Skrill to payoneer 2019

If skrill started that they will only process your withdrawals in euro's and not in USD, I would recommend you contact payoneer support and request to have the euro details set up for your account. This way you can receive e and access the money you withdraw from skrill in the euro currency. For any inquiries directly associated to your payoneer account, please contact payoneer's customer care support center.

Transfer monet from skrill to payoneer

Answers

Hi there, to transfer funds to your payoneer account, you need to use the global payment details from your payoneer account. If your skrill account is in euro and you don't have it set up, kindly contact our support center for assistance in setting up the euro payment service for your account.

| You can view your global payment service details by going to the “receive” menu and selecting the payment service tab with the relevant currency. |

Happy and willing to answer general questions.

For any inquiries directly associated to your payoneer account, please contact payoneer's customer care support center.

@WILMEROM said:

hi adam . It's a pleasure to make a question . Well . I have a SKRILL account, it is in dollar but they say ( SKRILL ) that no dollar transfer are made no more, only euro transfers ( but my account reflects dollars ) so . I have to use my bofa dollar account or my euro information in SKRILL ? I do not want to use the wrong payoneer option and so the payment can be rejected . From SKRILL to payoneer I have to use dollar account or euro account, my account is in dollar but they say that they will send euros . Thank you !

If skrill started that they will only process your withdrawals in euro's and not in USD, I would recommend you contact payoneer support and request to have the euro details set up for your account. This way you can receive e and access the money you withdraw from skrill in the euro currency.

The details payoneer provides can only receive funds in the same currency denomination as set up with the collection bank account details (USD --> USD, EUR --> EUR), so setting up your payoneer account to be able to receive the funds in the euro currency would be the best way to go about this.

Happy and willing to answer general questions.

For any inquiries directly associated to your payoneer account, please contact payoneer's customer care support center.

Compare skrill vs payoneer

What is better skrill or payoneer? Getting the best payment gateway product is all about cross-checking different solutions and figuring out the top software for your specific needs. Our proprietary process gives you a brief look at the general rating of skrill and payoneer. For all round quality and performance, skrill scored 9.0, while payoneer scored 9.0. On the other hand, for user satisfaction, skrill earned 98%, while payoneer earned 99%.

Below you can also verify their characteristics, terms, plans, etc. To find out which program will be more suitable for your situation. One critical element to assess is if the software allows you to toggle on/off limitations on various types of users to secure any sensitive corporate data.

We realize that not all companies have the time to test a large number of various services, so we came up with a list of recommendations that you may find useful. Our top selections for the payment gateway category are: stripe, paypal payments pro, 2checkout .

Skrill

Payoneer

2checkout

This product is our partner, which means they paid for being featured as one of the suggestions. Our team takes great care to ensure all sugested products are reliable, top-quality solutions.

Skrill

Smartscore™

User satisfaction

Pricing

Pricing model

List of features

Pricing info

Skrill is a money transfer service that charges either free or low fees for different types of transactions. Your account is free as long as you stay active by logging in and making transactions at least every 12 months. If you’re inactive, skrill will charge you a €3 service fee that will be taken from your account’s funds every month.

Here’s an overview of skrill’s fees and charges:

Here are the transactions you can do in skrill for free:

- Receiving money into your skrill account

- Paying a retailer online that accepts skrill using your skrill wallet

- Funding your skrill account (usually free, but other options may charge small fees which will be clearly stated)

- Using the local payment method fast bank transfer in uploading funds

- Using the global payment method swift in uploading funds

Uploading funds

- Rapid! Paycard – 0.50% of the amount funded

- Bitcoin – 1% of the amount funded

- Klarna – 1.90% of the amount funded

- Trustly – 1.95% of the amount funded

- Neteller – 3% of the amount funded

- BOKU – 15% of the amount funded

- VISA credit card – 1.90% of the amount funded

- Credit cards: american express, JCB, and diners – 2.50%

- Paysafecard – 7.5%

Withdrawing funds

- Bank transfer (local) and swift (global) – £4.76 or €5.50

- VISA credit card – 7.50% of the amount

Sending funds – 1.45% of the amount; minimum fee of £0.43

Currency conversion – 3.99% fee on skrill’s wholesale exchange rates

Compare skrill vs payoneer

What is better skrill or payoneer? Getting the best payment gateway product is all about cross-checking different solutions and figuring out the top software for your specific needs. Our proprietary process gives you a brief look at the general rating of skrill and payoneer. For all round quality and performance, skrill scored 9.0, while payoneer scored 9.0. On the other hand, for user satisfaction, skrill earned 98%, while payoneer earned 99%.

Below you can also verify their characteristics, terms, plans, etc. To find out which program will be more suitable for your situation. One critical element to assess is if the software allows you to toggle on/off limitations on various types of users to secure any sensitive corporate data.

We realize that not all companies have the time to test a large number of various services, so we came up with a list of recommendations that you may find useful. Our top selections for the payment gateway category are: stripe, paypal payments pro, 2checkout .

Skrill

Payoneer

2checkout

This product is our partner, which means they paid for being featured as one of the suggestions. Our team takes great care to ensure all sugested products are reliable, top-quality solutions.

Skrill

Smartscore™

User satisfaction

Pricing

Pricing model

List of features

Pricing info

Skrill is a money transfer service that charges either free or low fees for different types of transactions. Your account is free as long as you stay active by logging in and making transactions at least every 12 months. If you’re inactive, skrill will charge you a €3 service fee that will be taken from your account’s funds every month.

Here’s an overview of skrill’s fees and charges:

Here are the transactions you can do in skrill for free:

- Receiving money into your skrill account

- Paying a retailer online that accepts skrill using your skrill wallet

- Funding your skrill account (usually free, but other options may charge small fees which will be clearly stated)

- Using the local payment method fast bank transfer in uploading funds

- Using the global payment method swift in uploading funds

Uploading funds

- Rapid! Paycard – 0.50% of the amount funded

- Bitcoin – 1% of the amount funded

- Klarna – 1.90% of the amount funded

- Trustly – 1.95% of the amount funded

- Neteller – 3% of the amount funded

- BOKU – 15% of the amount funded

- VISA credit card – 1.90% of the amount funded

- Credit cards: american express, JCB, and diners – 2.50%

- Paysafecard – 7.5%

Withdrawing funds

- Bank transfer (local) and swift (global) – £4.76 or €5.50

- VISA credit card – 7.50% of the amount

Sending funds – 1.45% of the amount; minimum fee of £0.43

Currency conversion – 3.99% fee on skrill’s wholesale exchange rates

Payoneer vs skrill | which way does the pendulum swing?

Payoneer

EUR; GBP; JPY; CNY are free via receiving accounts while USD can charge 1%

Withdrawing EUR; GBP; JPY; CNY; USD can charge up to 2%.

Skrill

Using the services of payoneer or skrill to send money overseas does not work equally well for everyone. This is because various aspects require your attention in selecting the right service provider. For instance, it appears that one company falters when it comes to providing good customer service.

You may get an idea of what customers of both companies have to say about their services by taking the skrill vs. Payoneer comparison to trustpilot. On this review-based platform, while payoneer averages at 9.2 out of 10, skrill gets a dismal 1.2 out of 10.

Before you select either skrill or payoneer, take time to look at all the factors that might have an effect on your decision.

Exchange rates

One company scores over the other in this section of the payoneer vs. Skrill comparison.

Payoneer

- The exchange rate you get through payoneer comes with a 2% to 2.75% markup on the existing mid-market rate.

- You get to know of the guaranteed exchange rate before finalizing your transfer.

- Mastercard exchange rates apply when you use the prepaid payoneer mastercard in unlisted currencies.

Skrill

- Skrill applies existing mid-market rates on all transfers without adding any markup.

- You may view prevailing rates by using the skrill online currency calculator.

Which services of payoneer or skrill you plan to use tend to have a bearing on the fees you need to pay.

Payoneer

- Sending money to other payoneer account holders is fee-free.

- If you receive money from other payoneer account holders in USD, GBP, or EUR, you pay no fees.

- Withdrawing funds from your payoneer account into your local bank account requires that you pay a fee, which varies depending on your country of residence.

- Online sellers pay no fees for receiving payments in GBP, EUR, CAD, CNY, and JPY.

- Online sellers need to pay a 1% fee when receiving payments in USD.

- Using the prepaid mastercard in unlisted currencies attracts a conversion fee of up to 2.5%.

- Additional details about the company’s pricing structure are found online.

Skrill

- You pay no fees when transferring money to overseas bank accounts.

- Using your skrill wallet online and in-store attracts no fees.

- You may receive money into your skrill account without paying any fees.

- The company charges a U.S. $3 fee each month if there is no activity in your account for 12 months.

- Sending money to another skrill wallet or an email address requires that you pay 1.45% of the transfer amount as fees.

- Uploading funds into your skrill account attracts fees, which vary depending on the payment method.

- Withdrawing funds from your skrill account into your local bank account attracts fees.

- You may view more details about the company’s fee structure online.

Countries

Given their widespread reach, this section of the skrill vs. Payoneer comparison rates both companies well.

Payoneer

- Payoneer services are available in over 200 countries.

- The company trades in over 150 currencies.

- You may vide the list of payoneer supported countries when applying online.

Skrill

- Skrill provides services in all countries other than afghanistan, cuba, eritrea, iran, iraq, kyrgyzstan, libya, north korea, north sudan, south sudan, and syria.

- Gambling-related transactions are restricted in the U.S., turkey, israel, malaysia, and china.

Ease of use

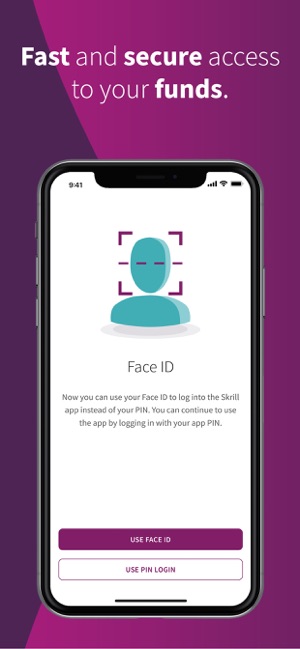

Registering with either skrill or payoneer takes little time, although you need to provide documents that help verify your identity and address. Both provide apps for ios and android.

Payoneer

- The company operates a multilingual website.

- You cannot use payoneer to transfer funds directly into an overseas bank account.

- Recipients need to withdraw money from their payoneer accounts into local bank accounts.

- Online sellers get receiving accounts in USD, CAD, GBP, EUR, AUD, CNY, and JPY.

- Payoneer accepts payments via bank account transfers and credit cards.

- If you live in the U.S., you may make payments via echecks.

- A prepaid mastercard gives you easy access to money in your payoneer account.

Skrill

- You may use the skrill website in various languages.

- Depending on where you live, you may make payments via bank account transfers, debit cards, credit cards, ACH, or paysafe cards.

- You may use the services of skrill to buy cryptocurrencies such as bitcoin, bitcoin cash, litecoin, and ether.

- You may use money in your skrill wallet to make online and in-store purchases.

- The prepaid skrill mastercard lets you access funds in your account easily.

Security

No matter whether you use payoneer or skrill, you can be sure that high encryption levels safeguard the information you provide online.

Payoneer

- Headquartered in the U.S., payoneer is registered with the financial crimes enforcement network (fincen).

- It has the required licenses to provide its services in 48 american states.

- The company has licenses issued by regulatory bodies in canada, gibraltar, australian, hong kong, and japan.

- Payoneer (EU) ltd., a subsidiary of payoneer inc. Payoneer (EU) ltd., is a licensed mastercard issuing member.

Skrill

- UK-based skrill is registered with the financial conduct authority (FCA).

- Paysafe financial services ltd. Is responsible for issuing the prepaid skrill mastercard.

Regular overseas payments

Both companies falter in this section of the payoneer vs. Skrill comparison because they are yet to start offering this service. If you wish to set up regular transfers, consider turning to alternatives such as OFX, worldfirst, FC exchange, or currencies direct.

Coupons

Using existing promotional offers provided by skrill or payoneer may lead to added savings.

- Icomparefx readers get to earn USD $50 through a payoneer coupon when their account balances reach USD $100.

- Skrill users may access special offers related to forex, gambling, cryptocurrency, and shopping.

Learn more

Payoneer vs skrill updates

Related posts:

Leave a reply cancel reply

This site uses akismet to reduce spam. Learn how your comment data is processed.

Search articles…

Country guides

Currency pairs guides

Guides & faqs

Recent posts…

Best expat blog awards 2017

Related posts

Icomparefx.Com is social!

Icomparefx.Com money transfer review apps

Recent comments

By using this website, you agree to be bound by our terms and conditions and to our full disclaimer and is summarised below.

This website provides an information service. Nothing on it constitutes professional advice. We show you a range of products & services but search results may not compare all features relevant to you. We make no warranties or representations about the accuracy or completeness of the information we provide. We disclaim liability to the maximum extent permitted by law. Buying and selling foreign currencies is risky. You assume all risks and are responsible for conducting your own due diligence. When we provide information, we are not recommending that you use a particular product or service. If you conduct foreign exchange you will deal directly with a financial institution and not with us. You should confirm rates and product information with the relevant institution before conducting any transaction. We may receive fees or other benefits through this website and may receive remuneration for vendor referral links. The information on this website is subject to copyright and may not be reproduced in any form without our express written consent.

Terms of service | disclaimer | privacy policy statement

Skrill в україні 2020: як створити гаманець, комісія та ліміти

Liza malt автор, эксперт по денежным переводам и платежным системам

Оновлення! Вивід грошей зі skrill можливий тільки на банківську картку.

↑ перша транзакція 0 $ комісія ↑

Skrill – це платіжна система, де користувач створює електронний гаманець і завантажує до нього гроші. Потім з гаманця можна здійснювати покупки в інтернет-магазинах, виводити гроші на свої рахунки і відправляти один одному.

Ця система онлайн платежів відома як moneybookers з 2001 року, належить paysafe group – розробникам, які створили neteller і paysafecard. Вона охоплює понад 36 мільйонів клієнтів в майже 200 країнах світу і підтримує понад 40 валют.

- Скрілл не надає послуги у афганістані, кубі, еритреї, ірані, іраку, киргизстані, лівії, північній кореї, судані та сирії.

Реєстрація skrill в україні

Зареєструватися і створити гаманець skrill – ці два поняття означають одне і те ж, в даному випадку гаманець це термін, яким позначається зареєстрований аккаунт.

Перед реєстрацією підготуйте банківську карту visa або mastercard (в USD або EUR) і встановіть з’єднання з інтернет-банкінгом. Також, підключіть можливість оплати в інтернеті і поповніть рахунок картки. На рахунку повинно бути не менше 3 $, ця сума знадобиться для верифікації.

Як створити гаманець скрілл: інструкція з реєстрації

- Введіть ім’я, фамілію згідно вашої банківської картки. Якщо ви реєструєтеся за внутрішнім паспортом, зробіть транслітерацію латиницею (наприклад в google translate). Ці дані потрібні для здійснення транзакцій.

- Країну;

- Валюту. Поміняти валюту аккаунта після закінчення реєстрації не можна. Всі платежі надходять у євро. Якщо ви відкрили рахунок у EUR, а отримуєте платежі в USD – вони будуть конвертуватися лише один раз. Якщо ви відкрили рахунок в USD, то одержані платежі в USD будуть конвертуватися двічі. Вигідніше відкрити рахунок у євро, так ви не будете переплачувати за додаткову конвертацію. Потім знімаєте евро готівкою і обмінюєте за вигідним курсом.

- Активну електронну адресу (email), в подальшому він знадобиться для входу в аккаунт, відновлення пароля і т.Д.;

- Придумайте складний пароль який містить цифри, букви, знаки пунктуації.

2 крок: захистіть свій рахунок.

- Введіть номер мобільного телефону;

- Натисніть зареєструватися зараз. Очікуйте сповіщення з перевірочним кодом;

- Введіть отриманий код і натисніть продовжити.

3 крок: введіть особисті дані.

- Введіть адресу;

- Місто;

- Поштовий індекс;

- Дату народження – дані повинні збігатися з паспортом. Зареєструвати гаманець можна з 18 років;

4 крок: захистіть свій рахунок.

- Створіть пін-код і натисніть зберегти. Це фінальний крок!

Як почати виведення грошей з скрілл

Після реєстрації аккаунта перевірте електронну пошту – прийде лист з верифікацією email-a. Після цього можете додати банківську карту, щоб виводити гроші.

Комісії та тарифи skrill в україні

Реєстрація, отримання платежів – 0 $

Обслуговування неактивного облікового запису – 3 € в місяць. Порада: обслуговування буде безкоштовним, поки ви входите в свій аккаунт або виконуєте транзакцію не рідше одного разу в 12 місяців.

- Через банківський рахунок: 1% (2-5 днів);

- Через будь-яку банківську карту: 1,9% (миттєво);

- Bitcoin, bitcoin cash: 1% (миттєво);

- Neteller: 1% (миттєво).

Комісія за вивід зі скрілл:

- Банківська картка mastercard: 4,99% (3 дні);

- Картка visa: 7,5% (2-5 днів).

Переказ всередині системи – 0 $;

Відправка платежу на банківську карту – 1,45% (мінімальний збір 0,5 €);

Комісія за конвертацію валют – 3,99%.

Порівняно з payoneer, комісії skrill здадуться вам завищеними. Але у цієї платіжної системи є велика перевага – поповнювати гаманець скрілл можна самостійно.

Ліміти на вивід із skrill в україні

Мінімальна сума виводу – обмежень немає, важливо щоб було достатньо для покриття комісії.

Мінімальна сума виводу – якщо користувач пройшов верифікацію email-адреси, йому доступні такі ліміти на висновок скрілл:

- На місяць = 150 EUR

- На період 90 днів = 500 EUR. Користуватися гаманцем без верифікації можна тільки 90 днів, після цього періоду необхідно пройти перевірку особистості.

Огляж платіжної системи скрілл

Як збільшити ліміт в скрілл

Багато користувачів задаються питанням – як збільшити ліміт в skrill? Щоб збільшити ліміти потрібно пройти повну верифікацію.

Більше переваг є у власників VIP статусу. Отримати VIP статус можна, якщо пройти повну верифікацію аккаунта і досягти суми транзакцій за 3 місяці в 6000 €. Здійснювати транзакції потрібно безпосередньо через акаунт, а не з картки, і тільки в магазинах, власники яких мають комерційний рахунок в скрілле.

Чим більше витрачаєте – тим вищий статус. Щоб підвищити VIP статус, потрібно досягти суми транзакцій бажаного статусу протягом кварталу (так позначаються період в 3 місяці).

- VIP-статуси скрілл:

- Бронзовий – 6,000 €

- Срібний – 15,000 €

- Золотий – 45,000 €

- Діамантовий – 90,000 €

Переваги skrill в україні

- Проста і зручна настройка облікового запису. Створення облікового запису займає менше п’яти хвилин, а відправка грошей – простий процес.

- Є додаток для IOS і android.

- Відправлення платежів без надання одержувачу особистої інформації.

- Високі ліміти виведення коштів. Після проходження повної верифікації ви можете відправляти до 25 000 доларів на місяць, що вище, ніж у конкуруючих сервісів.

- Ніяких мінімумів при знятті коштів.

- Безпечні платежі, регульовані FCA. Також є 2-факторна аутентифікація.

- Перекази по всьому світу (виняток 10 країн).

- Цілодобова підтримка клієнтів. Зручний розділ інтерактивних FAQ (де можна отримати миттєві відповіді на найбільш поширені запитання).

Недоліки skrill в україні

- Високі комісії (якщо у вас немає VIP-статусу) – знімаються з додатковими зборами, які включають плату за конвертацію валюти до 3,99%, що вище, ніж у багатьох інших послуг онлайн-трансферу.

- Плата за бездіяльність аккаунта (оновлено 13 березня 2019 року). Якщо ви не використовуєте, або входите в свій аккаунт не частіше ніж один раз на рік, буде стягуватися плата в розмірі 5 євро на місяць до тих пір, поки не обнулится баланс.

- Потрібно ідентифікатор особистості, виданий урядом.

- Болісний процес верифікації (перевірки особистості). Зрозуміло, що необхідно перевіряти особистість своїх клієнтів. Проте цей процес має тенденцію бути затягнутим. Ця платіжна система хоче багато конфіденційної інформації, і деякі скарги користувачів показують, що процес передачі може бути недостатньо обережним.

- Користувачі даної платіжної системи часто скаржаться на блокування рахунку, і грошей на ньому.

Остання думка

Серед моїх знайомих є користувачі скрілл, і вони цілком задоволені функціональністю цієї платіжки. Є й такі, хто перейшов зі skrill на payoneer, або користуються ними одночасно. Читайте наші огляди, порівнюйте і вибирайте найбільш підходящу платіжну систему для ваших потреб.

Сподобався наш огляд skrill в 2020 році – не забудьте поділитися з друзями!

YOUR PASSPORT TO

GLOBAL GROWTH

Payoneer’s cross-border payments platform empowers businesses, online sellers and freelancers to pay and get paid globally as easily as they do locally.

Payoneer empowers you to scale your business globally and domestically with a payments and working capital platform designed for today’s entrepreneur.

Trusted partner for thousands of leading digital brands

Freelancers & service providers

Ecommerce marketplace sellers

Digital marketing & beyond

ALL-IN-ONE PLATFORM FOR GLOBAL GROWTH

Get paid to international receiving accounts

Receive bank account numbers in USD, EUR, CAD, AUD, JPY, MXN & more and get paid as easily as having a local bank account

Expand into new marketplaces

Connect with thousands of marketplaces and start getting paid with a couple of clicks

Request a payment

Offer your international clients a simple way to pay you with our billing service

Withdraw your earnings

Into your local bank account at low rates or via ATM

Pay your VAT

Pay the VAT authorities in the EU and UK with the GBP and EUR funds in your payoneer account, for zero fees

Pay your suppliers

Reduce costs and simplify processes by paying your contractors from your payoneer balance for free

Connect with partner ecosystem

Leverage our network of integrated service providers to simplify your business, help you grow globally and enjoy benefits

Access working capital

Invest in the future by managing your cash flow

BEYOND PAYMENTS – THE COMPLETE SOLUTION

FOR YOUR BUSINESS

Expand your ecommerce business

Go beyond borders! A full platform designed for the needs of today’s cross-border seller. Get paid by any of the world’s leading marketplaces, pay your suppliers and VAT for free, and manage multiple stores in one place. Access working capital to invest back into your business and withdraw your earnings in your local currency at low rates.

Expand your ecommerce business

Go beyond limits! Differentiate your business with a platform designed for the needs of today’s ecommerce seller. Get paid by any of the world’s leading marketplaces, pay your suppliers and VAT for free, and manage multiple stores in one place. Finance the next stage of your business growth with instant working capital available to you at low rates.

Payoneer: recauda pagos globales de manera sencilla

Que es payoneer y cómo nos puede beneficiar, es de lo que hablaremos. Te contaré en base a mi experiencia porque es uno de los procesadores de pago donde debes estar registrado, su funcionamiento, las tarifas y hasta como ganar $25 por cada amigo que invites.

¿realmente valdrá la pena? Déjame mencionarte tres aspectos que destacaría de payoneer frente a otros procesadores de pagos: interfaz fácil de usar, crecimiento constante (cada vez más empresas la incluyen) y su excelente sistema de invitación.

Comencemos por tener claro la razón de ser de payoneer. Sigue leyendo ��

¿qué es payoneer?

Se trata de una compañía de pagos electrónicos que beneficia a profesionales y empresas a la hora de pagar y recibir pagos globalmente. Esta empresa fue fundada desde el año 2005 y opera en más de 200 países en todo el mundo.

Múltiples empresas de prestigio como clickbank, clixsense, google, etoro, elance, odesk, entre otras muchas más confían en los servicios de pagos en masa de payoneer. Su expansión es constante, ya que las empresas que lo utilizan son cada vez más.

Muchos negocios en línea ya lo están incluyendo en sus pasarelas de pago, así que si eres una persona que se dedica a estas actividades, abrirse una cuenta es un paso casi obligatorio.

¿cómo abrir una cuenta payoneer gratis?

Algo que tienes que saber antes de abrir tu cuenta payoneer, es que si te registras desde la invitación de una persona ganas $25 tanto tú como el que te invito. El requisito es acumular los primeros $1 000 en tu cuenta, así que deberías aprovechar esto.

Si quieres puedes apuntarte a través del mío, para ello puedes pulsar aquí o pulsar sobre el botón de abajo.

Paso 2.- al estar ya en la página pulsa el botón “regístrese & reciba $25” (sign UP & earn $25). El proceso de registro es sencillo y no debe tomar más de 5 minutos en completarse.

Paso 3.- ahora debes completar tus datos personales: nombre completo, dirección, teléfono, documento de identidad, cuenta bancaria (para recibir tus fondos), etcétera. Asegúrate de brindar datos completamente reales. Es un sitio seguro y de gran reputación, así que no debes preocuparte de nada.

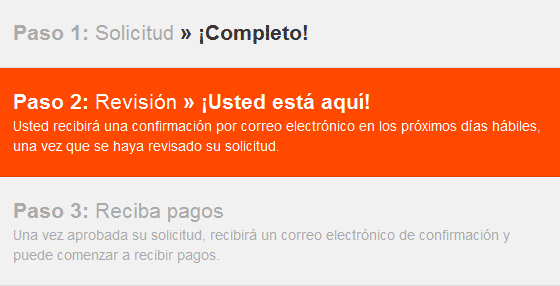

Paso 4.- una vez hayas terminado con el registro recibirás un correo electrónico notificándote que la solicitud de registro fue completada. Ahora solo deberás esperar a que lo revisen.

¿cómo funciona payoneer?

Seguramente ya estás registrado en otro procesador de pagos, por ejemplo, el ya tan conocido paypal. Son todos iguales, cumplen las mimas funciones y por ende te tomará segundos familiarizarte con la plataforma de payoneer.

Como puedes ver en la imagen, el uso de este procesador es totalmente intuitivo. De todas formas, vamos a repasar las opciones más importantes.

» recibir dinero : si deseas recibir pagos directamente a payoneer de los negocios online, debes seleccionar este procesador como método de pago y luego iniciar sesión en tu cuenta. Con esta acción quedará vinculada la página que estés trabajando y podrás recibir pagos sin inconvenientes.

Por otra parte, si lo que deseas es recibir dinero de algún familiar o amigo, lo que debes hacer es facilitar tu correo electrónico que utilizaste para registrarte en payoneer. Un proceso similar que se repite en muchos procesadores de pago.

» enviar dinero : para enviar dinero a un familiar o amigo, debes dirigirte al menú “pagar” –> “realizar un pago” y luego poner la dirección de correo del destinatario, así como la cantidad a enviar. La transferencia no tiene ningún coste y se realiza de forma instantánea.

Si lo que quieres es hacer un pago a un comercio asociado a payoneer, no hay que hacer nada. Lo único por hacer es seleccionar este método de pago y loguearte a tu cuenta, luego el saldo será descontado automáticamente.

» retirar dinero : para poder disfrutar de tu dinero, este procesador te facilita el poder hacer retiros hacia tu cuenta bancaria. El mínimo de retiro es de $50 y demora de 2 a 5 días laborales reflejarse el saldo en tu banco.

Revisa este listado para saber si tu país es apto para este tipo de transferencias.

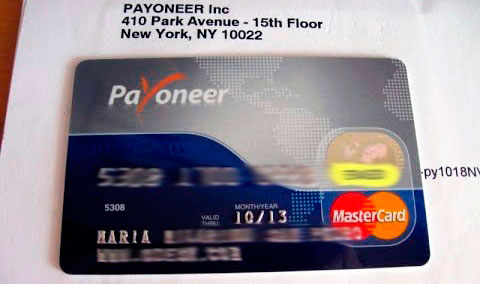

En caso tu país no esté disponible, puedes retirar tu dinero de todas formas con la tarjeta prepago mastercard. Con ella puedes hacer retiros en cualquier cajero ATM y pagar en comercios electrónicos donde acepten mastercard, ya sea online o de forma presencial.

Solicitarla y recibirla hasta tu casa no tiene ningún coste. Pero eso si, cuando tengas saldo en tu cuenta te cobrarán el mantenimiento anual, que equivale a $29.95.

Te dejo otro listado para comprobar si tu país está disponible para obtener esta tarjeta.

Programa de referidos payoneer

Con el sistema de referidos de payoneer puedes ganar dinero, de hecho es uno de los mejores pagados que conozco. Cada vez que una persona se registre mediante nuestra invitación, ganaremos tanto nosotros como el invitado, la generosa suma de 25 dólares.

Hay un requisito para que este premio por referido se sume a nuestro saldo. Nuestro invitado deberá haber llegado a $1 000 en transacciones en su cuenta de payoneer. Es por esta razón que es importante registrarse desde algún enlace de invitación.

Tienes que tener muy en cuenta que si te registras desde la página oficial sin un enlace de un patrocinador no obtendrás los $25. Es por ello que te invito a usar los botones de invitaciones que encuentres en este artículo, así los dos saldremos ganando.

Comisiones y tarifas de payoneer

Como cualquier procesador de pagos, payoneer basa sus ganancias en las comisiones por las transacciones que realizamos. Estas son:

〉 recibir pagos

Recibir pagos es gratuito, por lo que no se cobrará ningún tipo de comisión excepto para usuarios de EE.UU, que si pagan el 1% del monto total recibido.

〉 enviar dinero

Enviar dinero es totalmente gratuito

〉 retirar fondos a cuenta bancaria

- 2% de la cantidad total. Se aplica únicamente si la moneda de los fondos es idéntica a la moneda de la cuenta bancaria de destino.

- 2% (tasa de conversión) por encima de las tasas de mercado medio. Se aplica únicamente si la moneda de los fondos es diferente a la moneda de la cuenta de destino.

〉 retirar fondos usando cajeros ATM

- $3.15 al hacer retiros de efectivos en cajeros ATM.

- $1 por transacción rechazada en cajeros.

- $1 si quieres consultar tu saldo utilizando el cajero.

No puedo asociar payoneer con mi cuenta paypal ¿qué hago?

Hace un tiempo atrás, paypal está dando problemas para vincular cuentas bancarias de payoneer. Sin embargo, aún es posible asociar estos dos procesadores de pagos utilizando uno que otro truquito. ¿quieres saber cómo? Te dejo un video, ¡disfruta!

Opiniones y conclusión personal

Creo que la pregunta de que es payoneer y cómo funciona a quedado resuelta. Si decidí escribir una reseña acerca de este procesador de pagos, es porque me ha acompañado desde que me aventuré en los negocios online y hasta el día de hoy me es de gran utilidad

Al inicio me cree una cuenta solo para vincularla a paypal y poder retirar el dinero con la tarjeta de payoneer. Claro en ese entonces ambas se podían asociar, hasta que paypal cambio sus políticas; sin embargo aún es posible usando trucos como el vídeo que te dejo arriba.

Conforme fui probando nuevos negocios, me di con la sorpresa que podía cobrar directamente a mi cuenta de payoneer. Desde acortadores de enlaces como “adf.Ly”, red de anuncios “adnow”, programas CPA “mobidea”, sitios freelance “fiverr” y muchos sitios más.

Uno de los últimos sitios del cual vengo cobrando con payoneer es clixsense, luego que retiraran paypal como método de pago. Así mismo puedes ocurrir con muchos sitios, por lo que es mejor estar preparados, recuerda que registrarse en los procesadores de pago es gratis.

Por último, no hay que dejar de lado el excelente programa de referidos el cual ofrece una comisión suculenta. Si quieres apuntarte y ganar esos $25 dólares, te invito a inscribirte desde el botón el cual contiene mi invitación.

Eso es todo por hoy, si tienes alguna duda eres libre de dejar tu comentario y te ayudaré

Deja un comentario cancelar la respuesta

Comentarios (45)

Gracia por todo tu apoyo y dedicación que le pones a tu trabajo, yo ya hace tiempo estaba buscando como generar ingresos extras y tu información me ha parecido muy buena y ya estoy ansioso de ponerla en marcha, te deseo lo mejor y éxitos.

Excelente reportaje ¡muchas gracias!

Diego leonardo barrera higuera

Hola buenos dias. Geniales tus articulos.

Quiero hacerte una pregunta

1. La cuenta de paypal debe tener el mismo nombre (falso) que utilice para registrarme en los paneles de encuestas. Y los procesadores de pago tambien deben tener este nombre: o con mi nombre real. No tengo problemas

Para nada diego, puedes cobrar con tu paypal y procesador de pago personales, es decir con datos reales. No importa si no coinciden con tu perfil de USA, igual llegan los pagos.

Hola sergio mira tengo una duda como ago para conseguir ingresos para la payoneer es decir que paginas trabajar por favor responderme a mi correo joalberzambrano75@gmail.Com ya que se me dificulta algo volver por aqui

Muchas gracias por compartir sus conocimientos, tengo unas preguntas, mientras llega la tarjeta podemos ir realizando encuestas y no hay ningun problema?

2. En que formato tiene el documento para poner la tarjeta en paypal verificado? Gracias.

Claro alejandro, puedes ir trabajando con las encuestas remuneradas ya que estas pagan por paypal, puedes ir acumulando el dinero ahí hasta que llegue la payoneer. La segunda pregunta no te entendí muy bien, pero para asociar la tarjeta al paypal, y esta quede verificada el proceso sería irte a la pestaña “cartera” (dentro de tu cuenta de paypal) y añadir los datos de tu tarjeta, luego de unos 3 o 4 días paypal descontará algo de 2$ de tu saldo de tu tarjeta y en esa transacción habrá un código de 4 dígitos que paypal te pedirá para que quede verificada tu cuenta. Cabe señalar que debes tener tu paypal ya verificado antes de trabajar con encuestas remuneradas o cualquier negocio online, saludos.

Hola. Con esta tarjeta puedo verificar una cuenta paypal que aún no ha sido verificada? Mi idea es sacarla tan solo para verificar la paypal, no pienso retirar efectivo con ella ¿así y todo me cobrarian algo? ¿podría disponer de esos primeros 25 dólares en mi saldo paypal?

Gracias!

Hola sergio, gracias por tu apoyo con nosotros, ya me registre con tu invitación en payoneer, ahora tengo una duda, los 25 dolares estarán en mi cuenta cuando active la tarjeta o cuando tenga mas de 100 dolares ?? Actualmente esta en cero

Que tal, los $25 te serán acreditados en cuanto cargues tu payoneer con $100 o más.

Hola sergio me podria brindar la informacion de como obtuvistes la tarjeta soy de peru lima la victoria y estoy pidiendo la taarjeta como referido tuyo ¿ te vino por correo postal ? ¿ te llego a tu casa o tuvistes que recogerla ? ¿ es por serpost ? ¿ hace algun cobro? ¿ en que tiempo te llego a ti ?

Espero sus respuestas

gracias

La tarjeta llega hasta tu casa de forma gratuita diego. Demora en llegar entre 3 a 4 semanas una vez aprobada y el único cobro es de 29$ cuando haces la primera carga de dinero a tu cuenta payoneer, sea pasando dinero de paypal o de otros medios.

Buenos dias sergio

mi pregunta es en cuanto tiempo (promedio) te habilitan la tarjeta o la cuenta para poder empezar

Una vez que la solicitas, si todo esta correcto te lo habilitan y te notifican que tu tarjeta esta en camino. Demora de 3 semanas a 4 en llegar hasta tu domicilio, una vez la tienes en tus manos la tienes que activar desde la página oficial de payoneer y esta ya queda habilitada para hacer transacciones.

Sergio

jeje disculpa tantas preguntas jajajaja ya tengo la cuenta habilitada me dieron el numero en payoneer puedo empezar a trabajar con este numero de cuenta y cuando me llegue la tarjeta la activo y puedo reclamar lo acmulado o a partir de la activacion DE ESTA ES QUE PUEDO EMPEZAR A ACUMULAR CON LAS ENCUESTAAS

Jean luis grullon jiménez

Hola te agradezco mucho tus aportes �� tengo dudas

1-si tengo una cuenta paypal verificada con una tarjeta de credito o debito de mi pais me podrian congelar las cuentas de las encuestadoras de las que hablas en tu guia

2-en que bancos se puede retirar el dinero de paypal via payoneer o payoneer a paypal usando la tarjeta payoneer

3-es mas recomendable utilizar payoneer o paypal para cobrar el dinero de las paginas en las que tenemos que “engañar” con nuestra ubicacion y datos

Espero me contestes y muchas gracias por tus aportes. ��

Respondiendo a tus preguntas jean

1. No, eso no sucederá, podrás cobrar con normalidad.

2. En cualquier cajero ATM, esos que aceptan todas las tarjetas.

3. Los paneles de encuestas solo pagan por paypal, no payoneer.

Jean luis grullon jimenez

Muchisimas gracias �� otra cosa he escuchado que en algunas paginas cuando empiezas a ganar mas de 600 dolares al año te piden un numero de seguro social obviamente de estados unidos es cierto o no?

En el caso de las encuestas si es verdad, cuando se llega a esa suma simplemente se abandona la cuenta y se hace otra ��

Sergio, soy de venezuela y no he podido verificar mi cuenta en paypal por eso siempre cobro por gift cards. Con esta tarjera podría? Gracias espero tu respuesta.

Que tal alejandro, la verdad no es más para retirar el dinero en físico desde paypal. Te recomiendo visites nuestro post de amazon gift card y revisar inboxdollars que paga mediante tarjeta de visa prepagada, con la que puedes verificar tu paypal.

Hola sergio soy de venezuela , estoy empezando en esto y aun no tengo mi cuenta paypal verificada por que aun no tengo una tarjeta de credito virtual al registrarme en payoneer debo poner mis datos reales, direccion real, edad, etc? Gracias. Saludos

Así es jose, debes poner todos tus datos reales así como en paypal.

Tengo una duda sergio, debo tener saldo en la cuenta payoneer para hacer todo esto?

Hola pedro, no es necesario tener saldo en payoneer para vincularla a paypal si esa es la pregunta.

Gracias sergio por esta gran guia, solo tengo una duda,

es necesaria la cuenta payoneer para vincular con paypal o puedo usar una tarjeta de debito de mi pais?

Buenas daniel.

Puedes usar paypal independientemente de payoneer, no es necesaria la vinculación a menos que tu propósito sea el de retirar el dinero de paypal. Algunas entidades bancarias trabajan directamente con paypal, aquí en perú por ejemplo está interbank.

En cuanto tiempo recibo los 25 dolares por medio de la invitacion?

Hola sergio, una duda, después de pagar el mantenimiento de la tarjeta, no tienes que pagar nada más?

Solo se paga el mantenimiento anual nada más amigo, luego queda totalmente libre para que recibas tus ganancias de forma neta.

Muy buena pagina da todo tipo de informacion un capo en este negocio . Tambien soy peruano quisiera que me ayudaras mas sobre este campo ya que recien estoy comenzando en esto y asi apoyarnos mutuamente

Hola que tal compatriota, en el blog tienes muchas formas de ganar dinero disponibles, hecha un vistazo o contactarnos en nuestra página de facebook.

Hola amigo sergio ya realice la vinculacion de mi payyoner a paypal, al finalizar me salio un mensaje que me decia que en 3 a 4 dias me enviaban un valor menor a mi banco, pregunta ese banco es dentro de payyoner .

1. Debo entrar a mi payyoner para saber cuales son los valores ?

2. En que opcion del menu me apareceran los valores pagados por paypal para verificar mi cuenta ?

Que tal vladimir.

Efectivamente aparecerá en tu cuenta de payoneer. Pasado el plazo que te indicaron revisa en el menú “actividad” luego ” ver transacciones”.

Hola, dijiste que para abrir una cuenta bancaria en payoneer no era necesaria una cuenta de banco, me fui a registrar y si que la pide, no poseo cuenta de banco, estoy buscando trabajar en internet porque no hay ningun trabajo fisico donde vivo, como voy a conseguir una cuenta de banco…..

¿cómo vas alan? Para nada, no es necesario una cuenta bancaria, ya que payoneer es la que te la brinda. Al completar todo tu registro estás creando tu cuenta bancaria virtual en los estados unidos ofrecida por payoneer, además estás solicitando una tarjeta mastercard la cual recibirás de manera gratuita a la dirección que hayas colocado en el registro.

Hola, a mi me sale lo mismo, que ponga el nombre de mi banco, el nombre y numero de la cuenta y el swit o bic, entonces ahi que hacemos? Que respondemos. Por que si no llenamos esos espacios no nos deja avanzar

Hola susana.

Al parecer si están pidiendo una cuenta bancaria para crear una cuenta en payoneer. Es extraño porque no habían notificado nada al respecto, ahora mismo estoy consultando al soporte sobre esto. Cuando tenga algo en concreto voy a actualizar la información de este artículo.

Bueno, esperare tu actualizacion entonces, muchas gracias ��

Cómo retirar el dinero de skrill con payoneer

A finales del año pasado nos sorprendió a todos por la cancelación de todas las tarjetas de skrill y neteller, y este cambio también ha afectado a varios otros países, tales como:

Antes de eso, podríamos retirar efectivo en cualquier ATM. Pero ahora sin la tarjeta es más difícil de retirar dinero en efectivo, como dinero en efectivo directamente a su cuenta bancaria no es viable, ya que generalmente los bancos no aceptan dinero sin foco probado con la documentación y regresan al receptor, e incluso a aceptar que tendrá que pagar altas tarifas y impuestos.

Pero hay algunas buenas alternativas de dinero en efectivo a cabo los fondos que pocas personas conocen, como es el caso con la compañía payoneer ( https://www.Payoneer.Com/ )

Acerca de payoneer

Payoneer es como una cuenta bancaria en línea, está dirigido principalmente a los hombres de negocios, profesionales y autónomos, que ofrece varias maneras para que los usuarios reciban de sus clientes en el extranjero.

La gran ventaja de payoneer es que ofrecen 3 números de cuentas bancarias en diferentes países (estados unidos, alemania e inglaterra), y son las cuentas bancarias normales las que puede mostrar los datos para recibir pagos de cualquier persona o empresa.

Recuerde que el payoneer deja claro que tales servicios son para recibir pagos por trabajos realizados para clientes en el extranjero, como un profesional independiente y la difusión de los programas de afiliados, por ejemplo. No sé si el dinero ganado con el juego en línea, se permite el comercio o poker, por lo que si este es el caso, lo mejor es ponerse en contacto con los medios de comunicación antes de empezar a usar el servicio.

Cómo retirar el dinero de skrill con payoneer

Cómo retirar el dinero de skrill con payoneer: para retirar el dinero es bastante sencillo, sólo tienes que acceder a la versión en español del sitio https://www.Payoneer.Com/es/ y hacer tu registro, y luego enviar los documentos solicitados para la verificación de la cuenta.

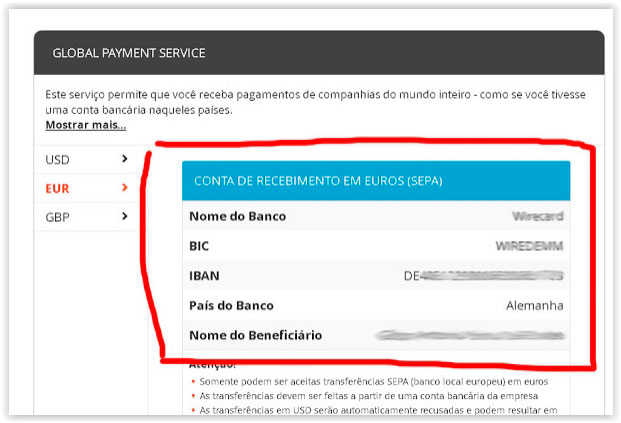

Una vez que tenga su cuenta activa, tendrá acceso a números de cuenta bancaria (dólares, euros y libras). Para retirar el dinero de moneybookers, usted debe utilizar la cuenta en euro (alemania) porque moneybookers hace sólo retiros en euros, si usted intenta sacar en las cuentas en dólares o libras, el dinero vuelve porque las cuentas no aceptan una moneda diferente del estándar de la moneda cuenta.

Para encontrar los números de sus cuentas clic GLOBAL PAYMENT SERVICE dentro de su inicio de sesión, verá algo como esto:

A continuación, sólo escribir los números y registrar en su cuenta moneybookers haciendo clic “add bank account ” en el apartado “cards and bank accounts”. Recordando que el código BIC y SWIFT ellos son los mismos.

Después sólo hacer la solicitud de retiro a la cuenta bancaria en moneybookers, se tarda hasta tres días para que el dinero para caer en la cuenta de payoneer.

También puede solicitar su tarjeta de prepago payoneer mastercard será enviado esta tarjeta puede ser utilizada para retirar en los cajeros automáticos y compras en tiendas virtuales y físicos.

De acuerdo con información del sitio, las retiradas en euros en payoneer no tiene costo, sólo la cuenta en dólares que cobran 1%, lo cual es muy bueno.

En payoneer también tiene la opción de transferir su saldo a su cuenta bancaria, y las transferencias son locales, evitando así los gastos y la burocracia de una transferencia internacional.

¿te gusta? Tiene más, la persona que se inscriba a través del siguiente enlace, ganará 25 dólares directos en su cuenta (después de mover más de $ 100 en la cuenta) tomar ventaja de esta promoción:

Conclusión

Como hemos visto los cambios ocurren rápido y tenemos que estar atentos. En este artículo usted se enteró cómo sacar el dinero referente trabajo autónomo recibido en moneda extranjera. Es relativamente simple, con los consejos que has visto en este post será más fácil tener opciones. El hecho es que donde se cierra una oportunidad otra se abre en el lugar. Esperamos que haya disfrutado de este artículo, nuestro objetivo es traer informaciones útiles e importantes.

¿ha quedado alguna duda sobre este proceso? Deje en los comentarios que responderemos tan pronto como sea posible.

Skrill vs payoneer: pick the best money transfer services for your business (2019)

If you have been looking for the best method to send money to businesses or marketplaces as well as receive payments, then you must have probably come across the two popular online payment services skrill and payoneer.

In this article, we’ll be making an honest comparison between the two companies to help you decide which one is best suited for your needs and requirements. We’ll be covering several factors such as exchange rates, security & credibility, fees, ease of use, countries, etc.

What is skrill?

Skrill – online payment company was launched in 2001, and since then, it has been helping its customers make transactions and send money to several countries across the world. At present, the paysafe group owns the company. Paysafe group is a multinational payments group that offers payment services in person, online, and through other channels.

Initially, skrill started as a payment gateway for ecommerce and was specialized in gambling. However, the company has broadened its services and now it offers an online service referred to as the skrill money transfer. It enables you to transfer payments around the world.

Skrill money transfer service is simple, fast, and affordable due to its attractive pricing, fees, and exchange rates. When you sign up with skrill, you’ll have access to this service along with skrill wallet (we’ll be talking more on that below).

You can transfer money overseas by using the skrill money transfer service and even fund the payment either with your credit/debit card, bank transfer, or SOFORT, depending on your location and your currency.

The payee can opt to receive their payments into their accounts directly. Aside from that, skrill also offers beneficiaries of certain countries the option to receive funds into their mobile wallets.

What is payoneer?

Payoneer is another online payment company, which is located in new york. Established in 2005, the company can process online transactions for both the US as well as overseas users. It has over 4 million users in more than 200 countries worldwide. The company can also facilitate cross-border payments in over 150 currencies.

Payoneer’s services are used in various major ecommerce marketplaces like upwork, airbnb, fiverr, google, and amazon. If your organization needs to transfer or receive funds either internationally or domestically, payoneer’s services can be beneficial.

Payoneer mainly focuses on currency conversions, receipts, and business payments. As such, the services it offers are slightly different compared to the traditional currency exchange providers. It depends on your and the payee’s payoneer account status.

Its services work best for businesses, professionals, product/service marketplaces, and freelancers that work with international clients a lot. It’s also quite beneficial for companies that make or receive several B2B payments.

Skrill vs payoneer: products & services

To understand how skrill differs from payoneer and vice versa, let’s dive deep into features that both companies provide to the community worldwide.

Payoneer’s services

When it comes to products and services, you need to note that payoneer isn’t like the standard merchant account provider. It doesn’t provide the full range of services you’d normally get from traditional providers. As such, you can’t use the POS system or the credit card terminal via your payoneer account.

The company also doesn’t have any support for a virtual terminal or a payment gateway. Here are some of the features payoneer offers:

Payoneer account

Payoneer’s global payment service provides a payoneer account to its users. This account enables you to accept funds in various currencies, and whenever someone sends a payment, it’ll be transferred to your payoneer account.

It also allows you to transfer money to other payoneer users across the globe, for free. Do note that payoneer’s services are not tailored for personal use but for just business transactions.

Payoneer’s billing service

Payoneer’s global payment service and its billing service work alongside each other. Therefore, requesting business payments requires a few clicks, allowing you to transfer it to your customers quickly.

The clients can then pay the invoice or bill with their debit card, credit card, or bank account. They don’t need to have a payoneer account to transfer the money. Once they make the payment, it’ll be sent to your payoneer’s receiving account. There are, however, certain restrictions you need to be aware of (find out here).

Payoneer’s prepaid mastercard

The company also offers prepaid mastercard to its account holders, which is used for making payments once your payoneer account has sufficient funds. Additionally, it charges a yearly fee of $29.95 for this card. The price is quite a lot, especially if you don’t use your payoneer account frequently.

Mobile app

It provides a free payoneer app with limited functionality. The app is compatible with both android and IOS devices. It enables you to withdraw funds, check your transaction history, instantly check account balance and currencies, and preset criteria by filtering key transactions.

- Withdraw funds: to access your payoneer funds, it enables you to transfer it to the local bank account and can be converted into the local currency. You can even withdraw the money via the ATM or a prepaid card.

- VAT services: the company allows businesses to transfer VAT payments to authorities in the UK and the EU with EUR and GBP funds in the user’s payoneer account.

Partner directory

Features several integrated services across various niches. The partner directory of payoneer features all of those businesses and services.

Integrated payments platform

The company allows business owners to make use of its payment platforms via a comprehensive API. This makes it easier for them to transfer or receive funds worldwide without having to leave the business’s website.

Now that you know some of the best features payoneer offers its customers, let’s have a look at what skrill has in store for its users to help you determine how skrill vs payoneer differs in terms of products and services.

Skrill’s features & services

Skrill offers the following two merchant services:

- Skrill’s wallet payments:

You’d expect, skrill allows businesses to accept funds from anyone who uses the digital wallet.

- Skrill’s hosted payments: this service lets you receive funds from both skrill users and non-users. When they check out from your site, they are redirected to the website to complete their transaction, which is quite similar to how paypal works.

Also offers an inframe to accept funds via skrill while keeping the customers on your site. Skrill boasts that its hosted payment solution can support over a hundred local payment methods & more than 170 bank transfers directly by using a single integration.

Here’s a list of some of the features skrill offers:

Skrill 1-tap

1-tap feature enables users of the skrill wallet to accept purchases automatically, without the need to go through the authorization process every time.

Shopping cart integration

Offers merchants the option to integrate with a wide range of shopping carts. Some of the notable ones include shopify, bigcommerce, volusion, opencart, and woocommerce.

Recurring payments

This feature is not as advanced as some of the tools you’d get in other merchant services, it’s still an excellent option for membership and subscription.

Mass payments

Offers a mass payment feature that enables users to transfer money to several people at once.

In-app microtransactions and payments

Allows developers to facilitate transactions in online apps, specifically within games.

Skrill’s prepaid mastercard

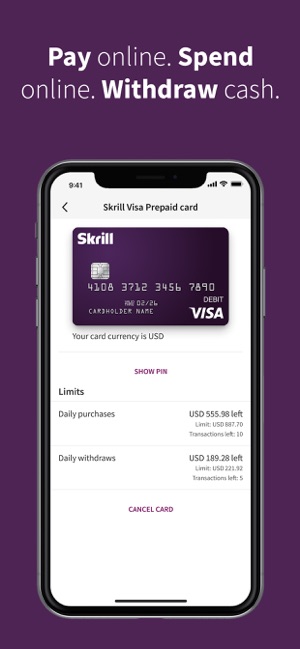

With this prepaid card you can access your account balance for making any payments worldwide, wherever mastercard is accepted. You can know more about its prepaid card here.

Skrill’s mobile app

Skrill offers an application for IOS and android devices so that you can use your skrill wallet and account, wherever you are. The app enables you to check your balance, upload and withdraw funds, transfer or accept money, and make a transaction with skrill’s prepaid mastercard.

- Additionally, it is also worth noting that it is PCI-compliant. However, you don’t have to worry as you do not host your own transaction page. Skrill also enables you to have access to its analytics. It may seem pretty basic, but it helps you to be aware of your processing volume.

- Skrill doesn’t offer in-person payments. It is strictly mobile and online only. Another downside of skrill is that there is no invoice support for users in the US.

Skrill vs payoneer: fees & exchange rates

One of the most crucial factors that will help you in determining whether skrill or payoneer is ideal for you is their fees. We are not talking about just transfer fees, but other charges associated with withdrawing and depositing funds and their exchange rates.

When it comes to depositing funds, skrill will charge you a fee of one percent, meaning if you deposit £500 to your account, you’ll have to pay a £5 fee. As far as withdrawing fees are concerned, you’ll have to pay £4.82 via your skrill wallet.

If you wish to withdraw money from your skrill wallet back to your debit or credit card, then you’ll have to pay 7.5%, meaning a £100 withdrawal will cost you £7.50 in fees.

Transferring money with skrill will charge 1.45 percent of the amount transferred. On the contrary, payoneer’s fee structure is what makes it quite popular among affiliates and freelancers. When you receive payments through your receiving account, you won’t have to pay any additional fees.

That said, payoneer does charge a fee for USD (0%-1%), depending on the payer’s country. Also, there’s a 3% charge for receiving payments via debit or credit card and a 1% fee (for echeck in USD). For transferring funds to your account, there’s a 2% fee above the mid-market rate. You can have a look at the image below or check their fee page.

When it comes to exchanging rates, skrill charges a fee of 3.99% whereas payoneer users are subject to paying a fee of 0.5%, above the interbank exchange rate.

Skrill vs payoneer: contract length and cancellation fee

The next factor that we’ll be talking about in our skrill vs payoneer comparison is the contract length and cancellation fee of both the platforms.

Payoneer charges on a monthly basis and doesn’t require its users to sign any long-term contract. Also, there isn’t any early cancellation fee when you close your account. However, it is recommended that you follow its account closure procedure as outlined in the contract to make sure that your account has been terminated for real.

Payoneer’s flexibility in offering a monthly-billing option is commendable. However, as we have mentioned before, you still need to pay the annual fee. Although this fee is actually supposed to be a payment for the payoneer debit card, setting up an account isn’t possible without this card.

Therefore, the annual fee is quite similar to the account fee that most merchant payment service providers charge. On the contrary, skrill service is more of a pay per transaction basis, where merchants have to pay per usage. Depending on its additional agreements, business accounts may have to pay other monthly fees. Like payoneer, there isn’t any early cancellation fee for skrill as well.

Skrill vs payoneer: customer service & support

When it comes to customer service or support, both platforms do a pretty decent job. They both have their own support center available on their website.

If you need any assistance while using your skrill account, it’s worth going through their large FAQ section first. Most account related queries can be answered by checking the extensive guide that’s on offer.

If you wish to interact with the team directly, there are quite a handful of options at your disposal. Firstly, you can contact skrill via telephone. The company offers several local phone numbers, which include that of the US and the UK.

Before contacting them, you need to have your reference number (you can find it on the top-right). This enables the support agent to bring up your account.

You can also message the support team directly using your skrill account. You can expect to hear back from them within 24 hours, but, if you require instant support, contacting via telephone is preferable.

If you happen to be a VIP skrill member, you can have access to its 24/7 customer support by using their dedicated phone number. As such, you won’t have to worry about any delay. Unfortunately, it doesn’t offer a live chat option.

Similar to skrill, payoneer features an efficient support center on its site. You will find an extensive FAQ segment containing detailed and thorough information for answering any queries and troubleshooting issues.

Get access to the live chat feature by signing in to their payoneer account. You can also get in touch with the team via email. The telephone support, however, is only intended for reporting stolen or lost debit cards.

The live chat option is available in three languages, namely, english, russian, and spanish. If you aren’t familiar with these languages, you are better off with the email option as it features plenty of additional languages.

Skrill vs payoneer: credibility & security

Can skrill or payoneer be trusted? The short answer to this is yes. Here’s why:

Formerly known as moneybookers, skrill has been running since 2001. They are fully regulated and authorized and have millions of users to back their credibility. They have been helping users make domestic as well as overseas transfers and even make online payments with ease.

Its owner, paysafe, has offices in more than 20 locations worldwide and that includes the USA and the UK.

On the other hand, payoneer may be relatively new in comparison to skrill. However, it has still managed to win the trust of millions when it comes to making payments online.

Developed in 2005, payoneer is backed by expedia and dropbox, the very investors that funded facebook. Ever since its establishment, payoneer has over a thousand employees worldwide, located across fourteen offices all over the world.

Several marketplaces, individuals, and companies use payoneer’s services to receive and make payments and also to transfer funds across the globe.

All of these prove that both platforms are legitimate and can be fully trusted.

Skrill vs payoneer: pros & cons

Skrill pros:

- Skrill money transfer offers very competitive exchange rates and fees.

- Excellent user reviews on trustpilot.

- Convenient, secure, and fast transfers via skrill money transfer.

Skrill cons:

- You can only transfer funds to the mobile wallet or bank account.

- Available in limited countries.

- High fees.

Payoneer pros:

- Offers extensive payment services & solutions.

- Reasonable currency exchange fees.

- Quick transactions from anywhere across the world.

Payoneer cons:

- Stringent terms & conditions for using its service.

- Currency conversion only meant for business payments and transactions.

- Lots of additional fees.

Final verdict

To determine a winner between skrill vs payoneer, it will ultimately depend on your personal needs and preference and your location.

If we were to pick a winner, it’d be payoneer. It is an excellent tool for international businesses and freelancers. Its ability to manage currency conversions and transfer payments to bank accounts worldwide makes it a compelling choice for most users.

Payoneer is an ideal choice to go for if you do international business or are just looking for a platform to make currency conversions and transfer payments.

That’s not to say that skrill is any less; it is a beneficial tool for sending and receiving money online. It allows you to transfer funds anywhere around the world. However, it’s more on the expensive side.

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

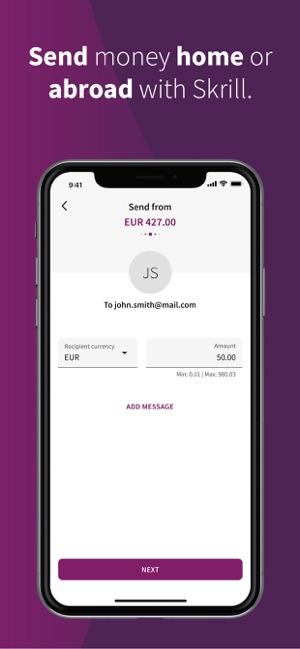

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Что можно сказать в заключение: hi dear, is there a way to transfer money from skrill to payoneer account? По вопросу skrill to payoneer 2019

Комментариев нет:

Отправить комментарий