Skrill to mastercard

Transfer £100 or more from the UK to an international bank account. No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

TRANSFER MONEY

FOR FREE

Send money abroad for free with skrill.

Try the calculator to see how much you will save.

Or, explore the tabs above the calculator to see the other benefits of using skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

TRANSFER MONEY

FOR FREE

No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

Aneta gave you £10

to send abroad

Get £10 off when you transfer £100 or more from the UK. Just make sure to use your friend's referral code [ anetaa23 ] when you register. Go ahead, start your transfer now! Terms apply.

This special referral offer is currently only available when making international transfers from the UK.

See how much you get sending £1000 to india

| provider | receive amount (INR) | send amount + fee | effective FX rate |

|---|---|---|---|

| send money with | exchange rate 92,380.00 | transfer fee 1,000.00 | 92.3800 |

| send money with | exchange rate 91,907.37 | transfer fee 1,000.00 | 91.9074 |

| send money with | exchange rate 91,891.16 | transfer fee 1,000.00 | 91.8912 |

| send money with | exchange rate 92,005.76 | transfer fee 1,001.49 | 91.8689 |

| send money with | exchange rate 91,865.16 | transfer fee 1,002.90 | 91.5995 |

| send money with | exchange rate 91,540.00 | transfer fee 1,002.99 | 91.2671 |

| the comparison fees displayed on our page have been published on 23/12/19 13:10 CET and have not been refreshed since this date. The data for the price comparisons shown have been taken from other providers’ websites, on specific dates. This information is freely available on the competitor’s websites we have listed. This is not an exhaustive list of companies offering a money transfer service and if you are interested in a particular supplier we suggest you check their respective website. Fees comparison disclaimer | |||

How it works

Register for a skrill account with your friend's link or code

Transfer £100 or more from the UK to an international bank account.

You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

FEE FREE

It's free to send with skrill money transfer to a bank account or mobile wallet abroad - more savings for you.

QUICK AND EASY

Send money to bank accounts internationally. Choose how much and where you want it to go.

SECURE

Your money transfer is protected by our industry-leading secure payment systems.

TRUSTED GLOBALLY

Millions of people use skrill to send and receive money around the world.

See what our customers are saying about us

Secure and easy transfers

SHISHIRA , india

Really good. It’s secure and fast

SOURABH , india

Using skrill has really made money transfers from kenya to other countries extremely easy.

IRENE , kenya

A great way to send money around the world

SAM , india

Our company

Don’t have the recipient’s bank details?

You can also send money instantly with just an email address.

Access your money wherever you are 24/7

Our fast, easy to use and secure app lets you access your account whenever you need it.

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international.

Copyright © 2019 paysafe holdings UK limited. All rights reserved. Skrill limited (FRN: 900001) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments. Skrill is a registered trademark of skrill limited. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

Skrill mastercard

The skrill mastercard works like every other prepaid mastercard:

You can easily access your savings by using the skrill mastercard without worrying about spending too much money. Your available balance with the prepaid mastercard is the same as in your digital wallet.

Compared to other ewallet providers the fees for the skrill card are very low. Skrill vips don’t even pay the skrill card order and usage fees.

You can order and activate your prepaid card under “skrill card” after logging into your skrill (moneybookers) account and the card is available in 4 different currencies (USD, EUR, PLN and GBP).

The following table shows you more about the limits and difference between regular skrill and skrill VIP customers.

Check our skrill fees page for the full info about all applying skrill fees.

Limits for the skrill card

Please also check our skrill limits page with all info about all the limits that apply and our skrill review for the overall conditions.

Problems using the skrill card at an ATM

If you cannot withdraw cash from an ATM by using your skrill mastercard and get an error message, please check your available balance in your (skrill) moneybookers account first. Also, please keep in mind possible foreign exchange fees and your actual 24h ATM limit which you can check at “my skrill mastercard”.

If you still can not find the problem, please try again a little later or at another ATM. In about 95% of the cases, those standard error messages occur if the ATM is not able to connect to the mastercard server in time. Different to other mastercards your skrill mastercard is a prepaid card and the ATM has to check your available balance first. If the ATM is not able to get the connection fast enough a standard error message appears on the screen.

In case it does not work later or even the next day, please send an email to [email protected] and ask for possible technical problems to be addressed or for your account to be manually checked for possible fraud.

Please also check our detailed article about skrill mastercard issues and how to solve them.

Refund in case of any fraud

If fraud occurs, skrill will refund your account by the full amount within ten business days. Please read paragraph 8 of the terms and conditions of skrill mastercard for detailed information.

Skrill virtual mastercard

The major benefits is, you can decide how long you want it to remain active which will give you an extra level of security and avoid potential fraud compared to the regular plastic skrill mastercard.

The following table gives you a quick overview about the available currencies, their limits and the fee for the card.

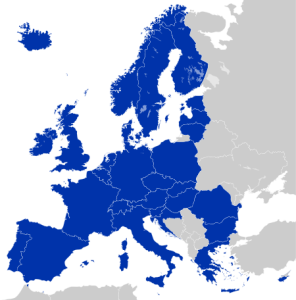

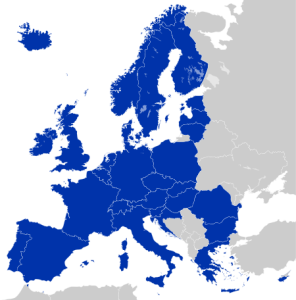

Please note, to be eligible to order the virtual card you account has to be registered to an address from the EU (SEPA region) and it also has to be fully verified. If your account is not fully verified yet use our fast ewo skrill verification service to remove your limits and get verified within 1 day.

The first virtual mastercard for each customer is free and to order the card simply click on the “skrill card” option on the left-hand side of your skrill account and choose “add a card“.

You can also have multiple cards, but each additional card comes with a fee of 2.50 EUR in addition to a 10 EUR annual service fee.

Skrill mastercard availability

Since the end of september 2016 skrill does not offer mastercards for residents of NON-SEPA countries any longer and those rules also apply to the skrill virtual mastercard. We have summarized all changes where the card is not available anymore for you. Besides the fact that those clients are not able to receive a new skrill mastercard, all other services will stay available.

The skrill card is available in the following countries only:

Please contact us if you have any further questions about the skrill card or skrill in general. We are there to help you.

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Skrill prepaid mastercard®

Skrill prepaid mastercard® is an indispensable tool for those using skrill wallet. This card allows to withdraw funds from your skrill account from any mastercard® ATM or pay for a purchase worldwide.

Only customers with VIP status can get skrill prepaid mastercard® for FREE

clients without VIP status can order a card for $13.

*the EEA includes: austria, belgium, bulgaria, croatia, republic of cyprus, czech republic, denmark, estonia, finland, france, germany, greece, hungary, iceland, ireland, italy, latvia, liechtenstein, lithuania, luxembourg, malta, netherlands, norway, poland, portugal, romania, slovakia, slovenia, spain, sweden and the UK.

Advantages of skrill prepaid mastercard®

- 3,99% – regular accounts;

- 3,79% – VIP bronze;

- 2,89% – VIP silver;

- 2,59% – VIP gold;

- 1,99% – VIP diamond.

| VIP status | ATM withdrawal | purchases |

|---|---|---|

| verified account, no VIP status | €900/day | €2700/day |

| VIP bronze | €900/day | €3000/day |

| VIP silver | €1500/day | €3000/day |

| VIP gold | €3000/day | €5000/day |

| VIP diamond | €5000/day | €10000/day |

How to order skrill prepaid mastercard®

When ordering a card, you will be asked to choose the same address which you provided while creating a skrill account.

Delivery usually takes around 7-10 business days, but the exact time depends on the postal service in your country.

Few tips on using skrill prepaid mastercard®

- Your card remains inactive unless you activate it and create a PIN in your personal account.

- Transaction history of your card is displayed in your skrill account under the history tab.

- In case your card is stolen or lost, you need to call skrill support +44 203 308 2520 or block it yourself in your personal account.

Skrill prepaid mastercard® allows to withdraw money worldwide, pay for goods and services, as well as access your skrill balance whenever and whenrever you prefer.

Skrill & NETELLER mastercard only for SEPA

No more mastercards for NON SEPA countries

At the end of september paysafe group informed us that skrill as well as NETELLER do NOT offer mastercards for residents of NON-SEPA countries any longer.

Who is affected?

Please check the following table which includes all SEPA countries. If you cannot find your country of residence in this table you cannot order a new mastercard for your skrill or NETELLER account:

| Austria | belgium | germany | greece | ireland | spain | italy |

| cyprus | latvia | lithuania | luxembourg | malta | netherlands | portugal |

| slovakia | slovenia | finland | france | estonia | bulgaria | great britain |

| hungary | denmark | poland | romania | croatia | czech republic | sweden |

| iceland | liechtenstein | monaco | norway | switzerland |

Information about locked skrill and NETELLER accounts for clients from crimea

First of all, we can confirm that all accounts for clients from crimea got locked. However, if those clients can proof that they are living outside the crimea, skrill will unblock their accounts again. Clients just need to provide a written proof of residence, similar to the verification documents right after their account registration. Once the document has been reviewed, the account will be reopened and can be used without any restrictions.

Skrill and NETELLER also confirmed, that it’s possible for crimea clients to send money from their account to a non-crimea account.

No other changes for the russian market

Besides the fact that clients from outside the european union are not able to receive a new skrill or NETELLER mastercard, there are no further changes for those clients. All other services will stay available.

What happens if you already have a NETELLER or skrill mastercard?

As of 25 november 2016, skrill and NETELLER will no longer offer their prepaid mastercard services for clients from almost all non-SEPA countries. The plastic card, as well as the virtual mastercard, cannot be used anymore after that date. If you still want to use your cards to spend or withdraw some of your funds, please make sure to do it in time. Otherwise you can only withdraw your money via bank transfer.

The following table shows all countries where the skrill and NETELLER mastercard will be terminated by november 25th 2016.

Please note, clients from russia and china can use their old cards until they expire. However, they will not be able to order a new mastercard.

| Albania | cameroon | indonesia | morocco | senegal |

| angola | cape verde | jamaica | mozambique | seychelles |

| anguilla | cayman islands | jordan | myanmar | singapore |

| antarctica | colombia | kazakhstan | namibia | sint maarten |

| antigua and barbuda | congo | kenya | nepal | south africa |

| armenia | cote D’ivoire | korea | netherlands antilles | suriname |

| aruba | curaçao | kuwait | new zealand | swaziland |

| australia | dominican republic | lao | nicaragua | taiwan |

| azerbaijan | ecuador | lebanon | nigeria | tanzania |

| bahamas | el salvador | macao | oman | thailand |

| bahrain | faroe islands | macedonia | pakistan | tonga |

| barbados | french guiana | madagascar | palestine | trinidad and tobago |

| belarus | french polynesia | malaysia | panama | tunisia |

| belize | georgia | maldives | paraguay | turkmenistan |

| bermuda | ghana | marshall islands | philippines | turks and caicos islands |

| bolivia | greenland | martinique | puerto rico | uganda |

| bonaire | guadeloupe | mauritania | qatar | ukraine |

| bosnia and herzegovina | guam | mauritius | saint kitts and nevis | uzbekistan |

| brazil | guatemala | mayotte | saint lucia | venezuela |

| burkina faso | guernsey | moldova | saint martin | vietnam |

| burundi | honduras | monaco | saint vincent and the grenadines | zambia |

| cambodia | hong kong | montenegro | samoa | zimbabwe |

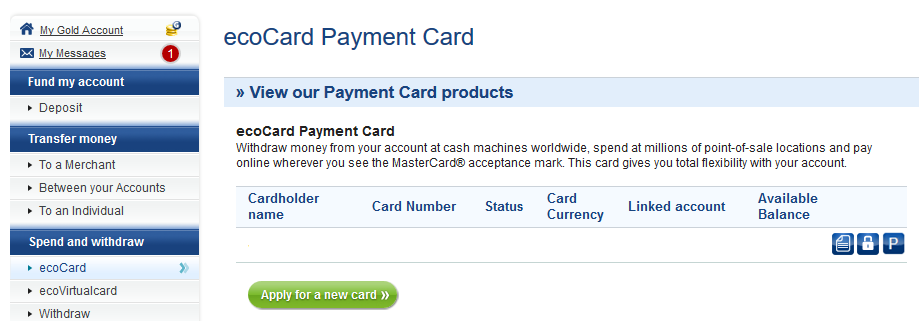

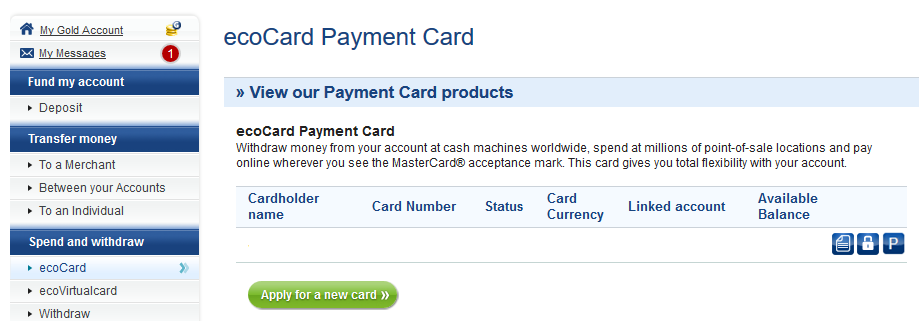

The solution – ecocard payment card

Every customer from countries outside of SEPA should take a look at our ecopayz bonus program. Besides benefits like increased transfer volumes, lower FX fees, monthly bonus payments and an instant VIP upgrade to gold status, ecopayz also offers a free ecopayz mastercard for all clients of ewallet-optimizer. Join us to get your free mastercard!

At this point, there are no indications from mastercard right now that ecopayz has to stop issuing cards, but of course we cannot guarantee that there will be no changes in the future. To make sure you are still eligible for an ecopayz mastercard, you should sign up as soon as possible and order your card.

If you have any questions about the recent changes or need any advice how to proceed, please do not hesitate to contact us.

Mastercard skrill

Caractéristiques de la mastercard skrill

Quelle mastercard skrill choisir?

Skrill propose deux cartes mastercard prépayées différentes: skrill mastercard prépayée et la carte virtuelle skrill. Si vous un compte VIP ( qui est gratuit), vous aurez également droit à une skrill mastercard prépayée gratuite – vous permettant d’économiser 10 € sur les frais annuels.

Posséder une carte prépayée mastercard skrill vous permet de bénéficier d’un accès instantané au solde de votre compte skrill n’importe où dans le monde où mastercard est acceptée. Vous pouvez dépenser le solde de votre compte en ligne ou dans des magasins habituels.

Les cartes prépayées skrill sont disponibles dans quatre devises: EUR, GBP, USD, PLN. La mastercard skrill est disponible pour tous les résidents de l’espace économique européen (EEE).

| Programmes | non VIP | BRONZE | SILVER | GOLD | DIAMOND |

|---|---|---|---|---|---|

| prix de la mastercard skrill par an | 10€ | gratuit | gratuit | gratuit | gratuit |

| retrait en cash / jour | 900€ | 1200€ | 1500€ | 3000€ | 5000€ |

| frais de retrait | 1.75% | €1.80 | gratuit | gratuit | gratuit |

| paiement maximum / jour | €2,700 | €3,000 | €3,000 | €5,000 | €10,000 |

| frais de change | 3.99% | 3.79% | 2.89% | 2.59% | 1.99% |

| coût en cas de perte | €10 | gratuit | gratuit | gratuit | gratuit |

| frais annuel | €10 | gratuit | gratuit | gratuit | gratuit |

Prix et frais de la mastercard skrill

- GRATUIT pour payer des biens dans les magasins, les restaurants et en ligne

- GRATUIT pour recevoir de l’argent

- Demandes de solde GRATUIT

- Relevés en ligne GRATUITS

- Changement du code PIN GRATUIT

- 10 € de cotisation annuelle (sauf VIP où c’est gratuit)

- 10 € pour le remplacement de la carte perdue ou volée

- 1,75% de frais de retrait en espèces à un distributeur

- 3,99% de frais de change

Puis-je utiliser ma carte prépayée skrill mastercard pour jouer en ligne?

Malheureusement, vous ne pouvez pas utiliser la carte mastercard prépayée skrill pour des activités de jeu en ligne. Cependant, vous pouvez l’utiliser pour les jeux hors ligne tels que les casinos et les boutiques de paris où mastercard est acceptée.

Comment alimenter votre compte?

| Transfert d’argent | frais | durée de transfert |

|---|---|---|

| virement bancaire | 1% | jusqu’à 5 jours |

| cartes de crédit / débit | 1% | immédiat |

| rapid transfer | 1% | immédiat |

| neteller | 1% | immédiat |

| bitcoin & bitcoin cash | 1% | immédiat |

| paysafecard | 1% | immédiat |

| trustly | 1% | immédiat |

| klarna | 1% | immédiat |

| fast bank transfer | 1% | immédiat |

Frais de retrait de skrill

Vous pouvez retirer votre argent de votre compte skrill par virement bancaire, carte de débit / crédit. Si vous devenez VIP skrill , ces frais seront réduits ou supprimés complètement. Le délai de retrait par virement bancaire est rapide et est généralement traité dans un délai de 3 à 5 jours ouvrables.

| Type de retrait | frais |

|---|---|

| virement bancaire | 5,5€ |

| visa | 7,5% |

| rapide | 5,5% |

L’envoi d’argent de skrill à neteller et inversement entraîne des frais supplémentaires de 1%.

Qu’est-ce que skrill?

Skrill est l’une des système de paiement les plus populaires aujourd’hui dans le monde entier. Skrill est un service de paiement qui vous permet d’envoyer de l’argent à vos clients ou amis plus efficacement sans vous soucier des retards de paiement.

Skrill a commencé ses services de paiement électroniques en 2001. Elle a conquis le marché mondial et compte actuellement parmi ses clients certaines des plus grandes marques au monde.

Bien que le portefeuille électronique proposé par skrill reste leur principal produit, le service de transfert de fonds proposé est hautement concurrentiel et se compare facilement à celui de transferwise en termes de frais et de fonctionnalité, sans aucun frais pour les virements vers des comptes bancaires.

Les comptes skrill peuvent être détenus dans n’importe laquelle des principales devises, mais une fois la première transaction effectuée, il n’est pas possible de changer la devise du compte. Les clients peuvent acheter une carte prépayée skrill, liée à votre compte skrill, dans l’une des quatre devises suivantes: USD, EUR, PLN et GBP.

Skill a également récemment introduit un nouveau service vous permettant d’acheter de la crypto monnaie à partir de votre compte skrill. Les crypto disponibles sont : bitcoins, bitcoins cash, ethereum, litecoin, XRP et 0x.

Comment fonctionne skrill?

Afin d’utiliser skrill et la mastercard skrill, vous devez d’abord créer un compte skrill. C’est un processus très simple et il ne faut que quelques minutes pour ouvrir votre compte.

Une fois votre compte enregistré avec succès, vous pourrez immédiatement effectuer des virements de fonds sans qu’aucune sécurité ou vérification supplémentaire ne soit nécessaire, et utiliser l’ewallet de skrill pour transférer des fonds vers vos sites de jeu, de change, de trading, etc.

Afin d’augmenter vos limites de transactions sur le portefeuille électronique et de commander une carte prépayée mastercard ou une mastercard virtuelle, vous devez avoir un compte skrill vérifié.

Topics

How do I withdraw money to my mastercard®?

The mastercard® withdrawal option lets you transfer money from your skrill account to a personal mastercard® credit/debit card. This option is available only in russia and ukraine for cards issued in these two countries.

How to withdraw money to my mastercard® card?

1. Go to the withdraw section of your skrill account.

2. Click withdraw now under credit or debit card.

3. Choose a card and click next. If you haven’t registered a mastercard® card, click add card to submit your card details.

4. Confirm the card currency on the next step (this is done only once). If the card is issued in russia, you can select RUB, EUR or USD. If the card is issued in ukraine, you can select UAH, EUR or USD.

5. Enter the amount and click next.

6. A summary page with your withdrawal information will appear. To finalize your withdrawal, click confirm.*

* to complete the transaction, enter your PIN.

What are the fees and limits?

To review your withdrawal limits, go to the withdraw section of your account. Select the card you want to withdraw money to, and you’ll see the applicable limits. The displayed limits are in accordance with your available balance and account verification status.

For the withdrawal fee, go to the withdraw section of your account or visit our fees page.

Note: we send your mastercard® withdrawals in the selected card currency. If the currency of the withdrawal is different from your skrill account currency, an additional 3.99% foreign exchange fee will be added on top of our wholesale exchange rates.

How long does it take to receive the money?

The money should reach your mastercard® within 3 business days.

Skrill to mastercard

CONVENIENCE

Send and receive money, store cards, link bank accounts and pay conveniently anytime and anywhere with your email address and password.

CONFIDENCE

Your security is a priority. We always keep your payments and personal information safe, and our anti-fraud team protects every transaction.

INSTANT

It’s easy for skrill wallet holders to send and receive money – you just need an email address.

WHAT IS SKRILL?

Moneybookers was considered as one of the fastest developing payment services provider in the UK in 2010 and remained to grow at a considerable pace since then. By 2011, they were serving close to twenty-five million clients across the globe. Skype, ebay and facebook to name a few are some of the globally renowned firms who provides skrill as a payment method for its users. In 2011, the UK-based company changed its name to skrill as part of their rebranding effort.

Skrill is regulated by the UK’s financial conduct authority and has passporting rights to run within the european union. The fact that it offers quick transactions with low commission and fees made skrill one of the leading online money transfer and payment platforms.

Thanks to skrill, sending money online and making international money transfers becomes astonishingly simple. All you need to do is to register at the web site with a valid email address and start utilizing the services. You can deposit funds to your skrill account through several options including bank transfer, credit card and intra-skrill transfers. Upon funding your account, you can make payments, purchase goods & services online and send money to other skrill users.

Additionally, payment processing with skrill is far from cumbersome for merchants who target to reach audience worldwide. It takes less than few steps to make a purchase. This is an important contribution because many potential buyers nowadays abandon the idea of purchase due to inability to pay instantly and obligation to share their critical information such as credit card details. Skrill makes online purchases a lot simpler and safer for buyers.

The company has gained a plethora of remarkable awards throughout the years. This includes winning titles at the financial sector technology award, international gaming awards, and EGR B2B awards among others.

Product & services

Skrill is a digital e-wallet platform working through an email address and a password. You can open a skrill account in the forty different currencies. But take note, the currency you will pick might not be altered afterwards. Nonetheless, you can make your payments along with currency conversion.

Having an account, you have the opportunity to do the following:

- Deposit and withdraw funds with various methods such as credit card, bank wire, etc…

- Receive and withdraw money,

- Make payments,

- Use skrill mastercard for online and in-store shopping,

- See all your transactions and charges online under the “history” section

Fees and limits

Opening a skrill account is always free of charge. You should log in or make a transaction at least once every twelve months, as failing to do so will lead to a service fee of 3 euros deduction.

Following services are free of charge;

- Making online payments via skrill e-wallet to merchants who accept skrill as a payment method

- Receiving cash into your account through bank transfer.

- Using the swift international payment method

Customers support

The contact us option of skrill covers telephone numbers for the UK, germany, spain, italy, poland, france, russia, USA, and an international number. Their business hours are typically monday to sunday from 9 AM to 6 PM GMT.

The lost cards line or stolen cards line number is +44 (20) 3308 2530. You can also find other contact options included on their website.

Skrill card

Skrill provides two different kinds of mastercard for a skrill account. You can take advantage of the skrill virtual mastercard or the basic plastic skrill mastercard. Through skrill card, you can access to all your funds and spend the balance on your account.

The skrill prepaid mastercard

It might be utilized as well to make online payments and to pay for purchases from any stores and shops, which accept mastercard. The card also enables you to make withdrawals from any atms across the planet. You need to make sure that the ATM accepts mastercard though. This can be observed with a mastercard logo on the ATM.

Account holders can apply for skrill card straight from the company’s website. The cost is €10 and the card will be delivered to your address. The process will typically take between ten to twenty days or less to come.

All users of skrill have access to their skrill 1-tap service. This is particularly helpful for super quick payments and perfect for online betting. 1-tap service enables users to make transactions through their mobile phones with a simple click.

You can easily access your funds by using the skrill mastercard without worrying about sending the funds to your bank account. Your skrill card balance is the same as in your skrill digital wallet. Opposed to other e-wallet providers today, the fees for skrill mastercard are low. Vips don’t pay still mastercard usage and order fees.

When you withdraw from an ATM using your skrill mastercard, you will be charged 1.75% fee. However, if you withdraw or make a purchase in a currency other than your skrill wallet currency, you will be charged an extra currency exchange fee of 3.99% on the top of 1.75%.

Therefore, it is advisable to withdraw money and make purchases in the same currency with your skrill wallet’s. For example, if your skrill digital wallet’s and skrill card’s currency is US dollars, I recommend you to find a ATM that dispenses US dollars.

You can order and activate your prepaid card after logging into your skrill account under the “skrill card” section. The card is accessible in four different currencies (GBP, PLN, EUR, and USD)

The skrill virtual mastercard

There is no withdrawal fee since you can’t use a virtual card to withdraw money from atms. However, the currency exchange fee applies to virtual card as well. If you make an online purchase in a currency other than your wallet’s currency, you will be charged a 3.99% currency conversion fee.

The major advantage of using this card is that you can decide how long you wish the card to be active. This feature will offer you an added level of security and prevent possible fraud compared to the standard plastic skrill mastercard.

Since september 2016, the platform doesn’t provide mastercard for people of NON-SEPA regions any longer, and these rules apply to their skrill virtual mastercard

Skrill & NETELLER mastercard only for SEPA

No more mastercards for NON SEPA countries

At the end of september paysafe group informed us that skrill as well as NETELLER do NOT offer mastercards for residents of NON-SEPA countries any longer.

Who is affected?

Please check the following table which includes all SEPA countries. If you cannot find your country of residence in this table you cannot order a new mastercard for your skrill or NETELLER account:

| Austria | belgium | germany | greece | ireland | spain | italy |

| cyprus | latvia | lithuania | luxembourg | malta | netherlands | portugal |

| slovakia | slovenia | finland | france | estonia | bulgaria | great britain |

| hungary | denmark | poland | romania | croatia | czech republic | sweden |

| iceland | liechtenstein | monaco | norway | switzerland |

Information about locked skrill and NETELLER accounts for clients from crimea

First of all, we can confirm that all accounts for clients from crimea got locked. However, if those clients can proof that they are living outside the crimea, skrill will unblock their accounts again. Clients just need to provide a written proof of residence, similar to the verification documents right after their account registration. Once the document has been reviewed, the account will be reopened and can be used without any restrictions.

Skrill and NETELLER also confirmed, that it’s possible for crimea clients to send money from their account to a non-crimea account.

No other changes for the russian market

Besides the fact that clients from outside the european union are not able to receive a new skrill or NETELLER mastercard, there are no further changes for those clients. All other services will stay available.

What happens if you already have a NETELLER or skrill mastercard?

As of 25 november 2016, skrill and NETELLER will no longer offer their prepaid mastercard services for clients from almost all non-SEPA countries. The plastic card, as well as the virtual mastercard, cannot be used anymore after that date. If you still want to use your cards to spend or withdraw some of your funds, please make sure to do it in time. Otherwise you can only withdraw your money via bank transfer.

The following table shows all countries where the skrill and NETELLER mastercard will be terminated by november 25th 2016.

Please note, clients from russia and china can use their old cards until they expire. However, they will not be able to order a new mastercard.

| Albania | cameroon | indonesia | morocco | senegal |

| angola | cape verde | jamaica | mozambique | seychelles |

| anguilla | cayman islands | jordan | myanmar | singapore |

| antarctica | colombia | kazakhstan | namibia | sint maarten |

| antigua and barbuda | congo | kenya | nepal | south africa |

| armenia | cote D’ivoire | korea | netherlands antilles | suriname |

| aruba | curaçao | kuwait | new zealand | swaziland |

| australia | dominican republic | lao | nicaragua | taiwan |

| azerbaijan | ecuador | lebanon | nigeria | tanzania |

| bahamas | el salvador | macao | oman | thailand |

| bahrain | faroe islands | macedonia | pakistan | tonga |

| barbados | french guiana | madagascar | palestine | trinidad and tobago |

| belarus | french polynesia | malaysia | panama | tunisia |

| belize | georgia | maldives | paraguay | turkmenistan |

| bermuda | ghana | marshall islands | philippines | turks and caicos islands |

| bolivia | greenland | martinique | puerto rico | uganda |

| bonaire | guadeloupe | mauritania | qatar | ukraine |

| bosnia and herzegovina | guam | mauritius | saint kitts and nevis | uzbekistan |

| brazil | guatemala | mayotte | saint lucia | venezuela |

| burkina faso | guernsey | moldova | saint martin | vietnam |

| burundi | honduras | monaco | saint vincent and the grenadines | zambia |

| cambodia | hong kong | montenegro | samoa | zimbabwe |

The solution – ecocard payment card

Every customer from countries outside of SEPA should take a look at our ecopayz bonus program. Besides benefits like increased transfer volumes, lower FX fees, monthly bonus payments and an instant VIP upgrade to gold status, ecopayz also offers a free ecopayz mastercard for all clients of ewallet-optimizer. Join us to get your free mastercard!

At this point, there are no indications from mastercard right now that ecopayz has to stop issuing cards, but of course we cannot guarantee that there will be no changes in the future. To make sure you are still eligible for an ecopayz mastercard, you should sign up as soon as possible and order your card.

If you have any questions about the recent changes or need any advice how to proceed, please do not hesitate to contact us.

Carta prepagata skrill

Ultimo aggiornamento: 21/02/2020

Skrill è tra le carte prepagate più conosciute al mondo. Ma quali sono le sue caratteristiche? Scoprile:

Tipo: carta prepagata

Circuito: mastercard

Canone annuale: 10 € / anno

Limite di spesa: - € / giorno

Limite di prelievo: - € / giorno

Uso: personale

Contactless: no

Colore (standard, nera, oro): standard

Adatta alle aziende: no

Quota di rilascio: GRATIS

Vantaggi di questa carta:

- Una delle prepagate più famoso

- Mastercard ne garantisce la sicurezza

- Commissioni più basse della media

Non sai da dove iniziare? Queste sono le sezioni della recensione:

Recensione carta prepagata skrill - mastercard

La carta prepagata skrill è un metodo di pagamento che può essere usato ovunque, in tutti i negozi o e-commerce in cui viene esposto il marchio mastercard.

Ami recarti spesso presso negozi fisici o ristoranti, ma al tempo stesso non sai fare a meno dello shopping presso gli store online? Allora prova a scoprire insieme a noi quali sono le caratteristiche di questa carta.

Non si tratta di una carta di credito o di debito, ma permette in modo facile di sfruttare una serie di servizi davvero completi e interessanti.

La carta può essere disponibile in quattro valute: euro, sterlina inglese, dollaro e zloty polacco. Servono mediamente dai 7 ai 10 giorni per poterla ricevere e a quel punto potrai usarla per pagare online o presso i negozi che hanno il marchio mastercard.

Puoi comodamente per prelevare denaro dagli sportelli bancomat in ogni parte del mondo. Dopo aver effettuato l'accesso al saldo del conto è possibile usare il tuo denaro anche mentre ti trovi in vacanza.

Come si richiede la prepagata skrill

Potrai però richiedere la tua carta skrill solo se hai compiuto 18 anni e se sei residente nell'unione europea (sono esclusi i dipartimenti d'oltremare e i territori autonomi).

Al momento dell'apertura del conto, ti verrà chiesto di fornire documenti d'identità e il tuo indirizzo.

Dopo questa prima fase, possono essere eseguiti dei controlli elettronici per verificare i tuoi dati. Se la richiesta è accettata, sarà poi inviata la carta skrill direttamente all'indirizzo che è stato fornito nel momento dell'apertura del tuo account. Per attivarla è necessario effettuare l'accesso sul sito e seguire le istruzioni.

Le transazioni effettuate devono essere autorizzate personalmente inserendo il tuo codice PIN o andando a firmare la ricevuta del commerciante. Attenzione però: dovrai sempre controllare che i fondi siano sufficienti a coprire il valore della transazione e le commissioni applicate.

Commissioni applicate sui servizi della carta

Le commissioni della carta skrill sono trasparenti e facilmente consultabili attraverso il sito ufficiale della carta. Per usare la skrill prepaid mastercard sono previsti i seguenti costi:

- Pagamenti nei negozi fisici e online: gratis;

- Ricarica dal conto corrente bancario: gratuita;

- Ricevere contanti: gratis;

- Rendiconto online: zero spese;

- Riemissione del PIN: gratuita;

- Commissione annuale: 10 €;

- Conversione valuta: commissione del 3,99%;

- Commissione bancomat: 1,75 %.

I conti che saranno considerati inattivi, dopo un periodo che equivale o supera i 12 mesi, il titolare dovrà passare al pagamento di un canone mensile di 3 euro.

Sei in cerca delle migliori carte prepagate del 2020?

Guarda la classifica cliccando qui o sul bottone.

Se vuoi vedere direttamente la carta prepagata n.1, clicca qui!

Sicurezza offerta dalla carta skrill

La skrill può essere considerata completa e dall'utilizzo immediato, proprio come se fosse denaro contante, e inoltre permette di conservare e gestire in modo sicuro le tue finanze.

E' nominativa, personale e non prevede l'utilizzo da parte di terzi. Non a caso, come è precisato dalla banca che emette la carta, se il titolare crede che il PIN sia stato scoperto, è possibile contattare tempestivamente il numero verde, attivo 24 ore su 24, +44 (0) 207 117 6017.

E' buona abitudine cercare sempre di verificare, come detto, il saldo e la cronologia delle transazioni del conto skrill, così da riconoscere eventuali movimenti sospetti che potrebbero non coincidere con quanto da te speso.

Se la tua carta viene smarrita o rubata, è possibile chiamare la linea dedicata “smarrimenti e furti” in modo da farla subito bloccare.

Servizi e funzionalità della carta

Le operazioni di trasferimento di denaro avvengono sulla stessa piattaforma; ti registri e sarà possibile trasferire fondi sul tuo account skrill, oppure usare il servizio per la ricezione di denaro.

Ti stai ancora chiedendo perché dovresti scegliere questa carta? La risposta è facile: con skrill trovi il tuo perfetto alleato se vuoi ridurre i costi previsti per l'uso e la gestione di una prepagata offerta da banche. Il discorso cambia sicuramente nel momento in cui si vogliono effettuare delle operazioni di bonifico estero, sfruttando un valuta diversa dall'euro.

In questo caso, infatti, le commissioni sono alte e vi sono anche delle maggiorazioni sul tasso di cambio.

Avendo valutato da vicino la funzionalità, i servizi e i costi della carta, possiamo dire che, in linea generale, il servizio di money transfer può essere considerato conveniente. Il discorso però riguarda tutte quelle operazioni che sono svolte al di fuori dell'area SEPA/euro.

Anche a livello europeo, risulta essere un rapido aiuto, grazie ai suoi costi davvero contenuti.

Sei in cerca delle migliori carte prepagate del 2020?

Guarda la classifica cliccando qui o sul bottone.

Se vuoi vedere direttamente la carta prepagata n.1, clicca qui!

Карта skrill prepaid mastercard®

Карта skrill prepaid mastercard® — незаменимый инструмент для тех, кто пользуется платежной системой скрилл. С помощью этой платежной карты вы можете мгновенно получить деньги с вашего счета skrill в любом банкомате мира или оплатить покупку в любой торговой точке по всему миру.

Бесплатно получить карту skrill prepaid mastercard® могут только VIP пользователи skrill (bronze, silver, gold или diamond).

Не имея активного VIP-статуса, карту skrill можно заказать за €10.

Vipdeposits поможет получить

VIP-статус!

*В зону ЕЭЗ входят: австрия, бельгия, болгария, великобритания, венгрия, германия, греция, дания, ирландия, исландия, испания, италия, кипр, латвия, литва, лихтенштейн, люксембург, мальта, нидерланды, норвегия, польша, португалия, румыния, словакия, словения, финляндия, франция, хорватия, чехия, швеция, эстония.

Достоинства карты skrill prepaid mastercard®

Имея карту skrill prepaid mastercard® в кармане, вам не нужно связываться с банком вашей страны или выводить деньги банковским переводом — вы имеете прямой доступ к вашим деньгам, которые находятся на счете skrill, моментально и по всему миру.

Карта чрезвычайно удобна и выгодна тем, кто часто путешествует и оплачивает покупки картой. При оплате в магазине комиссия не взимается, а при конвертации из другой валюты будет удержана комиссия в размере:

- 3,99% — для обычных пользователей;

- 3,79% — для VIP bronze,

- 2,89% — для VIP silver,

- 2,59% — для VIP gold,

- 1,99% — для VIP diamond.

Вы всегда можете снять деньги в банкомате любой страны, заплатив при этом 1,75%, если у вас нет VIP-статуса, €1,8 — для VIP bronze. А для статуса VIP silver и выше снятие бесплатно.

Карта skrill prepaid mastercard® обеспечивает доступ к вашим средствам, не имея отдельного баланса, то есть ее баланс равен балансу вашего электронного кошелька skrill.

Карту skrill prepaid mastercard® может заказать каждый пользователь платежной системы: при наличии VIP-статуса заказ карты бесплатный, для обычных клиентов оформление карты составляет €10.

Несмотря на то, что карта skrill prepaid mastercard® именная (на ней будет написано именно имя, которое указано в вашем счете skrill), все транзакции проходят лишь по номеру карты, что приравнивается к анонимным способам расчета в интернете).

Срок действия карты — 3 года.

Карта skrill prepaid mastercard® имеет суточные ограничения на операции, в зависимости от вашего VIP-статуса. Чем выше уровень, тем выше лимиты:

| статус | снятие наличных | оплата покупок |

|---|---|---|

| верифицированный счет без статуса | €900/сутки | €2700/сутки |

| VIP bronze | €900/сутки | €3000/сутки |

| VIP silver | €1500/сутки | €3000/сутки |

| VIP gold | €3000/сутки | €5000/сутки |

| VIP diamond | €5000/сутки | €10000/сутки |

Как получить карту skrill prepaid mastercard®

Карта «скрилл» высылается обычным письмом и приходит в обычный почтовый ящик. Пин-код для карты вы придумаете сами, когда будете активировать уже полученную карту в личном кабинете на сайте платежной системы. При оформлении карты нужно выбрать адрес, который указали при регистрации и уже верифицировали. Доставка карты skrill prepaid mastercard® занимает 7-10 рабочих дней, но во многом этот срок зависит от работы почты страны, в которой вы проживаете.

Советы при использовании дебетовой карты skrill prepaid mastercard®

- До тех пор, пока вы не получите карту и не активируете ее в личном кабинете на сайте платежной системы (и создадите самостоятельно для нее ПИН-код), карта будет неактивной.

- История транзакций по карте skrill prepaid mastercard® отражена в разделе «история» в вашем аккаунте skrill.

- Если вы хотите заблокировать карту в случае ее кражи или утери, то вы можете сделать это, позвонив в support, или самостоятельно войти во вкладку «управление картой» и отправить сообщение об утере или краже карты.

С картой skrill prepaid mastercard® вы можете снимать деньги по всему миру, свободно оплачивать покупки, не зависеть от банков и иметь доступ к своим средствам на счету skrill моментально в любой точке мира.

Что можно сказать в заключение: no transfer fee when you send money directly to a bank account abroad. По вопросу skrill to mastercard

Комментариев нет:

Отправить комментарий