Skrill prepaid mastercard

Delivery usually takes around 7-10 business days, but the exact time depends on the postal service in your country. When ordering a card, you will be asked to choose the same address which you provided while creating a skrill account.

Skrill prepaid mastercard®

Skrill prepaid mastercard® is an indispensable tool for those using skrill wallet. This card allows to withdraw funds from your skrill account from any mastercard® ATM or pay for a purchase worldwide.

Only customers with VIP status can get skrill prepaid mastercard® for FREE

clients without VIP status can order a card for $13.

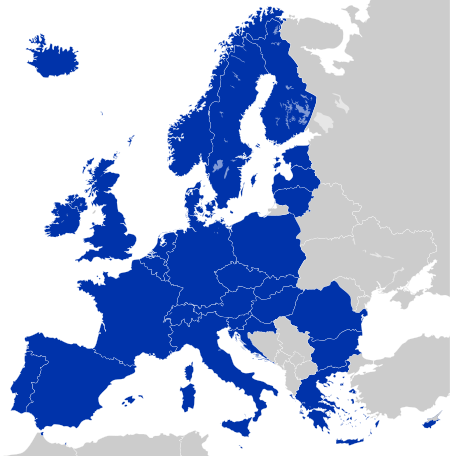

*the EEA includes: austria, belgium, bulgaria, croatia, republic of cyprus, czech republic, denmark, estonia, finland, france, germany, greece, hungary, iceland, ireland, italy, latvia, liechtenstein, lithuania, luxembourg, malta, netherlands, norway, poland, portugal, romania, slovakia, slovenia, spain, sweden and the UK.

Advantages of skrill prepaid mastercard®

- 3,99% – regular accounts;

- 3,79% – VIP bronze;

- 2,89% – VIP silver;

- 2,59% – VIP gold;

- 1,99% – VIP diamond.

| VIP status | ATM withdrawal | purchases |

|---|---|---|

| verified account, no VIP status | €900/day | €2700/day |

| VIP bronze | €900/day | €3000/day |

| VIP silver | €1500/day | €3000/day |

| VIP gold | €3000/day | €5000/day |

| VIP diamond | €5000/day | €10000/day |

How to order skrill prepaid mastercard®

When ordering a card, you will be asked to choose the same address which you provided while creating a skrill account.

Delivery usually takes around 7-10 business days, but the exact time depends on the postal service in your country.

Few tips on using skrill prepaid mastercard®

- Your card remains inactive unless you activate it and create a PIN in your personal account.

- Transaction history of your card is displayed in your skrill account under the history tab.

- In case your card is stolen or lost, you need to call skrill support +44 203 308 2520 or block it yourself in your personal account.

Skrill prepaid mastercard® allows to withdraw money worldwide, pay for goods and services, as well as access your skrill balance whenever and whenrever you prefer.

SKRILL VIRTUAL PREPAID MASTERCARD®

Skrill virtual prepaid mastercard® is a convenient tool for online payments at sites where mastercard is accepted for payment.

Currently, skrill virtual card is only available to residents of the european economic area* and a few other countries, who verified their accounts.

Transactions are conducted only by skrill virtual prepaid mastercard® card number, and transfer information and personal data are equated to anonymous online payment methods.

WHEN CONVENIENT TO USE SKRILL VIRTUAL PREPAID MASTERCARD®

It’s best to use your skrill virtual card when you are shopping online today or now. There is no need to wait for the delivery of a physical card, which takes almost 1-2 weeks.

Paying with a skrill virtual prepaid mastercard® is possible wherever mastercard cards are accepted. Even where there is no possibility of payment through the skrill wallet.

By the way, you can delete or block a virtual card in your account at any time.

BENEFITS OF THE SKRILL VIRTUAL CARD:

INSTANT CARD

Creating a new virtual card in the account – a couple of seconds;

VIRTUAL CARD BALANCE = ACCOUNT BALANCE

Virtual card balance is equal to skrill wallet balance;

CARD IS IMMEDIATELY READY FOR USE

No need to wait for the delivery and activation of the card, as in the case of the plastic skrill prepaid mastercard®;

HIGH TRANSACTION LIMIT

Daily limit for payment by virtual card: € 6,300 / $ 7,000, which is higher than the limit on skrill plastic card;

FREE CARD ISSUING

For one account you can create one card for free. Two accounts – free two cards;

FREE USE OF THE CARD

No fees for servicing a virtual card.

HOW DOES SKRILL VIRTUAL PREPAID MASTERCARD® WORK?

With a virtual skrill card, user can pay for goods and services on the internet wherever both skrill and mastercard® are accepted.

In order to apply for a virtual card you need to verify your account.

With the skrill virtual card, you can pay in the online store, but it does not withdraw cash from an ATM and does not work in a regular store.

The skrill virtual prepaid mastercard® card services have small limitations: it is not used to book a hotel room, purchase a ticket or rent a car, since this type of transaction requires a verified plastic card.

TARIFFS AND LIMITS OF THE SKRILL VIRTUAL PREPAID MASTERCARD® CARD

| service | cost |

| applying the first card for one account | free |

| issuing of the second and other cards | €2,5 |

| conversion fee | 3,99% |

| available currency for card | PLN, GBP, USD, EUR |

| daily limit for payment of | EUR: 6300, PLN: 23000, USD: 7000, GBP: 4550 |

HOW TO GET A SKRILL VIRTUAL PREPAID MASTERCARD® VIRTUAL CARD?

You can order the first skrill virtual card in your skrill account website only if you have a positive account balance. The user can remove the card at any time and issue a new one.

TO ORDER SKRILL VIRTUAL MASTERCARD®:

GO TO YOUR SKRILL ACCOUNT …

SELECT “SKRILL PREPAID CARD”. IN THE “VIRTUAL SKRILL CARD” SECTION, CLICK “ADD A CARD” BY SELECTING THE DESIRED CURRENCY …

VIEW THE VIRTUAL SKRILL CARD DETAILS …

ENTER THE SECURITY CODE FOR YOUR ACCOUNT SKRILL …

GET ALL THE DATA ON THE VIRTUAL MAP SKRILL …

*the EEA includes: austria, belgium, bulgaria, croatia, republic of cyprus, czech republic, denmark, estonia, finland, france, germany, greece, hungary, iceland, ireland, italy, latvia, liechtenstein, lithuania, luxembourg, malta, netherlands, norway, poland, portugal, romania, slovakia, slovenia, spain, sweden and the UK.

Skrill wallet and skrill prepaid mastercard® plastic card and skrill virtual card are more advantageous when connecting to the vipdeposits + skrill loyalty program!

Join SKRILL + VIPDEPOSITS LOYALTY PROGRAM

If you already have a skrill account,

please proceed to step 2 and fill out the form.

Skrill prepaid mastercard®

Skrill prepaid mastercard® is an indispensable tool for those using skrill payment system. This card allows to withdraw funds from your skrill account from any mastercard ATM or pay for a purchase worldwide.

Only customers with VIP status can get skrill prepaid mastercard® for FREE

clients without VIP status can order a card for $13.

Please note, that skrill prepaid mastercard is sent only to SEPA countries*.

*the SEPA zone includes: austria, belgium, germany, greece, ireland, spain, italy, cyprus, latvia, lithuania, luxembourg, malta, netherlands, portugal, slovakia, slovenia, finland, france, estonia, bulgaria, great britain, hungary, denmark, poland, romania, croatia, czech republic, sweden, iceland, liechtenstein, monaco, norway, switzerland.

Advantages of skrill prepaid mastercard®

- 3,99% – regular accounts;

- 3,79% – VIP bronze,

- 2,89% – VIP silver,

- 2,59% – VIP gold,

- 1,99% – VIP diamond.

| VIP status | ATM withdrawal | purchases |

|---|---|---|

| verified account, no VIP status | €900/day | €2700/day |

| VIP bronze | €900/day | €3000/day |

| VIP silver | €1500/day | €3000/day |

| VIP gold | €3000/day | €5000/day |

| VIP diamond | €5000/day | €10000/day |

How to order skrill prepaid mastercard®

Skrill usually sends the card in an ordinary letter which comes to your post box. You will have to create a PIN while activating the card in your personal account. When ordering a card, you will be asked to pick the same address which you indicated while creating a skrill account.

Delivery takes around 10-14 business days, but for the exact time depends on the post office in your country.

Few tips on using skrill prepaid mastercard®

- Your card remains inactive unless you activate it and create a PIN in your personal account.

- Transaction history of your card is displayed in your skrill account under the history tab.

- In case your card is stolen or lost, you need to call skrill support +44 203 308 2520 or block it yourself in your personal account.

Skrill prepaid mastercard allows to withdraw money worldwide, pay for goods and services, as well as access your skrill balance whenever and whenrever you prefer.

Skrill mastercard prepaid skrill card

Skrill mastercard

Anders als NETELLER, bietet skrill nur eine normale mastercard and und keine virtual mastercard. Auf der folgenden seite findet ihr alle informationen und details zur skrill prepaid mastercard und welche vorteile sie euch bringt.

Skrill prepaid mastercard

Die skrill mastercard funktioniert wie jede andere prepaid mastercard:

Verglichen mit anderen ewallet anbietern sind die gebühren der skrill mastercard sehr niedrig. Für skrill vips entfallen sie sogar komplett.

Bestellen könnt ihr eure prepaid karte unter “skrill prepaid karte” in eurem skrill konto.

Skrill card video

Fakten und zahlen zur skrill card

- Verfügbare währungen: USD, EUR, PLN and GBP.

- Mastercard gültigkeit: die karte ist 36 monate gültig, bevor eine neue karte zugeschickt wird.

- Kosten für die bestellung der mastercard: für die bestellung einer neuen skrill mastercard oder einer ersatzakarte fällt eine gebühr von 10 EUR an.

- Kündigung der mastercard: für die kündigung der karte fallen keine kosten an.

- Jahresgebühr: die jährliche gebühr der karte beträgt 10 EUR.

- Gebühr für abhebungen am geldautomaten: für eine abhebung wird euer skrill konto mit einer gebühr von 1.75% belastet.

- Tageslimit für abhebungen: das tageslimit für abhebungen am geldautomaten beträgt 900 EUR/24h.

- Benutzung der karte in shops/online-shops: die benutzung der karte in sämtlichen shops, weltweit, ist kostenlos.

- Privatsphäre: transaktionen mit eurer mastercard werden nicht auf eurem kontoauszug vermerkt.

- Tageslimit für die nutzung in shops/online-shops: die skrill mastercard hat ein tageslimit in höhe von 2,700€/24h.

- Vorteile und rabatte: bis zu30% rabatt bei ausgewählten skrill händlern.

- Transparenz: alle umsätze lassen sich jederzeit in eurem skrill konto nachvollziehen.

- Wechselgebühr: die wechselgebühr der skrill mastercard ist abhängig von eurem aktuellen skrill VIP status.

Vorteile der skrill mastercard für skrill vips

- KOSTENLOSE bestellung.

- KOSTENLOSE überweisungen an andere skrill konten ab silber VIP.

- KEINE jahresgebühr.

- KEINE gebühren für abhebungen an geldautomaten weltweit.

- Verfügbar weltweit für fast alle skrill VIP kunden.

- Nur 3.79% wechselgebühr für bronze vips, 2.89% für silber vips,2.59% für gold vips und 1.99% für diamant vips.

- Bis zu 5,000 EUR/24h am geldautomaten verfügbar, abhängig vom skrill VIP status.

- Bis zu 10,000 EUR/24h für zahlungen in geschäften.

Limits für die skrill mastercard

Die limits für bezahlungen in shops (POS) und bargeldabhebungen am automaten, sind je nach VIP status sehr unterschiedlich. In der folgenden tabelle findet ihr alle details zu den verschiedenen limits für VIP kunden und nicht-VIP kunden.

| Skrill mastercard® limits | bargeldabhebung / 24h | benutzung in shops / 24h |

| kein VIP level | 900 EUR | 2,700 EUR |

| bronze VIP level (niedrigere bedingungen für ewo kunden) | 900 EUR | 3,000 EUR |

| silber VIP level (niedrigere bedingungen für ewo kunden) | 1.500 EUR | 3,000 EUR |

| gold VIP level | 3,000 EUR | 5,000 EUR |

| diamant VIP level | 5,000 EUR | 10,000 EUR |

Probleme bei der benutzung der skrill mastercard am geldautomaten

Falls ihr am geldautomaten mit eurer mastercard kein geld abheben könnt, prüft bitte zuerst euer verfügbares guthaben. Kontrolliert ebenfalls eventuell anfallende wechselgebühren und euer tageslimit, welches ihr unter “meine skrill karte” einsehen könnt.

Sollte ihr dennoch den fehler nicht finden können, versucht es etwas später nochmal an einem anderen geldautomaten. In 95% der fälle kann keine verbindung zum mastercard server hergestellt werden. Im vergleich zu anderen kreditkarten handelt es sich bei der skrill mastercard um eine prepaidkarte. Das guthaben muss daher zuerst geprüft werden, was gelegentlich zu einer fehlermeldung führen kann.

Wenn es auch später nicht funktioniere sollte, wendet euch bitte an [email protected] und erkundigt euch nach technischen problemen oder nach möglichen problemen eures kontos.

Ersatz im falle eines missbrauchs der skrill mastercard

Solltet ihr einem kreditkartenbetrug zum opfer gefallen sein, wird skrill euch den dadurch entstandenen schaden innerhalb von 10 arbeitstagen vollständig ersetzen. Bitte lest dazu auch paragraph 8 der allgemeinen geschäftbedinungen der skrill mastercard für weitere informationen.

Verfügbarkeit der skrill mastercard

Bitte beachtet, seit september 2016 bietet skrill keine mastercards mehr für kunden aus NICHT-SEPA ländern an. Wir haben für euch alle details zusammengefasst. Alle weiteren dienste sind nach wie vor verfügbar.

Kunden aus den folgenden ländern können aktuell die mastercard für ihr skrill konto bestellen:

| Österreich | belgien | deutschland | grieschenland | irland | spanien | italien |

| cypern | lettland | litauen | luxemburg | malta | niederlande | portugal |

| slowakei | slowenien | finnland | frankreich | estland | bulgarien | england |

| ungarn | dänemark | polen | rumänien | kroatien | tschechien | schweden |

| island | liechtenstein | monaco | norwegen |

Solltet ihr noch weitere fragen haben, zögert nicht uns zu kontaktieren .

Skrill mastercard

The skrill mastercard works like every other prepaid mastercard:

You can easily access your savings by using the skrill mastercard without worrying about spending too much money. Your available balance with the prepaid mastercard is the same as in your digital wallet.

Compared to other ewallet providers the fees for the skrill card are very low. Skrill vips don’t even pay the skrill card order and usage fees.

You can order and activate your prepaid card under “skrill card” after logging into your skrill (moneybookers) account and the card is available in 4 different currencies (USD, EUR, PLN and GBP).

The following table shows you more about the limits and difference between regular skrill and skrill VIP customers.

Check our skrill fees page for the full info about all applying skrill fees.

Limits for the skrill card

Please also check our skrill limits page with all info about all the limits that apply and our skrill review for the overall conditions.

Problems using the skrill card at an ATM

If you cannot withdraw cash from an ATM by using your skrill mastercard and get an error message, please check your available balance in your (skrill) moneybookers account first. Also, please keep in mind possible foreign exchange fees and your actual 24h ATM limit which you can check at “my skrill mastercard”.

If you still can not find the problem, please try again a little later or at another ATM. In about 95% of the cases, those standard error messages occur if the ATM is not able to connect to the mastercard server in time. Different to other mastercards your skrill mastercard is a prepaid card and the ATM has to check your available balance first. If the ATM is not able to get the connection fast enough a standard error message appears on the screen.

In case it does not work later or even the next day, please send an email to [email protected] and ask for possible technical problems to be addressed or for your account to be manually checked for possible fraud.

Please also check our detailed article about skrill mastercard issues and how to solve them.

Refund in case of any fraud

If fraud occurs, skrill will refund your account by the full amount within ten business days. Please read paragraph 8 of the terms and conditions of skrill mastercard for detailed information.

Skrill virtual mastercard

The major benefits is, you can decide how long you want it to remain active which will give you an extra level of security and avoid potential fraud compared to the regular plastic skrill mastercard.

The following table gives you a quick overview about the available currencies, their limits and the fee for the card.

Please note, to be eligible to order the virtual card you account has to be registered to an address from the EU (SEPA region) and it also has to be fully verified. If your account is not fully verified yet use our fast ewo skrill verification service to remove your limits and get verified within 1 day.

The first virtual mastercard for each customer is free and to order the card simply click on the “skrill card” option on the left-hand side of your skrill account and choose “add a card“.

You can also have multiple cards, but each additional card comes with a fee of 2.50 EUR in addition to a 10 EUR annual service fee.

Skrill mastercard availability

Since the end of september 2016 skrill does not offer mastercards for residents of NON-SEPA countries any longer and those rules also apply to the skrill virtual mastercard. We have summarized all changes where the card is not available anymore for you. Besides the fact that those clients are not able to receive a new skrill mastercard, all other services will stay available.

The skrill card is available in the following countries only:

Please contact us if you have any further questions about the skrill card or skrill in general. We are there to help you.

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

TRANSFER MONEY

FOR FREE

Send money abroad for free with skrill.

Try the calculator to see how much you will save.

Or, explore the tabs above the calculator to see the other benefits of using skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

TRANSFER MONEY

FOR FREE

No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

Aneta gave you £10

to send abroad

Get £10 off when you transfer £100 or more from the UK. Just make sure to use your friend's referral code [ anetaa23 ] when you register. Go ahead, start your transfer now! Terms apply.

This special referral offer is currently only available when making international transfers from the UK.

See how much you get sending £1000 to india

| provider | receive amount (INR) | send amount + fee | effective FX rate |

|---|---|---|---|

| send money with | exchange rate 92,380.00 | transfer fee 1,000.00 | 92.3800 |

| send money with | exchange rate 91,907.37 | transfer fee 1,000.00 | 91.9074 |

| send money with | exchange rate 91,891.16 | transfer fee 1,000.00 | 91.8912 |

| send money with | exchange rate 92,005.76 | transfer fee 1,001.49 | 91.8689 |

| send money with | exchange rate 91,865.16 | transfer fee 1,002.90 | 91.5995 |

| send money with | exchange rate 91,540.00 | transfer fee 1,002.99 | 91.2671 |

| the comparison fees displayed on our page have been published on 23/12/19 13:10 CET and have not been refreshed since this date. The data for the price comparisons shown have been taken from other providers’ websites, on specific dates. This information is freely available on the competitor’s websites we have listed. This is not an exhaustive list of companies offering a money transfer service and if you are interested in a particular supplier we suggest you check their respective website. Fees comparison disclaimer | |||

How it works

Register for a skrill account with your friend's link or code

Transfer £100 or more from the UK to an international bank account.

You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

FEE FREE

It's free to send with skrill money transfer to a bank account or mobile wallet abroad - more savings for you.

QUICK AND EASY

Send money to bank accounts internationally. Choose how much and where you want it to go.

SECURE

Your money transfer is protected by our industry-leading secure payment systems.

TRUSTED GLOBALLY

Millions of people use skrill to send and receive money around the world.

See what our customers are saying about us

Secure and easy transfers

SHISHIRA , india

Really good. It’s secure and fast

SOURABH , india

Using skrill has really made money transfers from kenya to other countries extremely easy.

IRENE , kenya

A great way to send money around the world

SAM , india

Our company

Don’t have the recipient’s bank details?

You can also send money instantly with just an email address.

Access your money wherever you are 24/7

Our fast, easy to use and secure app lets you access your account whenever you need it.

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international.

Copyright © 2019 paysafe holdings UK limited. All rights reserved. Skrill limited (FRN: 900001) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments. Skrill is a registered trademark of skrill limited. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

Skrill prepaid mastercard

System mastercard type prepaid leistung (0.5 von 5) bargeld (0 von 5)

Vorteile

- Mastercard ohne schufa-abfrage / bonitätsprüfungen

- Kein bankkonto erforderlich

- Das konto / kreditkarte kann wahlweise in EUR, GBP, USD oder PLN geführt werden*. In dieser bewertung wird die kontoführung in EUR angenommen

- Geringe jahresgebühr

- Kostenloses aufladen per überweisung möglich

- Kein aufladelimit

Gut zu wissen

- Mindestalter: 18 jahre

- Funktionsweise ähnelt einem girokonto mit EC-karte**

- Überweisungen von kreditkarte zu kreditkarte sind nicht kostenfrei

- Bei bargeldabhebungen außerhalb des gewählten währungsraums fallen zzgl. Noch mindestens 3,99 % gebühren für den fremdwährungseinsatz an

- Die maximale haftung beträgt 50 GBP und wird in die gewählte währung des kontos umgerechnet

- Skrill VIP-level-status ab 6.000 euro transaktionsvolumen (je quartal) mit 100 % geld-zurück-garantie, niedrigeren transaktionskosten, mitgliedschaft im loyalty club, prämien aus dem skrill VIP store

Sicherheit

- Zwei-faktor-authentifizierung (2FA)

- Über die google authenticator app können codes zur zusätzlichen authentifizierung auf das smartphone geladen werden

Karte sperren: inland: 089 520 306 91

ausland: 0049 89 520 306 91

verantwortlich für die karte: wirecard card solutions ltd.

Ähnliche kreditkarten

Skrill prepaid mastercard

Konditionen der kreditkarte

Hauptkarte

| karteneinsatz | gebühr |

|---|---|

| karteneinsatz in der euro-zone | 0,00 % |

| karteneinsatz außerhalb der euro-zone | 3,99 % |

| bargeld abheben am automaten (eigenes institut) | 1,75 % |

| bargeld abheben am automaten (fremdes institut) | 1,75 % |

| bargeld abheben am automaten (außerhalb EWU) | 1,75 % |

| ausstellungsgebühren | euro |

|---|---|

| ersatzkarte | 10,00 |

| haftung und limits | euro |

|---|---|

| cashlimit tag inland | 900,00 |

| cashlimit tag ausland | 900,00 |

Anmerkung der redaktion

Skrill berechnet einen aufschlag von 3,99 % bei geldtransfers mit währungsumrechnung!

Die karte sollte wenigstens ein mal im jahr eingesetzt werden (unabhängig vom betrag) bzw. Sollten sie sich bei skrill einloggen. Andernfalls wird eine servicegebühr in höhe von 3 euro / monat (oder gegenwert in einer anderen währung) erhoben.

Fazit

Die skrill prepaid mastercard ist außergewöhnlich, da sie (bzw. Das konto) in mehreren währungen geführt werden kann, was für gewisse klientel viele vorteile mit sich bringt. Die jahresgebühr fällt gering aus. Wer jedoch in fremdwährung bezahlt, muss dafür hohe gebühren einkalkulieren. Entsprechend sollte die karte nur für bargeldlose bezahlungen eingesetzt werden, die sich mit der geführten kontowährung decken.

Bewertung der redaktion: ( 3.5 von 5 )

* wird das konto in euro geführt, entfällt innerhalb der eurozone das auslandseinsatzentgelt.

** funktionsweise: das guthaben der karte ist mit dem guthaben auf dem skrill konto verknüpft, so wie eine EC karte mit dem guthaben auf einem bankkonto verknüpft ist. Um die skrill mastercard zu nutzen, laden sie geld auf ihr skrill konto. Die mastercard kann sofort überall dort eingesetzt werden, wo mastercard akzeptiert wird.

Skrill zählt in europa zu den größten online-zahlungssystemen.

Das skrill konto ermöglicht allen kunden, ohne preisgabe persönlicher kontoverbindungs- oder kartendaten, im internet zu bezahlen sowie geldüberweisungen mit einer E-mail-adresse zu senden oder zu empfangen und wird beispielsweise von großen portalen / dienstleistern wie ebay und skype genutzt.

Skrill limited wurde 2001 in london gegründet und wird von der financial conduct authority (FCA) unter der E-geld-richtlinie 2011 als bereitsteller von E-geld autorisiert und reguliert. Skrill muss bestimmte mindestmengen an kapital bereithalten. Die anfängliche und dauerhafte grenze liegt bei 350.000 euro eigenkapital. Außerdem müssen ausreichend liquide mittel bereitgehalten werden, um alles ausgegebene E-geld zurückzukaufen und den betriebskapitalbedarf zu decken. Die einlagen der kunden sind gesichert über den vollen betrag der einlage / der aufladung des accounts.

Skrill prepaid mastercard

De skrill prepaid mastercard© is één van de goedkoopste prepaid creditcards die je op de markt kan vinden. Je betaalt hier slechts 10 euro per jaar voor en krijgt toch alle voordelen van een echte mastercard, hoewel het eerder over een debetkaart gaat. Je moet vooraf geld opladen op deze kaart, waarna ze gebruikt kan worden zoals een normale kredietkaart. Je kan hiermee overal betalen, zowel online als offline.

Skrill is een betrouwbare wereldleider op de markt van de prepaid creditcards. Skrill verstrekt je een prepaid creditcard van mastercard© voor 10 euro per jaar. Dit is bij de goedkoopste prepaid creditcards die je kunt vinden in nederland.

Skrill prepaid mastercard en skrill digitaal account

Skrill werkt met een online account, vergelijkbaar met paypal. Je kan deze skrill account gebruiken om geld te verzenden naar andere skrill gebruikers, om zelf geld te ontvangen of om te betalen in webshops. De prepaid creditcard wordt gekoppeld aan jouw skrill account en met de creditcard kan je het saldo van de skrill account daarna ook offline besteden. De prepaid mastercard van skrill is dus gewoon een manier om het geld op jouw skrill account te kunnen uitgeven.

Overige kosten

Je skrill accountsaldo opwaarderen via een overschrijving of een andere aangeboden methode kost 1%. Transacties in winkels, restaurants en webshops zijn ten laste van de verkoper, maar soms wordt er wel gekozen om deze kosten door te rekenen aan de klant. Verder zijn er amper kosten. Geld afhalen aan automaten kost 1,75% en voor betalingen in andere munten wordt een fee gerekend van 3,99%.

Skrill account openen

Om een skrill account te openen moet je minstens 18 jaar oud zijn. Skrill zal vragen om je identiteit en adres te bewijzen, maar een BKR check wordt niet uitgevoerd.

Extra's

Skrill eist dat je zeer regelmatig de stand van je skrill account bekijkt. Als je kaartgegevens gestolen zijn en er op onverklaarbare wijze geld van je rekening verdwijnt, moet je skrill meteen op de hoogte brengen. Skrill zal je een nieuwe kaart bezorgen en zal het bedrag van malafide transacties terugstorten.

Eventuele problemen met leveringen van artikelen die je online gekocht hebt moet je oplossen met de verkoper. Skrill biedt hier wat minder service dan ICS, die strikt toekijken op eventuele fraude en die bovendien een gratis aankoopverzekering aanbieden.

Kenmerken

- Makkelijk geld ontvangen met een skrill account

- Kosten voor een skrill mastercard zijn maar 10 euro per jaar

- Skrill behoort tot de goedkoopste prepaid mastercard aanbieders

- Geen BKR toetsing of registratie

- Wereldwijd pinnen bij pinautomaat met mastercard logo

- Het kost wereldwijd 1,75% per opname aan een geldautomaat

- Online account met realtime overzicht van je inkomsten en uitgaven

- Opladen via directe bank overschrijving is mogelijk

- Kaart aanvragen is gratis (dus geen inschrijfkosten)

- Prepaid skrill mastercard heeft de voordelen van een gewone creditcard van mastercard

- Prepaid mastercard aanvragen duurt in totaal zo'n 10 werkdagen voor je de kaart in huis hebt.

- Onbeperkte besteding, dus geen limiet.

Skrill kaart aanvragen

TRANSFIERA DINERO

GRATIS

No hay comisiones cuando envía dinero a una cuenta bancaria internacional.

Pruebe la calculadora para ver cuánto ahorrará.

O explore las pestañas encima de la calculadora para ver los demás beneficios de usar skrill.

Transferencia de dinero de skrill está calificado como "excelente" en

- Regulado por la FCA

- Millones de clientes

- Líder en tecnología de reducción de riesgo y antifraude

TRANSFIERA DINERO

GRATIS

No hay comisiones cuando envía dinero directamente a una cuenta bancaria.

Utilice la calculadora para ver lo que puede ahorrar enviando dinero de forma gratuita con skrill.

Transferencia de dinero de skrill está calificado como "excelente" en

- Regulado por la FCA

- Millones de clientes

- Líder en tecnología de reducción de riesgo y antifraude

LIBRE DE COMISIONES

Es gratis enviar con la transferencia de dinero con skrill a una cuenta bancaria o a una cartera móvil de forma global -más ahorro para usted.

RÁPIDO Y SENCILLO

Envíe dinero a cuentas bancarias de 45 países. Seleccione el importe y dónde quiere que vaya el dinero.

SEGURO

Envíe dinero a cuentas bancarias internacionalmente. Escoja la cantidad y dónde quiere enviarla.

CONFIANZA GLOBAL

Millones de personas utilizan skrill para enviar y recibir dinero por todo el mundo.

¿no tiene los detalles del banco del destinatario?

También puede enviar dinero instantáneamente con solo una dirección de correo electrónico.

Acceda a su dinero 24/7

Nuestra aplicación rápida, fácil de utilizar y segura le permite acceder a su cuenta siempre que lo necesite.

Copyright © 2019 skrill limited. Todos los derechos reservados. Skrill® es una marca registrada de skrill limited. Skrill limited está registrada en inglaterra (número de empresa 04260907) con su domicilio social que se encuentra en 25 canada square, londres E14 5LQ. Está autorizada y regulada por la financial conduct authority en virtud de las regulaciones sobre dinero electrónico 2011 (FRN: 900001) para la emisión de dinero electrónico e instrumentos de pago. Skrill prepaid mastercard es emitida por paysafe financial services limited conforme a una licencia de mastercard international. Paysafe financial services limited (FRN: 900015) está autorizada por la financial conduct authority en virtud de las regulaciones sobre dinero electrónico 2011 para la emisión de dinero electrónico e instrumentos de pago. Mastercard® es una marca registrada de mastercard international.

Copyright © 2019 paysafe holdings UK limited. Todos los derechos reservados. Skrill limited (FRN: 900001) está autorizada por la financial conduct authority conforme a las regulaciones monetarias electrónicas para la emisión de dinero electrónico e instrumentos de pago. Skrill es una marca registrada de skrill limited. Paysafe financial services limited (FRN: 900015) está autorizada por la financial conduct authority en virtud de las regulaciones sobre dinero electrónico 2011 para la emisión de dinero electrónico e instrumentos de pago.

Skrill taps football legend to publicise its prepaid mastercard

Online payments and money transfer fintech skrill has made a new TV advert staring “number 10” football legend alessandro del piero to promote its prepaid mastercard.

The television commercial featuring 2006-world-cup-winner del pietro touting skrill’s prepaid mastercard has hit screens across italy, airing on sky sport.

The ecommerce firm has also released exclusive behind-the-scenes footage from the shoot in milan where del piero can be seen preparing for filming, enjoying downtime and using his skrill prepaid mastercard.

The TV spot plays on del piero’s strong ties to the number ten—the number on the shirt he wore while playing for italian football team juventus.

Reasons to applaud number 10

But, as shown in the commercial, del piero isn’t the only reason for people to cheer about the number ten: skill has removed the €10 application fee on its prepaid mastercard, for a limited time, for customers in italy.

For skrill, the promotion supports its ongoing strategy to heighten its profile and increase the international use of its digital wallet.

In march last year, skrill was unveiled as the front-of-jersey sponsor of del piero’s los angeles team, LA10 FC.

“A great brand ambassador”

Lorenzo pellegrino, CEO of skrill, commented:

“alessandro is a great brand ambassador for skrill, and over the last two years we have been working together to put skrill front of mind for millions of new customers globally. This TV ad is an important part of our marketing strategy for skrill and paysafe in 2020. We’re super excited to see it go live across screens in italy and to be able to provide free prepaid mastercard applications for italian customers over the next few months.”

Skrill is an ecommerce business that allows payments and money transfers to be made through the internet, with a focus on low-cost international money transfers. Since 2015, skrill belongs to the paysafe group.

Skrill’s del piero TV commercial (in italian; read transcript below)

Advert storyline:

Walking into a bar in milan, italy, del piero hears coffee drinkers calling out ‘ten’, ‘ten’. Thinking that they have recognised him, he approaches a friend – skrill’s CEO lorenzo pellegrino – to voice his concerns. Pellegrino tells del piero that he’s mistaken. The customers have in fact heard about skrill’s latest offer: skrill has waived its 10€ prepaid card application fee in italy for six months.

Что можно сказать в заключение: how to get skrill prepaid mastercard and the benefits it gives to customers of the skrill payment system with vipdeposits loyalty program. По вопросу skrill prepaid mastercard

Комментариев нет:

Отправить комментарий