Transfer 90,000 EUR to merchants per quarter. → only 45,000 EUR with ewo. |

To see a full list of benefits, please check our VIP progam page.

Please note, as a ewallet-optimizer client you will enjoy lower requirement for get upgraded to bronze and silver VIP. If you already have an account, just submit your account details.

Skrill review – mastercard

The skrill card works like every other prepaid mastercard and is the perfect way to get access to your funds fast and easy all over the world. You can access your savings without worrying about spending too much money. Your available balance with the prepaid mastercard is the same as in your digital wallet.

Compared to other ewallet providers the fees for the mastercard are very low and silver vips or higher can use the card for free without paying any fees.

Skrill review – mobile app

The extreme popularity that mobile devices like smartphones and tablets enjoy is really impressive and therefore it is important for a company to offer an easy to handle and comfortable mobile app.

The app allows customers to manage your ewallet account and send and receive instant payments to anyone, anywhere and at any time. You can also check your account balance or upload your verification documents through the app directly.

Overall user experience with the mobile app is really good. It is available for free on android and ios platforms and can be found in apple app store or google play store.

For a detailed breakdown of all the information we have also added a review page that you will find at the link below.

Skrill review – deposit options

There are a lot of different options available to deposit funds into your account .Besides the standard bank transfer option, you can also use:

Please note, depending on your country of residence the fees for the different options can vary. Make sure to check the fees for your current location before making a deposit.

Skrill review – withdrawal options

The following payment options are available to cashout. You can withdraw your money by using the following options:

In addition you can also use your prepaid mastercard for ATM withdrawals and send money via p2p transfer to another account.

Support

If you have done some research or used the ewallet yourself, you might have noticed their support is not particularly good. They have only a 1.5 score out of 10 on trustpilot.

But do not worry: if you are a member of our skrill bonus program we can help you solve any problem that you might have. We will contact the right person and make sure it is solved in a timely manner.

Please do not hesitate to contact us if you have any issues or problems with skrill. We are there to help!

Skrill review – serviced and restricted countries

Skrill offers payment processing services in almost all countries with just a few exceptions. Please check our following overview to find some more details about their serviced and restricted countries.

Skrill serviced countries.

Completely restricted countries in grey .

And the prepaid mastercard is available only in the SEPA region marked in purple .

Where does skrill provide service?

Serviced countries

Please check the following overview to see all countries and regions where you are allowed to hold a paysafe account, transact with any merchants and have access to different deposit and withdrawal options.

Please note, skrill does not offer mastercards for residents of NON-SEPA countries any longer. We have summarized all details and facts for you. Besides the fact that those clients are not able to receive a new mastercard, all other services will stay available.

Further information

please note it is strictly forbidden to make payments to or to receive payments from persons or entities offering illegal gambling services. Countries where online gambling is illegal include the united states of america, turkey, china, malaysia and israel.

If you have any questions regarding serviced and restricted countries, please do not hesitate to contact us .

Serviced countries with mastercard available

Customers from the SEPA-region are still allowed to order a mastercard for their accounts.

Please check the following table to find all countries where you can use all services including the prepaid mastercard.

If you are not living in one of the following countries and you are interested in a prepaid mastercard, please contact us to check your options.

Non-serviced / banned countries

If you are residing in any of the following countries you are not allowed to use the ewallet services.

A violation gives skrill the right to suspend or terminate your account at any time.

Register with additional ewo benefits for free

No matter from what country you are, make sure to register your account with ewallet-optimizer to enjoy special benefits and better support.

If you have any questions about the free ewo program and the benefits, please do not hesitate to contact us . We are here to help you.

Skrill & ewo

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Skrill review

Taking $3,000 per month or less in card payments?

You’ll save with square

- Account stability issues

- Expensive fees to transfer money

- Poor customer support

- Basic reporting

- Limited pricing disclosed online

Overview

At first glance, skrill seems precisely like the paypal alternative people have been clamoring for since paypal started racking up legions of dissatisfied users and merchants. Skrill has digital wallet feature as well as merchant processing services, making it one of the most direct apples-to-apples comparisons I’ve seen. Skrill even promises that it’s available in 200 countries and 40 currencies. So it clearly has the same global reach.

Founded in 2001, the company was originally known as moneybookers. It wasn’t a paypal contender — it was simply a way for people to move money when they gambled or placed bets online. That’s still one of skrill’s product offerings, too. It’s owned by paysafe group, the people behind neteller and the paysafecard.

Since it launched, skrill has slowly expanded its services, evolving from a way to place bets online to a full-on digital wallet, and of course, a diverse suite of merchant services. It now claims 36 million users and 156,000 merchants, according to its “about us” page. Those numbers are nothing to sneeze at, but they aren’t even close to paypal’s adoption rates.

I can see the consumer draw of skrill. It’s an easy (albeit expensive) way to move money internationally. And for merchants, there’s probably has a similar appeal. It’s easy to do business across borders and to tap into a market of 36 million users.

I was initially very hopeful about skrill. The company looks like a very strong contender in the “anything but paypal” game. But that’s just appearances. When you scratch the surface, you reveal some serious problems — and a lack of information that I simply do not like. Not only that but, in an age when moving your money around can be nearly instantaneous and mostly free, skrill feels seriously behind the times.

I have absolutely no questions about skrill’s legitimacy as a business. It is the real deal. But for consumers who need a mobile wallet, I fail to see any real advantage over other options. For merchants, there are no unique services, and the company doesn’t have any competitive edge — nothing it does better than anyone else.

Combined with highly dubious customer service and some not-insignificant transparency issues, that’s more than enough for me to give skrill 3 stars in this review. Can you use skrill without any issues? Probably, but it’s not worth taking the chance.

If you’re a US merchant, even though skrill offers processing services, I strongly recommend looking elsewhere. If you’re in europe, skrill is a stronger contender, mostly thanks to a prepaid debit card option. However, the card is only available in select european countries. For a supposedly global wallet, that’s a major let down.

There are better, more transparent options out there — ones with better customer service to boot. Paypal is a better option if you’re interested in the mobile wallet aspect plus merchant services. If your focus is international business, stripe or braintree will also serve you very well.

Read on to find out more about skrill, or take a look at our list of the best online credit card processors!

Products & services

First and foremost, like paypal, skrill is a digital wallet. Consumers can load money onto it and spend it anywhere that accepts skrill payments — or send money to each other (for a cost of 1.9% of the transaction, up to $20). That was my first red flag for skrill: sending money to friends and family is typically free on most P2P payments apps. Customers have come to expect that.

It’s also used for placing bets online, including for esports and such. And it can be used for forex trading. I think these are the best applications for skrill. But I’m not here to look at the consumer product. I’m interested in skrill’s business solutions:

Something that may confuse is the fact that skrill offers business, merchant, and commercial accounts. (there’s also a difference between personal and customer accounts.) each one has its own specific use. If you want to accept payments online, a merchant user account is what you’re after.

I’m sad to say that there isn’t a neat list of features to look at or a way to nearly compare different account types. I think the company could stand to be a bit more explicit about everything it offers BEFORE someone signs up. The information is fragmented and difficult to find — even for someone like me, and I’ve got a black belt in google-fu (note: that’s an entirely made-up thing).

Skrill’s merchant services are broken down into two categories:

- Wallet payments: it should surprise no one that skrill allows merchants to accept payments from customers who use the digital wallet.

- Hosted payments: the hosted payment solution allows you to accept payments from skrill users and those without an account. After they check out on your website, they are redirected to the skrill site to complete the transaction, pretty much exactly how paypal works. You can also enable an iframe to accept payments through skrill while keeping customers on your homepage. Skrill brags that hosted payments supports “more than 20 local payment methods and over 80 direct bank transfer connections with a single integration.”

Skrill sort of fails at marketing its own features, but here’s a quick run-down of what you get.

- In-app payments and microtransactions: developers can use skrill’s wallet to facilitate payments in online apps, particularly within games.

- Mass payments: need to send money to a lot of people all at once? Skrill has you covered with its mass payment feature.

- Recurring payments: great for subscription and membership options. However, I wouldn’t expect these to be as advanced as the tools you would get with stripe or braintree.

- Shopping cart integrations: merchants can choose to integrate with a fairly large selection of shopping carts. Of note are shopify, woocommerce, opencart, volusion, and bigcommerce.

- Skrill 1-tap: the 1-tap feature allows skrill wallet users to approve purchase automatically, without having to go through an authorization process each time. If you think this sounds an awful lot like paypal’s onetouch, you’d be right, because that’s exactly what it is.

In addition, it’s worth mentioning that skrill is PCI-compliant. Since you’re not hosting your own payment page, you won’t need to worry about this. You’ll also get access to skrill’s analytics, which seem a bit basic, but will at least give you an idea of what your processing volume is like.

However, you’re not going to get any sort of in-person payments. Skrill is strictly online and mobile only. And I don’t expect to see the company roll out any terminal or mobile solutions any time in the near future. Not only that, but skrill also doesn’t support invoicing in the U.S. There’s no option to request payment either. Given that square and paypal both offer integrated invoicing among MANY other features, this is disappointing.

Fees & rates

You can’t find merchant processing rates on skrill’s site. Or at least, you can’t find U.S. Processing rates on the U.S. Site. But you can find the pricing for european merchants with no trouble, on the integrations page.

Account setups, account maintenance, and fraud protection tools are all free with skrill, which is nice.

- Digital wallet transactions: 1.9% + €0.29

- Quick checkout transactions: 1.9% + €0.29

- Chargeback fee: €25

I do want to point out this is a drop in fees compared with skrill’s rates last time I looked at this review. That’s a good thing, I think. But I have noticed some of the consumer fees have gone up. The withdrawal fee was previously €1.50 for a transfer or € per check (or cheque). On a $100 transfer, you’re already paying more and will continue to pay more as the amount you move increases.

Then, take note of these additional fees:

- Refunds: skrill actually charges YOU €0.49 per every refund, which is ridiculous. Lots of great processors will simply refund the transaction fees along with the rest of the money.

- Withdrawals: you’ll pay €4 for withdrawing fees from your skrill wallet. Which I guess is better than some of the consumer withdrawal costs, but I assume that’s for bank transfers only, which are free for consumers. And again, just about every standard processor routes money to your bank for free (including paypal).

- Minimum fee: undisclosed, applies to merchants generating less than €10 in processing fees per month.

I don’t like that skrill doesn’t disclose its monthly minimum rate at all because it makes me worry that it’s quite high. For example, payanywhere charges a whopping $80 if you don’t meet the $5,000 monthly minimum for its storefront plan. And if it was merely $10, why not say? The other alternative, of course, is that fees vary based on what services you use. But it really shouldn’t be that complicated. (for the record, the threshold is less than €500/month in processing, though the exact amount depends on your average ticket value).

There’s one final fee to talk about:

- Currency conversion: 3.99%

If you’re dealing with global business and want to convert transactions to your home currency, skrill charges you nearly 4% to do so. Most processors assess a small conversion fee for cross-border transactions, but it seems to vary.

The problem with merchants who keep their funds in a digital wallet is that you can only spend your money on sites that accept your digital wallet. That’s why paypal introduced its mastercard debit card. Skrill also has an offering — but it’s only available to users who reside in the european economic area. US users are no longer able to get this card. The limiting of the card’s accessibility costs skrill its partnership with the freelance platform upwork.

Contract length & cancellation fee

Skrill seems, for the most part, to be a pay-as-you-go service. Merchants will pay per-transaction fees and possibly other monthly fees (skrill simply says in its help center that “fees may be applied on business accounts depending on additional agreements.” I assume this includes the monthly minimum fee. I haven’t seen any reports of early termination fees, which I guess makes sense given how unstable accounts seem to be.

Customer service & support

I’m happy to say skrill finally added its help center to its main site. I don’t like that the help center is so sparse. There’s hardly any information available in it — most of the questions are pretty generic. Square and paypal’s self-service resources are far beyond this. You can find the developer guides (pdfs) on the main site, but there’s no developer center with all the documentation in the way you see from many other payment processors.

Apart from that, skrill offers a twitter account dedicated entirely to customer support (@ask_skrill). The team is responsive, even if most replies are copy/pasted from a template and not always helpful. The support team likes to direct most complaints to the help email address. A lot of tweets are from irate users wanting to know why transfers or verifications are taking a painfully long time.

I don’t like that there isn’t any US-based phone support anymore, either (a fact I only found out by following a link to phone numbers that was posted on twitter). Especially for merchants, this is a bit of a deal breaker. Having to make an international call for support is just ludicrous. So I don’t recommend skrill for US merchants.

If you’re in europe, you’ve got several options for phone based on your location. Check out the support center page for numbers and hours. I’ll give skrill credit for at least offering support seven days a week.

Given the lack of disclosure and limited support channels, I’m not at all surprised to see skrill has quite a few complaints that relate directly to its unreliable customer service. Check those out in “negative complaints and reviews,” below.

Sales & advertising transparency

I have a few (or more than a few) issues with skrill’s transparency. Reading online, I am not the only one.

Let’s start with the easy stuff: the company site looks great. Very slick and up to date. It’s really two different sites — one for consumers who use the wallet, and one for merchants. And I do like how easy it is to switch between them. Often in these situations, you find yourself down a rabbit hole that you can’t quite escape and your only option to is head to the home page and start over.

But I am frustrated at how little information is on the site. There’s no clear list of features. There are vague mentions to micro-payments and in-app payments but no details. I’ve found slightly more helpful information skrill’s developer guides, but it’s still not even close to on par with what it should be.

Complicating things even more, you’ll find a US-based english site and a UK-based english site, and you can flip between the two. There’s a lot of information on the UK site that the US one doesn’t have (like merchant rates). Of course, it seems like skrill is mostly targeted at the european market.

If you want to learn more about skrill, you need to sign up for an account or contact a salesperson. Fortunately, I haven’t been able to find any reports of pushy sales reps. But the fact that you can’t even get in contact with the company without providing your business information is worrisome.

There’s no blog, and the press release page redirects to the paysafe group site, where most of the press releases aren’t about skrill.

While the company does have active facebook, twitter, and linkedin pages, there’s not much that’s particularly compelling or useful to a merchant. At the very least, the social media team is responding. IT looks like the company has gotten a little bit savvier about social media marketing; I’ll give skrill that much. The facebook page has disabled posts to the page, so some of the comments on its posts are from people seeking customer support or otherwise voicing their complaints against the company.

One of the biggest points of contention for many skrill users seems to be hidden fees. There are a fair few complaints about loading funds into skrill, only to find out the company takes a cut well above what was stated. I also see complaints about holds and freezes — skrill, like most processing companies, has a provision that allows it to implement a reserve fund. However, it doesn’t seem to be well disclosed unless you read all the terms and conditions (which you should do before signing up with ANY merchant processor) and seems to be inconsistently enforced.

My impression of skrill is that it’s the kind of company that looks hip and sophisticated and easy to use, but once you’re in you find out it’s mostly a nightmare. I mean, I know there are a fair number of merchants who accept skrill, presumably with no problems. But I would expect a viable replacement for paypal to at least match the company on transparency, or pricing, or features, which are the biggest draws. I don’t see that.

User reviews

Negative reviews & complaints

Skrill has a B- rating from the BBB, mostly because of the time it takes for skrill to respond to complaints. It has a relatively small number of complaints — 57 in the last three years, 12 in the last 12 months. That’s down from 68 and 22, respectively, the last time I checked in. However, keep in mind that most of skrill’s customer base is outside the U.S.

You’ll also find 17 complaints on ripoff report. Other review sites on the web, especially global ones, have amassed a collection of scathing reviews, too.