Www skrill com

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international. You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

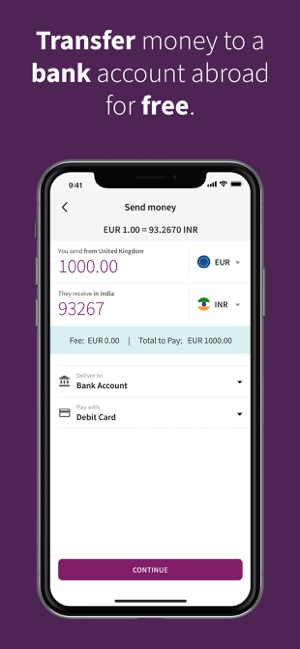

TRANSFER MONEY

FOR FREE

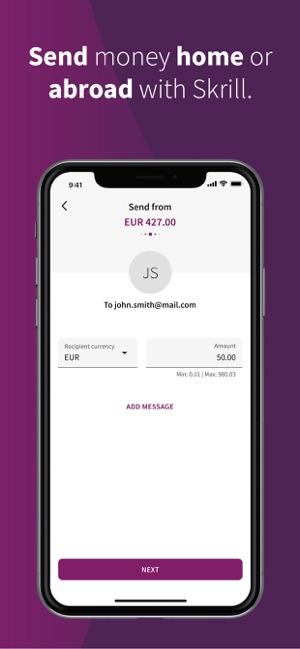

Send money abroad for free with skrill.

Try the calculator to see how much you will save.

Or, explore the tabs above the calculator to see the other benefits of using skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

TRANSFER MONEY

FOR FREE

No transfer fee when you send money directly to a bank account.

Try the calculator to see what you will save by sending for free with skrill.

Skrill money transfer is rated 'excellent' on

- FCA regulated

- Millions of customers

- Leading risk and anti-fraud technology

Aneta gave you £10

to send abroad

Get £10 off when you transfer £100 or more from the UK. Just make sure to use your friend's referral code [ anetaa23 ] when you register. Go ahead, start your transfer now! Terms apply.

This special referral offer is currently only available when making international transfers from the UK.

See how much you get sending £1000 to india

| provider | receive amount (INR) | send amount + fee | effective FX rate |

|---|---|---|---|

| send money with | exchange rate 92,380.00 | transfer fee 1,000.00 | 92.3800 |

| send money with | exchange rate 91,907.37 | transfer fee 1,000.00 | 91.9074 |

| send money with | exchange rate 91,891.16 | transfer fee 1,000.00 | 91.8912 |

| send money with | exchange rate 92,005.76 | transfer fee 1,001.49 | 91.8689 |

| send money with | exchange rate 91,865.16 | transfer fee 1,002.90 | 91.5995 |

| send money with | exchange rate 91,540.00 | transfer fee 1,002.99 | 91.2671 |

| the comparison fees displayed on our page have been published on 23/12/19 13:10 CET and have not been refreshed since this date. The data for the price comparisons shown have been taken from other providers’ websites, on specific dates. This information is freely available on the competitor’s websites we have listed. This is not an exhaustive list of companies offering a money transfer service and if you are interested in a particular supplier we suggest you check their respective website. Fees comparison disclaimer | |||

How it works

Register for a skrill account with your friend's link or code

Transfer £100 or more from the UK to an international bank account.

You get £10 off on your first transfer. Your friend also gets £10 off on their next transfer.

Transfer needs to be cross-border and from a participating country. Also transfer credit expires in 3 months.

Read terms & conditions

FEE FREE

It's free to send with skrill money transfer to a bank account or mobile wallet abroad - more savings for you.

QUICK AND EASY

Send money to bank accounts internationally. Choose how much and where you want it to go.

SECURE

Your money transfer is protected by our industry-leading secure payment systems.

TRUSTED GLOBALLY

Millions of people use skrill to send and receive money around the world.

See what our customers are saying about us

Secure and easy transfers

SHISHIRA , india

Really good. It’s secure and fast

SOURABH , india

Using skrill has really made money transfers from kenya to other countries extremely easy.

IRENE , kenya

A great way to send money around the world

SAM , india

Our company

Don’t have the recipient’s bank details?

You can also send money instantly with just an email address.

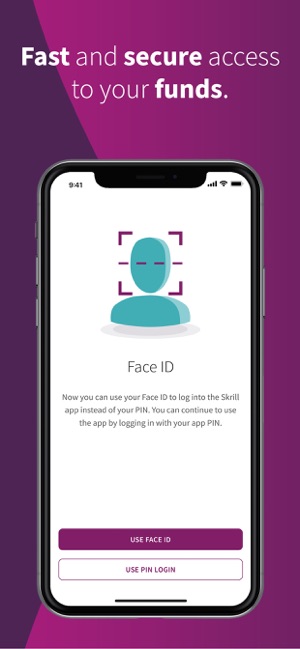

Access your money wherever you are 24/7

Our fast, easy to use and secure app lets you access your account whenever you need it.

Copyright © 2019 skrill limited. All rights reserved. Skrill® is a registered trademark of skrill limited. Skrill limited is incorporated in england (company number 04260907) with its registered office at 25 canada square, london E14 5LQ. Authorised and regulated by the financial conduct authority under the electronic money regulations 2011 (FRN: 900001) for the issuance of electronic money and payment instruments. The skrill prepaid mastercard is issued by paysafe financial services limited pursuant to a licence from mastercard international. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuance of electronic money and payment instruments. Mastercard® is a registered trademark of mastercard international.

Copyright © 2019 paysafe holdings UK limited. All rights reserved. Skrill limited (FRN: 900001) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments. Skrill is a registered trademark of skrill limited. Paysafe financial services limited (FRN: 900015) is authorised by the financial conduct authority under the electronic money regulations 2011 for the issuing of electronic money and payment instruments.

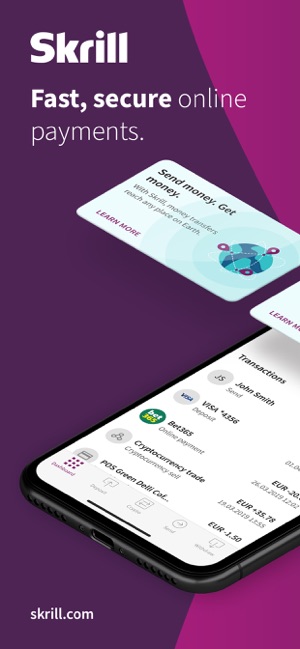

Skrill - transfer money 4+

Fast, secure online payments

Skrill ltd.

Screenshots

Description

Transfer money globally, pay online, and more. With skrill, online transactions are easy, secure, fast, and cheap. The app empowers you to make online payments, and send money to a friend or relative.

• transfer money to india, united kingdom, france and several more countries across the globe;

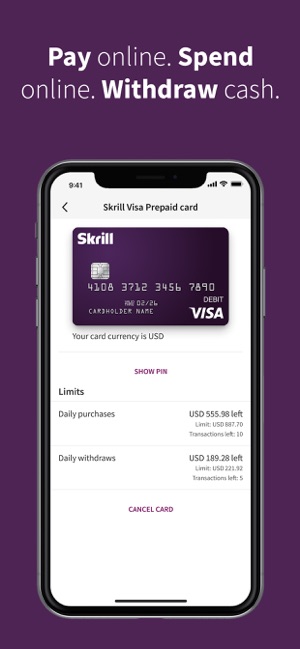

• get a skrill prepaid visa card to withdraw cash from thousands of atms around the world or make payments everywhere visa is accepted;

• load funds to your account via credit or debit card, bank transfer, or local payment methods;

• comfortably send money to another skrill member, a bank account, a mobile wallet, or just an email address;

• save considerably from transaction costs when transferring money abroad with skrill’s low and transparent fees;

• receive real-time notifications for your transactions;

• enjoy quick and friendly customer support in your language;

Trusted by millions of people worldwide to make global payments simple, safe, and quick.

*some features may not be available in your state/country of residence.

What’s new

From now on US customers from indiana, new mexico, rhode island and wisconsin can open accounts with skrill

Ratings and reviews

Does not notify me about verification

I am frustrated with skrill because the app did not notify me or remind me to verify my bank account in order to withdraw my balance I receive from a monthly work payment.

The first month I withdrew money without issue. The second time I received errors that didn’t specify what my issue was, forcing me to call in only for them to tell me I had to verify my bank account.

If they had told me this earlier, I’d have been happy. But because they told me as I tried to withdraw my funds, now I’m waiting 24-48 hours for verification without being able to access my funds.

Edit: spoke with a megan who helped me verify my card and up my limit. Changing my review from 3 to 4 stars

The worst ever( please run from this app)

You guys are just bunch of jerks toiling with people and their money.. After creating the account you never asked for personal information.. It was after I had put money and all this info became necessary which I uploaded and yet for the third time you’ve asked me to resend the utility bill which I have done and you keep rejecting.. I can’t even contact the customer care in the help section because you’ve made a reoccurring program that says the url is unsupported. What kind of crap is that?Why didn’t you ask for all this information to be confirmed before money is being credited ? It’s after there’s money then you bring up all of this delay cos you know there’s no other way to get the money back.. I’ve read other reviews from people and it seems this is just a scheme to collect money from people.. Bad app.. Y’all are fake .. No customer care contact number .. Y’all are terrible people and I know y’all won’t do anything to fix it cos you’re just there to make money for yourselves .. Idiots ..

Terrible

This is a very terrible app service. I have tried to get in contact with someone about my account not being about to transfer my money to my bank account but no one will help me. I’ve created a claim and I’ve even tried to send an email but both times I’m not given any information. The site is very sketchy in that I constantly get “unsupported URL” notifications whenever I try to use it on a computer and it constantly glitches. I have over $200 in the account and everything is verified, my phone my ID my email EVERYTHING has been verified and yet it keeps giving me an error that it can’t process my transaction with that stupid YETI graphic. I’ve talked to my bank and there’s no problem on there end so I want my money NOW.

Developer response ,

Hi nyoma, this doesn't sound right. We'd be happy to investigate and help ensure the app runs without crashing like this on you. Please get in touch with us via the in-app contact form under the “help” tab on your profile. Our team will be able to assist you accordingly if they have more detailed info about your issue. Thanks!

Skrill verification

On initial opening of your skrill account we would highly recommend you to verify your skrill account immediately. Whilst you can still use the skrill money transfer service with full functionality, your ewallet transaction and deposit limits will not be completely removed until the skrill verification requirements, have been met.

Additionally, if you are transferring funds to meet the next threshold of a VIP membership level you will not face any interruptions to the flow of funds to and from your skrill account if you are a verified member.

In order to take advantage of our exclusive bronze VIP upgrade you will to verify your skrill account.

Please note if you already have a verified neteller account, your skrill account should be automatically verified when you sign-up, regardless of whether you are an ewalletbooster customer or not as both companies are operated by the same parent company paysafe group ltd so they already have your details on record.

How to verify my skrill account?

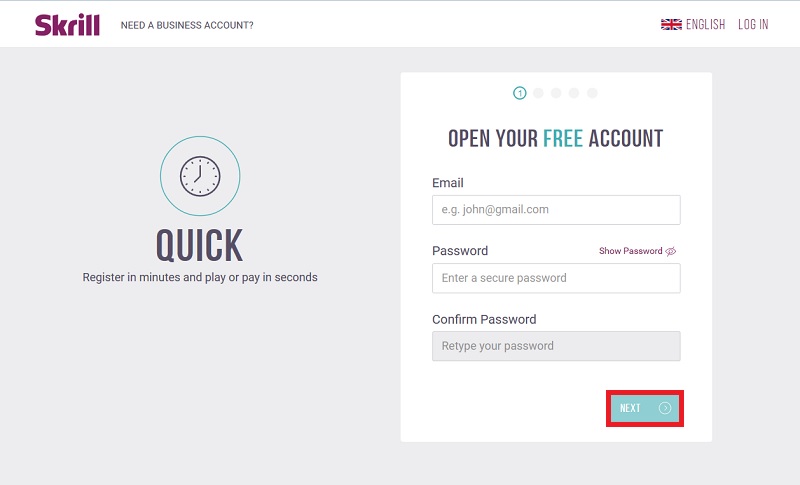

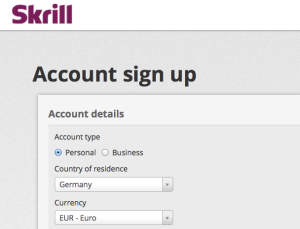

Please follow the easy steps below to verify your skrill account.

The skrill verification process is easy and fast. All you need to complete the process is either a well- established and verifiable facebook account for facebook verification or have valid photo ID and address documents ready before you begin the process.

One you are logged in to your skrill account you will be alerted to the fact that you need to verify your account by a message at the top of the screen.

Skrill identity verification

To verify your identity, you can upload either your passport, driving licence or identity card. The images you upload must be clear and show all 4 corners of the document.

Skrill address verification

To verify your address, you will need to provide proof of address which can be a bank statement, utility bill or another official document. The date of issue on the statement must not be older than 90 days. Once again, the images you upload must be clear and show all 4 corners of the document.

Skrill application form

Join skrill using the application form below or submit your existing skrill details to receive a FREE bronze VIP upgrade on your skrill account and take advantage of lower fees, increased limits and much more. New & existing skrill customers welcome.

About skrill

Skrill, formerly known as moneybookers, is an ewallet that allows online payments and money transfers for a large number of different merchants. You can choose from a variety of payment methods to withdraw or deposit funds. With the skrill mastercard you have access to your balance everywhere and at any time. You can also send money instantly to other account holders.

In 2015, optimal payments PLC, the mother company of competitor NETELLER, bought skrill and paysafecard and changed the name to paysafe group.

To learn more about skrill in general please check our detailed skrill review and make sure to join our exclusive ewo skrill promotion with easier skrill VIP status and additional cashback.

Skrill & ewallet-optimizer

Ever since ewallet-optimizer started to work with us in 2010, they have constantly delivered value for our product and brand, referring thousands of VIP clients through the exclusive skrill VIP promotion.

We hope that our partnership continues to grow and that ewallet-optimizer will continue to help our customers, provide additional support and explore new markets with us.

We started in 2010 by promoting skrill exclusively and quickly became one of their biggest affiliates. Thanks to skrill’s fantastic availability and usability, it is a great choice for any customer who wants to move online funds safely and easily.

We are happy about our long-lasting partnership with skrill and will continue to deliver the best benefits to our clients when signing up through us.

Reviews from our loyal clients

Partner network

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Www skrill com

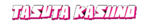

European payment services directive 2015/2366 (also known as PSD2) defines the following actors and roles:

Payment service user (PSU) - psus are the end-users of the services provided by tpps and aspsps. They are either physical persons or entities (organisations, companies, administrationsвђ¦). They do not interact directly with the PSD2 API.

Account servicing payment service provider (ASPSP) - these are payment service providers (psps) which are in charge of holding payment accounts for their customers (PSU).

Third party provider (TPP) - these actors can intermediate between psus and aspsps, acting on behalf of PSU. Depending on the services they provide tpps fall in one of the following categories;

- Account information services (AISP role) will allow the PSU to get information, through a single interface, about all of his/her accounts, whatever the ASPSP holding this account.

- Payment initiation services (PISP role) for requesting a payment request approval by the PSU and requesting the subsequent execution through a credit transfer.

- Card based payment instrument issuers (CBPII role) that will check the coverage of a given payment amount by the psuвђ™s account.

Skrill acts as account servicing payment service provider (ASPSP) in PSD2 terms.

Skrill payment service directive compliance

In compliance PSD2, skrill provides modified customer interface (mobile apis) to qualified third party payment service providers for the following purposes:

- Account and transaction information for account information service providers (aisps)

- Payment initiation for payment initiation service providers (pisps)

Card-based payment instrument issuers (cbpiis) use cases are not supported by skrill

The apis are modified existing customer interfaces fulfilling the following PSD2 requirements:

- API access is restricted only to qualified third party providers.

- TPP API access is restricted to their respective regulated roles

- Access to PSU account and data from TPP requires explicit user conscent, that can be revoked

- Transaction operations require strong customer authentication

Qualified third party providers

In the context of PSD2, being a qualified third party provider (TPP) means:

- Having obtained the authorization from a national competent authority (NCA) to operate as a payment services provider, with the roles it requires (AISP, CBPII, PISP). The list of national register entities can be found on the open banking europe website.

- Having obtained from a qualified trust service provider (QTSP), qualified website authentication certificates (QWAC) and qualified sealing certificates (qsealc), that have a PSD2 eidas certificate profile. Details on qualified trust service providers and the PSD2 eidas certificate profile can also be found on the open banking europe website.

Skrill supports only qualified website authentication certificates (QWAC) certificates for API access

In order for a third party to qualify for production API access, both steps must have been completed and they must have matching data (the NCA delivers a registration number that must written in the certificate data).

It is possible for a qualified third party to lose its qualification, either because the certificate becomes invalid, or because the NCA decides to revoke the tppвђ™s authorization.

Third party provider oauth client registration

In order to access skrill apis, the third party providers are required to register oauth 2 clients for their applications. Registration and management of oauth 2 clients is provided by PSD2 oauth2 and client management apis.

Client management API calls require mutual TLS authentication, with a qualified website authentication certificate (QWAC) issued to the TPP by a qualified trust service provider.

Client registration is performed through POST request on /psd2-oauth2/v1/registrations resource in client management API endpoint with JSON body containing the following properties:

- Client_name - A human-readable name for the client, that will be shown to the user during the consent process.

- Scope - REQUIRED A space-separated list of scopes, that the client has (or requests) access to. In a PSD2 context, the following values are available:

- Aisp - account information and recent transaction history apis

- Pisp - payment initiation service providers use cases apis

- Cbpii - card-based payment instruments issuers use cases apis

- Logo_url - OPTIONAL URI string that specifies a logo for the client, as a data scheme URI. If available, the data will be used to show the user a logo during the consent process.

- Token_endpoint_auth_method - token endpoint authentication method. Use urn:paysafe:oauth:token-endpoint-auth-method:eidas-qwac:psd here.

- Redirect_uris - REQUIRED A list of HTTPS urls that describes the redirection endpoints for the client.

- Grant_types - REQUIRED restricted to authorization_code and refresh_token . Other grant types are not supported in a PSD2 context.

- Response_typesREQUIRED - use code as a value here.

- Jwks - A JSON web key set object, that describes the public keys and certificates related to the given client. In the scope of PSD2, the JWK set must be the set of qualified sealing certificates (qsealc) that can be used by the client to sign requests.

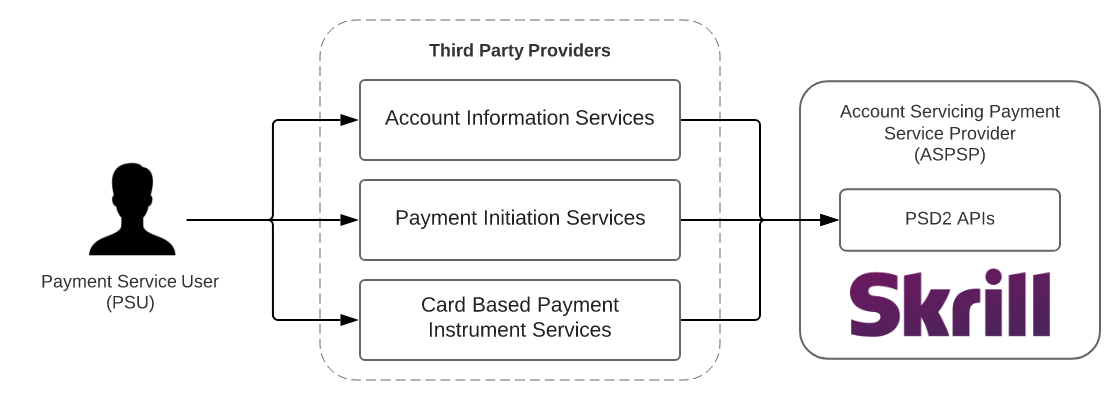

Authentication and authorization flow

Authentication and authorization is implemented as specified in oauth 2.0 authorization code grant flow RFC 6749.

The essential prerequisities for setting up the authorization flow for TPP applications are the following:

- Oauth 2 client must be registered for the TPP applicaion

- TPP application must integrate with the PSD2 oauth2 authorization server and token endpoints.

- Use of the oauth 2 PKCE extension is mandatory, with the SHA-256 method

The detailed authorization flow proceeds as described in the sequence diagram:

- From the third party provider (TPP) website/application, the payment service user (PSU) triggers the authorization process in order to allow access to his skrill account resources

- The TPP website/application redirects the browser to the ASPSP (skrill) oauth 2 authorization server, with the required oauth 2 client parameters

- Response_type - equals to code

- Client_id - the oauth client ID registered by TPP during onboarding

- Scope - the desired access scope. The scope must be one of client scopes defined during client registration.

- Redirect_url - the redirect url provided by TPP, to which to return the authorization code.

- State - the TPP session state parameter

- Code_challenge - SHA-256 code challenge parameter as defined in section 4.2 of oauth 2 PKCE extension

- The ASPSP (paysafe) oauth 2 authorization server provides the user login and conscent interface. At this point the payment service user, must authorize the third party provider.

- The browser gets redirected back to TPP redirect URL with the authorization code and state request parameters

- Third party provider (TTP) application uses the authorization code and PCKE secret (code_verifier) to obtain access and refresh token from oauth authorization server. The following parameters are passed to the oauth authorization server

- Client_id - the TPP oauth 2 client id

- Client_secret - the TPP oauth 2 client secret

- Grant_type - use authorization_code as value

- Code - the authorization code

- Redirect_uri - should match the oauth client redirect url

- Code_verifier - PCKE code verifier

- Refresh token can be persisted by TPP application and used for re-issuing access tokens as specified in section 6 of RFC6749. Access tokens obtained in this way only provide access to information for which an SCA is not necessary.

- Payment service user uses the related TPP functionality, that requires ASPSP

- TPP can access the corresponding ASPSP (skrill) apis on user behalf using the obtained access token.

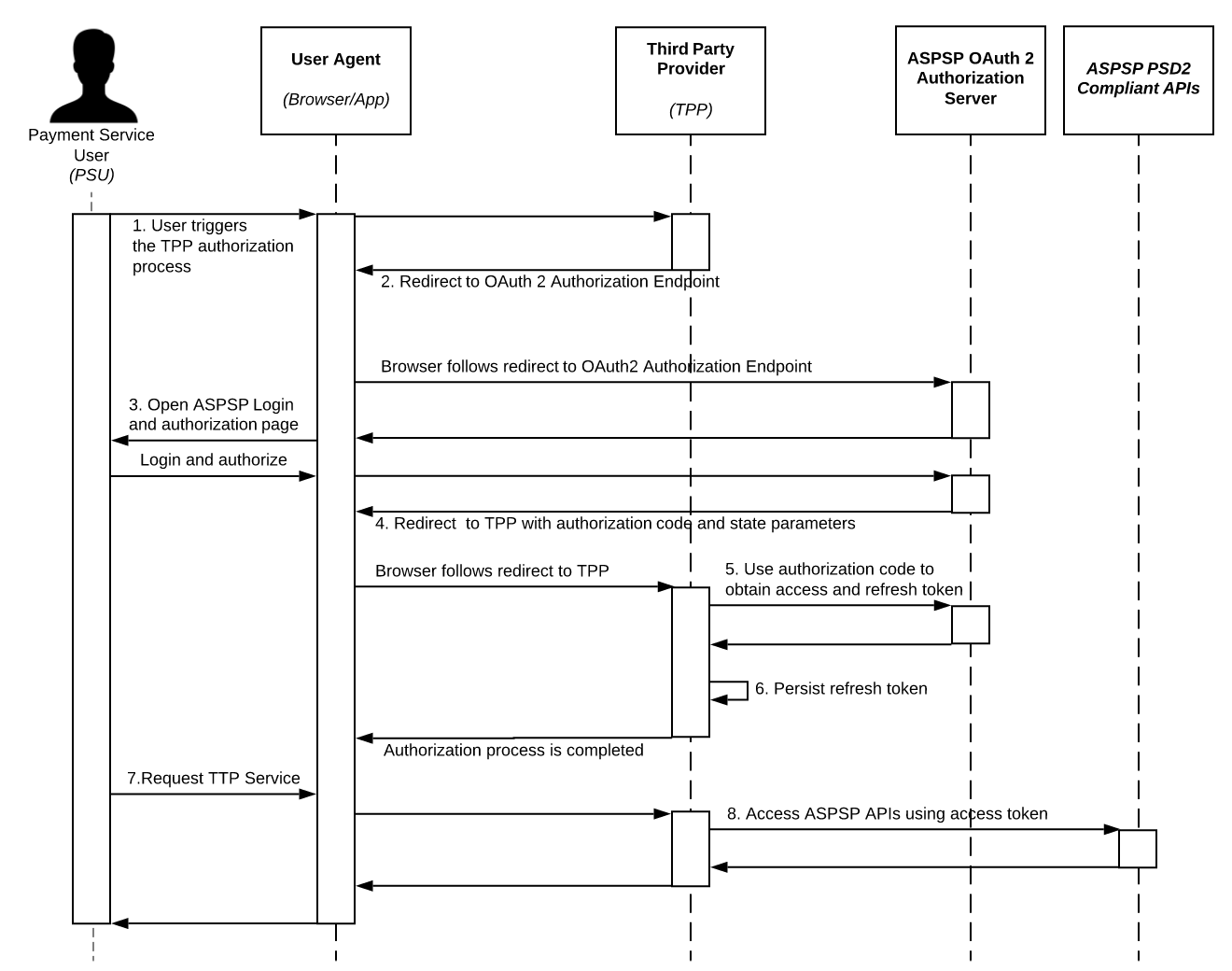

Strong customer authentication

Strong customer authentication (SCA) is a requirement for payment actions. Upon initiation of money transfer, the transfer will get SCA challenge in the response and can not be finalized until SCA challenge is resolved by the user.

One time password generation is triggered and send directly to the user according to his account configuration. The OTP is passed over from the user to the third party provider and used to confirm the OTP challenge. After that the transaction can be finalized.

User presence and offline account access

Tpps are required upon calling skrill apis for AISP and PISP use cases to attach PSU original IP address as HTTP header.

The following HTTP header should be present and carry the PSU origin:

The absense of the PSU IP address is interpreted as TPP accessing user data without user presence and such calls are subject to the following restrictions

- AISP shall not access PSU account data in unattended mode more than 4 times in 24 hours unless it has collected the user consent for that.

Account information services apis

The apis allow accessing PSU account and transaction history information using the below listed apis.

The apis requires one of the following scopes:

- Aisp - allows accessing customer account information and recent transaction history

Payment initiation services apis

The apis allow performing transactions to other skrill accounts.

The apis requires pisp scope for access. During money transfer SCA challenge will be triggered.

Card based payment instrument use cases support

Skrill mobile apis does not provide dedicated api for funds confirmation.

API documentation and support

Server API endpoints can be found in their respective API reference documentation:

Skrill erfahrungen - welche erfahrungen gibt es mit skrill?

Skrill ist ein onlinebasiertes bezahlsystem, für das eine E-mailadresse oder eine mobilfunknummer ausreicht. Geld senden und empfangen geht schnell und ist kaum mit aufwand verbunden. Aber wie schlägt sich skrill gegenüber mitbewerbern? Wir haben erfahrungen mit skrill in diesem beitrag zusammengestellt.

Inhaltsverzeichnis des artikels

Was ist skrill?

Skrill hieß früher moneybookers, viele werden es noch unter diesem namen kennen. Seit 2013 wird skrill als markenname genutzt und die onlinezahlungen unter diesem namen abgewickelt.

Ähnlich wie beim konkurrenten paypal reicht eine E-mailadresse, um zahlungen durchzuführen, in bestimmten mobilfunknetzen kann geld auch über handynummern gesendet und empfangen werden. So müssen beim bezahlen keine sensiblen konto- oder kartendaten eingegeben werden. Auch die paysafecard gehört seit 2013 zu skrill – in deutschland können beide zahlungsarten aber nicht kombiniert werden.

Die erfahrungen mit skrill sind vorwiegend positiv, aber je nach anspruch der kunden gibt es auch punkte, die negativ bewertet werden. Wir erklären ihnen zuerst, was skrill ist und welche dienste es bietet. Danach erfahren sie mehr über gebühren und sicherheit.

Konto einrichten

Das skrill-konto können sie schnell und unkompliziert einrichten. Die webseite ist übersichtlich und bietet ihnen alle wichtigen funktionen. Eine umfangreiche hilfeseite unterstützt sie bei ihren anliegen.

Einige nutzer berichten von problemen beim einzahlen von geld. Oft ist eine verifikation nötig, für die weitere unterlagen gesendet werden müssen. Erst dann kann geld vom eigenen bankkonto gesendet werden.

Der kundenservice sei nicht erreichbar oder nicht hilfreich. Bei problemen, die über die FAQ hinausgehen, sei der skrill-support unzureichend. Hier gab es aber auch andere erfahrungen, die den skrill-service als „sehr gut“ bewerten.

Digital wallet

Der wichtigste dienst von skrill ist die „digital wallet„, also ein digitaler geldbeutel. Er funktioniert ähnlich wie ein konto, aber auf prepaid basis. Das bedeutet, dass sie nur so viel geld ausgeben können, wie sie vorher eingezahlt haben.

Einzahlungen können per banküberweisung, aber auch mit kreditkarte und lastschriftähnlichen verfahren getätigt werden. Mehr über einzahlungen erfahren sie in diesem artikel: lastschrift bei skrill.

Sie können geld an freunde und verwandte senden und auch bei händlern und casinos bezahlen. Auszahlungen sind an ein bankkonto oder eine kreditkarte möglich.

Kunden berichten davon, dass auszahlungen sehr lange dauern. Auch wurde bemängelt, dass die kosten recht hoch seien.

Skrill prepaid mastercard

Zusammen mit einem skrill-account können sie eine prepaid mastercard nutzen. Diese ist mit ihrem skrill-konto verknüpft und kann auf das vorhandene guthaben zugreifen. So können sie auch mit skrill bezahlen, wenn der händler keine zahlung über skrill anbietet.

Informationen über die skrill-kreditkarte haben wir bereits in folgendem ratgeber für sie zusammengestellt: die skrill mastercard.

Kosten und gebühren

Ein wichtiger faktor bei der entscheidung für einen onlinebezahldienst sind die kosten und gebühren, die bei der nutzung anfallen. Das empfangen von geld ist beim privatgebrauch immer kostenlos, die gebühren bei transaktionen trägt der versender. Allerdings können kosten sowohl beim einzahlen als auch beim bezahlen und auszahlen entstehen.

Auch wenn onlineeinkäufe mit skrill grundsätzlich kostenlos sind, da der händler die gebühren trägt, fallen oft kosten an, wenn guthaben z.B. Auf glücksspielseiten eingezahlt wird. Je nach anbieter liegen diese gebühren bei etwa 2% auf den einzahlungsbetrag.

Auszahlungen auf das eigene konto kosten 5,50 EUR, auf eine kreditkarte kann es noch teurer sein. Die auszahlung lohnt sich also nicht für kleine beträge, sondern nur dann, wenn geld angesammelt wurde.

Das skrill-konto ist kostenlos, solange es aktiv genutzt wird. Ist das konto mehr als 12 monate nicht genutzt worden, gilt es als inaktiv und es fallen monatlich gebühren in höhe von 3 EUR an. Diese werden vom vorhandenen guthaben abgezogen.

Aufgrund der kosten und gebühren, die bei der nutzung von skrill entstehen, haben sich einige kunden für andere alternativen entschieden.

Wie sicher ist skrill?

Skrill ist als weltweit agierendes unternehmen bereits seit vielen jahren am markt und wurde vom TÜV als „geprüftes zahlungssystem“ zertifiziert. Eine zahlung über skrill ist also grundsätzlich sicher, wenn sie ihre kontodaten vertraulich behandeln. Geben sie ihr passwort niemals weiter!

Durch das prepaid-system können sie über skrill nicht mehr geld ausgeben als sie vorher eingezahlt haben. Das schützt vor unkontrollierten ausgaben. Wenn sie über skrill bezahlen, müssen sie beim händler keine bankdaten oder kreditkarteninformationen eingeben, sondern zahlen über ihre E-mailadresse. Unerwünschte abbuchungen vom konto bei unseriösen verkäufern werden so vermieden.

Wo kann ich mit skrill bezahlen?

Während skrill bei casinos und wettanbietern bereits etabliert ist, ist die verbreitung in onlineshops noch eher gering. Hier wird vor allem über den konkurrenten paypal bezahlt.

Eine liste mit händlern, bei denen sie mit skrill bezahlen können, finden sie in unserem artikel: skrill onlineshops & webseiten.

Bekannte probleme

Teilweise gibt es probleme bei der geldeinzahlung über skrill bei ausländischen casinoseiten. Auch wenn skrill als zahlungsart angeboten wird, kann es nicht immer genutzt werden. Mehr zu zahlungsproblemen finden sie in diesem artikel: fehlermeldung bei skrill-zahlung.

Wenn ihr skrill-konto in deutschland registriert ist, kann es – insbesondere bei der skrill-mastercard – bei der nutzung im ausland zu problemen kommen. Informieren sie sich vor der abreise, ob eine nutzung in ihrem reiseland möglich ist.

Vor- und nachteile von skrill

Kontoeröffnung schnell und einfach bezahlung weltweit und nur mit E-mailadresse möglich skrill-kreditkarte ermöglicht bezahlung auch bei händlern, die skrill-zahlung nicht unterstützen

Skrill-support manchmal langsam oder wenig hilfreich teilweise probleme bei einzahlungen auf glücksspielseiten hohe gebühren bei ein- und auszahlung (je nach zahlungsart), besonders bei gewerblicher nutzung

Welche alternativen gibt es zu skrill?

Je nach ihren ansprüchen gibt es einige alternativen zu skrill, die aber natürlich ebenfalls vor- und nachteile haben. Wenn sie skrill bevorzugt für das einkaufen in onlineshops nutzen wollen, ist paypal eine alternative. Beim bezahlen entstehen selten kosten und paypal wird von vielen shops unterstützt.

Wer vor allem die skrill-kreditkartenfunktion nutzt, erhält oft auch bei der hausbank eine prepaid-kreditkarte. Diese ist nicht automatisch mit dem konto verknüpft, sondern verfügt nur über vorher aufgeladenes guthaben.

Über eine paysafecard (gehört ebenfalls zur skrill-unternehmensfamilie) können onlinezahlungen anonym und unkompliziert getätigt werden. Die paysafecard wird besonders bei wettanbietern und spieleseiten akzeptiert.

Auch neteller kann sich lohnen, da die gebühren für einzahlungen oft geringer sind als bei skrill.

Zusammenfassung

Skrill empfiehlt sich besonders für onlinecasinos und wettanbieter über prepaid-kreditkarte auch nutzung in onlineshops möglich, die skrill nicht als zahlungsart anbieten erfahrungen mit kundenservice sehr unterschiedlich hohe gebühren für gewerbliche nutzer hürden bei einzahlung und auszahlung können entstehen alternative zahlungsanbieter vergleichen und erst dann die entscheidung treffen

Diese artikel können sie auch interessieren:

Skrill registration with $15 signup bonus

Skrill registration – register a 2nd currency account

As skrill silver VIP or higher, you are able to register additional currency accounts.

Skrill silver vips are allowed to have two currency accounts at the same time, skrill gold vips can have three and skrill diamond vips can even have four skrill currency accounts the same time.

Before proceeding with your additional skrill registration for another currency account, please make sure you fulfill these requirements, otherwise your new skrill account would be automatically suspended.

- Use our skrill registration link to setup your new skrill account:

https://www.Ewallet-optimizer.Com/go/skrill-signup/ - Enter your account data with your new preferred skrill account currency. Every skrill account is linked to one email address, so please choose another email address to the one you chose for your main skrill account. You might also need to enter a different last phone number digit that will be corrected by our skrill support later on.

- When you are done with the new skrill registration, please do not forget to send us your new skrill account data, so we can ensure this new skrill account is also part of our additional ewallet-optimizer program as well.

- Please note that the skrill system will most likely automatically freeze your new account.

To unlock your 2nd currency account, please send an email to [email protected] to request the activation of your 2nd currency account. The skrill VIP team will then transfer your verification and VIP upgrade from your 1st account and your new account will be ready within 1 day. - Once your new skrill account is linked to your old one, you can also order a new skrill mastercard for free for your new account.

- Make sure to hit the required transfer amounts to maintain your skrill VIP status and to benefit from our monthly ewallet-optimizer loyalty program.

Skrill registration – switch account currency

If you need to register another skrill currency account instead of your actual one, please follow the instructions below. By following all steps, you will NOT need to verify your account again and you will become member of our free additional ewo loyalty program.

- Log into your existing skrill account. Transfer any funds left to a friend of yours or withdraw them before you proceed so the account is completely empty.

- Go to your account → “account settings” and click “close” at the lower right corner to close your current skrill account.

- Use our skrill registration link to setup your new skrill account:

https://www.Ewallet-optimizer.Com/go/skrill-signup/

enter your address and preferred new skrill currency for your skrill account and use a different email address and phone number. Our skrill support will be able to correct this manually later on. - Your new skrill account will now be created and ready to use. Please enter your new skrill account details to join our additional ewallet-optimizer program for FREE to enjoy all additional benefits and services.

- Please note that your new accounts needs to be fully verified again. To start your skrill account verification, please login to your account and upload your documents directly from within it. To fully verify your account you need to upload a copy of your passport or ID with both sides and all four corners visible, a selfie of your face holding a handwritten note with “skrill” and the date of the verification process next to it as well as a document which verifies your address (like a utility bill) – our clients can directly upload their documents – no deposit or webcam needed!

When done, you are then able to use your new skrill currency account as your old one. If you want to use your old skrill account’s email address again, please make sure the skrill support deletes it completely from your old account and add it by going to account settings at:

My account -> settings -> personal info -> email addresses

In most cases, that’s it and you can enjoy your new skrill currency account with hopefully less future exchange fees.

Sometimes, you need to contact the support again about old bank accounts that were linked with your old skrill account. If so, please send another email to our skrill support team at [email protected] and they will take care of it.

If you have any questions or problems with your skrill registration or about our free ewo loyalty program, please do not hesitate to contact us .

Skrill – join us for FREE

Join us for free

New skrill account

Existing account

Enter your account data

Existing skrill account

New skrill account

Operating since 2010 promoting ewallets like skrill, ecopayz and NETELLER, we have become the biggest and most trusted ambassador worldwide.

Our clients benefit of the highest valued ewallet bonus program on the net while our partners can maximize their affiliate opportunities by advertising ewallets without time commitments.

With our internal support team within the ewallet brands and our additional help, we are able to take care of our clients’ issues whenever it is needed.

We are proud to have the highest satisfaction rate of clients using an ewallet of their choice.

With our ewo partner program and the ewo dashboard we offer our partners to work as skrill affiliate and NETELLER affiliate themselves.

The ewo dashboard is the ultimate tool for easier skrill VIP and NETELLER VIP upgrade, higher NETELLER commission and NETELLER bonus for all our ewo partners.

Please contact us and get your ewo dashboard as ewallet affiliate right away!

With the skrill promotion “true player growth” skrill starts the year with a great promo which allows you to use your skrill account basically for free.

Please note that the skrill promotion is designed for italian and UK customers only. All skrill members, existing and new, residing in the territories of the united kingdom and italy and meet the eligibility criteria can participate and reap the substantial benefits.

On february 11, the epayments suspended operations on its customer accounts at the request of the financial conduct authority (FCA). At the moment, users from all over the world cannot carry out any operations with the account: transfer funds, deal, deposit or withdraw funds, use their epayments prepaid card, or even just accept payments.

We completed some details about freezing accounts epayments. Also, you find below information on some alternative payment solutions to keep your funds safe.

Skrill VISA USA card has arrived. It was quite a long way for skrill inc until they have became the first fully licensed digital wallet in the state of new jersey for online gambling back in 2015. It took even more time to also start offering their own skrill card for the USA.

Until now, US citizens could not make any gambling deposits. They could use their ewallet balances for person to person and e-commerce transfers only.

Www skrill com

| | |||||||||||||

Комментариев нет:

Отправить комментарий